I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

These launch today. It’s a collaboration between us and Tapp Alpha. TSYX is a 1.3x levered version of TSPY and TDAX is a 1.3x levered version of TDAQ…….

Launching Today. Lightly leveraged 0DTE on SPY and QQQ

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

2026 Energy Deep Dive: Affordability + Volatility + Dispersion

2025 was the year “energy = AI = up.” The market didn’t care how you made electrons or molecules—just that you were anywhere near the story. 2026 won’t be like that.

2026 looks like a political year first and a commodity year second: an administration that wants lower gasoline and electricity prices, a market leaning bearish crude near-term, and a natural gas tape that’s set up to whip-saw everyone who treats it like a sleepy utility fuel.

So the regime shift is simple:

2025 paid “energy exposure.”

2026 pays “energy execution.”

That means dispersion—the gap between the winners and losers—stays brutal. And the smartest way to play it isn’t to bet on one macro line (“oil up” or “oil down”). It’s to own the parts of the stack that get paid because volatility and infrastructure spending are rising.

The 10 themes that matter (and how to trade them)

1) The White House wants cheaper gasoline + cheaper power

This is the backdrop: policy pressure caps the upside in headline energy prices (especially if inflation optics matter). That doesn’t kill energy stocks—it changes which ones work.

Winners: integrated scale + balance sheets ($XOM, $CVX), and “paid-by-activity” names when projects get greenlit ($SLB, $BKR).

Losers: high-beta upstream that needs $90 WTI to look “easy.”

2) “Bearish oil in 1H26” is a real setup… but it creates the 2027 trap

Your framework is clean: subdued crude in 2026, then a steepening cost curve in 2027 when the market realizes shale can’t grow at these prices without pain.

Trade logic: don’t marry oil beta early—build optionality for the turn.

Winners now: quality, dividends, buybacks ($XOM, $CVX).

Winners later: the names with inventory + execution that can actually grow when the curve steepens ($COP, $OVV).

3) Shale can “hold”… but sustaining growth gets harder

Scale + tech are buying time, but maturing acreage is real. The market can stay bearish… until it wakes up and reprices marginal barrels.

Watch: U.S. production response vs. strip pricing, service tightness, decline-rate reality.

4) Natural gas is the 2026 casino (in a good way)

This is the most important piece of your note: gas volatility rises because demand is outpacing storage. That means weather + LNG flows + power burn matter more, and the market becomes more “twitchy.”

First-order winners: gassy E&Ps with torque ($EQT, $GPOR, $BKV, $OVV).

Second-order winners: gas infrastructure that enables the system ($WMB, $EXE).

Energy consolidation isn’t just “finance games”—it’s how operators survive a flatter price tape. Scale wins.

Winners: consolidators + clean balance sheets ($COP, $XOM, $CVX), and the “services picks” that benefit from rationalized spending ($SLB, $BKR).

If Permian takeaway constraints keep WAHA wide until new pipes arrive, you can get huge dispersion in “same commodity” names.

Winners: midstream + the names positioned for relief later ($WMB, $EXE).

Losers: anyone trapped behind the pipe.

7) LNG is not as “obviously undersupplied” as the hype says

The market loves a single narrative (“LNG forever shortage”). Reality is messier: delays, utilization, curtailments, and price-driven rebalancing.

Winners: disciplined operators with optionality, not “max leverage to a brochure.”

Watch: feedgas, margins, and policy risk.

8) Refiners: numbers likely come down (and Venezuela makes it messier)

Your point is dead-on: R&M looks volatile—and if heavy sour becomes a bigger chess piece, cracks and differentials can get weird fast.

Implication: refiners can trade like macro instruments, not businesses.

9) OFS earnings may be bottoming (this is where asymmetry lives)

This is the classic late-cycle energy setup: everyone hates services right before utilization stabilizes and estimates stop falling.

Winners: $SLB, $BKR as “option value” with real franchises.

10) Offshore/deepwater: flat in ’26, better in ’27

You’re not buying this for next quarter—you’re buying it because long-cycle barrels come back when the cost curve steepens.

Winners: names leveraged to subsea and execution-heavy work (often shows up through the services complex).

Winners & Losers

Likely winners (2026)

Core “Affordability-proof” energy

$XOM, $CVX – scale, dividends, buybacks, and the ability to win in a “prices capped” world.

Nat gas torque (the volatility beneficiaries)

$EQT, $OVV, $GPOR, $BKV – positioned for the “gas gets jumpy” regime.

Midstream toll roads

$WMB, $EXE – paid to move molecules while everyone else debates the commodity tape.

OFS / “option on activity”

$SLB, $BKR – if capex stops falling and project work persists, these can re-rate off a hated base.

Watchlist (high upside, needs the tape to cooperate)

$COP – quality E&P exposure that can work when the market starts looking through 2026 to the 2027 cost curve.

$CRC – more idiosyncratic/regional; can move violently on local factors.

Likely losers / danger zone (2026)

High-cost, high-beta upstream that needs higher prices and easy capital at the same time.

Refiners/R&M if margins roll over and differentials get policy-whipsawed.

Anything priced for perfection after 2025’s “everyone’s a winner” stampede.

The simplest way to frame 2026 positioning

Barbell it:

Quality + shareholder return (the “politics wants cheap energy” hedge): $XOM, $CVX

Gas volatility + infrastructure tolls (the “AI keeps eating molecules” trade): $EQT + $WMB/$EXE

Selective OFS optionality (the “estimates have stopped falling” trade): $SLB, $BKR

And keep one truth taped to your monitor:

2026 is (still) an energy bull market… but it won’t be an “everyone wins” energy bull market.

