I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

Quantum is coming… and investors are about to learn the same lesson twice

Five years ago, “AI” was a nerd word.

Then one interface (ChatGPT) made it obvious, and the market did what it always does when something becomes obvious:

It stampeded.

Quantum is setting up for that same pattern — with one difference:

Quantum doesn’t need a consumer “chatbot moment” to matter.

The first real “killer app” for quantum isn’t cute demos.

It’s fear.

Because when quantum becomes strong enough, the conversation stops being “innovation” and becomes national security + financial security + communication security.

That doomsday has a nickname: Q‑Day.

And whether it’s 3 years away or 20… the defensive spend starts before the day arrives, not after.

The part most investors miss: the first quantum boom is NOT about quantum computers

The first wave of money is not “buy a quantum computer.”

It’s:

upgrade encryption

harden systems

migrate identity + payments + defense comms

build quantum-adjacent infrastructure

sell picks & shovels to the labs and hyperscalers

That’s not my opinion — that’s how every technological regime shift works.

And the proof is already sitting in plain sight:

NIST has already released its first set of finalized post‑quantum cryptography standards — meaning the migration isn’t theoretical anymore; it’s turning into compliance, procurement, and budget line-items.

Translation in newsletter English:

The money starts flowing while the headlines are still confusing.

The “two truths” of quantum investing

Truth #1: The science is real enough to change government behavior

You don’t standardize post‑quantum cryptography because you’re bored.

You do it because you assume:

“Someone, somewhere, eventually gets there.”

Truth #2: Most “quantum stocks” will still be terrible investments

Because quantum markets will be like early railroads and early dot‑com:

a few winners change the world

most contenders dilute shareholders into dust

the best risk/reward is often upstream (infrastructure + security), not in the flashy “future” names

The 3-lane map: where the market will splinter in 2026

Lane A — The Casino Chips (Pure-play quantum)

These are the tickers everyone will chase when quantum goes viral:

IONQ (IonQ)

RGTI (Rigetti)

QBTS (D‑Wave)

What they sell: the dream of being “the Nvidia of quantum.”

How they trade: like biotech pre‑FDA approval.

You are not investing in earnings — you’re investing in technical milestones + funding conditions + narrative heat.

How you win here:

small sizing

accept volatility

expect dilution

treat it like a venture sleeve inside a public portfolio

What to watch (the only stuff that matters):

real commercial bookings (not pilots)

government validation (defense + national labs)

repeatable revenue (cloud access, services, long-term agreements)

Lane B — The Giants (Quantum inside Big Tech)

This is the “I want quantum exposure without dying” lane:

GOOGL (Alphabet/Google)

IBM (IBM)

MSFT (Microsoft)

AMZN (Amazon)

These companies can fund quantum for a decade without blinking — and they’ll also be the ones who buy any pure-play that proves something real.

But here’s the catch:

If quantum works, it might be enormous… and still not move the needle near-term inside a $1T–$3T company.

So this lane is safer — but quantum upside is diluted.

Lane C — The Toll Roads (Where the first real money gets made)

This is the lane most investors ignore because it sounds boring.

It’s also the lane that tends to outperform during the messy middle of every tech revolution.

Sub-lane C1: Post‑Quantum Cryptography (PQC) = unavoidable spend

Because standards are out, the migration is real.

The winners aren’t “quantum.”

They’re the companies that sit inside enterprise security + identity + infrastructure upgrades:

Watchlist bucket (security/identity):

PANW (Palo Alto Networks)

CRWD (CrowdStrike)

FTNT (Fortinet)

OKTA (Okta)

ZS (Zscaler)

These firms win if PQC becomes:

compliance-driven refresh cycles

“rip and replace” of legacy crypto implementations

a multi-year re-architecture of authentication + secure comms

Important nuance: PQC won’t show up as “quantum revenue.”

It shows up as security modernization budgets getting pulled forward.

Takeaways

1) Quantum’s first commercial wave is defense + security, not consumer apps

The market will meme the sci‑fi angle.

But the cash starts with: “make encryption survivable.”

2) Pure-plays will trade like option contracts

Not because they’re scams — because the timeline is uncertain and the capex burn is real.

3) The smartest “quantum” positioning often won’t say quantum anywhere

The first winners are the people selling:

compliance upgrades

security migrations

infrastructure to the labs and hyperscalers

4) Expect a quantum hype wave in 2026

Especially if AI stays hot and “adjacent manias” keep rotating.

And when it happens, the market will do what it always does:

overpay for the dream

underpay for the toll roads

Winners and losers

Likely winners (2026–2028 positioning)

1) PQC / security modernization beneficiaries

PANW, CRWD, FTNT, OKTA, ZS

Because standards → upgrades → budgets.

2) Big Tech with quantum + distribution

GOOGL, IBM, MSFT, AMZN

Because they can fund it, cloud-distribute it, and acquire the winners.

3) Basket exposure

Quantum ETFs (COMING SOON)

Because most people won’t pick the right horse — they’ll buy the field.

