I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

This article caught my eye as this is a theme was have been talking about for a couple of weeks…..

Monetizers vs. Manufacturers” — how AI splinters in 2026

In 2025, you could buy “AI exposure” the way people used to buy dot-com exposure: broadly, lazily, and profitably.

You didn’t need to know who was selling the pickaxes… who was paying for them… or whether the gold was real. You just needed a ticker that rhymed with GPU.

That’s why the last three months of 2025 mattered.

The chop — those sudden sell-offs and face-rips — wasn’t random. It was the first tremor of what 2026 is going to be:

AI stops trading like a single story… and starts trading like a balance sheet.

CNBC’s framing is dead-on: the market is setting up to split into camps where some companies spend, some companies get paid, and some companies raise money because the vibe is good.

The key regime change

In 2025, “AI” was one trade.

In 2026, “AI” becomes three different businesses wearing the same Halloween costume.

And the market is finally going to ask the question it avoided all year:

Who’s monetizing… and who’s just manufacturing costs?

The three camps (and why the tape will punish confusion)

1) The AI creators / startups (OpenAI / Anthropic / “the model layer”)

These are the companies doing the “magic”… and burning an unbelievable amount of capital to do it.

They’ve pulled in enormous VC funding (CNBC cites PitchBook data showing a massive 2025 VC haul), but the structural issue is simple:

They’re buying compute like it’s oxygen

They’re signing long-duration infrastructure contracts

They’re still working out what “durable margins” even look like at scale

Market implication:

This camp doesn’t trade like “software.” It trades like R&D + compute costs + pricing uncertainty. In public markets, these are the future IPOs that get priced on hype… then repriced on unit economics.

2) The listed AI spenders (hyperscalers and mega platforms)

These are the giants cutting the checks: $MSFT, $AMZN, $META, $GOOGL — and depending on how you bucket it, names like $ORCL that are effectively in the “buildout + leasing + capex narrative” too.

Here’s the trap: for a decade, markets valued Big Tech like asset-light software platforms.

Now they’re morphing into something closer to AI utilities:

GPUs and accelerators

data centers

power procurement

land

networking

and the unsexy part investors always ignore until it hurts: depreciation

This is the 2026 landmine:

A lot of the AI buildout doesn’t hit the income statement immediately in a way that “feels painful.” Capex is capex. But over time, the hardware becomes an expense via depreciation, and the market starts noticing that “growth” is being purchased with an increasingly heavy asset base.

So even if AI works (and I think it will), valuation math changes:

Higher ongoing capex needs

More depreciation drag

Return on invested capital becomes the battleground metric

Market implication:

In 2026, the spenders are going to be priced less on “AI dreams” and more on:

proof of incremental revenue

margin defense

and whether the AI spend is earning its cost of capital (not just producing cool demos)

3) The AI infrastructure “receivers” (the paid end of the trade)

This is the camp CNBC highlights as the most attractive setup: the companies on the receiving end of the capex firehose — the toll collectors.

Think:

chips and accelerators ($NVDA, $AVGO, $AMD)

networking / connectivity (often shows up as “AI picks-and-shovels”)

data-center power & cooling suppliers

the “concrete and copper” ecosystem

and increasingly: private credit / structured finance facilitating the buildout

The key difference vs. the spenders:

Receivers don’t have to prove monetization of AI end-products.

They just have to prove:

demand is real

pricing holds

and the customer doesn’t default

Market implication:

If AI keeps scaling, receivers keep printing.

If AI slows, some receivers still do fine because they’re sitting on backlog, service revenue, replacements, and long-cycle infrastructure.

But there’s a nuance: valuation discipline matters here too. Some infrastructure names have become consensus darlings.

The real “splinter” isn’t bullish vs bearish — it’s cash flow vs narrative

Here’s the simplest way to understand 2026 AI:

2025 rewarded “AI exposure.”

2026 rewards “AI economics.”

That means investors will stop grouping these together:

“company has a product but no business model”

“company is burning cash to build infrastructure”

“company is selling the infrastructure”

“company is actually monetizing AI in revenue + margins”

That’s the ETF problem CNBC mentioned: retail flows (especially via thematic ETFs) often don’t differentiate.

