I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Table of Contents

H.E.A.T.

I’m starting to look at Europe again. Long time readers know we killed it with the European Aerospace and Defense theme…..

In my mind it was the most obvious Trump trade. I’ve been noticing the outperformance of stocks around the world, and for the most part I’m not interested, the best companies are still in the US. But the trend seems to be towards digital sovereignty in Europe.

Add in the AI arms race with China and I’m starting to smell opportunity…….

Europe’s New Arms Race Isn’t Missiles… It’s Middleware

International and emerging market equities have been outperforming United States — and most investors are still explaining it with the usual lazy narratives: “valuations,” “mean reversion,” “the dollar.” Those matter… but they’re not the main event.

The main event is this: the world is building optionality away from U.S. policy and platform dependence. And once you see it, you can’t unsee it — because it’s showing up in procurement decisions, supply chains, defense budgets, and capital flows.

You’ve already been on the right side of it with European aerospace & defense. But the next leg isn’t just “more tanks.” It’s digital sovereignty — and it’s quietly becoming the civilian version of rearmament.

And yes: the “China channel” is reopening too — not as a kumbaya pivot, but as a cold-blooded hedge in a world where everyone wants a second door.

The macro truth behind international + EM outperformance

1) A weak dollar helps… but it’s why the dollar is weak that matters

A weaker dollar tends to be constructive for emerging markets (looser global financial conditions, easier funding, better commodity translation, improving risk appetite). That’s the classic playbook — and it’s still valid.

But the bigger point is why the dollar is weak:

capital is demanding diversification and optionality. Not a full “abandon the U.S.” move — more like “I want exposure… but I want an escape hatch.”

2) The U.S.–China trade fight is increasingly a third-country game

The market is slowly waking up to something that central banks and policymakers have been talking about more explicitly: when trade barriers rise, trade doesn’t disappear — it reroutes. That means relative winners and losers shift across European Union, EM Asia, LatAm, and selected “connectors.”

Translation for investors:

This isn’t a one-ticker story. It’s a geography + supply-chain architecture story.

Theme #1: Europe’s next buildout — from defense to digital sovereignty

You’ve been in European aerospace/defense. Stay there — the structural bid is real. But now Europe is adding a second pillar:

Digital sovereignty = “defense spending” for the civilian economy

In plain English, digital sovereignty means:

If things get ugly, we can still communicate.

If things get weird, our core systems can’t be “turned off.”

If alliances wobble, we still control our own pipes.

That’s not a theoretical debate anymore.

Recent reporting highlighted France pushing government workers away from U.S. collaboration tools toward state-controlled alternatives as part of a broader sovereignty push.

And Schleswig-Holstein has been moving public-sector workflows away from Microsoft-dependent infrastructure toward open-source / European-controlled solutions.

This is the pattern:

Step 1: communications tools (video, chat, email, secure messaging)

Step 2: identity + security stack (IAM, endpoint, SOC tooling, encryption)

Step 3: hosting + cloud policy (sovereign cloud rules, procurement preference, localization)

Step 4: space + connectivity (satcom, launch, imagery, resilience)

It’s messy. It’s inconvenient. It won’t be “all at once.”

But it’s investable — because spending follows fear, and this fear is becoming policy.

Theme #2: “EuroStack” is the blueprint (even if the first versions are clunky)

If defense is Europe’s “hard power” rebuild, EuroStack-style thinking is the “soft power” rebuild: a push toward a European-controlled tech stack across compute, cloud, security, and apps.

Two important nuances (this is where people get faked out):

Europe doesn’t need to beat Silicon Valley at everything.

It needs to reduce single-point-of-failure dependencies in specific choke points (public sector comms, defense-adjacent systems, regulated data, critical infrastructure).The winners won’t just be “European SaaS.”

The winners will be the firms that sit in:compliance-required procurement lanes

regulated data environments

defense + civilian crossover (security, comms, satellites)

integration/implementation (because migrations are painful)

This isn’t sexy. It’s not an app store story.

It’s a multi-year plumbing capex cycle — and those are the cycles that tend to compound quietly.

Theme #3: China is not “back” — China is being used as leverage

When countries feel the U.S. is unpredictable, they don’t necessarily “choose China.”