Danger zone / likely losers (where investors get hurt)

1) “Quantum” story microcaps

If the whole pitch is “trillion-dollar TAM” and the financials are a bonfire, 2026 will eventually punish it.

2) Dilution machines

Any company that has to issue stock every time the hype cools.

3) Investors who size quantum like a “core position”

Quantum is not a widows-and-orphans trade.

It’s a volatility trade until revenue becomes durable.

Quantum isn’t a gadget.

It’s a weapon. It’s leverage. It’s the kind of technological edge that forces governments to move before the market understands why.

And that’s why the smartest quantum trade for most investors won’t be “buy the qubit.”

It’ll be:

Buy the toll roads everyone is forced to drive on…

before the headline writers learn what a qubit is.

News vs. Noise: What’s Moving Markets Today

The New Dumb Money are the Investors Who Think They are Smart but Don’t Pay Attention to Retail…..

News (what actually changed): 2025 was the year the “smart money” finally had to admit something humiliating: they aren’t the only price-setters anymore. Retail isn’t a sideshow — it’s the marginal buyer. The data points all rhyme: record inflows into stocks/ETFs, retail share of options volume near records, and retail showing up on every air pocket like it’s a Black Friday sale. That’s why the market kept snapping back from selloffs: the old reflex (“pros de-risk → market bleeds”) got interrupted by a new reflex (“apps ping → buy the dip”). The implication is bigger than meme stocks. When everyday traders are ~one-fifth+ of volume at times, institutions ignore them at their peril — because retail flow can be the difference between a correction that cascades and a correction that gets absorbed.

Noise (what people will misread): the labels. “Dumb money” vs “smart money” is outdated branding — and in 2026 it may be backwards. The dumb money is any institution still running the 2010s playbook: fade rallies, wait for capitulation, assume liquidity/flows behave like they did when retail was small and passive. The real takeaway isn’t “retail is always right.” It’s that market structure has changed: retail can keep markets pinned higher longer than pros think, and it can also make reversals nastier when the buy-the-dip muscle finally fatigues. So the tell you watch isn’t a strategist’s year-ahead target — it’s whether retail keeps being the buyer of first resort. When that flow slows (inflows roll over, call-buying cools, dip-buying stops working), that is when “news” flips — and the market reminds everyone who actually controls the air pockets.

This is one of the big reasons we believe markets are now thematic, and we believe that is not going to change. Ignore style boxes, market capitalization, growth vs. value, and traditional asset allocation. Focus on what are the likely major themes over the next 1-3 years, who are the likely winners, and what companies do the winners need to be winners.

A Stock I’m Watching

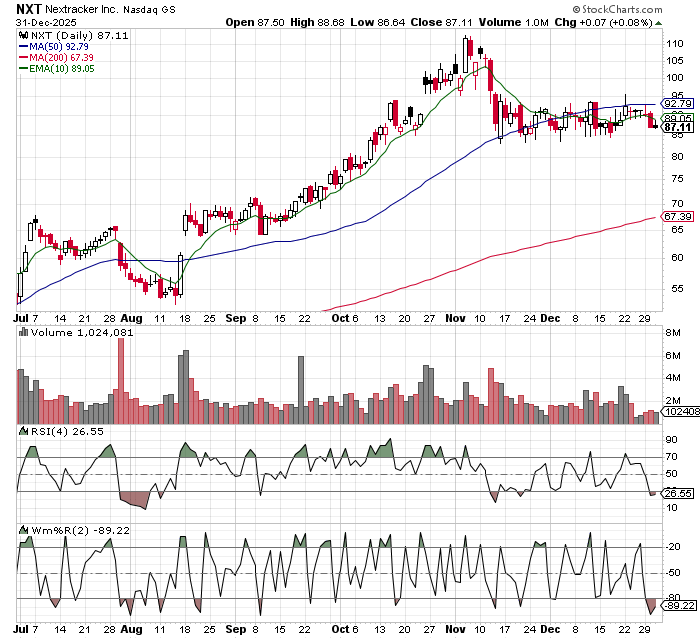

Today’s stock is Nextpower (NXT) (They changed their name from Nextracker on 11/12)….

NXT is one of the cleaner “AI-era electrification” equity setups going into 2026, because the market is currently treating it like a solar-tracker demand proxy at the exact moment the story is shifting toward (1) durable grid + data center-driven renewables buildout and (2) self-help. Post-investor-day, Street has been quick to haircut forward numbers on macro/permitting anxiety, but that “reset” is often the ingredient you want before the next beat/raise cycle—especially with backlog visibility, expanding attach across eBOS/foundations/inverter-adjacent content, and a credible path to margin lift via integration + cost synergies across the portfolio. The other underappreciated lever is FCF: if management leans into buybacks (and/or disciplined bolt-ons), the equity can re-rate without needing heroic end-market acceleration. Key risks to keep honest are permitting cadence, policy/headline risk, and execution on integration, but if those stay “normal,” NXT looks like a buy-the-weakness compounder rather than a single-cycle solar trade.

In Case You Missed It

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.