Wall Street’s 60/40 formula was born in 1952 — the same year as the first credit card. A lot has changed since.

That’s why we created a new approach — The H.E.A.T. Formula — to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

Table of Contents

BITK paid it’s second dividend yesterday…..

🔥 AI Hype, Volatility Spike, and the Argentina Lifeline

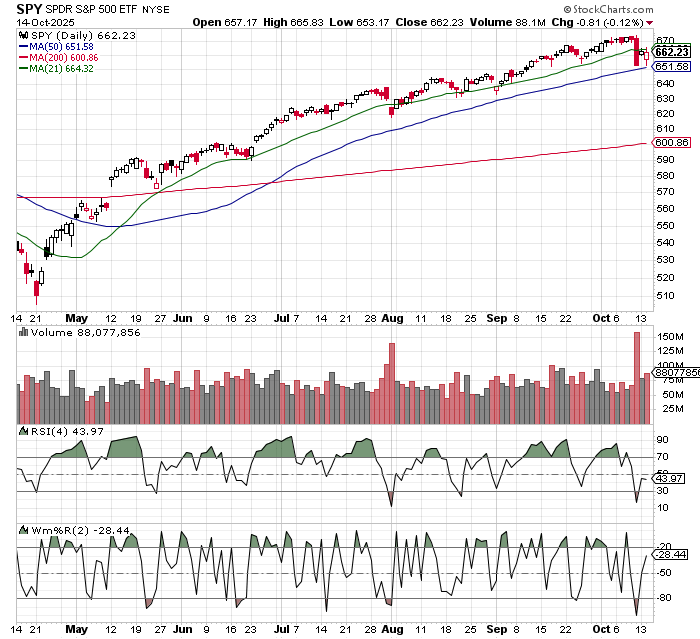

Another wild ride, they tried to sell the market off early, it briefly went positive, to only close slightly negative. Interestingly, SPY held at the 50 day, but bumped up against the 21 day…..

Something has to give here, either we move below the 50 day, which could be a short entry, or undercut and rally at the 21 day, which could be a long entry. I took profits from Monday’s gains just in case it’s the former.

Speaking of the bearish case, we interviewed Mark Spiegel on the podcast yesterday….

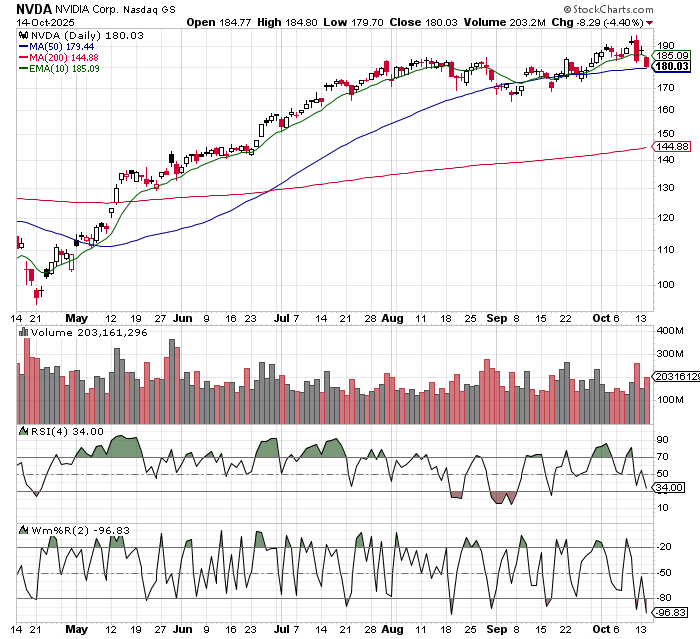

He’s a value investor, so he doesn’t like this market and he’s short. Just to be clear, he’s been short a while. He also doesn’t like TSLA, as he points out in great detail. His comments about NVDA where also real interesting. NVDA was down big yesterday, and if it breaks the 50 day could be shortable….

It seems as if NVDA may have some competition on it’s hands. This article is a couple of months old but it drives home the point….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday October 23rd 2-3PM EST

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market.

The truth?

Most of them suck.

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile.

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead.

