In Today’s Issue:

Retail Rally: How Everyday Traders Saved the Market from a Moody’s Meltdown

Deep dive on robotics, potential winners and losers

Is SAP a stock you should own?

Review of opportunities in AI infrastructure

Will Trump use LNG to reduce the trade gap?

and more……..

Next Webinar:

AI Unleashed: How to Harness AI to Crush Wall Street, Find the Top Investment Themes, and Obliterate Obsolete Investments

The AI Theme Engine Blueprint-How I train off the shelf AI models to scan thousands of data points to spotlight the hottest investment themes right now, and identify the stocks poised to soar before the “smart money” even notices.

How to Get Buy and Sell Signals from Trump’s Tweets-The exact signals you MUST watch when President Trump tweets, rallies his inner circle, or rolls out executive orders — and how to flip those cues into instant buy-and-sell alerts.

Inside the Inner Circle Playbook — Why investing in companies linked to Trump’s closest allies and favored asset classes can deliver asymmetric returns.

The Ultimate Hedge Strategy — How to combine options on VIX and SPY so you Sleep Better knowing your portfolio is bullet-proof against the next market shake-out.

Covered-Call ETFs Are a Con Game — The shocking data showing how poorly covered-call funds underperform and what could work better.

Why Index Funds Are Officially Obsolete — How AI’s precision targeting is rendering index fund strategies dead in the water

5/22 2pm EST

I will be speaking at the Money Show Virtual Expo

Wednesday, May 21, 2025, 1:40 pm - 2:10 pm EDT

Matthew Tuttle |Tuttle Capital Management

Join this session with Matthew Tuttle as he explains why most covered call strategies suck. Matthew will discuss put/write strategies and how they could generate more income with less risk. Additionally, he will go over how to structure 0DTE strategies on products that do not have 0DTE options.

Retail Rally: How Everyday Traders Saved the Market from a Moody’s Meltdown

In yesterday’s note I suggested that you are better off waiting for the institutions to do what they needed to do in the morning before making a judgement on the impact of the Moody’s downgrade. My sense was that it was probably not that big a deal, but in an overbought market not that big a deal can be a big deal. Once the “smart money” was done selling the retail traders bought the dip and the market closed green.

I have not talked about this in a while, but the market dynamics changed after Covid. I was a broker during the internet bubble. There are similarities between that and what is going on in AI and meme stocks now. The huge difference is that back then retail traders needed the brokers for information and execution. They also weren’t really connected together. Today, they can execute lightening fast with no commissions, they can use options to lever their bets, and they are connected through social media and discords. These connections allow them to act in mass, and allowed them to take down a hedge fund. There are retail traders way better than anyone I ever met on Wall Street, who generate returns better than the “smart money”. I keep four discords and X up during the day because I believe you ignore what retail is doing at your peril.

Not to say that buying the dip was the smart thing to do, time will tell, but all the “smart money” who got out at the lows yesterday look pretty stupid. Market’s are slightly red this morning though. In this note I am primarily focused on the shorter term. Charts can help a lot in figuring out where things are likely to go over the next few days, and as long as your are nimble that’s all you need. I tend to agree with what Mohit Kumar at Jefferies said last night……

In terms of market views, we still think that the path of least resistance would be higher for risky assets in the near term. That's not because we are constructive on the macro picture, but because we believe that investors are still underinvested and there's cash sitting on the sidelines. Investors will be forced to chase any move higher in risky assets

Longer term is impossible to predict, but there are some people I listen to, Jamie Dimon is obviously very plugged in, so when he talks you should listen……

“So America's asset prices—I still think they're kind of high—I put that in the risk category too. Credit spreads are kind of low—I would put that in the risk category too. I think both of those things may change, and that will change your psyche a little bit. Our P/E ratio is 21 or something like that today, forward-looking. Tariffs affect that—I think they might a little bit—the ‘E’ comes down. Right now, the forecast for earnings, we started the year, the S&P up 12%, now it is up 6% or 7%; my guess is in six months it will be 0. Because people will be working through, and you’ve heard from a lot of companies about guidance: ‘I can’t give it to you, I don't know the cost, I don't know if I can pass them on, I don't know what they're going to be.’ I think earnings estimates will come down, which also means probably the P/E will come down. If P/E comes down one turn, that means another 5%. Now you're talking about 10% between the earnings and the P/E. I think that's probably a likely outcome. It's my own personal opinion—I don't like to forecast the stock market.”

For now, as long as we are over the 200 day moving average I think you continue to buy dips. Most interesting name to me today is GLXY. It just started trading on the NASDAQ after being only listed in Canada so not much to evaluate on the US chart. The Canadian chart looks overbought…..

