I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Our next webinar is scheduled Friday, February 20 2pm EST more info below. Disclosure Day: A Playbook For Investors If the Government Confirms It Has Alien Technology. Click HERE to sign up.

Table of Contents

H.E.A.T.

This has been a tough couple of days in markets. The major indices aren’t down that much, but beneath the surface you have carnage in all the most popular areas—-crypto, precious metals, and anything tech related. I’ve been trading since 1981, and unfortunately times like this happen, a lot. Markets always come back, but the question is how long will it take and how much pain will you go through? 2008 took a while, Covid not so much. Markets are higher this morning, and corrections usually end in a flush, which is what yesterday felt like, so we will see.

If you are down more than your comfort level then something is wrong with your strategy. Today we will go through the H.E.A.T. Formula a bit, specifically how you manage it to fit your situation.

The first aspect is Hedges. Could you have seen this coming? Maybe, but you are still better off always having hedges. People always ask me how much they should be hedged. Going back to my above statement, if you are uncomfortable with your losses then you aren’t hedged enough. Remember, gold is not a hedge, neither are bonds. If you had long term treasuries they did help yesterday, but they don’t help all the time. I run my OHNO strategy (coming soon) and some zero DTE hedge strategies every day. I’ve talked about some of what I do, other things I have some NDAs from the people who taught me about them, so I don’t talk about those. There are multiple ways to add hedges where you have your hedge fully, or partially paid for and you don’t crush yourself if markets rip. The size of your hedges can vary based on the environment, I am pretty much double my current size right now.

Next is Edges. There are a number of Edges in the marketplace that retail investors can take advantage of. Options can provide edges as well, for example ratio backspreads (sell an ATM call and buy 2 OTM calls) allow you to break even if you are wrong, have unlimited upside, and only lose if there is a small up move in the underlying. These types of trades need a large move to payoff, which makes them a potential fit for an asset that just got crushed.

Next is Asymmetry. This is about structuring your trades and your portfolio so that you make a lot if you are right and lose a little if you are wrong. I’ve been reading X about the covered call/option income ETFs, which I’ve obviously had a lot to say about. Traditional covered call strategies are not an asymmetric trade, you give up a lot of potential upside and still have unlimited downside.

Finally we have Themes. This is your return lever, but it’s also where the risk in your portfolio lies. Most of my favorite themes have gotten crushed over the past few days. This brings me to position size. I see a lot of people on X talk about their 100%+ returns. It’s enticing, but to achieve that you need to be massively positioned in the top themes. You can certainly do this, if you can stomach the risks. Typically, we recommend our clients have no more than 20-30% of a portfolio positioned in the top themes. Losses suck, but add some smart hedges to this and you have drawdowns that you can retrace pretty quickly.

News vs. Noise: What’s Moving Markets Today

In times like these we wonder whether we are seeing a simple correction (where my thinking is currently) or a bear market. A bear market doesn’t happen because some asset class goes down a lot, or something that had a parabolic up move retraces a bunch. It happens because weakness in one area creates a domino effect and something breaks. A correction is painful, but it typically doesn’t last that long and isn’t that deep. A bear market, where something in the system breaks, is different.

Noise: The market is oscillating between two lazy extremes: (1) “software is getting smoked, but it’s contained — credit is fine, so ignore it,” and (2) “this is the start of a systemic event — AI is ‘breaking’ SaaS, private credit blows up, CLOs seize, and everything cascades.” Both miss the point. Contagion rarely arrives with a press release. It starts as a contained equity selloff… then shows up where nobody is watching (refinancing markets, ETF flows, and leverage vehicles) and only then becomes “obvious” in headlines. The same positioning-driven tape in precious metals and crypto is feeding that confusion: investors see correlated selling and assume fundamentals have converged — when it’s often just crowded trades unwinding in the same direction.

News & takeaways: The actual news is that the software rout is no longer “just an equity story” — it’s bleeding into the debt market, and that’s where contagion risk lives. Software is now roughly 13% of the Morningstar LSTA U.S. Leveraged Loan Index (bigger than any other sector), and it’s an even bigger share in private credit (estimates run roughly ~20% to ~⅓). Loan prices for a number of software issuers have fallen sharply; the average software-loan price in the LSTA index dropped to about 90.51 cents from 94.71 at year-end. That matters because loans coming due in a few years don’t get repaid out of a checking account — they get refinanced, and lenders need confidence today that the business model still exists in 2028–2030. The transmission mechanisms are clear: wider bid/ask + lower prices can spook loan ETFs (outflows → forced selling), chill CLO demand (less bid for new paper), and pressure semi-liquid private credit vehicles if investors start demanding liquidity at the wrong time. The tell going forward isn’t whether software stocks bounce tomorrow — it’s whether credit stays orderly (spreads, downgrades, loan-fund flows) while the equity narrative remains toxic. If credit cracks, the “contained” story stops being true.

