In Today’s Issue:

All roads lead to NVDA

Nvidia just made this ‘very smart move’ that could pay off big-time down the road

GPU vs. ASIC Showdown — Why Merchant GPUs Dominate Custom Chip Wars

Microsoft Build 2025: The AI Stack Winners (And Losers) You Need Now

Natural Gas Power Plants are Energy’s Biggest Buyout Targets

and more……..

Next Webinar:

AI Unleashed: How to Harness AI to Crush Wall Street, Find the Top Investment Themes, and Obliterate Obsolete Investments

The AI Theme Engine Blueprint-How I train off the shelf AI models to scan thousands of data points to spotlight the hottest investment themes right now, and identify the stocks poised to soar before the “smart money” even notices.

How to Get Buy and Sell Signals from Trump’s Tweets-The exact signals you MUST watch when President Trump tweets, rallies his inner circle, or rolls out executive orders — and how to flip those cues into instant buy-and-sell alerts.

Inside the Inner Circle Playbook — Why investing in companies linked to Trump’s closest allies and favored asset classes can deliver asymmetric returns.

The Ultimate Hedge Strategy — How to combine options on VIX and SPY so you Sleep Better knowing your portfolio is bullet-proof against the next market shake-out.

Covered-Call ETFs Are a Con Game — The shocking data showing how poorly covered-call funds underperform and what could work better.

Why Index Funds Are Officially Obsolete — How AI’s precision targeting is rendering index fund strategies dead in the water

5/22 2pm EST

I will be speaking at the Money Show Virtual Expo

Wednesday, May 21, 2025, 1:40 pm - 2:10 pm EDT

Matthew Tuttle |Tuttle Capital Management

Join this session with Matthew Tuttle as he explains why most covered call strategies suck. Matthew will discuss put/write strategies and how they could generate more income with less risk. Additionally, he will go over how to structure 0DTE strategies on products that do not have 0DTE options.

All Roads Lead to NVDA

Slightly red yesterday and red this morning. Perhaps this is the pullback I have been expecting. Interesting take from Mike O’Rourke last night….

The S&P 500 market capitalization is 176% of GDP, just shy of the record peak of 180% reached during the post-election exuberance this past November through January (chart below). The current level matches the previous record peak reached in the final stages of the pandemic recovery. These levels indicate there is no urgency to chase the S&P 500 at current valuations and make a strong case for even long-term investors to consider making sales. When one takes the additional debt into account, the readings are equally alarming. The S&P 500 market cap plus the $76 trillion of total (non-financial) U.S. debt outstanding—according to the Federal Reserve’s Flow of Funds—is 431% of GDP, just shy of the 438% reading in 2021 during the pandemic recovery (chart below). Simply stated, there has been a significant amount of financial steroids that have been juicing the economy and financial markets over the past decade.

Starting to see a bunch of potential short sale set ups which will probably be my focus today.

PLTR is a good example. In early May it looked like a double top short, which you could have made a couple of bucks off if you were nimble. If you weren’t nimble it quickly reversed to the upside and is stalling out again. A break back below the 10 day could be a short if overall sentiment turns negative here….

And no, bonds are still not a hedge…

On the long side I can’t imagine I would add anything now unless it’s a pre merger SPAC,

something tied to Trump’s inner circle, something tied to precious metals, or something tied to crypto. Of course I’m always open for stocks that retail decides to pump as well.

