Wall Street’s 60/40 formula was born in 1952 — the same year as the first credit card. A lot has changed since.

That’s why we created a new approach — The H.E.A.T. Formula — to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

Table of Contents

I am going to be in Korea this week, still plan on sending the newsletter out but not exactly sure on timing every day, may also be on a plane all of Tuesday and not able to get to it.

🔥 Here’s What’s Happening Now

I talked to Schwab Network on Friday about my thoughts on AI, ORCL, and NVDA…..

Speaking of NVDA, keep an eye on this today…..

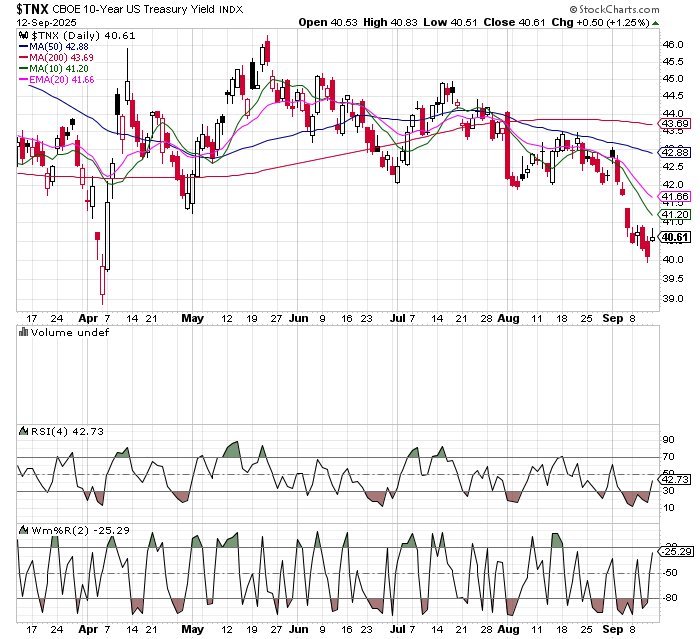

We have FOMC this week and unless Powell surprises with what he does, or what he says, we don’t have a lot going on until next earnings. Given the backdrop I think you have to be long stocks (with hedges of course). I think it’s unlikely the Fed signals a multi cut path and that could be a disappointment. Where I think you need to be cautious is bonds…..

I missed this latest move in rates, but it seems like the bond market is priced for peak dovishness, which I don’t think Powell is going to give us.

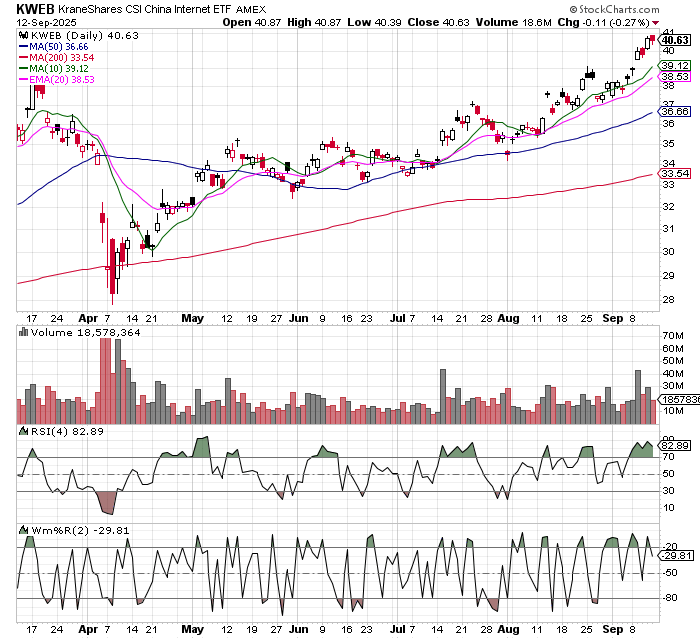

Meanwhile, Chinese stocks keep going up…..

