Wall Street’s 60/40 formula was born in 1952 — the same year as the first credit card. A lot has changed since.

That’s why we created a new approach — The H.E.A.T. Formula — to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

Table of Contents

Today is Ex Dividend Date for BITK. This week’s dividend will be .5/share, payable Monday

🔥 Here’s What’s Happening Now

The AI trade hit a wall yesterday—and it wasn’t just tech. Gold, Bitcoin, and other macro hedges were dragged into the selloff as risk appetite snapped. Some of the AI names gave back a bit of recent gains, while OpenAI's trillion-dollar spending plans are starting to raise real questions about systemic risk and leverage in the AI buildout.

Overnight, gold and crypto are bouncing as dip-buyers step back in, but the bigger macro force in play is the U.S. dollar, which is becoming the pain trade no one saw coming.

💲 The Big Dollar Short Is Getting Squeezed

The Bloomberg Dollar Spot Index just posted its strongest weekly performance in nearly a year, up 1.2% despite a U.S. government shutdown and soft economic data. That’s triggering massive pain for funds betting on a weaker greenback:

Hedge funds are scrambling to cover shorts, with options data showing the most bullish sentiment on the dollar since April

The yen and euro are collapsing, giving the dollar a relative bid as the "least dirty shirt in the laundry"

Fed officials are pushing back on rate cut expectations, suggesting the full easing cycle priced in by markets may be premature

That has created a cross-asset shock: higher dollar, weaker gold, Bitcoin, and export-heavy equities. Even emerging market bonds and equities, which had ridden the “soft dollar” tailwind all year, are under pressure.

⚠️ AI Leverage Is a Bigger Risk Than People Think

Yesterday’s selloff in AI names also revealed something deeper: the entire 2025 bull market may be overly dependent on one over-leveraged private company—OpenAI.

OpenAI has now committed to $1 trillion in data center and cloud deals

It owes $300 billion to Oracle ($ORCL) alone, whose stock soared 36% on that news

The firm needs 15 gigawatts of power—equivalent to 15 nuclear reactors—and has no clear path to fund the remaining $800 billion

That’s not just frothy. That’s 2000-era circular financing, with suppliers backing customers and Wall Street pricing perfection. If OpenAI stumbles, it could cause a cascading reversal in some of the biggest winners of the year, from chips to cloud to power.

🧠 Bottom Line

We’ve entered a new phase of the market, where:

AI optimism is colliding with fiscal, energy, and FX reality

The strong dollar is becoming a wrecking ball across macro hedges and EM trades

The OpenAI mega-spend is being tested for sustainability, and the cracks are starting to show

Crypto and gold are bouncing this morning, but don’t mistake that for the all-clear. The unwind in crowded long AI / short dollar / long beta positioning may just be getting started.

Recent history tells us to keep buying the dip, which I am doing selectively, but I have been raising a bit of cash just in case I get better dips down the road.

Why Covered Call ETFs Suck-And What To Do Instead

Thursday October 23rd 2-3PM EST

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market.

The truth?

Most of them suck.

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile.

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead.

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital

📉 How most call-writing strategies quietly destroy compounding

🚫 Why owning covered calls in bull markets is like running a marathon in a weighted vest

💡 The simple structure that can fix these problems — and where the real daily income opportunities are hiding

🧲 Rare Earths: The Cold War Commodities Supercycle

Washington and Beijing are back at the chessboard—and the battleground isn’t semiconductors or tariffs this time. It’s dysprosium. And neodymium. And lithium.

Rare earths and other critical minerals are no longer obscure inputs for niche industries. They're now weapons-grade economic leverage—and both the U.S. and China know it.

🇨🇳 China Escalates: Export Controls as Geopolitical Leverage

China, which produces over 80% of the world’s rare earth supply, is tightening the screws:

New restrictions require licensing for any product containing more than 0.1% rare earths by value

This move follows similar controls on lithium battery exports, targeting global EV supply chains

Comes ahead of a potential Trump-Xi meeting, likely as a preemptive show of strength

The rare earth market—often dismissed by generalists—is now becoming a high-volatility geopolitical trade.

🇺🇸 U.S. Responds: Strategic Equity Stakes and Nationalization Light

The U.S. isn’t standing still. Just as it has done with semiconductors and stablecoins, the Trump administration is quietly building a national mineral stockpile—this time via equity stakes in key companies.