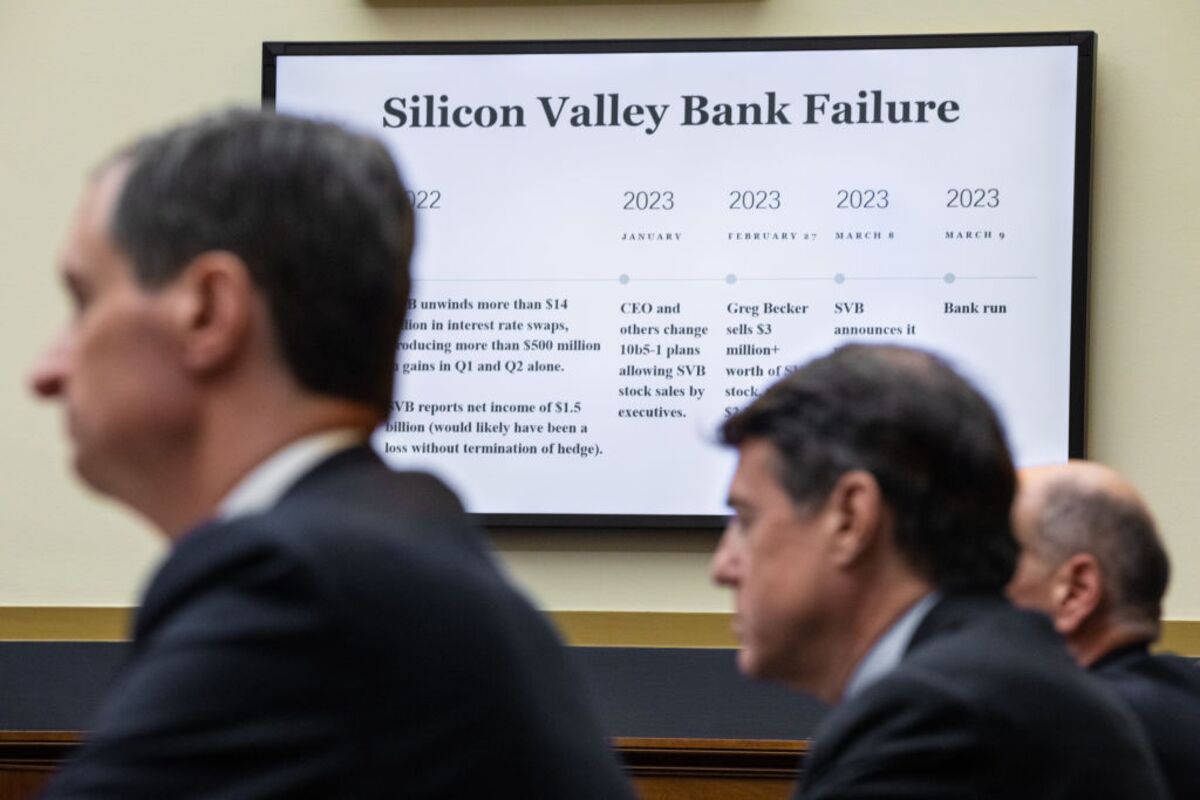

Haven’t talked about this in a while as there have been many other things going on, but still think regional banks are a ticking time bomb. Talking my own book but they look to be setting up as a short also…..

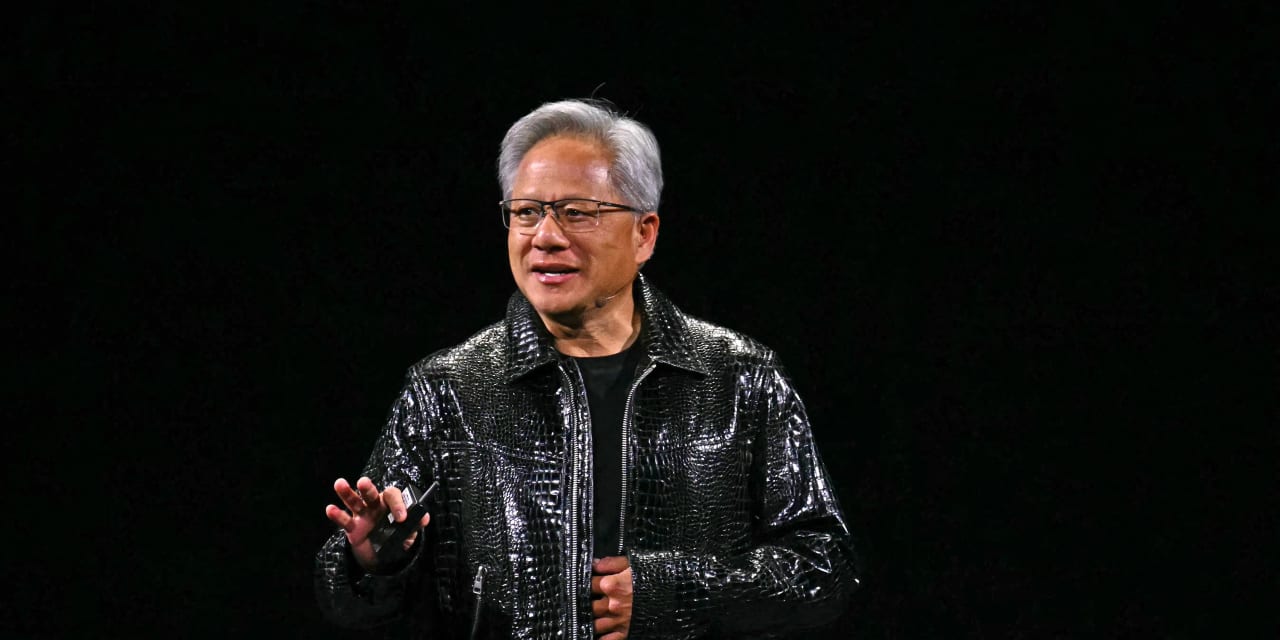

This morning we highlight a few things that caught my attention, most have one thing in common, all roads lead to NVDA.