A Stock I’m Watching

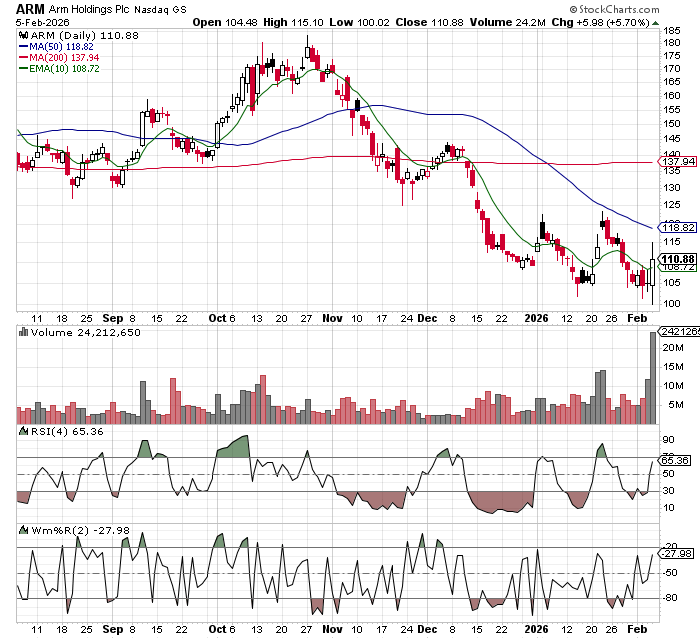

Today’s stock is ARM….

In times like these I will look more at the charts. I would prefer to buy stocks that have already corrected and look to be bottoming than stocks that are in a free fall still.

ARM is the closest thing in semis to a “compute tollbooth” — it doesn’t have to win any single chip socket to benefit as AI pushes more CPU + inference capability into everything (phones, PCs, edge devices, and increasingly the data center) because it monetizes via licensing + royalties across an enormous ecosystem. The bull case is straightforward: if AI drives higher compute content per device, and ARM continues to migrate customers toward higher-value IP (newer architectures / subsystems / platform-level design wins), you can get a multi-year royalty-rate + volume tailwind without needing a single OEM to dominate. The setup risk is that ARM can get overextended whenever the market trades it like a “pure AI proxy” — multiples can expand faster than royalties can compound, and then any whiff of “growth decel” (handset pauses, a pushout in PC refresh, or slower-than-hoped server royalty ramps) can trigger a fast, violent de-rating. The other risk bucket is strategic: large customers are constantly incentivized to pressure economics, internalize more IP, or experiment with alternatives (RISC‑V in certain categories), so ARM has to keep proving it’s adding enough performance / power / time-to-market value to defend pricing. Bottom line: I like ARM as a watch-list compounder tied to “AI everywhere,” but I’d treat it as a timing + position-sizing name — better bought on cyclical/handset-driven sentiment air pockets, and trimmed when it’s priced as if every end-market (phones + PCs + servers) will all hit at once.

Our next webinar…..

Fri, Feb 20, 2PM EST

Disclosure Day: A Playbook For Investors If The Government Confirms It Has Alien Technology

How to position your portfolio before Washington admits it has non‑human technology, and where the first trillion dollars of “alien alpha” could flow.

Click HERE to sign up

You’re not crazy if you believe in UFOs or UAP (unidentified anomalous phenomena).

In fact, you want to be ready for the day when we’re told, for real, that we’re not alone.

You won’t read about it in the Wall Street Journal or hear about it on CNBC — yet.

But “Disclosure Day” is coming.

And the reality of UAP could trigger a shift in global markets that — no hyperbole — makes the Internet boom and the AI explosion seem tiny.

Matt Tuttle, CEO of Tuttle Capital Management ($4 billion AUM), is an ETF rebel who’s spent decades trading big, unexpected market moves.

He created his H.E.A.T. investing framework—Hedges, Edges, Asymmetry, Themes—to turn left-field events into high-conviction opportunities.

Now, he's deploying that exact playbook on the one catalyst almost no one's positioned for...

In a free live “Disclosure Day” briefing, Matt will explain:

✅ Why this isn’t about tinfoil hats. A move from rumor to reality could shift seismic capital across defense, energy, materials, and data – with clear winners and losers.

✅ The “Disclosure Debris:” How small hints can move big money before any big speech from Washington. And why hearings, leaks, and half‑answers already matter more than one big moment if you want a shot at alien alpha.

✅ Early matters – even if you might feel a bit crazy: A simple way to look at UFO news that lets you stay sane, stay skeptical, and still be in position if this really is the next trillion‑dollar theme.

✅ Who could win, who could lose, and when it’s too late: Which sectors of defense, energy, and materials might see money rush in first, and how to think about bet size before everyone on TV is yelling about UFO trades.

✅ The one belief shift that could change how you see every headline about UFOs and tech: The real question isn’t “is this true?” but “what if enough other investors decide it is?”

✅ A 30‑day playbook for the month after confirmation: A practical way to think about reallocating, hedging, and positioning if Washington ever admits more than it already has – without abandoning your own risk limits.

PLUS . . . you’ll get a free copy of Matt’s Why The UAP Thematic Frontier May Be Closer – And Far Larger – Than You Might Think briefing.

In Case You Missed It

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.