What I said before about retail investors could come into play here. If they jump into this it can go parabolic, overbought or not. I may take a small position just to be there and then wait for dips to get more.

As for Treasuries everyone seems to hate them and TLT almost undercut the Liberation Day lows….

Whenever everyone seems to hate something that causes me to like it more, small position and I’m hanging onto it for now.

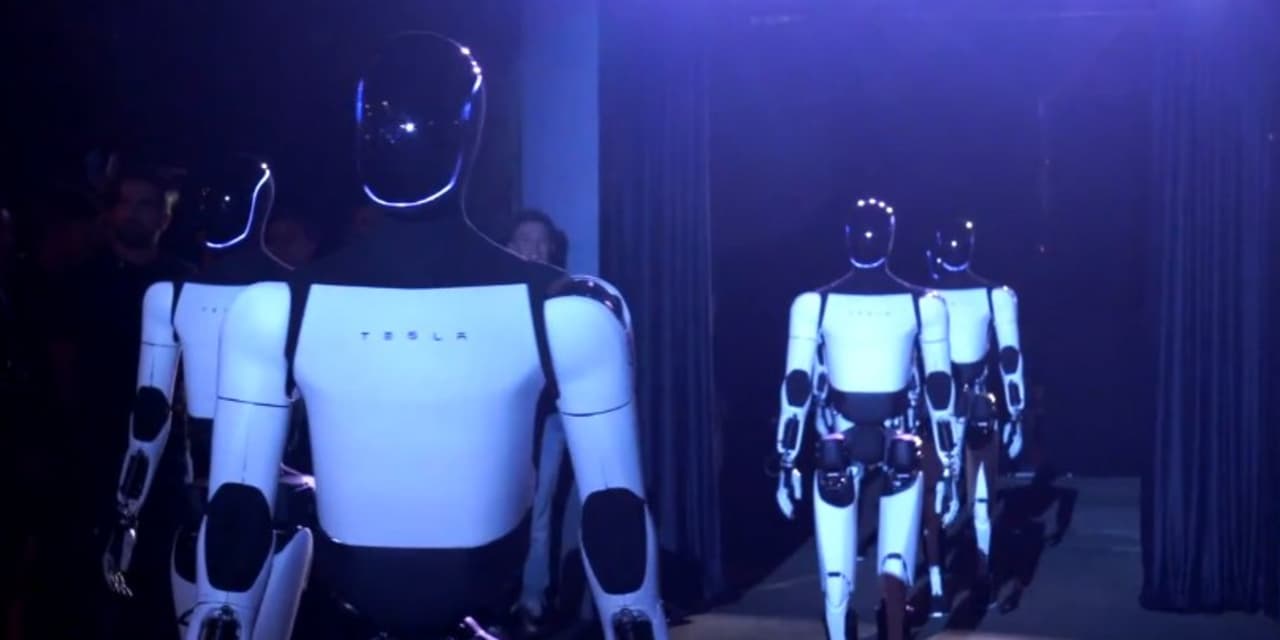

Huge believer that there will be massive opportunity in robotics (physical AI). I had GPT take a deep dive on this article and come up with some potential winners and losers….

1. Theme Takeaways

Physical AI Is Early-Majority: Traditional industrial robots have proven ROI; adding AI perception (LiDAR, vision, edge compute) unlocks new use-cases in warehousing, manufacturing, healthcare and logistics.

Cost Curve Favors Robots: Between 2008–2030, robot setup costs should fall ~58% while wages rise ~125%—supercharging capex returns.

S-Curve Dynamics: General-purpose humanoids (Tesla Optimus) are “innovators” play; focus now on “early majority” vendors delivering AI-augmented automation.

10-Year Horizon: Don’t chase a twelve-month pop—this is a decade-long revolution. Expect bouts of volatility as big tech, industrials and healthcare vie for prime movers.

