I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

With Thanksgiving tomorrow we announce dividends a day early:

BITK: .12/Share

MSTK: .28/Share

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) December 9 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

Today we talk about agentic AI. The internet has revolutionized how people, including me, buy. I hardly ever go to the grocery store anymore when Instacart can deliver whatever I want in an hour or less. I hardly ever go to the mall or a store when I can just get something on Amazon. But there is a still a lot out there to sort through, and it’s often hard to find exactly what you want, maybe that’s about to change….

AI Just Hijacked Your Shopping Cart (And Criteo Is Sitting on the Toll Booth)

While everyone has been laser‑focused on Google vs. Nvidia, there’s a quieter AI regime shift happening in the background: shopping is moving from search boxes to agents.

We’re early, but the numbers are already stupid:

Salesforce sees AI driving roughly $260B+ of global online holiday sales this year, including about $50B in the U.S.

Adobe’s data shows gen‑AI referral traffic to retail sites up ~1,200%+ year‑over‑year in October.

Shoppers sent by AI are ~16% more likely to buy and generate more revenue per visit than “normal” traffic.

That’s not a cute new channel. That’s the start of a new front door to e‑commerce.

From “search results” to “just buy it for me”

The pattern is clear:

A majority of people who use AI now say they’ll lean on it for gift ideas and shopping this holiday season.

Use cases are exactly what you’d expect: “find me something like X,” “compare these options,” “keep me on budget,” “don’t show me junk.”

OpenAI’s moves are the tell. They’ve:

Rolled out a shopping research tool to compare products/specs/prices

Announced integrations with Shopify, Etsy, Target, Walmart, so you can buy directly via ChatGPT

It’s clunky today – think one‑item checkout, limited loyalty integration, and bad UX for brands that care about control. That’s why operators like Brooklinen are saying, “We’re not going all‑in until we can sell more than one item and not confuse the customer.”

But everyone is still planning for the agentic future:

They’re asking: When an AI agent sends a customer to my site, am I ready?

And even more important: How do I make sure I’m one of the products the AI surfaces in the first place?

That second question is where the real money is.

Discoverability is the new SEO

In a world where the AI agent is the first stop, “page one of Google” becomes “the top three slots in the agent’s answer.”

Brands are already quietly playing this new game:

Cleaning up product titles, specs, and descriptions so LLMs can parse them

Making sure they’re mentioned in third‑party content – reviews, social, listicles, editorial pieces

Thinking about their data feeds not just for ad platforms, but for AI crawlers and shopping agents

AI referrals are tiny compared to search + email today… but they’re higher‑intent and higher‑conversion. That’s exactly the kind of channel that tends to grab budget fast once marketers see the numbers.

And because most companies don’t yet have a real AI strategy, referral traffic is up for grabs. Smaller DTC brands (Everlane, Brooklinen, etc.) have a window to punch above their weight if they show up in agent results. For once, you don’t need a nine‑figure brand budget to win the top slot; you need the right data, the right rails, and the right partners.

The platform war: open agents vs. walled gardens

At the infrastructure layer, we’re watching two models collide:

Open(ish) agent ecosystem

OpenAI + Shopify/Etsy/Target/Walmart are trying to lay the rails for “agentic commerce”

Shopify is basically becoming the default OS for merchants in this world:

AI agents can query product data across stores

Add items from multiple Shopify merchants into a single cart

Check you out via the AI interface

Etsy and others are also leaning in – they want agents to become a referral firehose for their sellers.

Walled‑garden control model (Amazon)

Amazon is rolling its own agent (Rufus) and suing Perplexity to stop third‑party agents from placing Amazon orders on users’ behalf.

The official line: security and customer experience.

The subtext: Amazon does not want to hand the shopping relationship and data exhaust to someone else’s AI.

Longer term, they’ll partner where it suits them, but on their terms, not the agent’s.

Underneath all of this sits a brutal, obvious fight:

Who owns the shopping experience, and who gets to monetize the data and “shelf space” inside the AI?

Retail media (ads inside Walmart, Amazon, etc.) has become a massive profit pool. None of these players are going to happily let ChatGPT or Perplexity siphon off that margin without getting cut in.

Which brings us back to Criteo.

