I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Dividend Payable Today:

BITK .11/ Share

MSTK .25/Share

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) December 9 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

Nvidia vs. Everybody: the AI chip war is turning into an “unbundling”

For two years, the market traded AI like it was a one‑stock supply chain: $NVDA builds the picks, everyone else buys the picks. That story is now fracturing—not because demand is collapsing (it isn’t), but because $NVDA’s profit pool is so big it’s become the industry’s strongest incentive to compete. Nvidia is still putting up monster numbers (record revenue and ~70%+ gross margins), which tells you the spending cycle is real. But those margins are also the invitation: hyperscalers can justify tens of billions in custom silicon and still win economically if they shave even a slice of Nvidia’s take.

The three fronts of “Everybody Else”

1) Hyperscalers externalizing their in‑house chips

Google’s TPUs and Amazon’s Trainium family were originally “house chips.” The shift now is commercialization: they want third‑party customers, not just internal workloads. AWS is already on a rapid cadence (Trainium generations, plus aggressive claims on perf/$) and is building gigantic clusters (Anthropic described Amazon building “Project Rainier” with “hundreds of thousands” of Trainium2 chips). That doesn’t kill $NVDA—what it does is cap pricing power as customers get credible alternatives for some workloads, especially inference.

2) Merchant rivals that can underprice and still make money

$AMD, $AVGO, $QCOM and others don’t need to “beat” Nvidia everywhere—only win enough sockets to reset the clearing price of compute. The crucial point: you don’t need feature parity to pressure margins; you need a “good enough” option with volume.

3) Nvidia’s customers becoming chip designers

Model companies and mega buyers don’t want single‑vendor dependence, and the biggest ones have the scale to co-design or build ASICs. Even if they stay multi‑vendor, diversification alone changes the negotiating leverage.

Why Nvidia’s moat is still real (and where it’s most vulnerable)

Nvidia’s real moat isn’t just silicon—it’s the full stack: CUDA and the developer ecosystem, libraries, tools, and systems integration. CUDA’s been compounding since the first release in 2006; that’s nearly two decades of “muscle memory” for developers and enterprises. This is why “Nvidia loses overnight” is lazy analysis.

But Nvidia is most vulnerable where:

The workload is standardized (commoditized inference at scale),

The buyer is massive (hyperscalers optimizing for $/token),

Switching costs are manageable (internal apps, controlled stacks),

The alternative is bundled with cloud pricing (chips sold through cloud, not as a standalone BOM line item).

A ton of “AI chip competition” is still constrained by who can actually build leading‑edge silicon at scale. TSMC remains the key gatekeeper, often cited as producing the vast majority of the world’s most advanced semiconductors. Competition is real—but capacity, packaging, memory, and supply chain still shape who can take share fast.

Likely scenarios (and who wins / loses)

Scenario 1 (Base case): “Nvidia stays the default, margins drift lower”

What happens: Nvidia remains the training + high-end inference standard, but customers diversify enough to pressure price. Gross margin compresses from “insane” to merely “great,” while volumes keep growing.

Winners:

$NVDA (still), but more “compounder” than “face-ripper”

$TSM (volume + mix), HBM/memory + networking ecosystems, and the “AI plumbing” layer

$AVGO (custom silicon + networking)

Losers:Any levered “single customer/single chip” compute story that assumed permanent scarcity pricing

Scenario 2 (Bear-ish for $NVDA): “Inference flips to ASICs faster than expected”

What happens: Training stays GPU-heavy, but inference becomes mostly TPU/Trainium/custom ASIC as clouds optimize cost. Nvidia grows, but loses the highest-margin, most scalable part of the long-run TAM narrative.

Winners:

$GOOGL and $AMZN (they monetize silicon as part of cloud margin structure)

$AVGO and other custom-silicon enablers

Losers:$NVDA’s multiple, even if earnings are still strong (market reprices the durability of 70%+ gross margins)

Scenario 3 (Tail risk): “Capex is fine, financing gets weird”

What happens: Demand remains, but the ecosystem is funded with increasingly complex debt/lease structures. A credit or rate shock forces slower buildouts, pushes renegotiations, and crushes the most levered link in the chain.

Winners:

The strongest balance sheets, diversified vendors, and “toll collectors”

Losers:More speculative infra sponsors relying on constant refinancing and perfect utilization

The 5 things to watch (these will tell you which scenario we’re in)

Nvidia gross margin trend (70%+ is the bull narrative; sustained slippage is the war showing up in P&L).

Hyperscaler chip adoption signals (named customers, contract durations, cluster size disclosures).

Workload mix shift: training vs inference economics and where each runs.

Ecosystem lock-in: CUDA/tooling momentum vs portability frameworks.

Foundry constraints: who can actually build at scale at the bleeding edge.