2. Potential Winners

Company | Ticker | ’24–’26 Sales CAGR | 12-mo Upside | Rating | Rationale |

|---|---|---|---|---|---|

NVIDIA | NVDA | +0.42% | +19% | 10/10 | Ubiquitous GPU backbone—powering every AI-robotics deployment from edge inferencing to training. |

Symbotic | SYM | +2.71% | +13% | 9/10 | Warehouse automation leader (WMT deal); software+hardware moat as AI drives fulfillment surge. |

Intuitive Surgical | ISRG | +0.59% | +2% | 8/10 | Dominant surgical-robotics franchise; recurring instrument & service revenue with 2M annual cases. |

Ambarella | AMBA | +1.42% | +30% | 7/10 | Vision-SoC specialist—key sensor chips for AI robots, drones and autonomous machines. |

AI | +3.20% | +25% | 7/10 | Enterprise AI platform; early innings of push into robotics control, asset-management and vision. | |

Autodesk | ADSK | +0.78% | +8% | 6/10 | Design/PLM software for robotic engineering; levered to industrial and construction automation. |

Dynatrace | DT | +0.64% | +18% | 6/10 | Observability stack for AI-driven operations; critical for maintaining large robotic fleets. |

ServiceNow | NOW | +0.48% | +5% | 6/10 | Workflow automation platform; less direct but supports back-end orchestration of robotic processes. |

Samsara | IOT | +1.04% | +1% | 5/10 | IoT sensors and telematics for industrial automation; modest growth and little near-term upside. |

3. Potential Losers

Company | Ticker | ’24–’26 Sales CAGR | 12-mo Upside | Rating | Rationale |

|---|---|---|---|---|---|

Procept BioRobotics | PRCT | -0.07% | +43% | 4/10 | Vertical-market surgical robotics; no revenue momentum, early-stage. |

Estun Automation | 002747 | +0.39% | -17% | 3/10 | China-only robot arms; shrinking sales estimates and ADR risk. |

Shenzhen Inovance | 300124 | -0.51% | +11% | 4/10 | Chinese PLCs/drives maker; declining growth and geopolitical headwinds. |

Hon Hai | 2317 | -2.53% | +28% | 4/10 | Foxconn parent; broad electronics exposure dilutes pure-play robotics value. |

Delta Electronics | 2308 | -2.16% | +20% | 4/10 | Power electronics for automation; shrinking sales and Taiwan-listing risk. |

4. My Take

Yes, physical AI is the next megatrend—but stick to pure or core-adjacent plays with proven scale, recurring revenue and long-term contracts (NVDA, SYM, ISRG, AMBA).

Avoid frontier “innovators” and small cap ADRs with spotty growth (PRCT, Estun, Hon Hai)—they carry execution, regulatory and valuation risk.

20–30% upside is reasonable in top winners over the next 12 months; the real gains materialize over multiple quarters of AI-robotics adoption.

Bottom line: Build your robotics sleeve around AI chip leaders, warehouse automation specialists, and mission-critical robotics OEMs—and be prepared to ride this theme for the next 5–10 years.

SAP is a stock I sold out of when it broke the 50 day in March. IMHO it is one of the key AI names going forward and a name I would have loved to get back into. A pullback into the 10 or 20 day could be a buying opportunity….

I had GPT take a deep dive on the stock and answer the question of whether I should look to get back in….

1. What SAP Does & Why It Matters

Business Software Leader: SAP is Europe’s largest company and a global #1 in enterprise resource planning (ERP), managing billing, HR, supply chains and procurement for 440,000+ customers Barron's.

Cloud & AI Pivot: Q1 ’25 cloud revenue €5 billion (+27% YoY) and a €18.2 billion cloud backlog (+28% YoY) underscore SAP’s shift to high-margin, subscription services—driven by its RISE bundle, Business Data Cloud (with Databricks) and >200 embedded AI use cases ASUGSAP News Center.

Tariff-Resilient Model: Unlike hardware makers (AAPL, TSLA), SAP sells pure software—immune to Trump’s goods tariffs—and its tools help clients manage trade-policy complexity, sustaining demand amid geopolitical uncertainty Barron'sFinancial Times.

2. Recent Financials & Growth Trajectory

Metric | Q1 ’25 Actual | YoY Growth | Consensus vs. Est. |

|---|---|---|---|

Total Revenue | €9.0 billion (–0.7% vs. est.) | +12% YoY (11% cc) | €9.06 bn est. ASUG |

Cloud Revenue | €5.0 billion | +27% YoY (26% cc) | €5.04 bn est. ASUG |

Operating Profit (adj.) | €2.45 billion | +60% YoY | €2.24 bn est. ASUG |

Non-IFRS EPS | €1.44 | +78% YoY | €1.30 est. The Futurum Group |

Cloud Backlog | €18.2 billion | +29% YoY | — |

Margin Leverage: Non-IFRS operating margin jumped to 27.2% (up 810 bps) on scalable cloud/AI mix The Futurum Group.

Free Cash Flow: €3.6 billion (+36% YoY), funding both job-restructuring (€3 bn) and continued R&D.