Where Criteo fits: the plumbing for AI‑native retail media

You and I talked about Criteo (CRTO) recently as a “stock of the day”: a beaten‑up, profitable retail‑media/agentic‑commerce option with real cash flow and real pipes.

This shift basically painted a giant arrow over their lane:

Criteo’s chief product officer is already out there saying brands are experimenting with how to advertise on AI platforms.

He fully expects sponsored placements inside agents to become a thing – the same way search ads eventually became the default.

That lines up almost perfectly with our core CRTO thesis:

They sit on real‑time SKU‑level data across a wide retailer network, not just one walled garden.

They already optimize every ad dollar for performance across merchants and publishers.

They’re deeply plugged into retail media networks, which is exactly where the first agentic ad formats will appear.

In an agentic world, someone has to:

Understand consumer intent (what the agent is being asked for)

Map that to actual SKU‑level inventory across multiple retailers

Decide which product/brand gets surfaced, in what order, and at what bid

Feed back attribution and performance data so the loop improves

Criteo already does versions of 1–4 in the current web + app ecosystem. Converting that into “AI shelf space management” is a logical extension of what they are, not a science project.

If agentic commerce takes off, discoverability becomes a paid auction again – just with different rails. CRTO is one of the few non‑walled‑garden assets that can credibly sit in the middle of that.

How I’m thinking about positioning this theme

Again, not investment advice, but if I zoom out from the stock tickers and look at the structure:

Agents are becoming a real shopping front door

Traffic is still small in absolute terms but off‑the‑charts in growth and conversion.

Think of this as the 2004–2005 phase of search ads: everyone sees the direction, nobody’s fully priced it.

The rails matter more than any one AI brand

Shopify and friends are laying the transaction rails.

Walmart/Target/Home Depot etc. are building in‑house AI search and will eventually hook into third‑party agents on their own terms.

Amazon is defending its walled garden and retail‑media profit pool aggressively.

Criteo is a leveraged bet on the “war for discoverability”

If agents become the default shopping UI, there will be an enormous fight over who shows up in the first three recommendations.

CRTO’s job is literally to help brands win that fight without owning the consumer directly.

At today’s depressed multiples, you’re effectively getting an out‑of‑the‑money call option on agentic retail media grafted onto an existing, cash‑generating ad‑tech business.

Big picture: AI isn’t just changing which chip we buy. It’s changing who controls the “buy” button.

The companies that own the rails (Shopify, the big box retailers) and the ones that broker attention and intent (Criteo, plus the big first‑party ad platforms) are the ones I care about. Nvidia vs. Google is the headline fight; agentic commerce is where a lot of the long‑duration profit pools get quietly rewired.

News vs. Noise: What’s Moving Markets Today

The big story is that the tape is healing, not breaking — even as the macro and AI narratives get messier under the surface.

Last week’s damage was overwhelmingly technical: intraday ranges blew out, skew and put volumes spiked, ETF share of volume hit the high‑90th percentiles, liquidity in ES futures collapsed, and CTAs/vol‑target funds were forced to de‑risk. Now those pressure points are reversing. Implied vols are compressing, skew is flattening, ETF activity is backing off extremes, correlation is rolling over, and systematic strategies are starting to re‑lever as realized vol falls. Breadth has ripped back hard — 400+ S&P names green two days in a row — just as the buyback window re‑opens and we enter the best seasonal window of the year. This is what a healing tape looks like: still choppy intraday, but with the violent non‑fundamental seller mostly out of ammo.

Inside that healing tape, we’ve also got a good old‑fashioned AI knife fight at the top of the market. Alphabet’s Gemini 3 and TPU stack have flipped the script from “AI bubble” to “maybe Google isn’t just an AI laggard after all.” Big‑money buyers (Buffett, Druckenmiller) were already lining up; now you’ve got Meta reportedly kicking the tires on a multibillion‑dollar TPU deal and Nvidia forced into public statements reminding everyone they’re “a generation ahead.” The result: $GOOGL and its supply chain ($AVGO, $CLS, $LITE, plus names like $MRVL) leading, while $NVDA and $AMD become a source of funds on AI up days instead of the only game in town. That’s healthy. It broadens the AI trade and reduces the risk that one stock’s unwind breaks the whole index.

