I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

Long term readers know I am not a fan of bonds. However, property and casualty stocks have bond like features. Basically, they take your premium and invest in bonds. Unlike a bond manager who is usually just hugging an index, they are actually trying to manage the portfolio to make money. That’s why I’m a fan of having a sleeve of P&C stocks in your portfolio. Here’s why now could be as good a time as any to do this…..

According to a document from January 6, 2026, the market is doing something very typical: it’s getting nervous about P&C pricing softening, so it’s discounting the whole “insurance complex”… even while the best parts of the complex are still compounding. Specifically, TD Cowen notes insurance broker stocks are down ~9% on average since year-end 2024, largely driven by falling P/E multiples, because investors are worried growth slows as commercial P&C rate increases decelerate. But they also expect flattish to slightly down P&C pricing, while brokers still post double‑digit EPS growth, supported by exposure growth + fee-based revenue + clients buying more coverage when pricing declines + non-P&C units, plus ~90 bps/year margin expansion and FCF modeled at ~95% of earnings. In plain English: the market is treating brokers like they’re “rate-cycle hostage businesses,” and the research argues they’re closer to toll collectors that tend to perform across cycles.

Wall Street always does this at the same point in the cycle:

It chases the obvious winners (AI, MAG7, semis).

Then it panics about “late cycle” and rotates into “defensives.”

But it overpays for the fake defensives… and ignores the real all-weather compounders because they’re boring.

That’s where your P&C “bond substitute” idea comes in.

Because the right P&C names can act like:

A bond (durable cash flow, resilience, capital returns),

Plus a pricing power business (they can reprice risk over time),

Plus an inflation hedge (premiums and exposures tend to rise with nominal growth).

The key is: don’t lump P&C into one bucket. The winners are not the same as the losers when pricing cools.

What this tells me about the AI trade

Here’s the part most investors miss:

The AI trade is creating a new premium pool.

AI isn’t just chips and data centers. It’s:

construction risk (builder’s risk on giant projects),

property risk (high-value assets clustered together),

business interruption (downtime is expensive),

cyber + operational risk (attack surface explodes),

liability/casualty complexity (new failure modes, new litigation, new exclusions).

TD Cowen cites an estimate that data center investments could generate >$100B of cumulative insurance premiums through 2030, and that emerging casualty risks could add ~$5B of annual reinsurance premiums. That’s not a “fun fact.” That’s a roadmap for who gets paid second-order from the AI arms race.

So when you say you like P&C as a diversifier: you’re not just buying “defense.”

You’re buying a different tollbooth on the same infrastructure build.

The market’s fear: “P&C rates are rolling over”

The near-term narrative is simple: rate increases are slowing, and the market worries brokers and carriers lose momentum.

But the nuance (and the opportunity) is that brokers aren’t a clean proxy for the underwriting cycle the way people trade them.

Even in weak sentiment / flattish pricing, brokers can stay resilient because:

not all revenue is commission-based (fees matter),

clients often buy more coverage when rates ease,

exposures (and insured values) keep growing,

and operational leverage + capital deployment keeps EPS compounding.

That’s exactly what you want in a bond substitute equity: cash-flow durability even when the macro narrative flips.

Winners and losers

First-order winners

1) P&C brokers (the “toll collectors”)

This is the cleanest “bond substitute” expression inside P&C, because brokers don’t take balance-sheet underwriting risk the same way carriers do.

The report explicitly favors: AJG, AON, RYAN.

Why brokers can win even if rates soften:

They still ride exposure growth.

Revenue can be insulated via fees and client behavior.

They have a long history of low-to-mid single digit organic growth with double-digit EPS growth across cycles (per the report).

2) Best-in-class carriers (selectively)

The report also notes best-in-class carriers can work over a cycle, but selectivity is key.

Translation: the carrier “winners” are the ones who treat underwriting like religion:

disciplined pricing,

conservative reserving,

smart reinsurance,

and they walk away from bad business in soft markets.

Second-order winners

3) Reinsurance + specialty capacity (if casualty risk is rising)

If emerging casualty risks truly add incremental reinsurance premium demand, reinsurers and specialty writers with the right mix can benefit.

4) AI buildout “insurance adjacency”

This is where the AI tie-in really matters:

Data centers → big insured values → new premium pools

Cyber risk + operational risk → more complex products

AI adoption → new liability theories (eventually)

Brokers and specialty underwriters tend to monetize complexity.

Likely losers

1) Undisciplined underwriters in a softening market

If P&C pricing goes flattish, the losers are the carriers that:

chase premium volume,

underprice long-tail casualty,

or get surprised by reserve development later.

2) Buyers of coverage (yes, including AI hyperscalers)

If the insurable value of AI infrastructure explodes, premiums can rise—especially for specialized risks. That’s not an immediate stock short, but it is a margin pressure line item over time.

3) Investors treating P&C like a literal bond

P&C can be a bond substitute, but it’s not a Treasury:

catastrophe years happen,

litigation/social inflation happens,

regulation happens.

If you size it like “risk-free income,” the market will eventually teach you a painful lesson.