They choose optionality.

That shows up in:

more diplomatic traffic

more business delegations

more selective deal-making

more “reset without romance” behavior

But the investable takeaway is not “buy China.” It’s: pick the lane.

The lanes that tend to benefit in a selective reset world:

domestic consumption + platforms (when policy allows)

industrial champions tied to energy transition / electrification

exporters that gain via trade rerouting (especially through third countries)

And the lanes that remain structurally fragile:

anything levered to policy surprise

sectors dependent on fragile offshore demand assumptions

high-debt balance sheets if growth disappoints

(And yes — the trade rerouting point matters here too.)

Winners and losers

Below are theme-level “winners/losers” with clear, specific tickers as examples (not recommendations).

Potential winners

A) Europe: defense + aerospace stays in the sweet spot

These remain direct beneficiaries of the “rearm Europe” and allied procurement cycle:

Airbus

BAE Systems

Rheinmetall

Leonardo

Saab

Thales

Dassault Aviation

Why they win: Europe is still rebuilding deterrence, munitions capacity, ISR, and air/space capabilities — and those programs don’t flip off in one quarter.

B) Europe: digital sovereignty plumbing (cloud, telco, integration, “boring but mandatory”)

Examples of “sovereignty-adjacent” beneficiaries:

OVHcloud (sovereign cloud posture)

IONOS (hosting/infra)

Orange (pipes + government relationships)

Deutsche Telekom (pipes + public sector relevance)

Capgemini (migration/integration winner in a forced-switch world)

Why they win: migrations are hard, procurement becomes political, and “good enough + sovereign” can beat “best-in-class + foreign-controlled” in regulated lanes. The existence of government pushes to move off U.S.-controlled tools is the tell.

C) Space, satcom, and redundancy becomes non-negotiable

Eutelsat

SES

Why they win: when sovereignty becomes policy, redundancy becomes procurement.

D) “Pick-your-lane” China exposure (selective reset beneficiaries)

Examples (again: lane matters):

Tencent (platform exposure when allowed)

Alibaba Group

BYD

Contemporary Amperex Technology

Why they win: if the world reopens the China channel selectively, scale platforms and industrial champions are the first places global capital looks — but it remains a “position sizing + policy risk” trade, not a marriage.

Potential losers

A) U.S. enterprise software and collaboration tools in public-sector Europe

This isn’t “the end” of U.S. tech in Europe — but it is a real headwind where procurement becomes sovereignty policy:

Zoom

Microsoft

Cisco

Google

Why they lose: not because the products stopped working — because dependency became the risk.

B) “Digital sovereignty fantasy” trades

Anything premised on Europe instantly replacing hyperscalers across the whole economy is likely to disappoint.

Why they lose: the world doesn’t pivot on a press release — it pivots where procurement, regulation, and security requirements force the change.

C) China exposures that require “everything to go right”

The fragile lane:

high leverage + low transparency

policy-sensitive balance sheets

anything that needs a perfect macro and a perfect geopolitics tape

Why they lose: in a rerouted trade world, volatility doesn’t vanish — it relocates.

The simplest way to frame it

Europe is building two shields:

a hard shield (defense)

a digital shield (sovereign comms + security + infrastructure)

And EM/China outperformance is less about “risk-on” and more about capital seeking non-U.S. pathways — often helped by a weaker dollar backdrop.

What I’d watch next (signposts)

More government procurement mandates (not speeches) across Germany, France, Nordics, and EU institutions

Sovereign-cloud standards tightening (who qualifies, who doesn’t)

Defense-tech spillover into civilian infrastructure budgets

Evidence that U.S.–China tension is causing persistent trade rerouting rather than one-off noise

News vs. Noise: What’s Moving Markets Today

A ton of news on Friday—we had the crash in precious metals and Bitcoin, Warsh (see below) and then this…..

Jensen walked it back, but this could be massive news.

The market is moving from “AI spend = automatically good” to “AI spend is only good if it shows up in growth and/or pricing power.” That’s why Meta Platforms can rally on massive 2026 capex (because ads are re-accelerating), while Microsoft can sell off on a small Azure growth disappointment paired with heavy spend.