What Happened?

At its GTC Taipei event, Nvidia unveiled NVLink Fusion, a new interconnect layer that lets hyperscale data centers seamlessly stitch custom accelerators (ASICs or CPUs) from third-party vendors into Nvidia’s GPU fabric. Instead of forcing customers into an all-Nvidia stack, the company is opening its networking, telemetry, and orchestration platform to partners’ silicon designs—ensuring Nvidia remains the “center of the AI wallet” even as customers experiment with bespoke chips.

Key Implications

Ecosystem Lock-In: Hyperscalers adopting NVLink Fusion face high switching costs, making it hard to abandon Nvidia’s networking fabric once integrated.

TAM Expansion: By supporting non-GPU accelerators, Nvidia broadens its Total Addressable Market to include every custom-chip player in AI training and inference.

Software Upsell Path: A unified interconnect becomes a conduit for Nvidia’s higher-margin software and services offerings down the road.

Intel Threat: Accelerates the shift from x86 CPU architectures toward heterogeneous accelerated platforms—intensifying pressure on Intel’s data-center franchise.

Enterprise Inflection: With NVLink Fusion and new RTX PRO servers, Nvidia is pushing GPU-accelerated infrastructure into mainstream enterprise workloads, especially if upcoming U.S. tax incentives fully write off AI capex.

Winners & Ratings

Ticker | Company | Rating | Rationale |

|---|---|---|---|

NVDA | Nvidia | 10/10 | Central compute fabric remains indispensable; Fusion cements Nvidia’s position at the heart of every AI data center. |

MRVL | Marvell Technology | 8/10 | Its custom interconnect IP for NVLink Fusion partners is a critical piece of the underlying switch fabric. |

SNPS | Synopsys | 8/10 | EDA leader for custom-silicon design; Fusion will drive incremental demand for partner chip development tools. |

QCOM | Qualcomm | 7/10 | Snapdragon-based server CPUs now plug into Nvidia’s AI fabric—boosting Qualcomm’s move beyond mobile. |

2454 | MediaTek (Taiwan) | 7/10 | Early Fusion partner; custom AI-accelerator designs on MediaTek IP could gain traction in Asia. |

Losers & Ratings

Ticker | Company | Rating | Rationale |

|---|---|---|---|

INTC | Intel | 4/10 | Faces steeper defensive battles as customers pivot from x86 to heterogeneous AI-accelerated nodes. |

6702 | Fujitsu | 5/10 | Limited non-Japanese data-center reach; Fusion support won’t move the needle on global share. |

Bottom Line

NVLink Fusion is a strategic masterstroke: Nvidia is wagering that customers will choose an open, scalable fabric—and then find it too painful to walk away. For your portfolio, lean into the primary winners (NVDA, MRVL, SNPS, QCOM) that underpin this emerging AI-data-center architecture, and underweight legacy x86 incumbents (INTC) whose day-one networking advantage is now at risk.

🚀 GPU vs. ASIC Showdown — Why Merchant GPUs Dominate Custom Chip Wars

TD Cowen wrote a report yesterday, I had GPT summarize it and come up with some potential winners and losers. If you want to read the full report…..

Report Overview: TD Cowen examines hyperscalers’ build‑vs‑buy decisions for AI accelerators, weighing commodity GPUs (merchant) against custom ASICs. Their “merchant‑vs‑custom” ROI model shows that unless a bespoke design delivers at least 55% of comparable GPU performance at scale, GPUs remain the superior choice. High NRE and long development cycles mean custom ASICs only win at massive volume deployments (100k+ chips).

Key Takeaways:

GPU Dominance: Unmatched perf/Watt, rich ecosystems and faster time‑to‑market give merchant GPUs a clear edge.

Custom Upside Limits: Only at extreme scale can ASICs justify their cost—else they underperform on IRR and risk obsolescence.

Margin Vulnerabilities: Custom‑chip startups face margin compression and binary execution risk; failures carry severe penalties.

