I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Today

Income Blast Dividend Payable:

BITK: .18/share

MSTK: .50/Shares

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) November 14 2-3pm. Sign Up Here

Speaking of covered call ETFs, I recently sat down with Income Architect to talk about the future of income investing…..

Table of Contents

H.E.A.T.

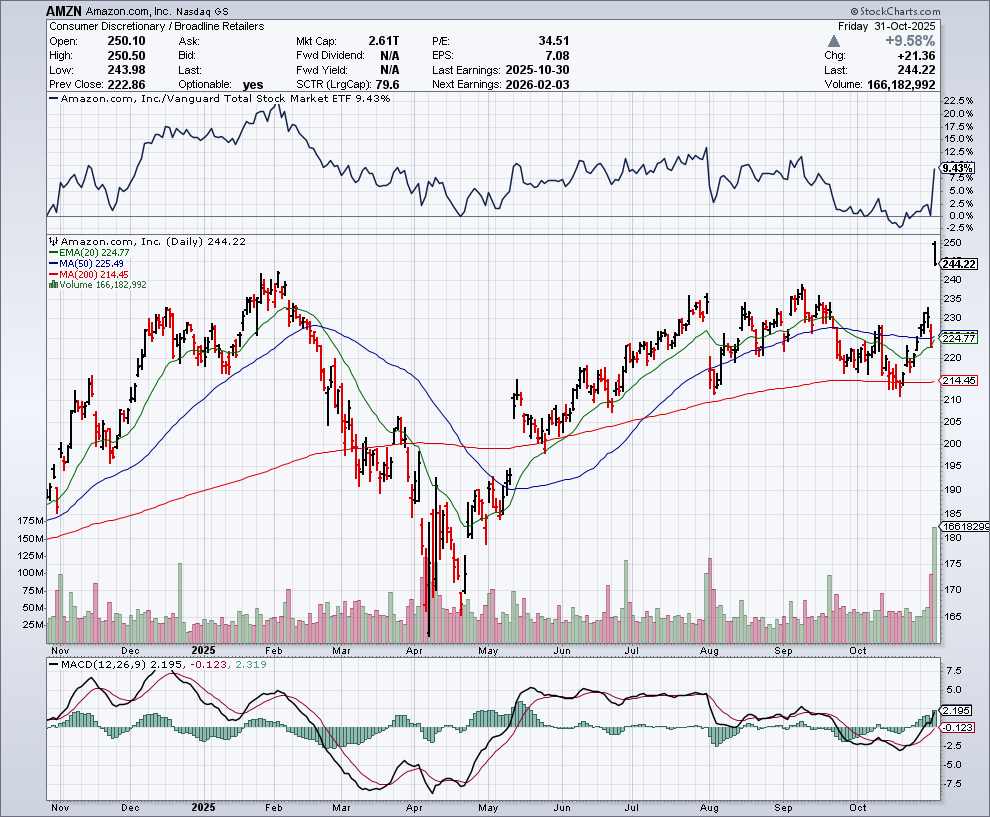

Taking a deep dive on AMZN earnings today and what it could mean for the AI infrastructure. AMZN stock price has lagged this year, but that could be about to change….

AWS Awakens: How Amazon’s AI Cloud Pivot Could Power the Next $1 Trillion Trade

What it means: AWS just flipped the AI narrative. With Q3 cloud growth re-accelerating to +20% YoY and fresh capacity coming online (3.8 GW added in 12 months, $125B capex this year, more in 2026), Amazon is set to close the “AI laggard” gap. If AWS avoids the two chokepoints—power and HBM/packaging—its backlog can compound into 2026. That shift doesn’t just lift $AMZN; it ignites a second- and third-order supply chain: grid equipment, substations, liquid cooling, optical/fiber, and custom-silicon enablement.

Second/third-order beneficiaries (where the money lands next):

Grid & interconnect: ETN, PWR, HUBB, POWL, HPS.A (x-formers, switchgear, EPC).

Power producers & PPAs: CEG, VST (sell electrons to AI load, capacity payments).

Thermal / liquid cooling & data-center MEP: VRT, CARR, JCI.

Colo & land/permits leverage: EQIX, DLR (neutral colo still wins when cloud bursts capacity), GE Vernova (GEV) for gen/transmission equipment.

Chips, memory, packaging & EDA: MU (HBM), TSM (advanced packaging for Trainium/Inferentia), SNPS/CDNS (design wins).

Optics & cables: COHR, LITE (high-speed optics), PRYMY (HV cable buildouts).

What to watch (and trade around):

Power & permits: interconnect timelines, minimum-bill/take-or-pay clauses; any utility guidance tying new rate base to AI load.

HBM/packaging supply: signals from MU/TSM on 2026 capacity; any slippage hits hyperscaler ramp math.

AWS backlog → revenue bridges: disclosed GPU/QPU hours monetized, Trainium/Inferentia adoption, and AI attach in ads/retail.

Colo pricing & utilization: if cloud is still “compute-starved,” EQIX/DLR capture overflow at improving economics.

Positioning: Barbell $AMZN (AWS re-accel) with power & grid (ETN, PWR, CEG, VST) and data-center picks & shovels (VRT, HUBB, POWL). Add HBM/packaging leverage (MU, TSM) on pullbacks. Avoid “compute renters” without firm PPAs or unit economics—the squeeze gets worse as AWS turns the jets back on.

News vs. Noise: What’s Moving Markets Today

When everything is going up and it seems like the market can never go down I like to highlight things to watch out for. Interesting when the S&P 500 hit an all time high on Wednesday, 33% of it’s constituents are down more than 20% from their all 52 week highs and 24% are within 24% of a new 52 week low. 60% of S&P stocks are below their 50 day moving averages…..

Cracks in Credit—A Canary, Not a Collapse

There’s growing chatter about a looming credit shock, with rising delinquencies in subprime auto loans, credit cards, and private credit. What’s unusual this time is timing — credit stress is emerging before unemployment rises. Normally, job losses trigger defaults, not the other way around. That inversion matters: it signals that households and smaller businesses are running out of liquidity, even as the labor market still looks “fine” on the surface. Household debt-to-income is at record highs, savings rates are at post-2008 lows, and high funding costs are starting to bite. We’ve also seen a jump in high-yield and asset-backed spreads — a subtle, early warning that capital markets are starting to reprice risk beneath the surface of the AI-fueled equity boom.

Takeaways for investors:

Credit is tightening quietly — watch auto ABS and credit-card spread data; a sustained widening would confirm stress beyond headlines.

Avoid over-levered consumer lenders and smaller financials exposed to subprime credit cycles (ALLY, COF, DFS).

Rotate toward balance-sheet strength — defensive cash-flow machines like insurers (PGR, CB), utilities (ETN, PWR), and energy infrastructure (CEG, VST) can outperform in tightening cycles.

Use volatility spikes to your advantage — liquidity shocks create entry points in quality credit or power/AI infrastructure names when panic hits.

Bottom line: credit cracks are forming, but this isn’t 2008. Think of it as a canary in the coal mine — a warning to lighten up on weak balance sheets and rotate into assets with real cash flow and pricing power before credit stress becomes consensus.

A Stock I’m Watching

Today’s stock is Amazon (AMZN)…..

This is the Mag 7 name that is now showing the most leadership.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Friday November 14, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.