At the same time, the “real economy” constraints (power, cleanrooms, memory supply, fiber, storage) are becoming the dominant drivers across semis and infrastructure.

Now onto Warsh…..

Noise: I’m hearing a lot of overconfident “one-headline, one-regime-change” takes: that Kevin Warsh is basically Paul Volcker reincarnated so the “debasement trade” is dead and gold/silver are finished, or the opposite—he’s a guaranteed puppet for Donald Trump so rate cuts are inevitable and the metals crash is a one-day fake-out. Same with the metal tape: people are narrating Friday’s move as if it’s a clean fundamentals verdict, when a violent, air-pocket unwind in crowded trades can look “fundamental” in hindsight even when it’s mostly positioning, liquidity, and headline reflex.

News & takeaways: The actual news is straightforward: Trump has nominated Warsh to succeed Jerome Powell, but the policy reality right now is still the Federal Reserve on pause—holding rates at 3.50%–3.75% while explicitly upgrading growth language to “solid pace,” noting labor-market stabilization, and keeping inflation flagged as “somewhat elevated.” Real-time growth trackers are consistent with “no urgency to cut”: the Federal Reserve Bank of Dallas WEI is 2.49% and the Federal Reserve Bank of New York staff nowcast is ~2.7%. Markets treated Warsh’s nomination as a near-term reduction in “political-dovish” tail risk, which helped spark a dollar squeeze and a brutal unwind in precious metals—silver -31% to $78.29 and gold futures -11% to $4,713.90, the worst day since 1980 per the report (The CME hiked margin which probably had way more to do with this move than Warsh). The takeaway for “news vs. noise” is: don’t trade your entire macro worldview off the first reaction—this looks like a positioning reset around a policy-perception shift; what matters next is whether the Fed’s “hold” becomes a sustained stance (inflation data), whether the dollar strength persists, and how Warsh threads credibility vs. growth politics once the nomination process turns into actual governance.

A Stock I’m Watching

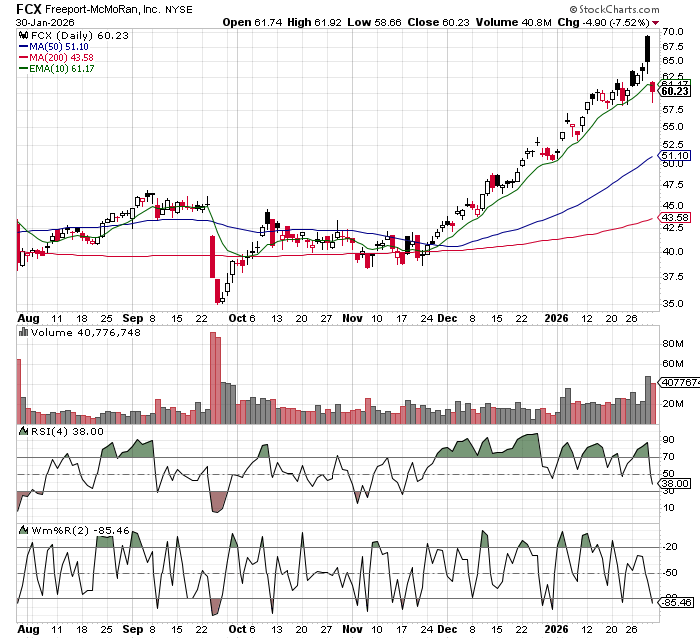

Today’s stock is Freeport McMoRan (FCX)…..

I still love the natural resources/metals trade. It’s gone parabolic so there could be some more downside here, but much prefer buying dips than buying highs.

Freeport-McMoRan (FCX) — it’s a high‑beta copper lever, so I treat it like a read‑through on copper + macro risk sentiment; after Friday’s sharp pullback to about $60.23 (roughly ‑7.5% on the day) with a $58.70–$63.19 range and heavy volume, the key for me is whether it can hold the high‑$50s and then reclaim the low‑$60s with follow‑through—if it does, it’s a clean “bounce setup” watch, and if it loses the day’s lows decisively, I’d rather wait for a steadier base before getting interested again.

In Case You Missed It

Been making the rounds on YouTube lately as our unique approach to option income is starting to get noticed……

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.