My “Top P&C Stocks” short list

Not investment advice—this is the high-quality, bond-substitute + compounder basket I’d build from the framework above.

Broker “toll collectors” (cleanest bond-substitute feel)

AJG (Arthur J. Gallagher) — compounding machine; strong organic growth profile in the broker group.

AON (Aon) — global broker + reinsurance + complex risk; directly levered to “the world got riskier.”

RYAN (Ryan Specialty) — specialty/E&S lever; tends to thrive when risks get harder to place; also explicitly favored in the report.

Carrier “best-in-class” (where selectivity matters)

CB (Chubb) — high-quality underwriting culture + global scale; one of the most “bond-like” large carriers in behavior.

TRV (Travelers) — steady underwriting discipline; tends to act like a quality defensive with cycles.

WRB (W.R. Berkley) or ACGL (Arch Capital) — specialty-tilted underwriters where discipline and mix can matter more than the broad cycle.

PGR (Progressive) — personal lines execution is a different animal, but historically one of the most consistent operators.

The 3 things I’d watch in 2026 (to know if this thesis is working)

Rate environment vs. broker organic growth: if rates go flattish but brokers keep printing mid‑single-digit organic, the market is mispricing durability.

Margins + capital deployment: the report flags long-run margin expansion (~90 bps/year) and strong FCF conversion (~95% of earnings). That’s “bond substitute” DNA.

AI infrastructure premium pool: if data center buildout continues, that cumulative premium opportunity is a structural tailwind.

News vs. Noise: What’s Moving Markets Today

Whether you love Trump or you hate him, he’s the most consequential president for markets we’ve ever had.

Monday was the fallout from Venezuela, yesterday was announcements about homes…

"immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations. I will discuss this topic, including further Housing and Affordability proposals, and more, at my speech in Davos in two weeks

This tanked the private equity firms and the homebuilders. Then there was this…

Which crushed defense stocks. After the close he announced that he was increasing defense spending, and now the defense firms are all back up.

A lot of times you can guess where he’s to issue executive orders, or what industries he will tweet positively about. These types of things would be much harder to figure out.

Something to keep an eye on is whether we get anything, either a tweet or an executive order, on utilities. Energy Secretary Wright has been making comments about rising electricity costs. This is an area you could definitely see Trump weigh in on. Not sure what you do with this, I’m pretty heavy in the whole AI infrastructure trade and at the end of the day I know he wants to win the AI race. However, with the midterms looming and affordability on the ballot, anything that raises prices for consumers is a possible target.

A Stock I’m Watching

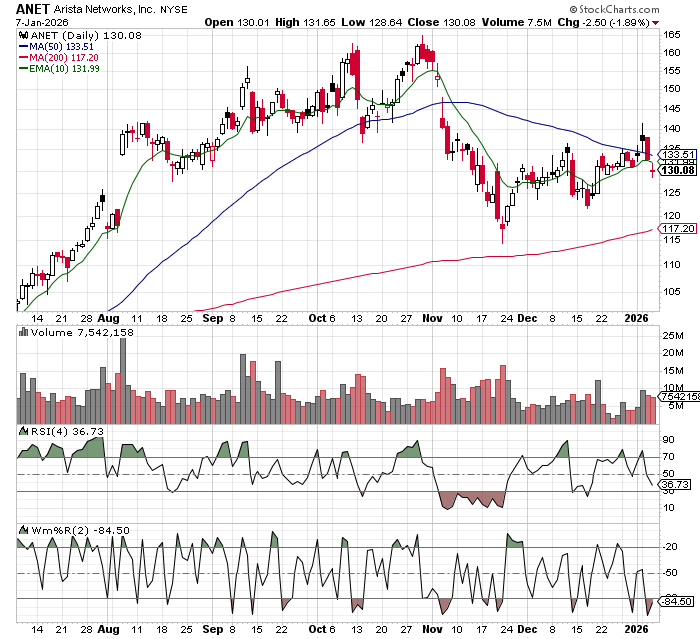

Today’s stock is Arista Networks (ANET)……

Arista Networks (ANET) remains one of the cleanest “picks-and-shovels” ways to stay long the AI buildout without having to underwrite who wins the GPU/ASIC race. The core bull case is that AI is pushing data centers into a networking- and systems-constrained regime: bigger clusters, more east‑west traffic, and faster upgrade cycles to 400G/800G (and eventually 1.6T), which structurally raises switching/routing content per rack and per campus. Arista’s edge is not just boxes—it’s the software stack (EOS + CloudVision), which makes high-speed Ethernet fabrics operable at hyperscale (telemetry, automation, rapid upgrades) and helps enterprises run AI workloads with fewer “human-in-the-loop” networking bottlenecks. If 2025 was about funding/compute, 2026 is about making the infrastructure actually work at scale—and ANET is a prime beneficiary as customers prioritize throughput, reliability, and operational simplicity. The key risk to watch is customer concentration and any digestion/pause in top cloud capex, but the offset is Arista’s expanding routing/campus footprint and the secular “AI traffic multiplier” that keeps pulling networks forward even when compute ordering gets choppy.

In Case You Missed It

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.