Winners & Ratings:

Ticker | Company | Rating | Rationale |

NVDA | NVIDIA | 9/10 | Leader in merchant GPUs; broad AI‑compute moat and ecosystem lock‑in. |

AMD | AMD | 8/10 | Strong GPU roadmap, node partnerships with TSMC, growing data‑center share. |

AVGO | Broadcom | 8/10 | Networking and ASIC integrator with deep hyperscaler relationships. |

AMAT | Applied Materials | 8/10 | Critical fab-equipment vendor enabling advanced GPU production. |

ASML | ASML | 9/10 | Monopolistic supplier of EUV lithography—indispensable for next‑gen GPU node scaling. |

Losers & Ratings:

Company | Rating | Rationale |

Groq, SambaNova, Cerebras | 3/10 | Pure‑play custom XPU startups; lack scale, face high IRR hurdles and binary exec risks. |

Conclusion for Investors: Lean into merchant‑GPU leaders and their critical suppliers—NVIDIA, AMD, ASML, Broadcom and Applied Materials—while sidestepping small custom‑chip plays that lack economic scale or proven performance. This focus aligns your portfolio with the most durable, high‑margin nodes of the AI accelerator value chain.

I went to Microsoft’s website and downloaded the Book of Build, it was 88 pages long so I had GPT summarize. I already think MSFT is an AI winner, so I applied second order thinking and had GPT pick the suppliers to MSFT who could also be winners, and identify the stocks likely to miss out…

Microsoft Build 2025: The AI Stack Winners (And Losers) You Need Now

Key Points from the Build 2025 Book of News

Copilot Everywhere:

Fine-tuning & Agents: Enterprises can now tailor Microsoft 365 Copilot to their own data and spin up custom “Agents” inside Teams via a new low-code/Pro-code Agent Builder.

Copilot Studio & BYOM: A unified dev environment (APIs, SDKs) plus “Bring Your Own Model” support lets partners plug any open-source or proprietary AI into the same Fabric pipeline.

Azure AI Foundry & Fabric:

Model Catalog & Orchestration: 10,000+ pre-built models (open source + first-party like Grok 3) with multi-agent workflows, auto-routing, observability and cost controls.

On-Device AI: Foundry Local brings the same runtime to Windows 11 and macOS for privacy-sensitive or offline scenarios.

Data Services: Cosmos DB, Databricks, SQL Server 2025 and Power BI are all built into Fabric for real-time analytics and “Chat with your data.”

Edge & Windows AI:

Edge AI APIs: On-device prompts, writing assistance and soon, real-time translation—all running on the browser.

Copilot+ PCs: Snapdragon and Intel NPU APIs expose hardware acceleration to developers, creating a seamless edge-to-cloud AI continuum.

Security & Compliance:

Purview SDK & Defender Integration: Enterprise-grade data classification, DLP, insider-risk, and runtime threat protection baked directly into every Copilot agent and AI app.

Strategic Implications

End-to-end Lock-in: Microsoft now owns every layer—models, data, dev tools, compliance, edge runtime—making it the hub for enterprise AI and discouraging multi-vendor sprawl.

Partner Boom: To execute this vision at scale, MSFT will lean heavily on GPU makers, fab-tool vendors, security specialists, observability suites and consulting outfits.

Edge Surge: On-device AI features shift workloads (and value) from hyperscale clouds to Windows PCs and edge appliances.

Top Public Winners (Rated ≥ 8/10)

Ticker | Company | Rating | Role in the Microsoft AI Ecosystem |

|---|---|---|---|

NVDA | NVIDIA | 10/10 | Azure GPU backbone for training/inference; NVLink Fusion fabric. |

AMD | AMD | 9/10 | Alternative GPU supply & Windows NPU partnerships. |

ASML | ASML | 9/10 | EUV lithography tools for next-gen GPU and ASIC fabs. |

TSM | TSMC | 9/10 | Exclusive advanced-node foundry for Nvidia, AMD chips. |

AMAT | Applied Materials | 8/10 | Deposition, etch & inspection equipment for advanced-node fabs. |

LRCX | Lam Research | 8/10 | Critical etch & deposition tools for AI accelerator wafers. |

KLAC | KLA | 8/10 | Metrology & yield-management platforms ensuring fab quality/scale. |

DDOG | Datadog | 8/10 | Observability & tracing for Azure AI Foundry and Copilot health. |

SPLK | Splunk | 8/10 | ML-driven security, log analytics & threat detection in Fabric. |

SNOW | Snowflake | 8/10 | Data-warehousing backbone for Copilot Studio’s “Chat with data.” |

OKTA | Okta | 8/10 | Identity/access management for secure Copilot agent deployment. |

CRWD | CrowdStrike | 8/10 | AI-powered endpoint protection integrated with Windows ML. |

Key Losers (Rated ≤ 5/10)

Ticker | Company | Rating | Headwind from Microsoft’s AI Stack |

|---|---|---|---|

CSCO | Cisco | 5/10 | Traditional switches/routers squeezed by NVLink Fusion fabric. |

ORCL | Oracle | 4/10 | Dynamics 365 + Copilot undermines standalone ERP/CRM sales. |

CRM | Salesforce | 4/10 | Embedded AI features in Teams/365 cut into pure CRM platforms. |

Bottom Line:

Microsoft Build 2025 isn’t just about flashy demos—it maps out a single-platform future. By embedding Copilot, Fabric’s data services, edge runtimes and enterprise-grade security, MSFT locks in its ecosystem partners (GPUs, fab tools, observability, identity, security) as indispensable pillars. Position your portfolio accordingly: own the hardware and software specialists powering Microsoft’s AI juggernaut—and underweight legacy incumbents whose value stacks are being absorbed into the Copilot platform.