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital

📉 How most call-writing strategies quietly destroy compounding

🚫 Why owning covered calls in bull markets is like running a marathon in a weighted vest

💡 The simple structure that can fix these problems — and where the real daily income opportunities are hiding

What Else Happened Today

1) Broadcom × OpenAI: Why the Hype Can Backfire

Thesis: The OpenAI–Broadcom (AVGO) pact is bold but execution-, funding-, and margin-risk heavy. It asks the market to finance massive custom ASIC systems (10 GW from AVGO alone; ~26 GW across AVGO/NVDA/AMD) on a demand curve that may normalize as chips get more efficient. Analysts are split: skeptics flag OpenAI’s lack of silicon pedigree and over-hyped capacity needs; bulls model $150–$200B multi-year AVGO revenue. (MarketWatch)

Bear case (why “not all it’s cracked up to be”):

Customer concentration & custom lock-in: AVGO’s custom systems aren’t easily repurposed if OpenAI slows or pivots; that dilutes gross margins even if revenue prints. (MarketWatch)

Moat mismatch: NVIDIA still leads on silicon + networking + software stack (ecosystem/CUDA), a full-stack advantage hard to “out-design.” (MarketWatch)

Funding risk: OpenAI’s capex dreams outrun near-term cash flows; frame-order structures imply rollout pace will follow real demand, not headlines. (MarketWatch)

Winners (base case):

NVDA (ecosystem moat intact), AMD (incremental share, x86/accelerators) (MarketWatch)

Foundry/packaging & HBM: TSMC (TSM), AMKR, MU (HBM ramp)

Power & data-center picks-and-shovels: ETN, ABB (ABBNY), SIEGY, CEG, VST, EQIX, DLR (load & buildout beneficiaries)

Losers / Risk buckets:

AVGO margins if custom ramps hard while pricing stays competitive; second-tier AI chip hopefuls without software moats; cash-burn LLMs if adoption lags (consolidation risk). (MarketWatch)

How I’d trade it: If long AVGO, pair with puts or put spreads into big funding/production headlines; keep a core AI-power stack sleeve (ETN/ABBNY/CEG/VST/EQIX) that wins regardless.

2) VIX Spiked. Here’s the Edge (Again).

Setup: The VIX jumped above 22 intraday (highest since May) on renewed U.S.–China trade tensions, then faded back near/just over 20 by the close—classic shock → reversion behavior. Futures curve isn’t screaming “prolonged stress.” (Reuters)

Your edge (reiterated): On VIX spikes, I prefer buying puts on VIX ETPs (e.g., UVXY, VIXY), because the VIX needs a reason to stay elevated. When the catalyst cools, term-structure & roll decay resume, and those ETPs leak.

Quick playbook:

Trigger: Spot VIX > ~20 with a discrete catalyst (tariffs headline, macro shock). (MarketWatch)

Trade: Buy near-money puts on UVXY/VIXY 2–6 weeks out; scale entries.

Risk controls: If VIX > ~28–30 and the curve inverts, stagger maturities; add index put spreads as tail protection.

Exit: Into vol crush or when VIX retakes the teens.

3) Argentina: Policy Put…With an Election Timer

What happened: The U.S. framed a $20B currency-swap lifeline and bought pesos to stabilize Argentina—explicitly tied by President Trump to Milei’s midterms. “If he loses, we’re gone.” Markets read it as a conditional policy put with geopolitical intent (countering China). Merval dropped >4% on the headline. “Stargate Argentina” ($25B OpenAI DC) is reportedly on the talking list. (The Wall Street Journal)

What it means for stocks:

Bull path (Milei strengthens): The swap underwrites peso stability, lowers crisis odds, and unlocks capital for energy and infrastructure. Expect a risk-premium compress in local equities and USD-ADRs if Congress math improves. (The Wall Street Journal)

Bear path (political setback): The lifeline gets pared back; FX stress returns. Re-widening risk premia hit banks/consumers first.

Tickers & angles (tactical):

Energy/upstream & utilities: YPF , PAM, TGS (TGSU2), EDN—benefit from reform + FX stability; watch pricing frameworks.

Banks/financials (beta to macro): BBAR, SUPV—winners on stable FX and NPL containment; fragile if swap conditionality bites.

Materials/infra: LOMA, IRS—re-rating if capex resumes.

Basket: ARGT (broad exposure), sized small.

My take: I have a small YPF position until we see the vote map and swap terms. If Milei adds seats, I’d scale energy + infra first, financials later. If not, keep it a trader’s market (event-driven).

TL;DR positioning into today

AVGO/OpenAI: Trade, don’t marry; own the power stack that wins regardless (ETN/ABBNY/CEG/VST/EQIX). (MarketWatch)

VIX spike: Express mean-reversion via puts on UVXY/VIXY; pair with index put spreads for tail risk. (Reuters)

Argentina: Maintain small YPF; add on Milei tailwind confirmation; use ARGT for broad beta. (The Wall Street Journal)

🤝 Before You Go Some Ways I Can Help

ETFs: The Antidote to Wall Street

Inside HEAT: Our Monthly Live Call on What Wall Street Doesn’t Want You To Know

Financial HEAT Podcast https://www.youtube.com/@TuttleCap Freedom from the Wall Street Hypocrisy

Tuttle Wealth Management: Your Wealth Unleashed

Advanced HEAT Insights: Matt’s Inner Circle, Your Financial Edge

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.