Wall Street’s 60/40 formula was born in 1952 — the same year as the first credit card. A lot has changed since.

That’s why we created a new approach — The H.E.A.T. Formula — to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

Here’s what’s happening today:

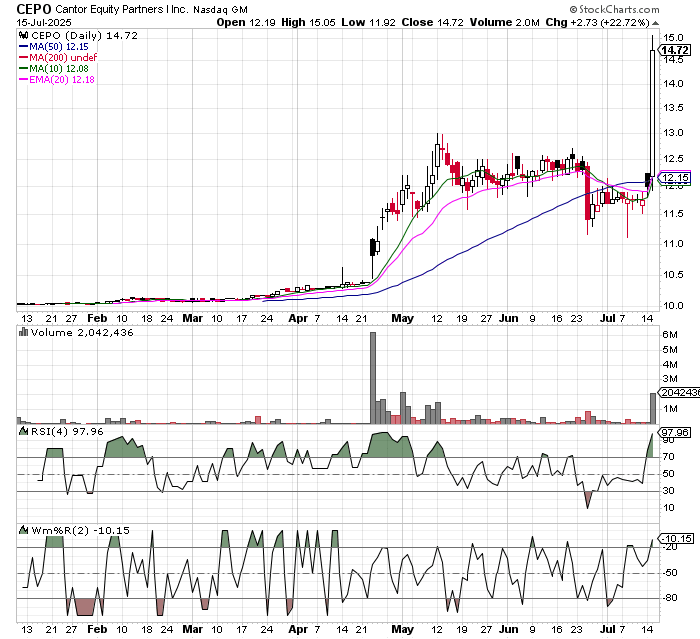

A lot going on in SPACs, CLBR ticker change to PEW is today and the Cantor SPACs continue to do well…

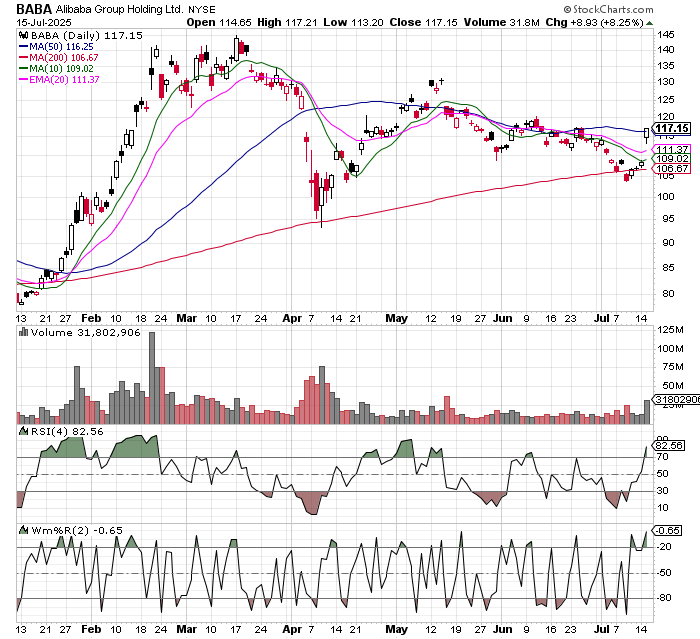

Looks like it, BABA had a nice undercut and rally at the 200 day…..

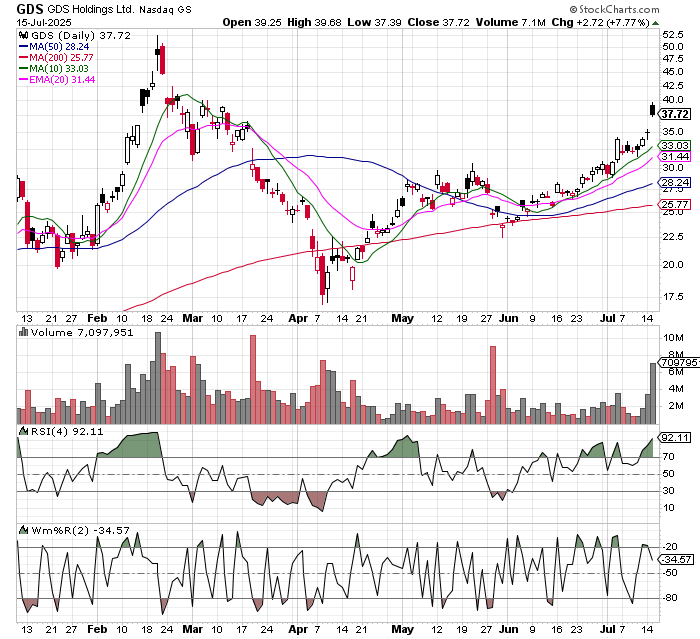

GDS is in an interesting one, I’ve been in it for a while and @Jbulltard1 flagged some unusual options activity in it Monday.

