I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Today is Payable Day for the Income Blast ETFs:

BITK .13/Share

MSTK .35/Share

We will post yield numbers on X later.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) December 9 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

There’s a lot going on in markets right now, and a lot of people running around saying that this is the top. This brings me to an interesting question, can you predict market tops and get out before, or short it and make a lot of money? The answer is maybe, but it may not be all that it’s cracked up to be.

I’ve been investing since 1981, I’ve seen a lot of market crashes and everyone of them has multiple people who called it ahead of time. In recent memory there’s the big short and guys like Michael Burry and John Paulson. There are a couple of key things to remember though before you go out and try to predict a top:

Guys like Burry were way early and got crushed before they were eventually proven right. Most people would not have the intestinal fortitude, or the capital to ride that out.

A lot of people who call crashes are people who are constantly calling for a crash. The media loves that stuff, If I keep saying the market is going to crash, eventually I will be right and CNBC will trot me out as the guy who called the crash (they actually wouldn’t as I’m banned from CNBC for the Inverse Cramer thing, but you get the idea).

Many of the people throughout history who did accurately call a crash never got anything right again.

Not only do you have to call the top, you also have to call when to get back in. Eventually all of these market declines retrace to the upside.

So that leaves you with a few choices:

Try to be that guy and predict the market top, get out or go short.

Think markets go up forever and don’t do anything different. This is ok if you are young and have plenty of time to recover, but not really ok if you are older.

Be cognizant of what’s going on around you and plan for the worst and hope for the best. This is my preferred choice. I always have hedges, but I’m holding more than usual and I like to add on green days like Friday. I’m buying the dip but keeping position sizes smaller and using ratio spreads whenever there’s enough liquidity. I’m doing the same in crypto, but only with ratio spreads or buying puts against anything I’m long. I’m also looking to add more to MicroStrategy’s preffered issues (wrote about those a little bit ago).

Speaking of being cognizant of what’s going on, there are three more dangers I am seeing beyond AI capex and a hawkish Fed……….

News vs. Noise: What’s Moving Markets Today

Three Tripwires the Market Isn’t Pricing: Japan’s Yield Shock, Private‑Credit Math, and DATs vs. the Indexes

You already know my two core pillars for this tape: AI capex keeps the growth engine humming, and a dovish Fed keeps the multiple elevated. Last week showed those pillars can wobble. Today I want to cover three under‑discussed threats that can crack the market also: Japan’s regime shift in rates and funding, stress building inside private credit, and the possibility of DATs being delisted from stock indices. I’ll frame each like a PM would: what’s actually happening, why it matters for risk assets, what to watch, how to position—then give a 1–10 “bubble‑pop score” for its ability to break equities (or crypto, for DATs).

1) Japan: From “free funding” to term‑premium risk

What’s happening

Long‑dated JGB yields have surged to multi‑decade highs as domestic demand softens (lifers less compelled to buy ultra‑longs post rule changes; BoJ tapering at the long end), while overseas buyers step in because currency‑hedged yields now screen compelling versus U.S./EU duration. At the same time, the classic yen‑carry play—borrow cheap in JPY, lever risk elsewhere—looks less one‑way as the curve gets volatile and intervention risk rises into the 155–160 USDJPY zone. Add fresh fiscal stimulus in Japan and you’re embedding a real term premium in JGBs.

Why it matters

A fatter, more volatile Japan term premium can (i) cap how low U.S. long yields can fall, even if the Fed wants to ease; (ii) make yen funding less reliable for levered global books, forcing periodic deleveraging in crowded trades (U.S. tech, EM carry, long credit beta); and (iii) reroute global savings back to JGBs at the margin, competing with Treasuries/IG credit. That’s sand in the gears for multiple expansion right when AI capex needs cheap, abundant funding.

What to watch

• 30y/40y JGBs holding >3.3%–3.7% and BoJ long‑end purchase pace

• USDJPY spikes or surprise MoF intervention headlines (Asia hours)

• Cross‑currency basis and hedged JGB yields vs. USTs; foreign flow data into 10y+ paper

• Correlation flips: Asia‑hour JGB/FX vol bleeding into SPX realized and VIX tails

Bubble‑pop score (equities): 8/10. It’s a slow‑burn risk that raises fragility across the plumbing. One nasty Asia‑hour squeeze can force de‑risking in otherwise “unrelated” U.S. assets.

2) Private Credit: When someone actually checks the math

What’s happening

Direct‑lending CLOs have ballooned alongside the $2.3T private‑credit complex. Unlike traditional drawdown funds (where managers mark their own books), CLOs run hard OC/coverage tests. A BlackRock middle‑market CLO (Baker 2021‑1) repeatedly breached tests and was “cured” in part via fee deferrals and cash diversion up the stack—an extraordinary step that underscores how tight the math is when loans sour. Elsewhere you’ve seen high‑profile blowups (auto, industrials) and mergers walked back under scrutiny. Troublesome datapoint: “criticized”/troubled loans up multiple‑fold since 2022 even as headline defaults stay low—a classic extend‑and‑pretend tell.

Why it matters

If more vehicles trip OC tests, two things happen: (i) equity/mezz tranches get zeroed and cashflows get trapped—return expectations reset for a wide swath of LPs, and (ii) warehouse lenders tighten or freeze new prints. That starves mid‑market borrowers right when a refinancing hump hits. It’s not a 2008 bank‑capital event, but it is a pro‑cyclical credit shock that can spill into employment, capex, and—critically—the private financing spigot feeding parts of the AI buildout (off‑balance‑sheet data‑center financings, vendor finance, project bonds).