3. Valuation & Analyst Sentiment

4. Upside Catalysts & Risks

Catalysts | Risks |

|---|---|

• Continued Cloud & AI adoption | • High valuation leaves little margin for error |

• Cross-sell of AI use cases across suites | • Macro downturn or renewed trade tariffs |

• Expansion in sovereign-cloud pockets | • Intense competition vs. Oracle/Microsoft |

• Acceleration of net-new customers (2/3 cloud wins from new logos) | • Execution on €3 bn restructuring costs |

5. Technical Snapshot (ADR Chart as of May 16)

Current Price: $296.41

Key Moving Averages:

10-day EMA: $293.30

20-day EMA: $285.53

50-day SMA: $270.87

200-day SMA: $247.77

Momentum Indicators:

RSI(14): ~74 (overbought territory)

Williams %R: ~-15 (also signaling short-term overextension)

Insight: SAP ADR is trading well above its 20-day and 50-day averages, confirming a strong uptrend—but the RSI near 75 warns of a near-term pullback risk.

6. Buyback Recommendation

Rating: 7 / 10

Action: Buy on Dips

Ideal Entry Zone: $285–$290 (around the 20-day EMA)

Stop-Loss: Below $270 (the 50-day SMA) to contain risk if the uptrend falters.

Target: Re-test May highs near $300–$305, with further upside if SAP confirms new cloud/AI catalysts at the Orlando event.

Bottom Line:

SAP ADR’s USD-denominated cloud & AI transition remains intact. The ADR’s chart shows sustained momentum, but with overbought signals in place, Steve should look to re-enter on a pullback into the $285–$290 zone—where support converges—and then ride the next leg of the cloud/AI-driven uptrend.

1Q25 Data Center Leasing & Earnings Season Tidbits Across the Market

Jefferies put out this piece on Sunday night….

North American leasing volume of 1.6 GW was among the best quarters in history; although ~1 GW of this leasing was in tertiary markets. Hyperscalers are dealing with a lack of availability in top markets and are re-evaluating data center designs to account for the latest NVIDIA chips. However, demand continues to surpass supply, and we expect hyperscalers will need to lease more data center space to meet their capacity needs.

I had GPT create a list of winners and losers……

Winners

Ticker | Company | R/R Rating | Thesis |

|---|---|---|---|

NVDA | NVIDIA | 10/10 | $11 B Blackwell quarter—100k‐GPU clusters live. AI’s prime mover; capacity constraint drives pricing power. |

DLR | Digital Realty | 9/10 | 3rd-highest leasing ever with all-time high rents; proving ground for AI power leases across hyperscalers. |

EQIX | Equinix | 9/10 | ~50% of top-25 deals AI-driven; global interconnect leader capturing hyperscale, edge and colocation demand. |

CRWV | CoreWeave | 8/10 | $4 B OpenAI expansion plus multi-GW pipeline; pure-play GPU-as-a-Service at peak RPO. |

GOOGL | Alphabet | 8/10 | Gemini 2.5 launch + non-commenced leases tripled to $17.3 B; back-loaded capacity build — durable tailwind. |

META | Meta Platforms | 8/10 | +$5.5 B capex bump, accelerating site builds; now fighting to keep up with Reality Labs & AI demand. |

AMD | Advanced Micro Devices | 8/10 | 30 new hyperscaler instance wins; Zen & Instinct roadmaps locked into AWS/Oracle/BABA expansions. |

MSFT | Microsoft | 7/10 | Demand still outstripping capacity; supply gap now pushes beyond June FY—raises visibility on Azure AI. |

VRT | Vertiv | 7/10 | Americas orders +30% TTM; critical power & cooling backbone for every new data-hall and AI cluster. |

ETN | Eaton | 7/10 | Transformer lead times now 1–2 years, data-center backlog 7→9 years; the grid-in-a-box supplier. |

AMZN | Amazon (AWS) | 7/10 | “Capacity consumed as fast as added”—AWS re-accelerates build-out after a brief pause in 2024. |

CEG | Constellation Energy | 6/10 | Nuclear-to-data-center pilot deal shows creative power-sourcing edge; optional upside if scaled. |

Losers

Ticker | Company | R/R Rating | Thesis |

|---|---|---|---|

CONE | CyrusOne | 4/10 | Over-reliant on top-market shovel-ready capacity; leasing stalled in Q1 as hyperscalers pivot. |

QTS | QTS Realty Trust | 4/10 | Similar top-market exposure with limited tertiary fallback; long time-to-power drags growth. |

Bottom Line:

AI Power Leaders (NVDA, DLR, EQIX, CRWV) are firing on all cylinders—scale your overweight there.

Hyperscaler In-House Builds (GOOGL, META, AMZN, MSFT) remain capacity-constrained, underpinning outsized infra spend.