I had Grok 4 rate it…..

Based on the latest analysis as of July 15, 2025, I rate GDS Holdings' investment potential an 8 out of 10. This reflects strong tailwinds from China's AI and data center boom, with revenue projected to grow 11.1% to 11.47B CNY in FY2025 and 13.93% to 13.06B CNY in FY2026, alongside a consensus analyst price target of 41.35 CNY (upside from current ~38.52).

The stock's recent 10% surge and bullish moving averages underscore momentum, but deductions come from short-term negative EPS (-0.71 CNY for FY2025), geopolitical risks, and high valuation scrutiny.

Overall, it's a high-beta play with 20-40% upside potential in 12-18 months if US-China tech relations stabilize, but not without volatility.

I also had GPT come up with biggest winners….

Company | Beneficiary Role | Analyst Take |

|---|---|---|

BABA | Leading AI cloud infrastructure builder | 8/10 – High scale, cloud dominance, GPU-ready |

VNET | Data center operator hosting AI workloads | 7.5/10 – Infrastructure play, scalable model |

BIDU | AI model training and service platform provider | 8/10 – AI leader, GPU-dependent execution |

TCEHY | Consumer & enterprise AI ecosystem provider | 7.5/10 – Broad user base, technology pipeline |

As usual I don’t disagree with Mohit here…..

The coming months should see higher inflation and weaker employment data as the tariff impact feeds through. Our view remains that from next month onward, we should start to see more of an impact from tariffs. Hence, our view remains that we would turn more defensive on risky assets in August.

For now, we remain constructive on the market. We have toned down our risk by a notch as our positioning indicators suggest that positioning is no longer as supportive as it has been for the past few months. However, technicals are still supportive, and newsflow of more deals being struck over the coming weeks (potentially India) should offset some of the negative trade rhetoric.

CPI was tame, but keep an eye on this…..

The June CPI report, while broadly in line with expectations on headline and core figures, revealed a deeper concern beneath the surface: price increases in import-heavy categories such as furniture, toys, and electronics signaled that tariff pass-through is potentially emerging. This shifted market focus toward the PCE index, where different category weightings—particularly higher exposure to goods and healthcare—suggest greater inflationary risk. Hence: rate cut expectations for July collapsed, and September became a coin toss. Meanwhile, the divergence in CPI and PCE methodologies—CPI’s heavier shelter weight vs. PCE’s broader inclusion of healthcare and financial services—has become a focal point for investors. PPI, due shortly, is now in the spotlight as a leading indicator of whether producer cost pressures will further spill into consumer inflation.

Had a nice talk with the ETF Spotlight Podcast about some of our favorite themes……

Yesterday I wrote about rising global bond yields, bonds, as you probably know, move down in price as interest rates rise. It’s no secret that I’m not a fan of bonds and I think their inclusion in portfolios as a risk reducer are misguided. In 1980ish interest rates were around 20%, they had only one direction to go from there, down. Any backward looking analysis that added bonds to a portfolio would look great. Fast forward to today, interest rates in the US are in the 4% area, and they could go either way. What we saw during the liberation day selloff and 2022 was that bonds went down at the same time as stocks, meaning that instead of being a risk reducer they were actually a risk enhancer.

Asymmetry, heads I win a lot, tails I lose a little, is also a big part of the H.E.A.T. Formula, and bonds are typically not an asymmetrical asset class. However, I do like the diversification benefits of adding things that aren’t totally correlated to stocks, that’s why we use preferred shares and property and casualty stocks. Here is a deep dive on the why’s behind the strategy…..

Navigating Rising Interest Rates: Preferred Shares and Property & Casualty Insurance Stocks as Superior Alternatives to Traditional Bonds

In an environment of persistently elevated global interest rates as of July 2025, traditional bonds face significant headwinds, including price depreciation and reduced attractiveness relative to new issuances. This report evaluates preferred shares and stocks of property and casualty (P&C) insurance companies as viable alternatives untethered from direct interest rate sensitivity. Preferred shares, hybrid securities offering fixed or floating dividends, provide higher yields and tax advantages while exhibiting lower duration risk than bonds, particularly in variable-rate forms. P&C insurance stocks leverage premium floats invested in bonds to generate enhanced investment income during rate hikes, historically outperforming bonds amid economic resilience. Comparative analysis reveals these assets deliver superior risk-adjusted returns, with preferreds yielding 6-7% and P&C stocks achieving double-digit gains in 2022-2023. Risks such as callability and catastrophe exposure are mitigated through diversification and selective investment.