2026 forces differentiation.

Winners list (the kinds of names that tend to win this phase)

Not advice — this is a playbook.

Bucket A: The toll collectors with pricing power

These are businesses where AI demand shows up as:

units shipped

backlog

higher ASPs

service / maintenance annuities

and (critically) cash generation

This tends to include:

core AI silicon and key suppliers ($NVDA / $AVGO-type setups)

critical infrastructure vendors that are hard to substitute quickly

“boring, required” parts of the stack where customers don’t negotiate hard because downtime is existential

Bucket B: The “real monetizers” (AI shows up in customer billing)

These are the companies that can point to:

usage-based revenue lift

seat expansion tied to AI value

measurable productivity ROI that drives renewals

margin expansion (or at least margin stability) despite AI costs

In 2026, this bucket will matter more than people expect because it’s the antidote to “AI is just cost inflation.”

Bucket C: The quiet second-order winners

These aren’t the model makers. They’re the enablers:

data-center build ecosystem

power, cooling, grid gear

contractors and integrators

security, compliance, governance layers

When investors realize AI is a physical buildout (not just a software upgrade), these names keep getting pulled into the trade.

Losers list (where the splinter gets violent)

Bucket D: “Funded by optimism, not earnings”

CNBC calls this out plainly: the danger zone is companies catching the AI bid without profits.

In 2026, the market is far less tolerant of:

pre-revenue stories

“we’ll monetize later”

“our TAM is infinite”

adjacent manias (CNBC specifically mentions quantum as an example of froth risk)

Bucket E: The levered middlemen

If your model is:

borrow expensively → buy expensive hardware → rent it out → hope pricing stays high

…you are effectively running a carry trade on utilization + credit markets.

This is exactly where “AI splintering” becomes “AI accidents.”

Bucket F: The spenders with weak incremental ROI

Even if Big Tech is net-cash and can fund it, the market can still compress multiples if:

AI revenues don’t ramp fast enough

margins compress

depreciation ramps

competition forces everyone to spend defensively

This is the subtle re-rating risk: not bankruptcy… de-magnification.

What to watch in 2026 (the checklist that tells you who’s winning)

If you want one sentence:

Follow the money — not the model.

Here are the tells that will matter more than “cool product launches”:

Free cash flow yield vs. narrative

If the stock prices in perfection while FCF yield collapses, the market eventually notices.Capex intensity trend

Is capex still accelerating? Flattening? Is it producing revenue, or just capacity?Depreciation catches up

A lot of the AI spend becomes an earnings story with a lag. 2026 is when more investors start doing that math.ROI disclosure quality

The best operators start giving you:

AI bookings / usage

attach rates

retention impacts

customer ROI case studies that show up in renewal dollars

Who’s paying vs. who’s getting paid

A simple but deadly framing:

Are you funding the arms race… or selling shovels into it?

The AI boom isn’t fading.

It’s being segmented.

2025 was a liquidity-and-narrative market.

2026 is shaping up to be a cash-flow-and-depreciation market.

And that’s why the “AI trade” won’t end — it will splinter:

Manufacturers still win when orders keep coming.

Monetizers win when AI shows up in revenue and margins.

Spenders only win if they prove ROI fast enough to justify becoming asset-heavy.

Story stocks get exposed the moment the market stops confusing funding with fundamentals.

News vs. Noise: What’s Moving Markets Today

The day after a major holiday is often dull, Friday was no exception, except for the move in gold and silver, which I talk about below.

As we head into the new year I’m often struck by how bad the “experts” predictions fared. While I heard a lot of people predicting Bitcoin would be a $1 million, I didn’t hear a lot talking about precious metals. Speaking of precious metals, I cut my silver exposure way down on Friday. I’ll buy it back at some point, but this is what concerns me here….

Silver is ~89% above its 200 DMA. Outside of the 'Hunt Brothers' squeeze in 1979, every time Silver has been 60% above its 200 DMA it has been meaningfully lower 20, 30 and 40 days later. While the fundamental story might be different this time, the 174% YTD gain has likely priced in much of that good news.

