I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Table of Contents

Ex Dividends Today

H.E.A.T.

Claude Cowork Just Spooked Wall Street… But It Didn’t Kill Software

It exposed which software companies are real businesses… and which ones were just renting a feature.

This week’s “software panic” has a clear villain: Anthropic’s Claude Cowork — an autonomous assistant that can actually do work (touch folders, operate browser tools, run multi-step tasks) instead of just chatting. The market’s immediate conclusion was simple: “If an agent can do the task, why pay for the app?” So investors hit the whole software complex like it was 2000 again. But here’s the better framing: Cowork isn’t a software killer. It’s a software sorting machine. It accelerates the shift from “software = UI” to “software = system + data + permissions + audit trail.” In other words, the front end gets more replaceable… while the back end (systems of record, identity, security, and workflows) gets more valuable. I’ve been positive on software going into 2026, was I wrong? I don’t think so, I think I was early for the part that matters: software leadership in 2026 will skew toward platforms with distribution + data + trust, while “thin wrapper” apps get repriced.

The real regime shift

In the old world, software won by owning the user interface and charging per seat.

In the agent world, software wins by owning:

the data (proprietary, messy, regulated, enterprise-grade)

the permissions (identity, access, audit, controls)

the workflow (what gets approved, logged, reconciled, and governed)

the distribution (already installed, already budgeted, already trusted)

Cowork is powerful — but in real companies, autonomy without guardrails is a lawsuit, not a product. The first wave of AI agents will live inside environments that have: SSO, access policies, compliance, logging, and admin controls. That’s why the “software is obsolete” take is usually lazy. What’s actually happening is more uncomfortable for investors:

The seat-based SaaS model gets pressured… but the platforms become toll booths.

Winners and Losers

Winner bucket #1: The “control planes” that will host the agents

These companies are positioned to become the default distribution layer for “AI coworkers” inside the enterprise:

$MSFT — the ultimate agent distribution story (Microsoft 365 + Copilot + Teams + Windows + enterprise identity). If agents become normal, Microsoft becomes the operating system of work.

$GOOGL — Workspace + Gemini + deep infrastructure; they can ship agents at scale and price aggressively.

$AMZN — not “office software,” but if agents become real workloads, AWS is still the backend toll booth.

Winner bucket #2: Systems of record and workflow platforms (the stuff agents can’t “wing”)

Agents don’t replace systems of record — they use them. And the systems that are deeply embedded become harder to dislodge:

$NOW — workflows, approvals, tickets, IT + employee operations. Agents will run through ServiceNow rails, not around them.

$CRM — customer data + workflows + enterprise embed. “Agentic CRM” is a feature war, but Salesforce owns the installed base.

$ORCL — database + enterprise backbone + cloud infrastructure; boring wins when the world gets more complex.

$INTU — high-stakes + regulated workflows (tax, payroll, small business financials). This is exactly where “general agents” sound scary but hit reality fast.

Winner bucket #3: Second-order winners (the “AI safety rails” trade)

If agents touch files, move money, and execute tasks, then security, identity, and monitoring become mandatory spend:

Identity / access: $OKTA

Security platforms: $PANW, $CRWD, $ZS, $FTNT

Monitoring / reliability layer: $DDOG, $DT

This is the underappreciated part: agents increase the blast radius of mistakes, so boards respond by funding controls.

The Danger Zone

Loser bucket #1: “Point solutions” that are mostly UI + light workflow

If your product is primarily “click here to do X,” an agent can eventually do X without opening your app. That doesn’t mean these go to zero — it means pricing power and growth rates get questioned:

$ASAN, $MNDY (workflow/project UI risk)

$DOCU (signature/workflow gets absorbed into suites + agents over time)

$DBX, $BOX (storage is real, but the UI layer gets commoditized; the question becomes “who owns the agent surface?”)

$ZM (meetings are durable, but AI changes how value is captured — minutes, summaries, actions, automation vs “video squares”)

Loser bucket #2: “We sell seats” models with weak proof of ROI

When budgets get tight, the question becomes:

“Does this software produce measurable profit… or does it just feel useful?”

AI agents are a brutal excuse for CFOs to cut anything that doesn’t defend itself.

Loser bucket #3: RPA-style automation that isn’t agent-native

Agents can make older “script the UI” automation look clunky unless vendors reinvent quickly:

$PATH (doesn’t have to lose, but it’s in the blast zone if enterprises pivot budgets toward agent-first automation)

So is this a problem… or a buying opportunity?

It’s both — depending on what you own.

If you’re buying category leaders with distribution + data + compliance embed, the Cowork selloff looks more like a buying opportunity (because it’s sentiment first, fundamentals later).

If you’re buying thin apps that can’t defend pricing, it’s a real thesis break risk over the next 12–24 months.

The market always does this at regime turns: it sells the whole shelf before it learns which products are actually shelf-stable.

What I’m watching next (the tells)

If you want to stay ahead of this story, track these—because they’ll decide who bounces and who keeps bleeding:

AI attach rate and pricing power

Are incumbents charging extra (and customers paying), or is AI just a free feature?Net retention + seat behavior

Are customers consolidating tools, or expanding usage because AI increases ROI?Security spending trends

If agents spread, security budgets follow. That’s not optional.Agent “surface area” control

Who becomes the default place you “talk to work”?

