I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) December 9 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

Software Is Dead, Long Live Software: Where the Real AI Asymmetry Might Be Hiding

For two years the AI trade has been all GPUs, data centers, and power — semis and infra sucking up every dollar while software quietly eats dirt. The scoreboard shows it: the S&P is up ~16.5% this year, the main software ETF (IGV) is up ~4%. That’s huge underperformance for a sector that should be a prime beneficiary of AI. Why the faceplant? Three things: rates, narratives, and disappointment. Higher real yields crushed long-duration “50x sales” stories; investors decided the cleanest AI monetization was in chips/power, not apps; and a lot of SaaS names simply slowed post‑Covid while still trading at bubble multiples. Layer on the fear that “LLMs will let every enterprise rebuild SaaS in-house” and you get multiple compression plus apathy.

The interesting part is where we are now. A bunch of high-quality software names have been derated to the point where they no longer need fantasy growth to work. Zoom trades around 9x 2027 free cash flow, Twilio at ~18x. Cybersecurity leaders like Zscaler and Palo Alto have seen their multiples cut, while Rubrik and Okta sit at single-digit EV/sales on 2027 numbers. Across the sector, Baird’s analysts basically say: the reset we’re seeing is what usually happens before multi‑quarter outperformance. The twist is that this isn’t a “buy every SaaS ticker and forget it” moment. The AI world is going to be more brutal on undifferentiated software than the pre‑AI world. You want names that sit on revolutionary themes with asymmetric payoffs — not generic tools that can get rebuilt by a smart engineer with an API key.

Think in themes, then pick your shots. In AI‑native security and identity, the trend is almost embarrassingly obvious: more cloud, more AI, more attack surface. Zscaler and Palo Alto are the large‑cap must‑owns here — real platforms, real cash flow, and direct leverage to AI‑driven security spend. Rubrik and Okta are the more asymmetric plays: Rubrik as a data‑security/cloud backup winner at ~6–7x forward sales, Okta as a bruised identity leader that the market hates at ~3–4x. If AI actually makes security harder (it will), these are the tollbooths. The losers are the tiny point‑solution vendors that do one narrow thing and can be automated away or rolled into platform bundles; they may bounce tactically, but structurally they’re features, not businesses.

In AI as the workflow operating system, you’re looking for companies that own how work happens and can keep layering automation on top. ServiceNow, Atlassian, Monday, Tyler, and Axon all sit in this camp in different ways. ServiceNow is the purest “must own” — entrenched in big‑company workflows with a clear path to infusing AI into every ticket, request, and process. Atlassian and Monday are the more volatile, higher‑beta ways to bet on AI‑driven collaboration and dev productivity. Tyler is a stealth compounder in public‑sector software; once you run a city/court on Tyler, ripping it out is a career‑risk decision, and AI simply makes that moat deeper. Axon looks expensive on simple P/E, but 30%+ growth and mid‑20s margins tied to AI video, evidence management, and public safety is exactly the kind of “revolutionary but under‑owned” theme I want in size. The laggards in this bucket will be the generic “project management” or task tools with no data moat and no real domain depth.

Then there’s vertical SaaS riding AI data moats: Autodesk, Veeva, Procore, Q2, Klaviyo. These all live where workflows, compliance, and data are gnarly enough that “just throw an LLM at it” is a fantasy. Autodesk owns design data in manufacturing/construction, Veeva owns structured workflows in life sciences, Procore owns construction project data, Q2 sits at the core of small‑bank digital, Klaviyo ties merchant data to marketing. AI is accelerant here, not a threat — it makes these platforms more indispensable and gives them upsell pricing power. Valuations aren’t dirt cheap across the board, but after the sector’s derating you’re paying “good business” prices for what could become AI‑supercharged category killers. The obvious losers from AI live outside this group: horizontal SaaS with no real data advantage and a thousand clones. Those can stay cheap for a long time.

Finally, communications and engagement — Zoom and Twilio — are where the asymmetry is sharpest. The market has decided these are ex‑growth relics of the Covid era. If they stagnate, those 9–18x FCF multiples will look fair or even rich. But if Zoom can turn AI into a true collaboration layer (summarization, agents, workflow) and Twilio can prove durable demand for intelligent customer engagement, the re‑rating can be violent. These are not “safe core” positions; they’re sized‑small, watch‑closely shots on goal in themes (real‑time comms + AI) that are not going away.

Software has lagged because the market stopped believing the old story (infinite growth, infinite multiples) at the exact moment AI made the story more complex. That’s created exactly the environment you want if your edge is picking themes and asymmetry instead of chasing whatever went up yesterday. I wouldn’t buy “software” as a blob and hope mean reversion bails you out. I would: make ServiceNow / Palo Alto / Zscaler / Tyler / Autodesk / Veeva the core “revolutionary but durable” holdings, then sprinkle in a few asymmetric‑heavy bets like Rubrik, Okta, Klaviyo, Procore, Zoom, and Twilio — sized so that if AI supercharges their categories you feel it, and if they stay stuck in the bargain bin, they don’t blow up your P&L. Software isn’t dead; the lazy part of the software trade is.