Infrastructure Backbone (AMD, ETN, VRT, CEG) get a durable multi-year runway as the compute boom collides with grid limitations.

Pure-Play Top-Market REITs (CONE, QTS) should be underweighted until shovel-ready supply normalizes or they pivot more to tertiary/edge leases.

Alpha Hard To Generate; Refining Leads; LNG to Close Trade Gap

Jefferies also wrote a piece on another one of my favorite areas, LNG…..

Capturing energy alpha in '25 has been especially tricky, with the "momentum / short" index reversing (Ex 1), coupled with the complexities of the macro. What's evident is more oil coming and recession risk declining. Within energy, refining was best performing sub-group for 4th straight week, with LNG lagging (more micro than macro). In fact, within we cover: (1) LNG updates & trade gaps, and (2) read throughs of Canada 'becoming an energy superpower'.

US LNG to Reduce Trade Deficits? We reiterate our view that the Trump administration will use US LNG as a lever to reduce trade deficits (LINK), particularly with Asian nations, and mgmt commentary from Cheniere, Venture Global, Woodside Energy, and Energy Transfer at 1Q25 results confirmed they expect this to materialize. While LNG can help improve the imbalance, we note that the US trade deficit with Asian nations is unlikely to be materially improved by incremental investments / offtake from Asian buyers.

I had GPT analyze the note and create list of potential winners and losers…..

Jefferies’ Core Thesis

Policy Tailwind: The Trump administration will lean on U.S. LNG to chip away at the bilateral trade gap—especially with Asia—though the volumes needed to fully “balance” trade are infeasible.

Demand vs. Supply: Asian importers (Japan, Korea) are flat‐to‐down in LNG needs; China is sidelined until geopolitics thaw; true incremental growth will come from South Asia—but that’s a modest incremental market.

Alpha Trap: LNG has lagged 2025’s energy rally despite tightness; the “trade‐deficit” narrative is more micro than macro, so only the best‐positioned exporters will outperform.

Winners

Ticker | Company | Rating | Why |

|---|---|---|---|

LNG | Cheniere Energy | 8/10 | #1 U.S. exporter, long‐dated offtake contracts (>20 years), Sabine & Corpus optional expansions, strong cash flow. |

SRE | Sempra Energy | 7/10 | Integrated utility with Cameron & Port Arthur LNG; investment‐grade credit; balanced U.S.‐Asia portfolio. |

ET | Energy Transfer | 7/10 | Lake Charles stake via Energy Transfer NE; diversified midstream cash flows underpinning export growth. |

KMI | Kinder Morgan | 6/10 | Emerging Gulf Coast export pipeline player (Elba Island); credit‐rich balance sheet; asset optionality. |

Losers

Ticker | Company | Rating | Why |

|---|---|---|---|

TELL | Tellurian | 3/10 | No FID on Driftwood; pre‐revenue developer with execution and financing risk. |

FLOC CN | Flex LNG (TSX) | 4/10 | Pure‐play spot shipping; charter rates under pressure; limited take‐or‐pay cover. |

WDS AU | Woodside Energy (ASX) | 5/10 | Large LNG seller but lacks U.S. cost structure edge; geopolitics cap china upside. |

My Take

Opportunities:

Tier‐1 Exporters (LNG, SRE, ET) with secured, fee‐based contracts and flexibility to add trains stand to outpace the broader energy complex.

Pipeline‐to‐Export Plays (KMI) can capture incremental egress volumes at attractive returns.

Risks:

Macro Overhang: If Asian demand disappoints and European supply diversifies (more LNG/renewables), spot spreads could compress.

Policy vs. Fundamentals: The “trade‐deficit” storyline is largely political; don’t mistake it for a volume breakout beyond contracted growth.

Bottom Line: Stick with the fee‐based, contract‐heavy names (Cheniere, Sempra, ET) for predictable FCF and low execution risk. Avoid the pre‐FIDs and spot‐exposed shippers chasing headline alpha—their returns hinge on macro whims, not locked‐in cash flows.

Before you go: Here are ways I can help

ETFs: We offer innovative ETFs that cover all aspects of The H.E.A.T. Formula, Hedges, Edges, and Themes.

Consulting: I'm happy to jump on the phone with financial advisors at no charge. I've built a wealth management firm and helped other advisors grow their practices through the use of substantially differentiated investment strategies. If you want to talk just send me an email at [email protected]

Monthly investing webinars

Rebel Finance Podcast https://www.youtube.com/@TuttleCap

Wealth Management-Coming Soon

Paid Newsletter Service-Coming Soon

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.