This isn’t “Nvidia is over,” it’s “AI compute is getting unbundled.” Nvidia can still win the decade and also see margins compress. The winners won’t be “one chip to rule them all”—they’ll be the companies that own the chokepoints: the foundry, the memory, the networking, the power chain, and the software ecosystems that make the hardware usable.

News vs. Noise: What’s Moving Markets Today

This week, the market isn’t trading the cut — it’s trading the message. The Fed meets Dec 9–10 (SEP meeting) and the policy rate is currently 3.75%–4.00%.

The street is leaning toward “cut, but don’t get cute”: a 25bp move with guidance that pushes back on the ~2026 easing path markets keep trying to price in. That’s the “hawkish cut” playbook — and it has a recent precedent: in Dec 2024, the Fed delivered a cut while leaning hawkish in its projections/guidance, and stocks sold off hard (roughly ~3% on the day) because the dots and presser mattered more than the headline cut. If Powell repeats that vibe, it can easily read as: “We’ll move once, then we’re closer to done than you think.”

The other “noise” the market keeps clinging to is politics: the idea that a future chair can simply force through aggressive cuts. But the “news” is the constraint set: after one more cut, policy is near neutral, inflation is still not at 2%, and the Committee math/credibility will matter. Even a dovish chair can’t routinely drag rates into stimulative territory if the data doesn’t give cover — and attempts to politicize the Fed risk doing the opposite of what bulls want by raising term premium (the bond market demanding more compensation for uncertainty). Net: don’t anchor on “cut vs no cut.” Anchor on (1) the dot plot/SEP and (2) whether the statement/presser signals a pause regime. The cut is the headline; the guidance is the trade.

Takeaways

Base case: 25bp cut is likely, but the risk is a hawkish cut (fewer dots in ’26, “we’re close to neutral,” more conditionality). Markets are already leaning that way.

The “tell” is the front end: if 2Y yields pop and 2s10s steepens, that’s the market hearing “insurance cut, then pause.” High-duration growth and crowded beta hate that.

Risk assets can fall on a cut: because what matters is whether the Fed validates “easy financial conditions forever” or tries to re-price them tighter. That’s exactly how Dec 2024 played out.

QT ending helps liquidity, but doesn’t immunize markets: the Fed already concluded balance-sheet runoff on Dec 1 — supportive at the margin, but guidance can still tighten conditions faster than QT relief can loosen them.

A Stock I’m Watching

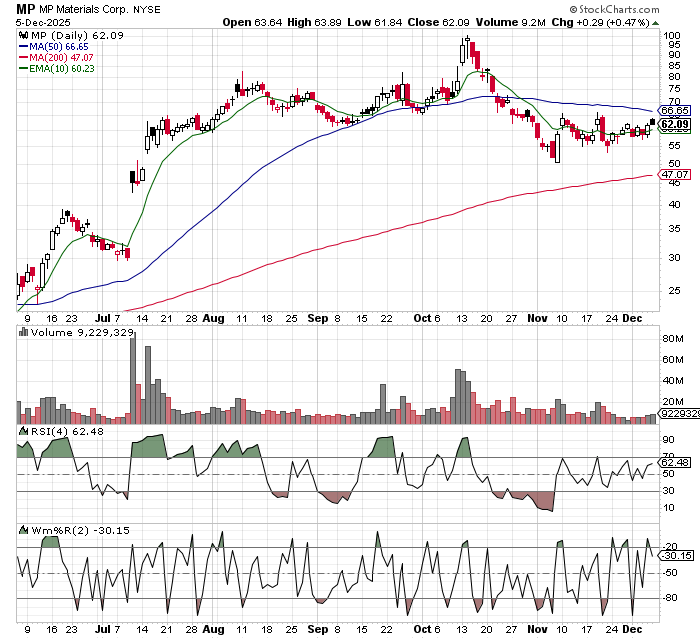

Today stock is MP Materials (MP)….

MP Materials is basically a geopolitics + supply‑chain optionality trade with an unusually explicit policy backstop. China still accounts for roughly 90% of global permanent‑magnet supply, so any renewed export friction or licensing bottleneck can force buyers to pay up for ex‑China supply again. MP’s differentiator is vertical integration (mine → processing → magnets) and, crucially, the U.S. government has effectively “underwritten” the ramp: the DoD-backed agreement includes a NdPr price floor ($110/kg) plus an offtake commitment, alongside $400M of convertible preferred and warrants (up to ~15%) tied to building a 10,000‑metric‑ton “10X” magnet facility targeted for commissioning in 2028. If the world re-learns that rare-earth security isn’t solved by one trade headline, MP’s strategic premium can come back fast; if not, the main risks are execution/capex timing (waiting until 2028 is a long bridge) and a benign pricing regime that keeps the “strategic” bid compressed.

In Case You Missed It

Made a few media appearances the past couple of days, talked to Schwab Network about TSLA, The Street about the market and stocks I like, Oliver Renick about crypto and some of the other things we are working on, and Quasar Markets about the market.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Tuesday December 9, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.