I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Table of Contents

H.E.A.T.

I usually like to write about the T in the H.E.A.T. Formula as the market mostly goes up. However, when things are in a bit of turmoil I like to go back to the H, hedges. I believe you should always have hedges in place. You can ramp them up and down based on your taste and your feelings about the market, but they should always be there. Wall Street will tell you that bonds are a hedge, they aren’t. For something to count as a hedge, it has to work every time. So I like to see articles like this pointing out the fallacy of bonds as a hedge…….

H is for Hedge — and most people don’t actually hedge

The market is starting to creak in all the familiar places: rates, leverage, liquidity, and “consensus” trades that suddenly realize they’re crowded. And that’s the perfect moment to talk about the most misunderstood letter in the H.E.A.T. Formula: H = Hedging. Most investors think they hedge. What they really do is diversify. They add something that behaves differently sometimes and call it protection. But a diversifier is not a hedge. A hedge is designed to pay you when you need it most — on the day correlations go to 1, liquidity disappears, and the tape starts gapping.

And even BlackRock is now saying the quiet part out loud: long-term Treasurys don’t provide the “ballast” they used to, and bond markets have started 2026 “bumpy,” with yield spikes themselves becoming part of the risk.

The two “hedges” people love… that don’t hedge when it matters

1) Bonds aren’t a hedge.

For 40 years, investors learned one lesson: when stocks get hit, bonds rally — so a stock/bond mix “hedges itself.” That worked in a disinflationary world where recessions meant yields fell and duration saved you. But in an environment dominated by inflation uncertainty, fiscal pressure, and supply of government paper, bonds can sell off with stocks, and the “hedge” becomes a second source of drawdown. That’s exactly why BlackRock’s 2026 outlook argues traditional diversifiers like long-dated bonds offer less cushion against risk-asset selloffs, and why they’ve been explicit about being tactically underweight long-term U.S. Treasurys.

2) Gold isn’t a hedge either — not the way people use it.

Gold can be a long-run store of value, and it can do great in certain regimes. But as a crisis hedge, it’s unreliable because it can get hit by the exact same forces that hit everything else: dollar strength, real-rate shocks, forced deleveraging, and margin calls. Case in point: today’s continuation of the metals meltdown — Reuters notes gold and silver extended their plunge as the futures exchange raised margin requirements, accelerating forced selling.

And yes, you can own “bond substitutes” like P&C insurers for income and steadier business models — I’ve talked about that before — but those are still equities. They can gap down in a real risk-off tape. They’re not a hedge. They’re a different kind of exposure.

The only real hedge is convexity (tail risk)

If you want something that actually offsets portfolio pain during the ugly moments, you need convex payoffs — positions that get more sensitive as things get worse. That means tail-risk structures:

SPY/QQQ puts

put spreads (to reduce bleed)

VIX calls / call spreads

ratio spreads

“collars” and “seagulls” (buy downside, sell some upside to finance)

There’s no magic: a hedge has a cost. You either pay premium (insurance), or you finance premium by giving something up (usually upside). The key is to stop pretending diversifiers are hedges, and instead budget hedging like you budget insurance: small, systematic, and designed to show up when the building is on fire — not when the weather is nice.

Here’s an example of a trade I like to put on every night. This is an example only, it’s a fairly complex trade that if you do it wrong can bite you in the ass….

Trade evaluation: your daily QQQ hedge (2/2, QQQ = 621.87)

Sell a QQQ call credit spread and use the proceeds to finance a QQQ put. Here’s today’s structure:

Sell 2/3 622 call @ 3.97

Buy 2/3 625 call @ 2.46

→ Call spread credit = 3.97 − 2.46 = +1.51Buy 2/3 619 put @ 3.51

→ Put cost = −3.51

Net cost (what you actually paid)

Net debit = 3.51 − 1.51 = 2.00 points (≈ $200 per 1-lot).

So the call spread financed ~43% of the put (1.51 / 3.51).

What this trade really is

This is essentially a 1‑day “seagull” hedge: long put + short call spread.

You’re buying crash convexity and partially paying for it by selling upside (with defined risk).

Risk/reward at expiration (2/3 close)

Max loss: 5.00 points (≈ $500)

Happens if QQQ closes ≥ 625

Why: the 622/625 call spread is worth 3 points against you, and you paid 2 points net premium.

Max gain: effectively large on a hard selloff (grows as QQQ falls)

Below the put strike, you’re long linear downside via the put.

Downside breakeven: 617

Because: 619 put strike − 2.00 net debit = 617

Quick payoff map (per 1-lot)

If QQQ closes between 619 and 622 → you lose your premium: −2.00 (−$200)

If QQQ closes at 617 → breakeven

If QQQ closes at 610 → +7.00 (+$700)

If QQQ closes at 600 → +17.00 (+$1,700)

If QQQ closes at 625 or higher → max loss −5.00 (−$500)

The practical interpretation (why it works as a hedge)

At 621.87, your breakeven 617 is only 4.87 points lower — about 0.78% downside in one day. In other words: you’re not buying a “crash-only” hedge. You’re buying something that starts paying on a normal red day in a stressed market.

But you’re financing it by taking on upside risk:

If QQQ rips higher, you cap your loss at 5 points — which is manageable if your overall book is long risk, because the portfolio gains can swamp that hedge loss.

The two big pros

Defined risk (you know the worst-case number).

Convexity where you actually need it: you get paid for downside acceleration and gap risk, the exact moment “diversifiers” tend to fail.

