I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Now Trading: Tuttle Capital Magnificent 7 Income Blast ETF

$MAGO combines direct exposure to the Magnificent 7 with a systematic put‑spread program implemented with listed options and FLEX Options®.

Distributor: Foreside Fund Services

Learn More: IncomeBlastETFs.com

https://www.barchart.com/story/news/36827092/tuttle-capital-management-launches-the-tuttle-capital-magnificent-7-income-blast-etf-mago

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

There are a few enduring memories from 2025, one is the DeepSeek selloff. I didn’t see it coming and had my worst day of the year. I’m pretty conservative so it wasn’t that bad, but I hate losses. I’m now always looking for that next threat to the AI trade, perhaps I found it…..

China’s “LightGen” Chip & The DeepSeek Playbook

Why this matters… and why you shouldn’t panic-buy or panic-sell on headlines

A year ago, the market got its first real AI “cold sweat” moment from China.

DeepSeek showed up, proved you could do more with less, and the market reacted the way it always reacts when the “U.S. monopoly” narrative gets punctured: it sold first and asked questions later. Reuters described Nvidia dropping ~17% in a single session around the DeepSeek shockwave.

Now we’ve got the sequel setup:

A reported Chinese breakthrough called LightGen — a photon-based (optical) AI chip aimed at training and inference for certain workloads — being framed as “a threat to Nvidia.”

If you’re reading this newsletter, you don’t need more AI hype.

You need the implications.

Because the real story here is not “China beat Blackwell.”

The real story is: China is building a parallel AI stack (models + hardware + manufacturing + deployment) fast enough that U.S. investors can’t ignore it anymore.

What actually happened

LightGen is being described as an optical computing chip (photons, not electrons) that can accelerate certain generative tasks — notably vision-heavy generation (images/video/visual synthesis). In reporting on the work, it’s described as dramatically faster and more energy-efficient for the tasks it targets than conventional silicon approaches.

That last clause is the whole game.

This isn’t a claim that LightGen replaces every GPU in every data center tomorrow.

It’s a claim that for specific workloads, different physics can win.

That’s the part that matters.

This is not about “one chip.” It’s about who controls the next cost curve.

Nvidia’s empire was built on a simple truth:

Whoever controls AI compute controls the tollbooth.

But compute is splintering:

Training made Nvidia the king.

Inference volume (real products, real users, real agents running 24/7) is where the unit economics start to matter more than bragging rights.

And once the world cares about cost per output (tokens/$, tokens/watt, latency), specialized architectures start getting real oxygen.

DeepSeek scared markets because it hinted:

“AI might not require infinite spend to keep improving.”

LightGen scares markets because it hints:

“AI might not require Nvidia’s physics to keep improving.”

That doesn’t mean Nvidia dies.

It means the AI trade becomes a competition trade, and competition trades compress margins and multiples over time — even if revenue keeps growing.

What’s real “news” here

1) China is attacking the stack from multiple angles

DeepSeek was software.

LightGen is hardware.

That’s a pattern: China isn’t just copying models — it’s trying to change the underlying constraints.

2) If optical compute works in production, it’s a category, not a one-off

Photonics has been “the future” for a long time… but the reason this matters now is that AI is forcing the industry to confront physical bottlenecks:

power delivery

heat removal

memory bandwidth

latency sensitivity

If a new architecture wins on energy + speed for even a meaningful slice of workloads, it can create a second compute lane alongside GPUs.

3) The market reaction risk is asymmetric because positioning is crowded

Even if LightGen is early-stage, the trade around it can be violent because the market is already jumpy about AI capex, ROI, and “who actually monetizes.” (That’s exactly what made the DeepSeek moment so sharp.)

What’s mostly “noise” right now

1) “Outperforms Nvidia” is usually task-specific

Most breakthrough chips “beat Nvidia” on a specific benchmark, in a controlled environment, on a narrow workload.

Production reality is brutal:

manufacturing yield

software stack + tooling

developer adoption

integration into racks, networking, orchestration

reliability at scale

A lab win is not the same thing as a hyperscaler deployment.