Long time readers know we recommend precious metals AND crypto in portfolios of course…..

Gold, & Silver Just Ran Over the “Experts” Again

Silver just had one of those moves that makes you check the quote twice. Gold is printing numbers that would’ve sounded like a typo a year ago.

Gold pushed to new records above $4,500/oz this week.

Silver has been even more unhinged — ripping to fresh highs near $70/oz and putting up a triple‑digit yearly gain that basically nobody penciled in twelve months ago.

And that sets up the only lesson that matters for 2026:

You can’t build a portfolio by following “expert” predictions.

The real headline

Every year, Wall Street sells “certainty” in the form of targets:

S&P target

Gold target

Silver target

“Best ideas” list

“Base case” deck with 37 charts and a smug conclusion

Then the market does what it always does: it trades the tail, not the brochure.

Gold and silver are perfect at exposing this game because they’re not “earnings stories.” They’re regime barometers:

currency credibility, real yields, liquidity, geopolitics, positioning, and—especially in silver—physical vs paper plumbing.

When those variables shift, price targets get incinerated.

What was “news” Friday

1) This isn’t a normal “risk-on melt-up” metal move

Gold and silver didn’t hit records because analysts suddenly got smarter.

They hit records because the market is repricing a handful of big, uncomfortable themes:

Geopolitical escalation is back in the price (safe-haven bid).

Dollar weakness has been a tailwind (metals don’t need to do anything “special” when the unit of account is sliding).

Rate-cut expectations / lower real yields support non-yielding assets like gold (the opportunity cost drops).

Those are macro regime inputs — not “silver is undervalued vs its 200‑day” inputs.

2) Central-bank buying is still the quiet structural bid

Gold has had a persistent buyer in the background: central banks.

Even when quarterly buying moderates, survey and reported flows still show ongoing intent to add gold as a reserve asset.

This matters because it changes the character of dips:

In a normal commodity, dips invite producers and hedgers.

In gold, dips increasingly invite reserve managers.

That’s not “bullish forever.” But it’s a different demand curve than 2010–2019.

3) Silver is not just “gold, but smaller” — it has plumbing risk

Silver has had real physical tightness episodes and dislocations that don’t show up in a clean spreadsheet.

After the October squeeze, there were big vault flows and cross‑market movement (metal pulled from one hub to another as arb opened/closed), including large withdrawals from COMEX inventories and shifting availability.

Translation: silver can gap because of mechanics, not because your favorite macro strategist updated a target.

That’s why silver humiliates forecasters even more than gold:

It’s smaller

It’s thinner

It’s more easily “cornered” by positioning + physical constraints

And year-end liquidity makes it nastier

What was “noise” Friday

1) The “expert prediction” treadmill

The same people who were cautious all year will now explain, very confidently, why the move “makes sense.”

That’s not research. That’s narration.

Markets don’t pay you for narration.

2) One-day catalysts

Headlines are always available:

a strike here

a blockade there

a central bank rumor

a “China demand” anecdote

a “short squeeze” tweet

Some of those inputs are real, but the daily storyline isn’t tradable unless you’re managing risk like a pro.

If you’re a newsletter investor, the edge is not predicting tomorrow’s candle.

It’s knowing when you’re in a regime where metals behave differently.

3) “This is the new normal” takes

Whenever an asset goes vertical, the internet will tell you it’s obvious… and permanent.

Gold and silver don’t do permanent. They do cycles.

The big takeaway for 2026: Stop outsourcing conviction to forecasters

If you only own gold/silver when a bank raises its price target, you’ll usually be late.

If you sell because a talking head says “overbought,” you’ll usually be early — and wrong.

Here’s a better framework:

The only 3 questions that matter

Is the regime supportive?

Watch: real yields, USD trend, liquidity, policy credibility, geopolitical risk.Is positioning fragile?

Silver especially can move on positioning + physical constraints.What’s your role for the position?

Insurance (small, steady, rebalance)

Speculation (trade it, respect stops, accept whipsaws)

Inflation/FX hedge (size appropriately; don’t leverage it like a meme)

Most people blow it because they don’t answer #3.