I’ve been talking about BABA and China for a few weeks here. Normally, I much prefer Chinese stocks when nobody wants them, but can’t ignore the strength.

I disagree…

What you want is to pick out unusual trades, for example a senator who just buys Mag 7 types of stocks all of the sudden buys some unknown biotech. Or, you want to mimic the trades of a senator who serves on a committee and trades the stocks he/she oversees. GRFT comes out in October.

🤖 Tesla’s Pivot to Robots: Genius rerate—or cover for a stretched multiple?

TSLA may be the most hated stock by retail investors. The question is what are they? Are they an EV company or a company on the forefront of all that’s going on with AI?

I’ve told this story before, I was a broker in the late 90s during the internet boom. I vividly remember talking to a colleague about how I couldn’t understand how AMZN had a market cap more than Borders and Barnes and Noble combined. At that point AMZN was an unprofitable online book seller, while Borders and Barnes and Noble we big and profitable. What I didn’t see was that AMZN was much more than an online bookseller.

Not saying TSLA is AMZN when it comes to AI, just saying it’s possible. Elon has to execute though.

The setup

Tesla’s core EV business has slowed (pricing pressure, tariffs, tougher comps), while the stock still embeds a growth/multiple that assumes a new, massive profit engine.

Elon now says “80% of Tesla’s value will be Optimus.” The market is being asked to underwrite a humanoid robotics S-curve (and robotaxis) while near-term EPS trends are soft.

My view: Unless Tesla becomes a sustained leader in useful, unit-shipped, cash-flowing robots, today’s valuation looks rich. The bar is extraordinarily high: leadership in hardware + actuation + edge AI + data + safety + manufacturing scale—and real customers using robots beyond demos.

What would “leadership” actually require (scorecard for 2025–2028)

Product-market fit: A repeatable “job to be done” (logistics, factory handling, inspection, eldercare assist) with daily utilization and payback <3–4 years.

Unit economics: BOM cost curve falling fast (actuators, batteries, reduction gears, sensors) and field-serviceable designs.

Software edge: On-device perception + manipulation + task planning; continual learning from fleet data; low failure rate in unstructured environments.

Regulatory/safety: Clear playbooks for workplace deployment (OSHA/CE) and incident reporting.

Scale: A credible path to tens of thousands of deployed units—not a few dozen pilots.

Tesla could score well on #3–5 given its data/compute culture and manufacturing muscle. But until we see #1–2 (economic proof outside of demos), the market is paying for a story, not cash flows.

Where this goes next for the stock

Bull path: Optimus shows real factory productivity inside Tesla (dog-food first), then paid pilots with external customers, with BOM falling below ~$15–20k and ASP/support >$25–35k/year equivalent. That would justify the “AI + robotics” premium and keep the multiple aloft.

Base path: EV cyclicality persists; robotaxis stay in prolonged pilot; Optimus demos continue but revenue remains de minimis. Multiple compresses toward megacap quality tech, not pure “sci-fi”.

Bear path: Safety/regulatory or technical setbacks; service costs and field reliability disappoint; margins pressured by EV price wars. Multiple resets sharply.

Positioning: If you own it for “Elon optionality,” you need evidence of external, paying robotics customers in 12–24 months. Otherwise, favor second-order robotics winners that monetize regardless of who ships the first humanoid.

Robotics landscape: winners, losers, second-order plays

🏆 Likely winners (12–36 months; rating 1–10)

NVIDIA (NVDA) — 9/10

The control stack for modern robotics is AI-first (perception, planning, simulation). NVDA’s Jetson/IGX, Isaac Sim/ROS connectors and Omniverse-based digital twins are the default toolchain.

ABB (ABBNY) — 8.5/10

Industrial robotics leader: arms, cells, AMRs, and a massive installed base across automotive, electronics, logistics. Monetizes from real deployments now, not hype.

Rockwell Automation (ROK) — 8/10

Factory automation + controls + software (Plex/FT Optix). Beneficiary of the “robotic factory” push irrespective of who ships humanoids.