News vs. Noise: What’s Moving Markets Today

When Silver Goes Parabolic and the Long End Calls BS

If you’re looking for a clean example of “this can’t last,” precious metals are it. Gold is up ~60% YTD and silver is up ~100% – both absolutely monster years. For context, gold’s best year since 1980 before this was +31% in 2007. Now silver has gone full-face-melter: three straight days of +2.5% gains, something that’s only happened five other times in SLV’s history – and four of those were at or right before major tops. It’s also trading ~50% above its 200‑day moving average, levels that have historically led to pauses or sharp shakeouts, not fresh bases. The real tell is the cross‑asset divergence: since late October, 30‑year real yields have moved higher and bitcoin has taken a beating, yet gold and especially silver have ripped anyway. Those three usually rhyme; right now metals are singing a very different song. That’s classic late‑stage behavior in a move – the “everyone in the pool” vertical that ignores macro and positioning until gravity reasserts itself.

At the same time, bitcoin is doing its best to give everyone whiplash. Monday’s flush looked ugly, but BTC snapping back over 90k puts the 100k target back in play for bulls as long as Monday’s low around 83,800 holds as a hard stop. That’s your line in the sand: above it, you can argue this was a nasty but “normal” shakeout in an ongoing uptrend; lose it with volume, and you’re talking about a much deeper de‑risking across crypto and the high‑beta complex. Overlay that with the rate backdrop: the market is ~90%+ priced for a December Fed cut, but 10‑year yields have actually moved higher immediately after the last five cuts. The global long end – Japan, Germany, France – is quietly breaking out while everyone stares at Powell. Translation: the Fed can nudge the front end, but it does not control the long end, especially when cuts are being front‑run and inflation progress is marginal. Betting the farm on “Fed cuts = lower yields = everything moon” is exactly the kind of lazy macro that gets punished late in the cycle.

How I’d translate this into action:

Don’t chase parabolic silver. If you’ve been long metals, think trim/hedge, not add – take some off, or roll a chunk of linear exposure into call spreads so you keep upside but protect against a “catch‑down” to bonds and BTC.

Treat gold as a core, silver as a trade. Gold can justify a strategic allocation; silver at +100% YTD and 50% above its 200‑day is a tactical position that needs position sizing, stops, and a plan.

For bitcoin, respect 83,800. If you’re bullish, size so that a stop below that level doesn’t blow you up. Use call spreads instead of naked leverage if you’re trying to play for 100k+.

Don’t assume a Fed cut = collapsing long yields. If you want to express a view, steepeners (2s/10s) and selective risk-on in quality names make more sense than blindly loading duration just because the calendar says “FOMC.”

A Stock I’m Watching

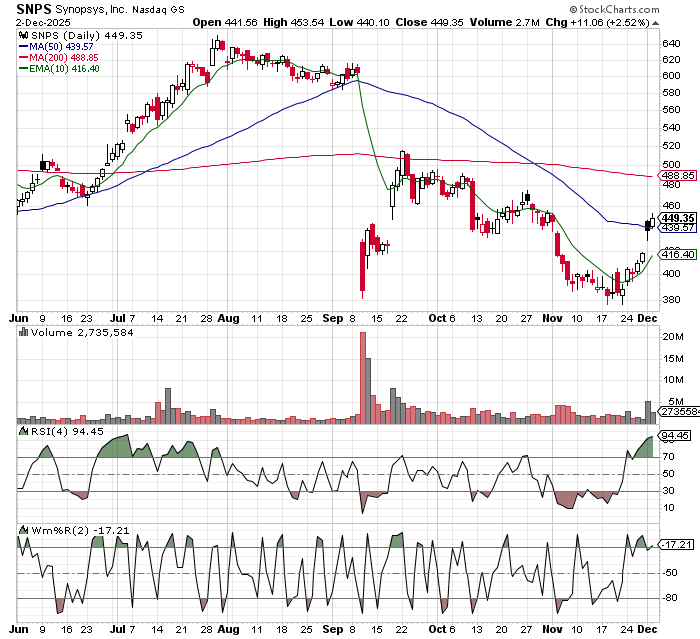

Today stock is Synopsys (SNPS)….

Synopsys (SNPS) is the quiet toll‑booth on the entire AI hardware arms race – nothing gets built without going through their software first. Every GPU, TPU, custom accelerator, HBM controller, and next‑gen “physical AI” chip for autos, industrials, and defense has to be designed and verified on EDA tools, and Synopsys sits at the top of that stack. As AI models get bigger and move off the web and into cars, factories, robots, and edge devices, design complexity explodes, but SNPS doesn’t need to guess which chip wins – it clips a fee on all of them. Add in a deep strategic alignment with the leading AI chipmakers and you’ve got exactly the kind of picks‑and‑shovels name I want on my radar: levered to multi‑year AI capex and silicon complexity, not to any single product cycle

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Tuesday December 9, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.