Wall Street’s 60/40 formula was born in 1952 — the same year as the first credit card. A lot has changed since.

That’s why we created a new approach — The H.E.A.T. Formula — to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

Table of Contents

🔥 Here’s What’s Happening Now

Friday was supposed to be the jobs number, but it didn’t happen with the shut down. The headlines from Friday look like this….

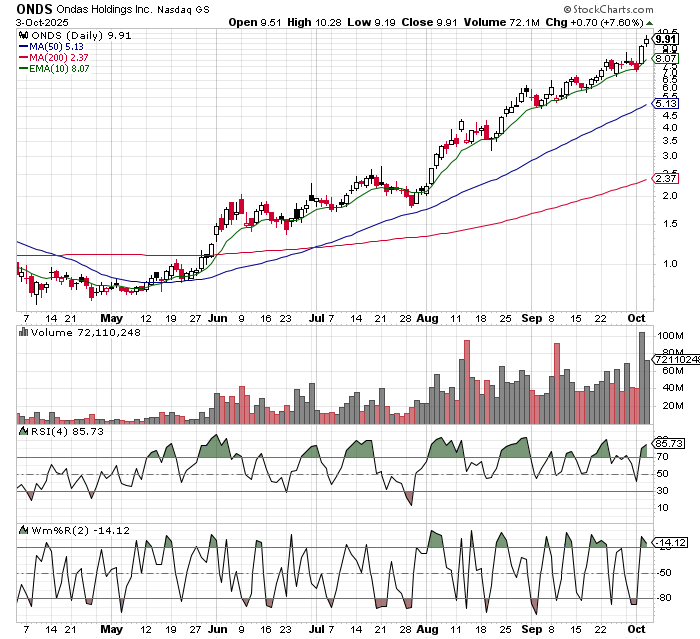

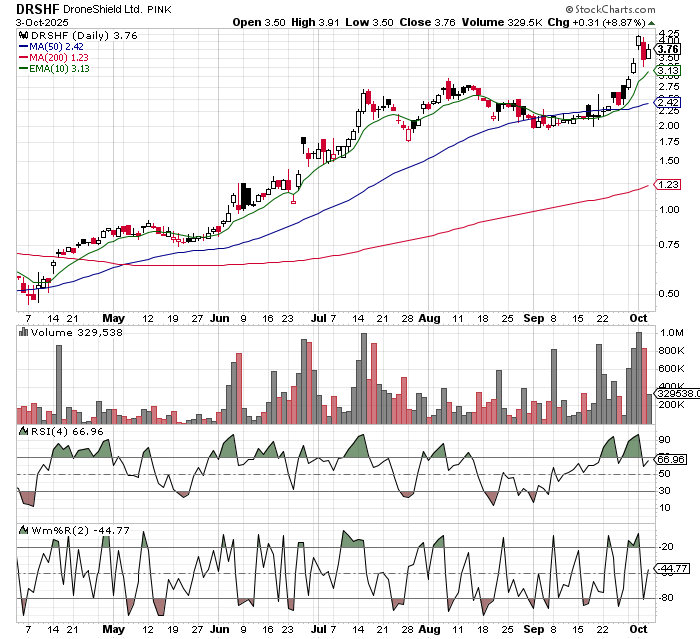

But if you are thematic (more below) then nothing fizzled on Friday. Outside of crypto (more below), Friday’s biggest theme was the drone stocks. I’ve been talking about ONDS since it was in the 1’s….

A while back I wrote about how a caddy was bugging me for like 10 holes for a stock tip, I gave him this when it was in the 2s and said it was either going to zero or 10. Hope he took my advice.

We talked about this on one of our podcasts, pretty sure it’s close to doubled since then….

If you are not watching our podcast you should. I want to present you with deep dives on different thematics and exposure to all sorts of different types of investors.

If you have any suggestions for guests and topics feel free to send them over.

Last week there were all sorts of article about how Crypto was losing steam, now we see a bunch of these…..

I continue to believe you need to own crypto, which is why many of our launches focus there….

Gold is something you need to own also, it’s up big pre market. Another reason Wall Street is broken…

If you want a reason to be bearish, last week was the second week in a row where the Magnificent 7 underperformed the S&P 500. Are cracks starting to emerge, or is the rally just broadening out?

Why Covered Call ETFs Suck-And What To Do Instead

Thursday October 23rd 2-3PM EST

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market.

The truth?

Most of them suck.

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile.

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead.

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital

📉 How most call-writing strategies quietly destroy compounding

🚫 Why owning covered calls in bull markets is like running a marathon in a weighted vest

💡 The simple structure that can fix these problems — and where the real daily income opportunities are hiding

💀Is Value Investing Dead?

Why Thematic Investing Is the Only Way to Beat a Transparent Market

🔍 The Setup

MarketWatch’s Joseph Adinolfi highlighted what many portfolio managers are afraid to admit:

value stocks are being left in the dust—again.

By Evercore ISI’s data, value names (low price-to-book, low P/E) are underperforming growth stocks by the widest margin since the dot-com bubble. The Russell 3000 Growth Index is up ~17% YTD, while the Value Index has barely cracked 10%.

That gap isn’t just cyclical noise—it’s structural.

⚙️ The Death of Value Investing

Value investing worked when:

Information was scarce,

Mispricing was common,

And time arbitrage existed—buy something cheap, wait for recognition.

But that edge died the moment information became free.

Every balance sheet, cash flow model, and analyst upgrade is available to anyone with a phone.

ChatGPT and AI research tools can instantly synthesize data that used to take weeks for analysts to find.