Siemens (SIEGY) — 8/10

Digital twins (NX/Teamcenter), PLCs, motion control. Key to simulation-first deployment and scalable commissioning.

Keyence (KYCCF/KYCCY) — 8/10

High-margin sensors/vision/LiDAR—every robot needs reliable sensing; Keyence is the picks-and-shovels cash machine.

Intuitive Surgical (ISRG) — 8/10

Healthcare robotics already at scale (da Vinci) with defensible moats; the “AI in healthcare” angle adds future software upsell.

Symbotic (SYM) / Ocado Group (OCDDY) — 7.5–8/10

Warehouse/grid robotics with real customer wins; direct leverage to retail/3PL automation budgets.

Teradyne (TER) — 7.5/10

Owns Universal Robots (collaborative arms) and MiR (mobile robots). Beneficiary of brownfield automation and SME adoption.

Fanuc (FANUY) / Yaskawa (YASKY) — 7.5/10

Scale leaders in industrial arms; cyclical, but robotics penetration continues to climb.

Boston Dynamics (Hyundai) — 7.5/10

Spot/Stretch maturing into logistics/inspection; deep manipulation R&D pipeline backed by Hyundai.

TSMC (TSM) / ASML (ASML) — 8–9/10

If robotics adoption explodes, so does edge compute demand. Foundry/litho are the silent beneficiaries of every AI+robotics device.

Software layer (PLTR, SNOW, NOW) — 7.5–8/10

The orchestration/enterprise plumbing for robot fleets and manufacturing data (asset twins, maintenance, quality).

⚠️ Names at risk / “show-me” stories

Tesla (TSLA) — 6.5/10 (until proof of paying deployments)

Enormous upside if Optimus works, but near-term numbers don’t pay for the current robotics narrative. Needs customer proof + unit economics.

Humanoid pure plays / SPAC-era robotics (various) — 5–6/10

High demo value, limited commercial proof, heavy capex burn. Expect consolidation.

Legacy auto suppliers without robotics strategy — 5–6/10

If factories become robot-dense, value shifts to controls/software/integration—traditional mechanical suppliers risk margin compression.

🧰 Second-order winners (the quiet cash flows)

Drives/actuators/gearing: Harmonic Drive (6324 JP), Nabtesco (NABTY), Nidec (NNDNF) — critical for precise, low-backlash motion.

Battery & thermal: Panasonic (PCRFY), Enersys (ENS), Boyd/Modine (MOD) for thermal management of AI/compute in mobile robots.

Safety & standards: SICK AG (sensors), Pilz (safety relays)—compliance revenue grows with deployments.

Simulation & digital twin: Ansys (ANSS), Dassault (DASTY) — robot task planning, validation, CFD/FEA for end-effectors and cells.

Integration & services: Accenture (ACN), Cognizant (CTSH), TCS—big share of early spend is integration.

How to build a robotics sleeve (practical)

Core basket (40–50%): NVDA / ABB / ROK / SIEGY / KEYENCE / ISRG

Industrial arms/logistics (20–25%): FANUY / YASKY / SYM / OCDDY / TER

Second-order picks (15–20%): Harmonic Drive/Nabtesco, ANSS/DASTY, thermal/battery names

Speculative (5–10%): TSLA robotics optionality; one humanoid pure play; a startup via private side or warrants

Hedge: If cyclicals wobble, keep some dry powder; many of these are macro-sensitive.

Bottom line

Yes, TSLA looks overvalued unless it becomes a real robotics leader with commercial deployments and improving unit economics. Great demos aren’t enough at a Magnificent-Seven multiple.

The investable edge today is in companies that monetize automation now (industrial arms, warehouse robotics, sensors, controls, digital twins) and the compute stack that makes robots useful (NVDA + software + simulation).

Treat Tesla’s Optimus like a lottery-ticket overlay on top of a handsomely profitable automation core—own the cash flows first, the optionality second.

