I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

The setup: 2025 was the “scarcity stampede”

Last year, the market didn’t care how you made electricity.

If you produced electrons—or even talked about producing electrons—you got paid.

Solar ripped. Nuclear ripped. Gas ripped. Even coal ripped.

That’s not “fundamental stock-picking.” That’s a scarcity panic dressed up as an AI thesis:

AI loads surged faster than the power sector can respond.

Utilities, regulators, EPC labor, transformers, turbines, interconnect queues… all moved at “infrastructure speed,” not “venture speed.”

So investors did the only thing they can do in a hurry: bid up everything in the power complex.

And it worked… until it won’t.

Because “everyone’s a winner” trades die the same way every time:

the market stops paying for proximity and starts paying for proof.

The 2026 regime shift: “Show me the megawatts”

In 2025, the market bought the story:

“AI needs power → power stocks go up.”

In 2026, the market buys the receipts:

Signed contracts / PPAs

Permits and interconnection secured

Equipment slots actually booked (turbines / transformers / switchgear)

Delivery timelines that don’t slip

Returns that clear the cost of capital

That’s why this rally can continue in 2026… but it will stop being a blanket trade. It becomes a dispersion trade.

Why the “everyone wins” energy trade can’t last

Three reasons the easy money phase ends:

1) Valuations are already pricing in a lot of perfection

A bunch of the “AI power” winners are now priced like software companies:

30x+ forward earnings in places you used to buy for stability

90x forward earnings in “hot” names that still have to prove durability

That doesn’t mean they must crash. It means the bar is higher:

It takes more good news to push them up

It takes less bad news to knock them down

2) Scarcity flips from tailwind → bottleneck

The same scarcity that lifted the whole complex becomes the thing that punishes the weak links:

Not enough EPC contractors

Not enough skilled labor

Not enough transformers / switchgear

Not enough transmission to deliver power where compute is going

Not enough gas generation brought online fast enough

In 2026, “power demand is huge” stops being a catalyst if supply can’t physically show up on schedule.

3) The market will punish “PowerPoint megawatts”

The biggest losers in the next phase are predictable:

pre-revenue “AI power” developers

speculative SMR names with more narrative than deliveries

any project that depends on perfect financing + perfect permitting + perfect grid access

2026 is when missed timelines stop being “growing pains” and start being equity wipeout risk.

The real opportunity: second-order winners (the people selling the shovels)

If data-center construction and grid upgrades keep accelerating, the cleanest “second-order” beneficiaries are not always the power producers.

They’re the companies that get paid whether the tenant is OpenAI, Meta, or whoever wins the model race.

Think of it like this:

A data center isn’t an office building. It’s a power plant + a chiller farm + a substation with servers inside.

So the money goes into MEP (mechanical, electrical, plumbing), grid gear, and thermal.

Pocket #1: Grid buildout (the toll booths on megawatts)

This is the “you can’t cheat physics” bucket.

If load is rising, the grid gets upgraded. Period.

What tends to win:

Transmission & distribution buildout

Substations & interconnection work

Utility-side hard goods and components

Example tickers to bucket-watch:

$PWR, $MYRG, $MTZ, $HUBB

Why it works in 2026:

Even if AI sentiment cools for a quarter, grid backlogs don’t vanish. These projects are multi-year bottlenecks.

Pocket #2: Electrical guts inside the fence

Inside the data-center campus, reliability isn’t a feature — it’s survival.

Power distribution, switchgear, UPS, breakers, busways… this is where the spend explodes.

Example tickers:

$ETN, $POWL (and you can include $VRT here as the “critical infrastructure integrator” even though it straddles power + cooling)

Why it works in 2026:

Data centers don’t “value engineer” uptime. These systems are non-negotiable.

Pocket #3: Cooling (the silent kingmaker of AI compute)

AI racks are denser. Denser racks = hotter racks. Hotter racks = more cooling spend.

This is the part the market consistently underestimates until it becomes the gating factor.

Example tickers:

$TT, $CARR, $JCI (and again $VRT lives here too)

Why it works in 2026:

Cooling is becoming a constraint on how much compute you can deploy, not just an operating cost.

Pocket #4: Backup power and redundancy

Even if you get grid power, you still need redundancy. AI workloads don’t tolerate downtime.

Example tickers:

$GNRC, $CMI, $CAT

Why it works in 2026:

As AI becomes “production,” redundancy budgets rise. This isn’t discretionary.

Pocket #5: Specialty contractors (the true picks-and-shovels)

When everybody wants to build at once, the winners aren’t just the OEMs — it’s the people who can install, commission, and deliver on time.

Example tickers:

$EME, $FIX, $STRL

Why it works in 2026:

Execution capacity becomes the choke point. Choke points get pricing power.

Pocket #6: Materials (boring… but huge volume)

If you’re pouring massive pads and shells, aggregates and cement-heavy inputs can quietly compound on volume.

Example tickers:

$VMC, $MLM (and “electrification metal” exposure like $FCX is the classic second-order tie-in)

Why it works in 2026:

The build-out is physical. Physical booms consume materials.

