In Today’s Issue:

Adding a bit to hedges

SPACs are back

Betting on Trump’s handpicked winners

and more……..

In The News:

I am scheduled to be on NewsMax at 9:25AM EST today

I am scheduled to be on the Stock Trader Network at 10AM EST Today, you can tune into the show here….

On Friday we talked to Dr. David Watts about tokenization

Next Webinar:

Tariffs, Inflation, and Recession: What To Do Now

5/22 2pm EST

Betting on Trump’s Handpicked Winners

The market rallied Friday on the better than expected jobs number. That’s now 9 up days in a row…..

You will continue to see stuff like this in the media, it’s meaningless….

I would suspect, that like GDP earlier in the week, that the full impact of tariffs are not baked in yet…..

Things are going so well in the trade war and the U.S. economy that the S&P 500 is in the midst of its best daily winning streak in two decades. Obviously, we are being facetious. The winning streak is real, but it is founded on hopeful headlines and little more.

Mike O’Rourke-Jones Trading

The negative aspect of Friday was that it makes Fed rate cuts less likely, at least in the market’s view. SPY could easily stall right below the 200 day…..

Personally, I continue to add long exposure slowly, but I am also adding more hedges up here. I also think this is one of the biggest takeaways from earnings so far…

I also think if you are a bull you love this weekend’s Barron’s cover, just like they called the top in gold this could be bullish….

Pay attention to clues….

If you give Trump the benefit of the doubt that he knows exactly what he’s saying, then using the words “long-term” are key here. He also mentioned that next quarter will be Biden’s economy. My guess is that the economic numbers get worse before they get better. Don’t disagree with Mohit or Krinsky here and we have added some more hedges going into this week as I mentioned above….

The market's focus would shift to the tariff impact and economic data rather than just headlines. We see a weakening in the data going forward. We see limited room for further rally in risky assets and would reduce our exposure to US assets.

-Mohit Kumar, Jefferies

While it's possible there is an overshoot here even up towards the 200 DMA (5745), a 'sell the news' reaction on any actual trade deal would not be surprising to us. With that backdrop, we are hard pressed to chase strength. It doesn't mean we have to go back to 5k right away, but we see very minimal near-term upside here. With that said, if economic data continues to hold up we have to be open to the trading range resolving to the upside later this year.

-Jonathan Krinsky, BTIG

And of course this can’t be good for bulls…..

One of my favorite themes at the moment is Trump’s handpicked winners, this can be people, like Elon or Lutnick, or asset classes like Bitcoin. One of those is CLBR (full disclosure this is the top holding in SPCX). It’s a SPAC that Donald Trump Jr. is on the board of.

Somewhat of a difficult chart if you are looking for an entry…..

At some point I’ll do a primer on how SPACs work for those who don’t understand the risk/reward.

Last week was the largest week for SPAC new issuance in more than 3 years. There were 9 deals that priced raising $2bln in trust proceeds, predominantly from seasoned sponsor teams, which included the likes of Gores, Cartesian, and Atlas Merchant. YTD new issue tally moves up to 36, $7.2bln (2024: 57, $9.6bln). Given the robust demand for SPAC paper, the desk continues to field interest from investors on how best to deploy capital back into the SPAC market. There are several areas of outperformance, which include names seeking target acquisitions, announced deal names, and now recently priced IPO paper, trading at a premium right out of the gates (eg Friday's CEPT $11.25 debut / closed $11.08 after pricing 24mm units @ $10.00).

-TD Securities Special Situations Commentary

Speaking of SPACs, Cantor’s recent one, CEP, really seems to have opened up the floodgates for companies copying MSTR and buying Bitcoin. This is the reason we launched 2x GME (GMEU) and 2x DJT (DJTU), expect some more from us here. We missed CEP for SPCX, I never make the same mistake twice (Cantor has CEPO and CEPT which we do own), so now I am searching for some under the radar screen names.

I had GPT create a watchlist for me of companies and I show a couple of charts that look interesting (already in a few of them)……..

Here’s a focused watchlist of additional public companies—beyond MSTR and CEP—that are actively adding Bitcoin to their balance sheets, along with a 1–10 investment‐potential rating:

Tesla (TSLA): holds

10,000 BTC ($900 million) as a strategic treasury diversification beyond its core EV and energy businesses.

Investment potential: 7/10 – Tesla’s industry leadership and strong cash flows cushion crypto swings, but Bitcoin exposure is a small fraction of its balance sheet.

Would like to see TSLA move back above the 200 day…..

Block (XYZ): owns 8,485 BTC (~$825 million) as of April 3, 2025, via its corporate dollar-cost-average program integrated with Cash App.

Investment potential: 6/10 – Block’s clear Bitcoin blueprint and developer tools help adoption, but Square/Cash App competition and unrealized losses weigh on stock momentum. BitcoinTreasuries.com

Block had horrific earnings on Friday, but it pulled an undercut and rally at the 4/7 low, which could be taken as a long entry….