The two big cons

You’re still paying premium (2 points/day). If you do this daily, you’re running an insurance program that will bleed in quiet tapes. That’s fine — if it’s budgeted.

You’re selling near-the-money upside (622 is basically spot). In a choppy bear market, that’s great. In a face-ripping bear-market rally, you’ll hit the max-loss zone repeatedly.

As a daily hedge overlay on a portfolio that’s structurally long equities, this is a smart, honest trade: you’re explicitly exchanging a small, known daily cost — and some upside — for protection that actually shows up when stress hits. As a standalone trade (without a long book behind it), it’s simply a short-term bearish bet with a capped loss — still fine, but it’s not “free protection,” and it’s not positive carry.

Remember, I am putting this on with 1 DTE options, which means this trade has to be managed every day. If you forget about a leg that’s in the money then you will be exercised. That’s another reason I give this to you as an example of how to think about hedging, not as a recommendation.

News vs. Noise: What’s Moving Markets Today

Noise: Today’s chatter is doing what it always does in a stressed tape: collapsing a multi-variable market into a single headline. “Shutdowns don’t matter” vs. “shutdown = crisis,” “the Fed-chair pick killed metals so the debasement trade is dead,” “oil/gas down = recession,” and “big AI spending needs big funding so the AI boom is either over… or guaranteed.” That’s all narrative whiplash. One-day (or two-day) commodity air pockets are often positioning + leverage + margin mechanics, not a clean macro verdict, and equity indexes can levitate for a while even as the plumbing (commodities, credit, funding) flashes yellow.

News & takeaways: The U.S. government slipped into another partial shutdown over the weekend, and the U.S. House of Representatives is moving toward a vote expected Tuesday; the first real market consequence is a data gap — the Bureau of Labor Statistics says the January employment report (and December JOLTS) will be delayed until funding is restored. Equities didn’t blink: the S&P 500 closed at 6,976.44, just a hair under last week’s record close, with the Dow +1.05% and the Nasdaq +0.56%. The stress is in commodities: gold slid to about $4,630/oz and silver to about $76.8/oz as CME Group margin hikes and a stronger dollar kept deleveraging pressure on precious metals after Friday’s historic flush. Energy rolled too: crude fell roughly ~4% on Iran de-escalation chatter, and U.S. natural-gas futures printed a roughly ~26% one-day drop on warmer mid‑February forecasts. On policy, Donald Trump has nominated Kevin Warsh to run the Federal Reserve when Jerome Powell exits in May — markets are reading “hawkish credentials,” but the political pressure for lower rates is already out in the open. And in AI, Oracle is effectively telling you the next constraint: it plans to raise $45–50B in 2026 (including up to ~$20B via share sales) to finance cloud buildout tied to OpenAI — translation: the AI boom is increasingly a capital-markets/funding story, so watch credit/funding appetite as closely as you watch AI revenue headlines.

So far this morning precious metals are rallying hard. I continue to be the camp that nothing has changed here and you want to be a buyer of dips. Crytpo seems to have stabilized, I still think you should be a buyer of dips here also. I’ve talked about how the M-W-F in IBIT options allows for some cool strategies with covered calls, but it also allows for some other options based strategies, may talk about that in a future newsletter.

In earnings, PLTR and TER are killing it this morning, guess what new ETF owns both?

A Stock I’m Watching

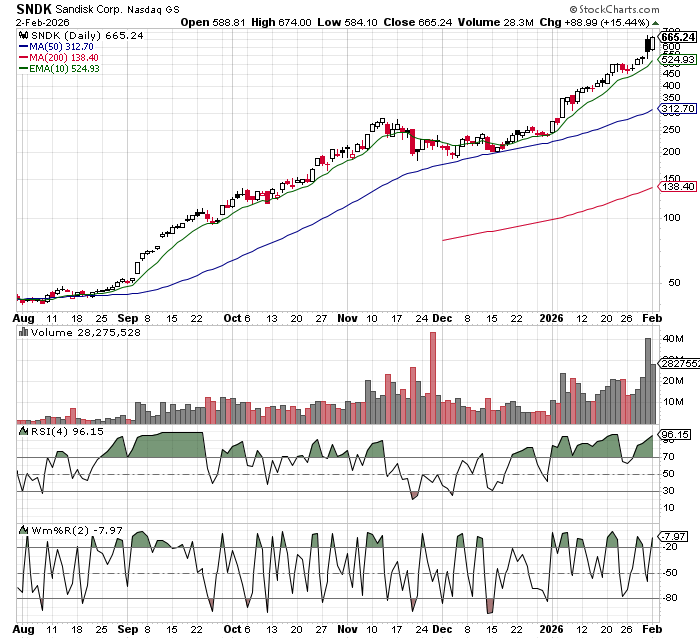

Today’s stock is Sandisk (SNDK)…….

Sandisk (SNDK) — after the post‑print momentum surge, the setup is attractive fundamentally on the “AI storage + tight memory” narrative, but it’s also the kind of name that can get overextended fast when expectations reset higher in a single week. If it keeps grinding higher without a pause, the risk is an air‑pocket pullback (profit‑taking + crowded positioning) where even “good” news isn’t enough because the bar is already sky‑high; I’d rather see it digest (sideways base or a controlled retrace) and then prove it can hold a new support area before getting aggressive, because in overextended tape, the move becomes the risk—any hint of easing tightness, slowing orders, or a broader risk‑off day can hit it harder than you’d expect.

In Case You Missed It

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.