Where 2026 can still surprise to the upside

AI-driven load growth stays real

Interconnect and permitting processes slowly adapt

Data-center demand remains sticky (even if hype cools)

Then the trade broadens from “own power producers” to “own the industrial machine building the power system”

That’s the key nuance:

The “everything energy” trade can fade while the “energy infrastructure” trade keeps working.

The danger zone in 2026

Likely losers (or at least “highest downside convexity”)

Pre-revenue power developers selling a dream and financing risk

Speculative SMR / moonshot power projects with long timelines and binary outcomes

Anything priced for perfection without clear contracted cash flows

Overcrowded “AI power” trades that pop on headlines and gap down on delays

The tell will be simple:

In 2026 the market won’t ask “is AI big?”

It’ll ask “who’s actually getting paid, and when?”

2025 was a phase where exposure was enough.

2026 is the phase where execution is the catalyst.

If you want to stay in the theme without playing valuation roulette in the most crowded names, you tilt toward:

grid buildout

power distribution equipment

cooling

backup generation

specialty contractors

That’s where the “AI → electricity → construction → cash flow” chain is the cleanest.

News vs. Noise: What’s Moving Markets Today

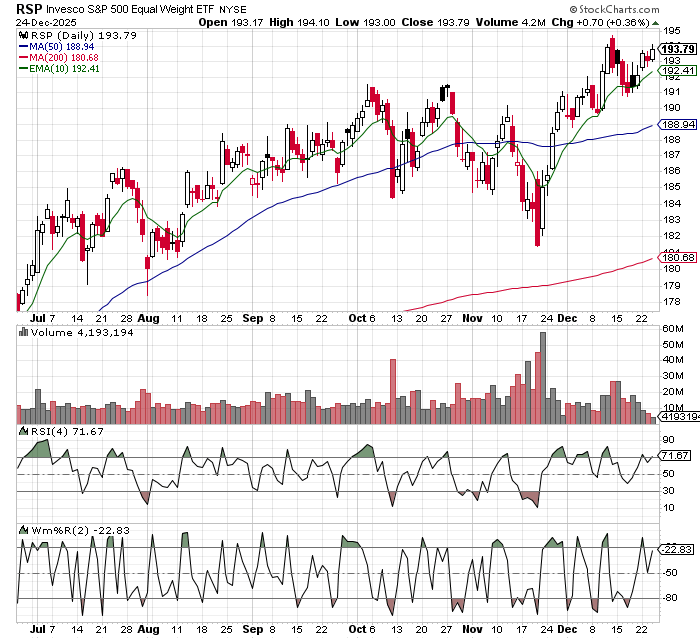

I’ve always thought market cap weighted indices were kind of stupid. They are so top heavy they really don’t provide the real story about what’s going on. Right now you have the S&P 500 at all time highs, and the NASDAQ 100 fairly off. So sometimes it’s helpful to take a look at the equal weight S&P 500…..

It’s outperformed the QQQ and SPY so far this month. Now remember, a lot of stuff happens in December that may have no implications for next year. A big reason for the outperformance is small cap stocks. Long time readers know I think the Russell 2000 is a crap index. Money will go in there from time to time, but I think you treat IWM as a trading vehicle, not a long term buy and hold. Small caps may do well in 2026, but I really think you have to be a stock picker if you are going to venture there.

One thing I did do was add an AI adopters bucket to my portfolio. These are old economy stocks that are using AI to enhance the bottom line. These stocks won’t double to triple next year, but they could be steady growers and provide some stability to the portfolio. They also tend to be “value” stocks. Again, long time readers know I think that traditional value investing is dead. You are not going to consistently find undervalued stocks that Wall Street has missed. I am going to look to continue to expand this bucket next year. I will not be looking to find undervalued stocks, but valuation is going to matter. A stock like WMT is using AI to enhance the bottom line, but it’s also trading at a 40+ P/E.

A Stock I’m Watching

Today’s stock is Huntington Ingalls (HII)…..

One aspect of the Trump trade I still love is to look for areas we are behind China, knowing Trump is going to want to catch up. Shipbuilding is a big one. This stock has run a lot, if you are looking to add it I would do it on dips.

HII is a rare “hard-asset + high-tech” defense compounder: it’s the nation’s largest military shipbuilder and it’s increasingly attaching software, autonomy, and AI to that installed base. The most important near-term signal is demand visibility—Ingalls was selected by the U.S. Navy to design/build the future Small Surface Combatant using the proven Legend-class cutter design, with management explicitly emphasizing speed, schedule predictability, and capacity to execute alongside existing destroyer/amphib lines.

On the nuclear side, Newport News continues to drive key Virginia-class milestones (e.g., SSN 802 “pressure hull complete”), which matters because submarine throughput and industrial-base scaling are the gating items for Navy readiness.

What makes HII more than a “steel-and-labor” story is the tech attach: HII is partnering with Shield AI to integrate autonomy software onto its ROMULUS AI-enabled uncrewed surface vessels, a credible wedge into unmanned maritime programs.

And on the productivity front, HII’s C3 AI partnership is aimed at using AI to improve shipbuilding planning/throughput and execution—exactly the kind of operational leverage investors will pay for if it shows up in cycle times and margins.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.