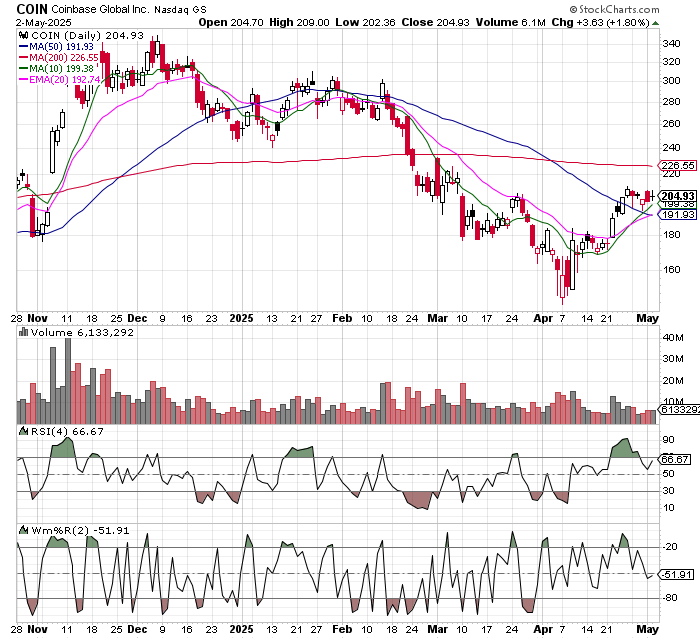

Coinbase (COIN): holds 9,480 BTC (~$924 million) on its own books, supporting its exchange, custody, and institutional services.

Investment potential: 8/10 – Coinbase’s direct crypto exposure and diversified fee streams offer asymmetric upside, although regulatory headwinds and trading volumes can be volatile. Bitcoin TreasuriesNice chart, holding a couple of key support areas…

GameStop (GME): has announced plans to include Bitcoin as a treasury reserve asset to bolster its turnaround beyond gaming retail.

Investment potential: 4/10 – while innovative, GME’s core business remains challenged and its crypto allocation scale and execution are still unproven. Reuters

Riding along the 10 day moving average…

KULR Technology (KULR): allocated a meaningful slice of surplus cash into Bitcoin, triggering a notable stock rally.

Investment potential: 5/10 – KULR’s small-cap fintech profile offers high beta to Bitcoin moves but carries execution and liquidity risks. Financial TimesMarathon Digital (MARA): holds 47,531 BTC (~$4.65 billion) as of April 10, 2025, blending mining and direct market purchases via equity raises.

Investment potential: 6/10 – Marathon’s scale and vertically integrated mining give it cost advantages, but energy costs and discretionary BTC sales add earnings variability. BitcoinTreasuries.comRiot Platforms (RIOT): accumulated 19,223 BTC (~$1.6 billion) unencumbered, delivering a 37.2% year-to-date BTC yield from its mining operations.

Investment potential: 6/10 – Riot’s operational growth and recent acquisition of Rhodium assets drive scale, yet regulatory scrutiny and power-price swings remain headwinds. tipranks.comFold Holdings (FLD): a pure-play Bitcoin financial-services firm that has grown its treasury to 1,485 BTC via opportunistic purchases funded by convertible notes.

Investment potential: 5/10 – FLD offers direct leverage to Bitcoin’s upside through its consumer apps, but as a small-cap with limited revenue diversification and execution risk, its share price can be highly volatile. SEC

This is a De-SPAC. Could really run based on what’s going on with CEP….

Semler Scientific (SMLR): a medical-technology company that pivoted its treasury into Bitcoin, now holding 3,303 BTC after recent at-the-market offerings and cash purchases.

Investment potential: 6/10 – semler’s core diagnostics business plus aggressive BTC stacking gives it asymmetric upside to Bitcoin gains, though high balance-sheet concentration and a narrow float introduce liquidity and sector risks. coindesk.com

Clear downtrend, but could see this break through the 50 day and move back up….

This one is getting listed on the NASDAQ in a couple of weeks….

Galaxy Digital (GLXY CN) - On April 30, GLXY CN announced that they now expect their dual NASDAQ listing to go into effect on 5/16/25, assuming shareholders approve the reorg proposal on 5/9/25.

Interesting if true….

Traditional Industry Companies Diversifying into Crypto

These companies come from traditional industries (energy, industrial) and have diversified a portion of their treasury or operations into cryptocurrency holdings.

ARLP

CANG

Mainstream Tech and Gaming Companies (with Crypto Treasuries)

These companies have core businesses in technology, gaming, or e-commerce unrelated to crypto, but have allocated a portion of their treasury or investments into cryptocurrency.

MELI

RUM

Chat GPT missed this one…..

DJT is one to watch, as far as I can tell they haven’t added Crypto to the balance sheet yet, but it would make sense from a business standpoint. It also fits very well into the Trump’s handpicked winners theme…

Needs to break through the 200 day….

Before you go: Here are ways I can help

ETFs: We offer innovative ETFs that cover all aspects of The H.E.A.T. Formula, Hedges, Edges, and Themes.

Consulting: I'm happy to jump on the phone with financial advisors at no charge. I've built a wealth management firm and helped other advisors grow their practices through the use of substantially differentiated investment strategies. If you want to talk just send me an email at [email protected]

Monthly investing webinars

Rebel Finance Podcast https://www.youtube.com/@TuttleCap

Wealth Management-Coming Soon

Paid Newsletter Service-Coming Soon

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.