Confirmed or reported companies the U.S. government has taken a direct position in:

Ticker | Company | Mineral Focus | Gov’t Involvement | Rating (1–10) |

|---|---|---|---|---|

$USAR | USA Rare Earth Inc. | Rare Earths (REEs) | Confirmed gov’t contact, equity stake rumored | 9 |

$MP | MP Materials | REEs (Mountain Pass) | Public-private partnership via DoD | 8 |

$LAC | Lithium Americas | Lithium (Thacker Pass) | U.S. stake confirmed, key for EV supply chain | 8 |

$ALB | Albemarle Corp. | Lithium, bromine | Major domestic lithium supplier, supported by DOE grants | 7 |

📈 Market Implications

🟢 Why Rare Earths Matter More Now Than in 2010

REEs are essential for: EVs, wind turbines, defense systems, drones, satellites, and AI hardware

Unlike 2010’s hype cycle, this time the demand is real, accelerating, and national security-grade

The Trump admin is reframing REEs as critical infrastructure, akin to chips, nukes, and stablecoins

🔥 A U.S. Rare Earth Renaissance Is Brewing

A 25% federal procurement mandate for domestic rare earths is reportedly in discussion

DOE is funding U.S.-based REE separation and magnet manufacturing, long dominated by China

The Genius Act model is being quietly mirrored: public-private co-ownership of mineral and energy infrastructure

📊 Winner & Loser Watchlist

✅ Winners: U.S. Rare Earth & Lithium Stocks

Ticker | Company | Theme | Rating |

|---|---|---|---|

$USAR | USA Rare Earth | Leading U.S. REE developer | 9 |

$MP | MP Materials | Only scaled U.S. rare earth miner | 8 |

$LAC | Lithium Americas | Flagship lithium asset in NV | 8 |

$ALB | Albemarle | Global lithium leader | 7 |

$TM.V | Tartisan Nickel | Speculative North American REE exposure | 5 |

⚠️ Losers: Chinese or Ex-China REE Dependents

Ticker | Company | Why At Risk | Rating |

|---|---|---|---|

$TSLA | Tesla | Lithium/REE supply chain risk | 5 |

$AAPL | Apple | Uses Chinese REEs in devices, at risk from controls | 5 |

$NIO, $LI | Chinese EVs | At risk of U.S. retaliation or restrictions | 4 |

$CATL | EV battery giant | Could be hit by U.S. limits on battery imports | 4 |

🧠 Strategic Playbook

Long Rare Earth “Cold War” Winners:

$USAR and $MP for U.S.-based REE leverage

$LAC and $ALB as lithium national champions

Short Exposure Trades:

Tail-risk puts on $TSLA or $AAPL in event of supply disruption headlines

Consider $YINN puts as a China macro hedge

Macro Narrative Tie-In:

Position REEs as the next "strategic stockpile" the U.S. government is accumulating by stealth

Use REEs as a hedge against inflation, de-dollarization, or kinetic escalation with China

📈 Stock Corner

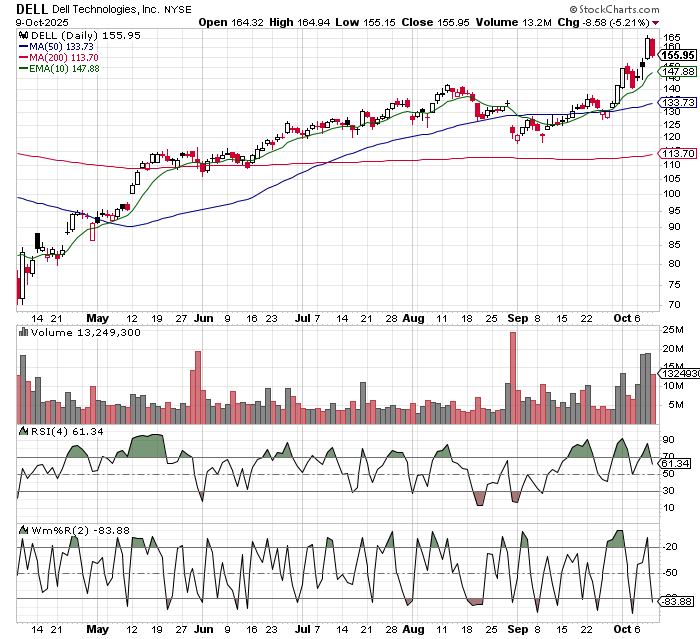

Today’s stock is Dell (DELL)….

Dell is no longer just a PC company—it's fast becoming an AI infrastructure powerhouse.

The company is projecting $20 billion in AI server sales this year, fueled by soaring demand from hyperscalers and enterprise clients (including a reported $5B order from Elon Musk’s xAI). Its Infrastructure Solutions Group just posted 44% YoY sales growth, with AI server demand driving 69% growth in servers and networking.

Despite this, the stock trades at just 14.5x forward earnings—a steep discount to the S&P 500's 22x, even as analysts expect 16–18% EPS growth next year.

With a growing services business, $8B in cash, and optionality for M&A, Dell is transforming into a high-growth name still priced like a legacy hardware stock.

Cheap, fast-growing, and misunderstood. We like that.

🤝 Before You Go Some Ways I Can Help

ETFs: The Antidote to Wall Street

Inside HEAT: Our Monthly Live Call on What Wall Street Doesn’t Want You To Know

Financial HEAT Podcast https://www.youtube.com/@TuttleCap Freedom from the Wall Street Hypocrisy

Tuttle Wealth Management: Your Wealth Unleashed

Advanced HEAT Insights: Matt’s Inner Circle, Your Financial Edge

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.