2) Nvidia’s moat isn’t only silicon

Even if alternative accelerators improve, Nvidia has gravity in:

software ecosystem (CUDA, libraries, dev tooling)

systems + networking integration

distribution relationships

cadence and platform roadmaps

That’s why “competition appears” doesn’t equal “share collapses.”

It means the tollbooth gets negotiated.

The big implications for 2026

The 5 takeaways that actually matter

Takeaway #1: The “AI monopoly multiple” is at risk

Nvidia can still grow like a monster… while also seeing the market slowly price in:

more alternatives

more customer vertical integration

more price pressure in inference

That’s not a crash call.

That’s a regime call.

Takeaway #2: Inference is the battleground where weird architectures can win

Optical compute, ASICs, LPUs, TPUs — all of these are basically saying:

“GPUs are great generalists.

But inference is where specialization prints money.”

If inference becomes more heterogeneous, the winners are the ones who sell the full menu.

Takeaway #3: DeepSeek wasn’t bearish for AI — it was bearish for complacency

Reuters framed DeepSeek as potentially accelerating adoption because cheaper/more efficient AI changes the investment playbook.

That can be true here too:

If LightGen-like approaches reduce compute cost for certain workloads, AI usage can expand.

But the value capture may shift away from “one dominant hardware vendor.”

Takeaway #4: The real winners might be “plumbing,” not the headline chip

If compute becomes more diverse, you still need:

optical networking

interconnect

power delivery

cooling

racks, integration, and deployment capacity

The “picks and shovels” don’t care which model wins.

Takeaway #5: China headlines are a volatility engine

DeepSeek proved something important for investors:

China breakthroughs can hit U.S. mega-cap AI like a surprise rate hike — fast, indiscriminate, and emotionally violent.

Even when the long-term fundamentals don’t change overnight, the positioning unwind can.

That’s why this is a “risk management” story as much as a “tech” story.

Winners and losers

(Not advice — this is the “map” for how the tape could treat this theme.)

Likely winners

1) “AI plumbing” that benefits no matter who wins the chip war

If optical compute becomes more real, you don’t just need chips — you need optics everywhere.

Bucket to watch: optical components + high-speed data-center networking

$AVGO (networking + connectivity gravity)

$ANET (data-center networking demand doesn’t slow because compute gets more diverse)

Optical/component ecosystem names (watchlist logic): $COHR, $LITE, $CIEN (not pure-play “optical compute,” but levered to the “more optics in the data center” direction)

2) Nvidia’s best move: become the platform that sells every lane

Ironically, one of the most bullish outcomes for Nvidia is:

more architectures exist

Nvidia integrates/partners/absorbs them into its platform

Nvidia stays the control plane

That’s how empires survive technology shifts: they eat the shift.

Watchlist

1) Companies building non-GPU inference acceleration

These names are “prove it” stories because inference specialization is real — but the market can overpay fast.

If you see public names pitching “we beat GPUs,” the first question is:

Do they have distribution, or just benchmarks?

2) Anything in the “AI-national-strategy” orbit

China treating AI as strategic means sustained funding, procurement, and long timelines. That’s hard to trade — but important for long-run narrative gravity.

Likely losers / danger zone

1) “GPU-only forever” narratives

If your entire thesis assumes GPUs remain the one universal unit of AI compute, you’re going to live through more DeepSeek-style air pockets.

2) Levered compute middlemen

If the compute mix shifts and pricing pressure shows up, the weakest business model is:

borrow → buy hardware → rent it out → hope utilization stays perfect

This is where “AI competition” becomes “AI credit events.”

3) Story stocks funded by optimism, not earnings

China hardware headlines are gasoline on the fire for investors who suddenly decide they only want:

real revenue

real margins

real moats

That’s when the “AI adjacent” stuff gets repriced hardest.

The bottom line

LightGen might be early.

It might be narrow.

It might take years to matter commercially.

But it’s still a signal.

DeepSeek was the warning shot that software efficiency can change the cost curve.

LightGen is the warning shot that hardware physics can change the cost curve.