Macro is where the “healing tape” story and the “something’s off” story collide. The Fed futures curve has gone all‑in on a December cut — ~80–85% odds — as Williams, Waller, Daly and Miran all leaned dovish and openly prioritized a weakening labor market over still‑elevated inflation. ADP data show job losses accelerating, consumer confidence has rolled over to post‑“Liberation Day” lows, and more households now say we’re already in a recession. At the same time, producer prices are still grinding higher, with energy and AI‑driven power demand doing their part. Layer on top the prospect of Trump naming a new Fed chair before Christmas and you get a market that’s suddenly convinced: policy will be easier, one way or another, and sooner rather than later.

Put it together and you’ve got a very specific regime: flows and policy are turning supportive just as growth wobbles and AI leadership rotates. That’s a powerful near‑term tailwind for risk assets and a warning that 2026 earnings and the consumer are not bulletproof. My bias in that mix is to lean with the healing tape — use vol and intraday swings to upgrade quality and add the right kind of risk (infrastructure AI, and more biotech) — while avoiding the corners of the market that only work if the consumer is invincible and Nvidia’s multiple never gets questioned.

Key Takeaways

The tape is healing, not breaking.

Vol is compressing, skew is flattening, ETF flow pressure is cooling, correlations are drifting lower, and systematic sellers are turning into buyers as CTAs/vol‑target funds re‑lever.Breadth is back.

400+ S&P names green on consecutive days, with rotation into small caps, regionals, and homebuilders — a template for 2026 if AI productivity starts leaking into the rest of the index.AI is now a competition, not a monopoly.

Gemini 3 + TPUs have turned $GOOGL, $AVGO, $CLS, $LITE, $MRVL into leaders and chipped away at the “no alternative to $NVDA” narrative. Nvidia is still the training king, but the upside path now includes real competition.The Fed is leaning dovish into weakening data.

Dovish Fed speak + deteriorating labor and confidence data = high odds of a December “insurance” cut and more in 2026. Policy is shifting from “fight inflation” toward “protect the labor market and asset prices.”The consumer is quietly flashing yellow.

Confidence, jobs data, and recession sentiment are all moving the wrong way into the most important spending window of the year. Great for rate‑cut odds, less great for 2026 earnings.Positioning playbook:

Respect the healing tape and seasonal tailwinds, express risk through quality AI infrastructure and broadening trades, and keep using intraday volatility as an asset — not a reason to panic.

A Stock I’m Watching

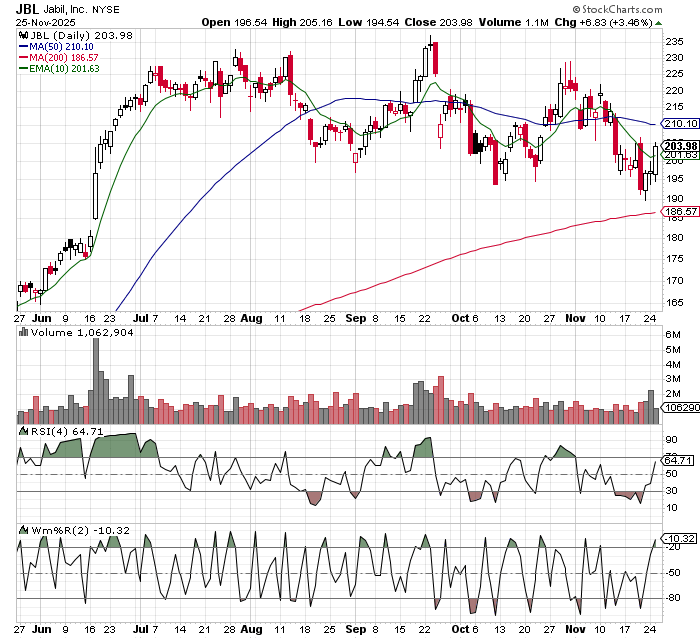

Today stock is Jabil (JBL)…..

JBL is now explicitly positioning itself as AI data‑center manufacturing muscle – committing $500m to US AI/Cloud infrastructure plants; AI‑linked capex is a strategic focus.

The Street still mentally buckets JBL as “low‑margin EMS”; the AI infra narrative is only now being fully digested. That mismatch between perception (commodity EMS) and reality (quasi‑OEM on AI racks, networking, optics) is what you want.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Tuesday December 9, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.