News vs. Noise: What’s Moving Markets Today

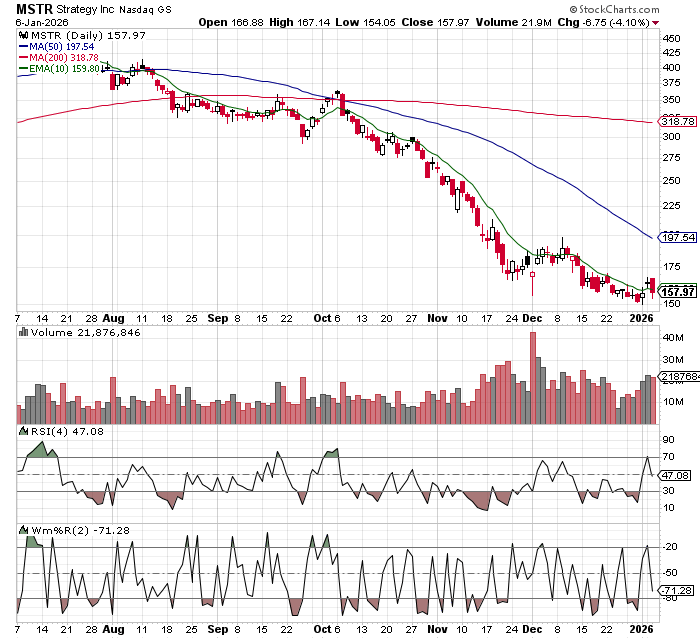

Yesterday’s big news came minutes after the close when MSCI announced they would not exclude digital asset treasury companies from their indices. This also means that MSTR stays in. The potential removal has been a massive overhang on the stock….

MSTR is currently up around 5%, Bitcoin initially rallied on the news but looks pretty flat at the moment. I do think this is positive for Bitcoin as it had been speculated that if MSTR got removed from MSCI indices it may have resulted in a few to several billion dollars coming out of Bitcoin. MSCI did say this though, which could keep the door open for exclusion down the road….

However, MSCI intends to open a broader consultation on the treatment of non-operating companies generally. This broader review is intended to ensure consistency and continued alignment with the overall objectives of the MSCI Indexes, which seek to measure the performance of operating companies and exclude entities whose primary activities are investment-oriented in nature

Elsewhere….

News: The market may be underpricing a very specific 2026 “macro cheat code”: energy-led disinflation that gives the Fed cover to cut rates far more than consensus — without reigniting inflation. If Venezuela barrels re-enter faster than people expect because sanctions/blending constraints are the real bottleneck, you don’t need a perfect “infrastructure recovery” story for the oil tape to change. You just need enough incremental heavy crude hitting the market to cap crude rallies, cool gasoline, and mechanically pull headline CPI/PCE down. In a world where Treasury financing is short-tenor heavy, that disinflation is rocket fuel: lower inflation optics → easier Fed policy → lower debt-service costs → better fiscal optics → easier financial conditions → stronger real growth. Importantly, it also gives the U.S. a credible bull case that doesn’t rely solely on the Mag 7 continuing to drag the index higher — i.e., a path to broader leadership (rate sensitives, cyclicals, “old economy” winners) even if AI leadership gets choppier.

Noise: The trap is treating this like “new supply next month” and trading it like an earnings catalyst. Venezuela is still a sanctions/legal/security chessboard, and “policy-engineered” is not the same thing as “operationally delivered.” The next few weeks can easily produce whipsaw: a strong-looking NFP headline (even if it’s calendar quirks/government job payback), a CPI “giveback” print, and a Supreme Court tariff ruling that could spark fiscal/tape volatility before markets decide whether it’s ultimately disinflationary. Also, oil doesn’t need to crash for the thesis to work — the more realistic takeaway is “upside capped” and “risk premium repriced,” not a straight-line move to permanently cheap crude (because push oil too low and shale becomes the balancing mechanism). So treat this as a scenario with asymmetric upside, not a certainty: watch for actual sanctions/licensing changes, actual export/blending flows, and actual inflation transmission — not the headlines.

A Stock I’m Watching

Today’s stock is Moody’s (MCO)……

Moody’s (MCO) — “old economy AI + credit cycle torque” to watch into 2026. The cleanest setup for MCO is not an AI hype narrative—it’s a classic ratings-cycle inflection with a modern analytics moat. As rates drift lower and credit spreads normalize, the next leg is typically a re-opening of debt issuance + refi + M&A financing, and one under-the-radar leading indicator is Ratings Assessment / Ratings Evaluation work (pre-transaction “test runs” that often precede actual issuance, IPOs, spinoffs, and acquisition funding). If that pipeline keeps building, MCO has meaningful operating leverage because ratings revenue tends to scale with volume while costs are relatively sticky. Importantly, the “AI disrupts software” fear looks misplaced here: MCO’s edge is proprietary data + entrenched workflows + regulatory/mandate embed, and its value isn’t seat-based in the way many SaaS vendors are. The way to play it in a portfolio like yours is as a high-quality cyclicals/financial-conditions beta that can work even if “AI infrastructure” leadership chops around—while still benefiting from AI-driven demand for analytics and automation across credit markets.

In Case You Missed It

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.