Longer term readers know AI power and natural gas are one of my favorite themes, so this article obviously caught my eye. I had GPT do a deep dive and point out any other potential takeover targets……

Why It Matters

Electricity Demand Soars: AI data centers + EV charging have reignited U.S. power growth—retail prices are up 21% since 2021 and capacity is scarce.

M&A Gold Rush: Buyers are paying ~$1 billion/GW for existing gas plants (vs. $1.5–3 billion/GW to build new)—a rare opportunity to acquire cash-gen assets at a discount to replacement cost.

Turndown on New Builds: Gas-turbine shortages and permitting delays limit greenfield projects, super-charging the value of brownfield plants.

Potential Buyout Targets (Publicly Traded)

Ticker | Company | Rating | Why It Fits as a Takeover Candidate |

|---|---|---|---|

AES | AES Corp. | 8/10 | Pure-play IPP with 14 GW global gas/thermal; under-levered balance sheet and private-equity appeal. |

CWEN | Clearway Energy, Inc. | 8/10 | 3 GW U.S. gas/solar fleet spun out by NRG; compact, high-margin portfolio ripe for roll-up. |

NRG | NRG Energy | 7/10 | Active consolidator—but could itself become a target for larger utilities or P-E given asset mix. |

DTE | DTE Energy | 6/10 | Regulated utility with merchant gas exposure; strategic buyer but balance-sheet light for big bolt-on. |

Other Key Winners & Ratings

Ticker | Company | Rating | Rationale |

|---|---|---|---|

CEG | Constellation Energy | 9/10 | Led the M&A wave with $27 billion Calpine deal—scales nuclear+gas merchant platform. |

VST | Vistra Corp. | 8/10 | Bolt-on of 2.6 GW Lotus portfolio at 7× EBITDA—highly accretive and leverage-neutral. |

BX | Blackstone (Infrastructure) | 8/10 | TXNM take-private at 23% premium; P-E firepower to roll up more high-cash plants. |

KMI | Kinder Morgan | 7/10 | Midstream backbone for new plant fuel and CO₂ transport—wins from higher load factors. |

GE | General Electric | 7/10 | Dominant gas-turbine OEM; order book backlog to stay full given replacement demand. |

EQT | EQT Corp. | 6/10 | Natural-gas producer benefitting from higher power‐plant utilization and gas spreads. |

Possible Losers & Ratings

Ticker | Company | Rating | Rationale |

|---|---|---|---|

NEP | NextEra Energy Partners | 5/10 | Renewables-focused MLP; growing gas demand shifts capital away from wind/solar. |

PLUG | Plug Power | 4/10 | Hydrogen hype gets overshadowed by gas-fueled power rush; capex cycle mismatch. |

PEG | Public Service Enterprise Group | 5/10 | Regulated utility with little pure-play gas exposure—misses out on merchant upside. |

Implications for Your Portfolio

Overweight: The strategic buyers (CEG, VST, BX) and critical enablers (GE, KMI, EQT) that capture both M&A gains and higher utilization.

Tactical: Short-list AES & Clearway (CWEN) as potential LBO candidates; take gains in pure renewables (NEP, PLUG) under reassessment pressure.

Watch: Pipeline bottlenecks—higher power prices may spur P-E sponsors to circle back for round-two deals.

Bottom Line: The AI/EV-driven power crunch has flipped brownfield natural-gas plants into takeover gold. Position alongside the acquirers and enablers—and eye pure‐play IPPs as the next rip-and-rebuild M&A targets.

Before you go: Here are ways I can help

ETFs: We offer innovative ETFs that cover all aspects of The H.E.A.T. Formula, Hedges, Edges, and Themes.

Consulting: I'm happy to jump on the phone with financial advisors at no charge. I've built a wealth management firm and helped other advisors grow their practices through the use of substantially differentiated investment strategies. If you want to talk just send me an email at [email protected]

Monthly investing webinars

Rebel Finance Podcast https://www.youtube.com/@TuttleCap

Wealth Management-Coming Soon

Paid Newsletter Service-Coming Soon

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.