What to watch

• OC test breaches/downgrades and trustee reports across direct‑lending CLOs

• Warehouse capacity, AAA spreads on new issues, equity NAV marks in BDCs

• “Restructurings” that look like evergreening (maturity push with PIK) and the gap between criticized loans and defaults

• Any signs of large allocators pausing commitments to flagship private‑credit funds

Bubble‑pop score (equities): 7/10. Not the spark by itself, but a very plausible accelerant that turns a rates wobble into a cash‑flow scare for Main Street borrowers and select AI infra financings.

3) DATs vs. the Indexes: What Happens If “Bitcoin-on-Balance‑Sheet” Stocks Get Kicked Out?

What’s actually on the table

Index providers (think MSCI, FTSE Russell, S&P DJI) exclude vehicles they deem “non‑operating” (ETFs, closed‑end funds, certain holding companies). DATs—public companies whose core economic function is to raise capital and hold Bitcoin via equity, preferreds, or debt—are now in the crosshairs. You saw the smoke in Strategy’s own “Response to the MSCI Index Matter,” emphasizing “we’re an operating company, not a fund.” That’s not a press release you publish unless the classification question is real. The rule of thumb for indexers is simple: if the equity behaves like a wrapped exposure to an external asset with limited operating revenue, it’s a candidate for exclusion or reclassification.

Why index exclusion bites

Forced passive outflows: If a DAT is removed from MSCI ACWI/World/USA, FTSE Russell, or related style/size indices, every index‑tracking product linked to those families becomes a mechanical seller. For many mid‑ and small‑cap names, passive ownership can be 10–30%+ of the free float. Even at the low end, that’s meaningful inventory hitting the tape into a thinner order book.

Multiple compression via “NAV logic”: DATs often trade at a premium to their BTC net asset value (mNAV). Index inclusion supports that premium by supplying constant, non‑discretionary demand. Remove the passive bid and the equity migrates toward pure arbitrage math: BTC per share ± a funding/management haircut. Premiums can compress to ~1.00x mNAV or even flip to discounts in stress.

Capital‑markets knock‑on: DATs finance themselves with serial preferreds and converts at high coupons. A smaller natural buyer base + lower equity premium = higher all‑in cost of capital. That makes new Bitcoin purchases harder, raises dilution risk, and turns a flywheel in reverse (less issuance → less BTC buying → slower AUM growth → lower premium).

Portfolio plumbing: Many long‑only or factor mandates are constrained to benchmark constituents. Exclusion shrinks the discretionary buyer pool and can increase borrow availability/cost dynamics for shorts, raising day‑to‑day volatility.

What to watch

January 15th is the date we find out about any index withdrawals.

Bubble‑pop score (crypto): 8/10. High reflexivity means small shocks can snowball. For equities, more like 3/10 except for BTC‑linked names.

Bottom line: AI capex and the Fed still set the ceiling for this market, but the floor is increasingly set by funding—Japan’s, private credit’s, and crypto’s. Respect the plumbing, size your risk, and buy yourself time with structures that survive a few bad days.

A Stock I’m Watching

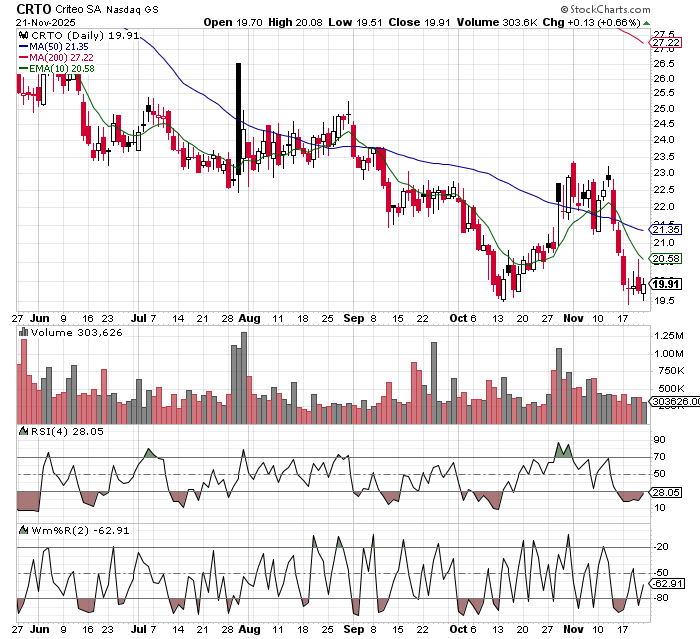

Today stock is Criteo (CRTO)…..

Agentic AI for commerce could blow up the traditional search / display / retail‑media boundaries and that Criteo has the right plumbing:

They sit on real‑time SKU‑level data across a broad retailer network, not just one walled garden. That’s exactly the substrate agentic shopping agents will need (availability, price, promo, margin, etc. at SKU level across retailers).

As AI agents start to do “find me X under $Y” style purchasing across sites, whoever already has the multi‑retailer graph plus bid/attribution stack has enormous leverage. That’s Criteo’s core competence today.

Asymmetry / quant lens

Stock is trading around $19–20 with Stifel and others sitting at $41–42 PT – ~100% implied upside.

Near the 52‑week low, down ~50% YTD, despite strong Q3 EPS beat (1.31 vs 0.89) and solid retail‑media growth.

Balance sheet is clean; this isn’t an unprofitable concept stock. You’re basically getting a profitable retail‑media/agentic‑commerce option at a distressed multiple (~2x EBITDA per Stifel).

Risks

Key risk is execution and whether non‑Amazon retail media ever scales to the hype. But structurally, if retail media and agentic shopping become what they’re supposed to be, Criteo is one of very few pure‑play, non‑walled‑garden assets.

That combination – depressed price, real cash flow, and genuine “plumbing for the new regime” – is exactly what you said you want: large upside, bounded downside.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Tuesday December 9, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.