That winner taxes everyone else.

Watchlist Box

BUY-THE-PANIC (quality platforms): $MSFT, $NOW, $CRM, $INTU, $ORCL

SECOND-ORDER “AGENTS NEED GUARDRAILS”: $PANW, $CRWD, $ZS, $OKTA, $DDOG

DANGER ZONE (UI-heavy point solutions): $ASAN, $MNDY, $DOCU, $DBX, $BOX, $ZM, $PATH

News vs. Noise: What’s Moving Markets Today

News: Today’s real “what’s moving markets” wasn’t a hot take about AI models — it was TSMC quietly telling you the infrastructure buildout is still in full sprint. The quarter was strong (no surprise), but the tell was the forward posture: TSMC guided 2026 capex to $52–$56B — a step-function up that effectively green-lights another year of heavy spending across the semi supply chain. That matters because TSMC is the throughput engine for the entire AI complex… and when they lean in, the picks-and-shovels (semi equipment + critical process control) feel it immediately. That’s why the clean “winners” bucket remains: $TSM (demand + pricing power + scale), and the semicap stack that gets paid when fabs get built and yields get squeezed: $ASML, $AMAT, $LRCX, $KLAC. And the second macro layer: the U.S.–Taiwan tariff/industrial deal headlines are doing something markets love — reducing unknowns around where capacity gets built and how policy hits earnings. Less policy fog = more willingness to pay for a longer earnings stream.

Noise: The trap is treating this as “all clear for anything AI.” The tape actually showed the opposite: discernment. Semicap ripped… then faded. Big AI beta rallied… then gave it back. That’s not bearish — it’s a regime change: the market is starting to separate AI suppliers from AI spenders, and “AI capex” from “AI profits.” Bigger TSMC capex is a tailwind for the tool-and-shovel ecosystem, but it also reinforces a new reality: the AI trade is getting more capital intensive, and Washington is getting more involved in where capacity goes and who pays which costs. In other words, this is when leadership broadens inside AI: the durable winners are the ones with contracted demand and pricing power (semicap / manufacturing bottlenecks), while the “soft underbelly” is anything where ROI is still a story, not a line item — think cloud/capex optics and software names getting kneecapped by agent headlines (e.g., $ORCL as a sentiment proxy for AI platform competition, and software bellwethers like $CRM, $NOW, $ADBE when the market’s in an “AI eats software” mood). The right way to play this isn’t to chase the whole theme — it’s to own the toll booths and be picky about who can actually turn AI into margins.

A Stock I’m Watching

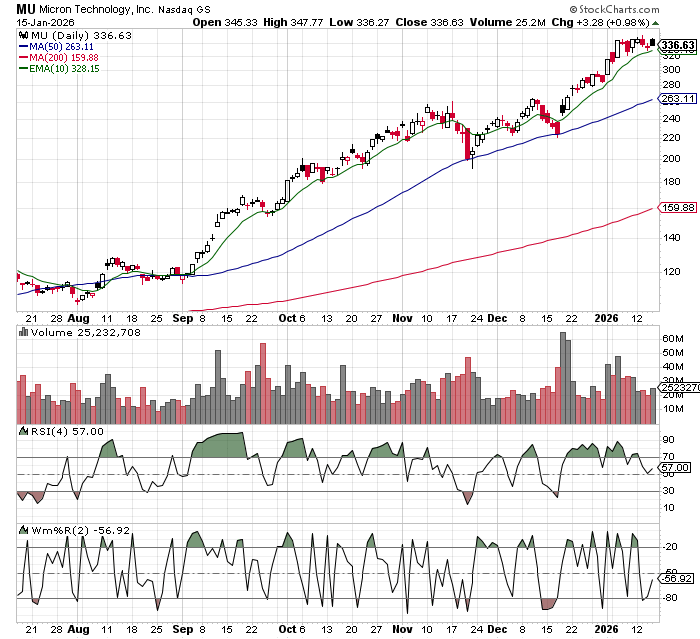

Today’s stock is Micron (MU)…..

Here’s the tell: Micron board member Mark Liu (former TSMC co‑CEO) just put ~$7.8M of his own money into MU in the open market — not on a panic dip… but with the stock essentially at all‑time highs. That’s not a “hope it bounces” trade. That’s a “the runway is longer than the crowd thinks” signal. Insiders can buy for many reasons, but when a guy who lived inside the foundry + supply chain machine for decades steps in after a 200%+ run, he’s implicitly saying: this isn’t just momentum… it’s a cycle shift.

My read: this reinforces the thesis that the AI trade isn’t cooling off — it’s spreading into the physical bottlenecks. GPUs were the first choke point. Now it’s memory bandwidth + capacity (DRAM/HBM) and the “stuff around it” (packaging, yields, tools, power). If memory stays tight, MU gets paid two ways: (1) price and (2) mix (more high-value, AI-linked products flowing through). That’s why MU can still work even after a huge move — memory names have violent operating leverage when pricing turns, and AI demand can keep the pricing umbrella up longer than the old “PC/phone cycle” playbook.

In Case You Missed It

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.