The “undervalued gem” you think you discovered? Thousands of algorithms saw it before you hit “buy.”

Even Warren Buffett’s brand of deep-value investing relies on a scarcity of information and patience.

In a world where everyone has the same data and the same calculators, that edge is gone.

As you said, — the internet killed value investing. AI and crowdsourced research just finished the job.

📈 The Rise of Thematic Investing

If value is dead, what replaces it? Themes.

Because while everyone has access to the same information, not everyone can connect the dots.

Themes are about recognizing structural shifts before Wall Street’s models do.

They’re not about cheapness—they’re about change.

Examples:

AI Infrastructure: Not “cheap,” but essential. You’re not betting on P/E ratios—you’re betting on the cost curve of compute.

Digital Energy: Nuclear, nat gas, and grid modernization (your JUCE thesis) — the bottleneck to AI adoption.

Defense Tech and Drones: The geopolitical tailwinds are obvious, but Wall Street models still underestimate long-cycle procurement.

Crypto Treasury & Tokenization (DATs): The next evolution of corporate balance sheets.

Thematic investors don’t care if something looks expensive—they care if it’s early.

🧠 The Modern Framework: HEAT vs. Value

Approach | Edge Source | Limitation | Modern Upgrade |

|---|---|---|---|

Value Investing | Mispricing of fundamentals | Data transparency eliminated edge | AI finds fair value faster than humans |

Growth Investing | Momentum & EPS trajectory | Crowded in mega-cap AI names | Works only if thematic tailwind persists |

Thematic Investing (HEAT) | Identifying structural shifts early | Requires synthesis, not spreadsheets | Uses AI + macro pattern recognition to find edges |

Your H.E.A.T. Formula — Hedges, Edges, Asymmetry, Themes — is the antidote to this transparency trap.

In a market where everyone knows everything, the only way to outperform is to look where the algorithms aren’t trained to look yet — new energy infrastructure, digital assets, AI healthcare, and national-security tech.

🧩 The Bigger Picture

Value investors are waiting for a “reversion to the mean” that may never come.

That world assumed mean reversion mattered.

Today, we’re in a world of winner-take-all dynamics, network effects, and data monopolies. Cheap companies stay cheap because scale and compute power compound faster than value metrics can catch up.

If the dot-com era rewarded vision over valuation, this AI era rewards narrative married to execution.

💬 Context

The data confirms what you already see:

Value’s underperformance isn’t a trade—it’s a paradigm shift.

Long-term alpha will come from theme discovery, not valuation discovery.

The future of fund construction is dynamic, AI-assisted thematic weighting, not P/B sorting.

The winners? Thematic allocators who use AI to detect capital flow, regulatory policy, and technological acceleration.

The losers? Quant screens still pretending the market is inefficient.

🗞️ Bottom Line

Value investing isn’t coming back — transparency killed it. When every investor, algorithm, and AI has the same data, “finding hidden value” becomes impossible. The edge now lies in identifying the next theme before Wall Street can model it — AI power, nuclear, defense tech, crypto treasuries, healthcare AI.

In today’s market, themes are the new value — and the winners will be those who can see the next one before the crowd does.

📈 Stock Corner

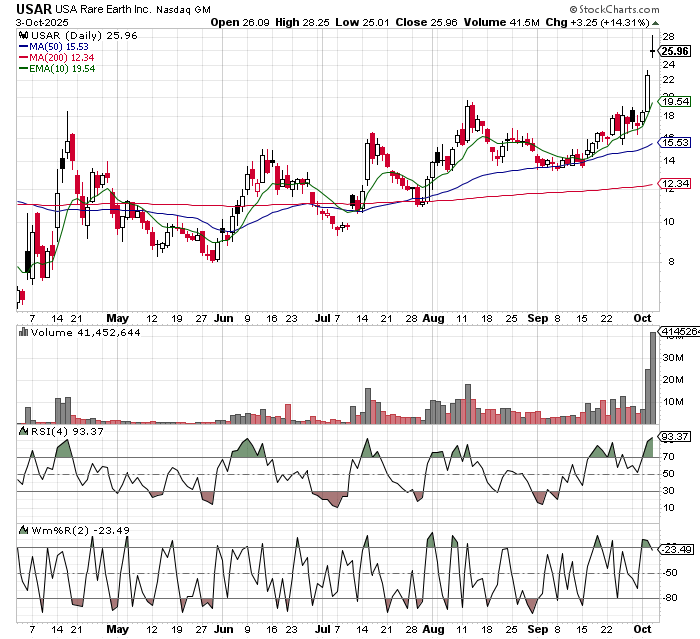

Today’s stock is USA Rare Earth (USAR)…..

Longer term readers know that one of my top themes is Trump’s Inner Circle. No matter what you think of him as a President he’s extremely consequential for themes and individual stocks.

As one reader texted me last week…..

God bless Donald Trump is all I can say….He’s handing out free dough

After a bit of censorship we’ve gotten the go ahead to launch our Tuttle Capital Government Grift ETF (GRFT). Hoping for Friday, but may bleed into next week. One of the biggest parts will be Trump’s Inner Circle. Stay tuned.

📬 In Case You Missed It

Jerry Parker on trend following…

🤝 Before You Go Some Ways I Can Help

ETFs: The Antidote to Wall Street

Inside HEAT: Our Monthly Live Call on What Wall Street Doesn’t Want You To Know

Financial HEAT Podcast https://www.youtube.com/@TuttleCap Freedom from the Wall Street Hypocrisy

Tuttle Wealth Management: Your Wealth Unleashed

Advanced HEAT Insights: Matt’s Inner Circle, Your Financial Edge

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.