Global interest rates remain elevated in July 2025, following aggressive hikes initiated in 2022 to combat inflation. The U.S. Federal Reserve's federal funds rate stands at 4.50%, with projections for gradual cuts to 3.0-4.0% by year-end amid sticky inflation around 2.5-3.0%. Similar trends persist internationally: the ECB anticipates cuts to 1.75% by mid-2025, while Japan's Bank continues quantitative tightening. Rising rates erode bond values, as evidenced by the Bloomberg U.S. Aggregate Index's -13% return in 2022—the worst year on record. Investors seek alternatives decoupled from rate volatility. This report posits preferred shares and P&C insurance stocks as innovations in fixed-income substitution, drawing on their hybrid income generation and asymmetric upside in high-rate regimes.

The Impact of Rising Interest Rates on Bonds — Bonds inversely correlate with interest rates: as rates rise, existing bond prices fall to align yields with new issuances. In 2022-2023, the Fed's hikes from near-zero to over 5% triggered a bond market rout, with long-term Treasuries losing 20-30%. Inflation, peaking at 9.1% in June 2022, exacerbated this, as real yields turned negative. By mid-2025, the 10-year Treasury yields ~4.2%, reflecting ongoing pressures from fiscal deficits and economic strength. This dynamic underscores the need for alternatives that mitigate duration risk while preserving income.

Preferred Shares as an Alternative- Preferred shares are hybrid securities blending equity and debt traits, offering priority dividends over common stock but subordinated to bonds in liquidation. Issued at par (typically $25), they pay fixed or floating dividends, appealing in rising-rate environments.

Types and Features - Cumulative: Accumulates missed dividends for future payout. - Non-Cumulative: No accumulation; common in banks. - Convertible: Exchangeable for common shares. - Callable: Redeemable by issuer, often after 5-10 years. - Perpetual: No maturity, enhancing yield but increasing perpetuity risk. - Adjustable/Variable Rate: Dividends tied to benchmarks like SOFR, reducing interest rate sensitivity.

Advantages- Preferreds yield 6-7% in 2025, surpassing investment-grade bonds (4-5%) and offering qualified dividend income (QDI) taxed at 15-20% vs. ordinary rates up to 37%. They exhibit lower volatility than common stocks and reduced duration (1-3 years for variable-rate) compared to bonds (5-7 years), cushioning rate hikes. In high-grade fixed income, they provide diversification, with impairment rates akin to BBB corporates (~1%).

Risks- Callable features risk reinvestment at lower rates; dividends are suspendable without default. Concentration in financials (70-80%) amplifies sector risks.

Property & Casualty Insurance Stocks as an Alternative- P&C insurers underwrite risks like property damage and liability, collecting premiums upfront (float) invested primarily in bonds (70-80% of portfolios). Higher rates boost reinvestment yields, enhancing net investment income.

Business Model and Rate Benefits Float generates income without immediate claims payout; rising rates lift portfolio yields to 4.0-4.3% in 2025-2026 from 3.7% in 2024. Unlike bonds, stocks capture operational leverage: premium growth (8-9% projected) and underwriting profits rise with economic activity. Capital ratios exceed 11%, bolstering resilience.

Risks-Catastrophe losses (e.g., hurricanes) and claims inflation pressure combined ratios (~95-100%).

Comparative Analysis

Asset Class | Yield/Return (2025 Est.) | Rate Sensitivity | Volatility | Tax Treatment | Historical Return in Rising Rates (2022-2023) |

|---|---|---|---|---|---|

Traditional Bonds | 4-5% | High (Duration 5-7 yrs) | Low | Ordinary Income (up to 37%) | -13% |

Preferred Shares | 6-7% | Medium (Duration 1-3 yrs for variable) | Medium | QDI (15-20%) | -5% to +5% (variable-rate) |

P&C Insurance Stocks | 2-4% Dividend + 10-15% Total | Low (Indirect Benefit) | High | Capital Gains (15-20%) | +15-20% |

Risks and Mitigation Strategies - Preferreds: Call risk mitigated by selecting non-callable or long-protection issues; sector concentration via diversified ETFs. - P&C Stocks: Catastrophe risk hedged through reinsurance exposure; valuation via fundamental analysis (e.g., combined ratio <95%). - General: Economic downturns; diversify across 10-15 holdings, monitor Fed policy.

Conclusion- Preferred shares and P&C insurance stocks transcend bond limitations in rising-rate regimes, delivering resilient income and capital appreciation. Their structural advantages—hybrid dividends and float leverage—position them as paradigm-shifting alternatives, substantiated by empirical outperformance.

Before You Go Some Ways I Can Help

ETFs: The Antidote to Wall Street

Inside HEAT: Our Monthly Live Call on What Wall Street Doesn’t Want You To Know

Financial HEAT Podcast https://www.youtube.com/@TuttleCap Freedom from the Wall Street Hypocrisy

Tuttle Wealth Management: Your Wealth Unshackled

Advanced HEAT Insights: Matt’s Inner Circle, Your Financial Edge

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.