They buy “insurance”… and manage it like a lottery ticket.

How I’d translate this into “doable” portfolio behavior

Not advice — just the process:

If you’re an allocator (not a trader)

Treat gold as a diversifier, not a “prediction trade.”

Treat silver as higher-octane diversification (and therefore smaller sizing).

Mechanically:

Build a baseline exposure you can live with.

Rebalance when it gets extreme (up or down).

Don’t let a strategist’s year-end target bully you out of the position.

If you want equity torque, don’t confuse metal with miners

Metals can be calm while miners get wrecked (cost inflation, politics, hedging, management mistakes).

And metals can chop while miners rip (margin expansion, multiple expansion, M&A).

A simple “menu” (tickers you can mention on-air / in print):

Gold exposure: $GLD / $IAU

Silver exposure: $SLV / $PSLV

“Quality gold miners”: $AEM, $NEM, $GOLD

“Silver miners / levered torque”: $PAAS, $HL, $AG

“Streams/royalties” (often cleaner models): $WPM, $FNV

Bottom line

Gold and silver are doing what they do best: exposing the difference between forecasting and positioning.

Forecasts: comforting, precise, usually wrong at the turning points.

Positioning: messy, probabilistic, and built for regimes where the “obvious” outcome is not what hits.

The “news” is that the metals tape is screaming that 2026 won’t be a polite, linear, spreadsheet year.

The “noise” is everything that pretends anyone can pin these markets to a tidy target price and call it a plan.

A Stock I’m Watching

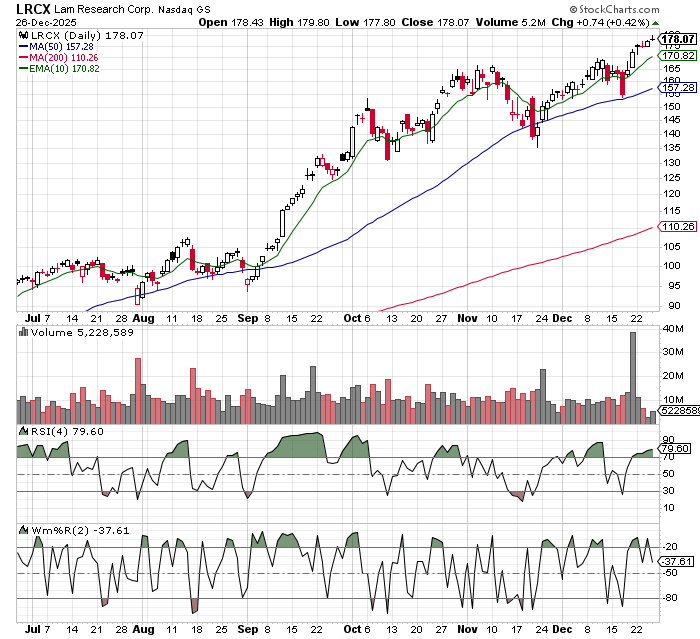

Today’s stock is Lam Research (LRCX)…..

Lam Research (LRCX) is one of the cleanest “picks-and-shovels” ways to play the AI buildout without having to underwrite the next model winner. As hyperscalers scale GPU clusters, the real choke point becomes advanced memory and leading-edge process intensity—HBM-driven DRAM, high-layer 3D NAND, and increasingly complex patterning/etch/deposition steps that push wafer-fab capex higher even when end-demand looks “normal.” Lam sits right in the critical path (etch + deposition + clean), where every new node and every incremental layer adds process steps, tool intensity, and high-value services pull-through. The bullish variant is straightforward: AI shifts the cycle from “units” to “bits”—and bit growth forces sustained capacity adds plus more frequent technology transitions, which is where Lam’s economics (installed base, spares, recurring service revenue, operating leverage) get best. The bear case is also clear and worth respecting—WFE is cyclical, and export controls/China demand swings can create headline volatility—but if you’re building a portfolio around durable AI infrastructure, LRCX is a high-quality way to stay long the build cycle with less single-customer/model risk.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.