The Investment Strategy Wall Street Hopes You Never Discover

Tue, Sep 30, 2025 2:00 PM - 3:00 PM EDT |

-Why the 60/40 strategy is dead and what to do instead

- How to use AI to uncover today and tomorrow's hottest themes

- 4 unknown edges that still exist in today's market

- How to set up your portfolio for asymmetrical returns

- Little-known asset class that has limited risk and potentially unlimited returns

- 4 ways to hedge your portfolio that don't include bonds

Click Below to Register |

📈 Stock Corner

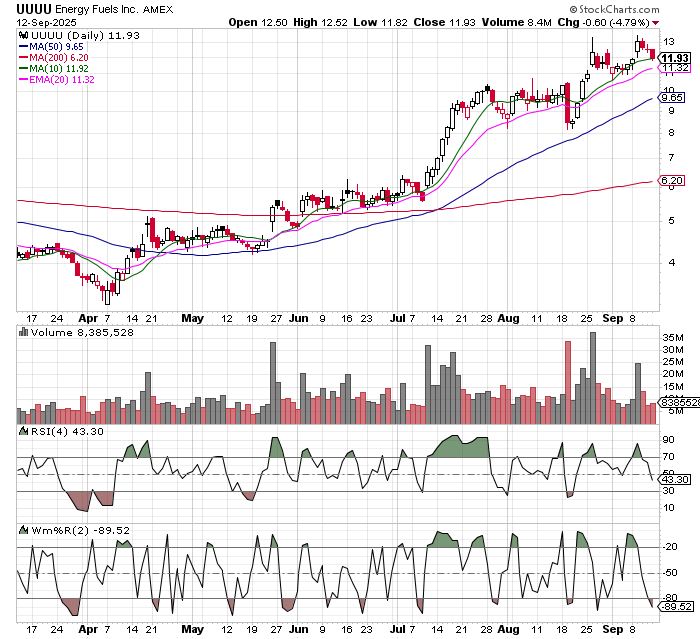

Today’s stock Energy Fuels (UUUU)…..

I’ve been in this for a while, it straddles the nuclear and rare earth themes. This uptrend has pretty much held the 10/20 day, except for a brief trip to the 50 day. This could be a decent entry at the 10 day.

From Chat GPT…..

Energy Fuels (UUUU) is the closest thing the U.S. has to a nuclear + rare earths “dual mandate” champion, and it just pulled back after a hot run. Unlike most uranium names that are pure miners, UUUU controls the White Mesa Mill in Utah — the only licensed conventional uranium mill in the country — which makes it uniquely positioned to monetize not just uranium but also vanadium and rare earth element (REE) processing under U.S. policy support. With Washington pushing hard for domestic uranium supply (to cut Russian dependence) and for non-Chinese REE separation capacity (FEOC rules kicking in for EV credits), UUUU sits at the exact intersection of two critical supply chains. The company has already shipped commercially separated REE carbonate, is scaling toward NdPr oxide, and has DOE support to keep ramping. Yes, the stock has been volatile and yesterday’s pullback reflects hot money leaving the sector, but the structural story hasn’t changed: you’re buying into the only U.S. facility that can pivot between uranium, vanadium, and REEs depending on where the margins and subsidies are richest. In my view, this dip is buyable if you want asymmetric exposure to both the nuclear renaissance and the de-Sinicization of rare earths — two of the most powerful policy-driven themes in play.

📬 In Case You Missed It

We talk about crypto, tokenization, and some of our ETF filings…..

🤝 Before You Go Some Ways I Can Help

ETFs: The Antidote to Wall Street

Inside HEAT: Our Monthly Live Call on What Wall Street Doesn’t Want You To Know

Financial HEAT Podcast https://www.youtube.com/@TuttleCap Freedom from the Wall Street Hypocrisy

Tuttle Wealth Management: Your Wealth Unshackled

Advanced HEAT Insights: Matt’s Inner Circle, Your Financial Edge

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.