And when the cost curve shifts, the market stops paying for “exposure”… and starts paying for who captures the economics.

That’s the real 2026 trade.

News vs. Noise: What’s Moving Markets Today

I’m bullish going into 2026, but that’s for two very specific reasons. First, I think AI capex will continue to be a major market driver (see our podcast below for more on that). Second, I think the Fed will aggressively cut rates. If either one of those things doesn’t happen then we could have a problem. That’s one of the big reasons we tell you to always have hedges in place.

I wouldn’t fight Trump here, I think he gets his way on rates next year. But be ready if he doesn’t.

Silver was up big yesterday and down big pre market. I talk about this in the podcast below also, I think you need to own precious metals, but if you are looking to get exposure I’d wait for whatever is going on to settle down.

Remember in the first part of the year just about everyone (not me) was telling you to get out of US stocks and go into international……..

A Stock I’m Watching

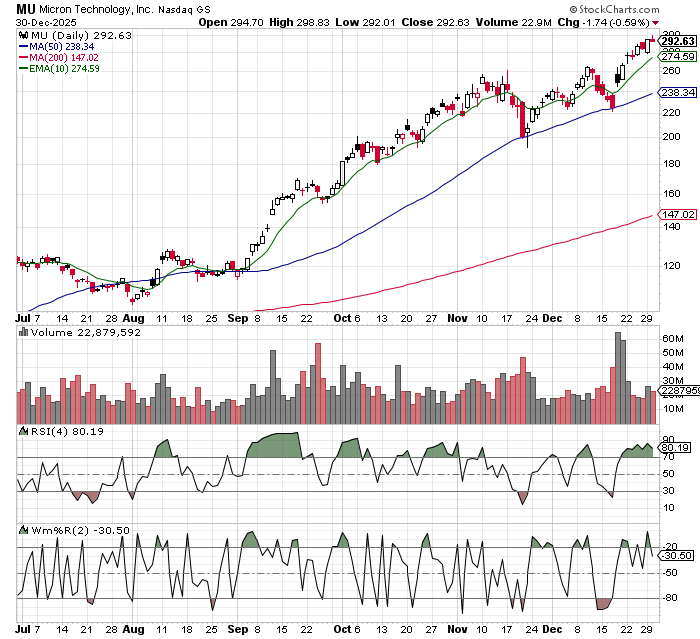

Today’s stock is Micron (MU)……

Paul talks about this one in the podcast below….

Micron (MU) is one of the cleanest “AI is eating the stack” expressions right now because memory has shifted from a cyclical afterthought to a hard bottleneck in accelerator-heavy data centers. The bull case is straightforward: HBM is increasingly the limiting reagent for GPU/ASIC deployments, pricing is firming, and MU’s latest messaging (HBM capacity essentially spoken for into 2026, higher forward capex to add supply, and sharply higher near-term margin/earnings power vs prior expectations) reads like the early innings of a structurally tighter cycle rather than a one-quarter squeeze. The more important nuance is that MU doesn’t need to “win” every share point in HBM4 to work—if the industry is undersupplied and contracts are being locked, the pie is expanding and the operating leverage is enormous once utilization + mix swing together. The pushback risk is also clear: memory upcycles always invite supply response (Samsung/Hynix aggression, faster capacity adds, or customers engineering around constraints), and MU’s ramping capex is bullish for durability but also plants seeds for a 2027–28 normalization if demand lags. Net: MU is a “watch closely” name because it sits at the intersection of tightening AI infrastructure constraints (bullish), rising industry reinvestment (late-cycle warning flag), and a still-evolving competitive map in HBM4—if pricing stays tight while bit growth accelerates, the stock can rerate again; if supply response shows up faster than expected, it can mean-revert violently like memory always does.

In Case You Missed It

We discuss AI and tech companies with Paul Meek……

Matt Tuttle of Tuttle Capital shares quick-hit investing advice for navigating today’s market. From hedging strategies to spotting hot themes and identifying potential winners, his tips help investors stay ahead in unpredictable times.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.