I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

The AI Burnout Trade: Oracle, CoreWeave, and the Moment the Math Caught Up

If the 2023–2025 AI story was “infinite demand,” the new chapter is simpler and much less fun:

Can any of this actually earn its cost of capital?

You can see the mood shift in two names that were supposed to be big winners of the AI build‑out:

Oracle – the “AI cloud comeback” story

CoreWeave – the poster child of the new GPU‑cloud middlemen

Both just gave us a live demo of AI burnout—not because AI demand died, but because investor patience did.

Oracle: From AI Darling to Credit Risk Proxy

Oracle’s last earnings call was meant to calm everyone down about its OpenAI mega‑deal and AI data‑center build‑out. Instead, it poured gasoline on every existing worry:

The stock is down ~15% since the print.

Its 5‑year CDS has blown out to ~147 bps from under 60 bps in September—the highest since the financial crisis.

On top of $18B in recent bond issuance (including a 40‑year tranche), Oracle’s latest 10‑Q quietly revealed $248B in long‑term lease commitments for data centers (15–19 year terms).

The company keeps telling a good top‑line story:

A $300B contracted deal with OpenAI.

Remaining performance obligations (RPO) north of $500B.

But investors are staring at the funding side:

D.A. Davidson estimates Oracle could run negative FCF of ~$20B+ this fiscal year as capex ramps.

S&P’s downgrade trigger is ~4x net debt/EBITDA; Oracle is hovering right below that line.

That’s why Oracle’s CDS has basically become the “AI credit stress index.” If you’re using debt to chase GPU capacity, the bond market is now marking you in real time.

Management insists everything is fine:

“All milestones remain on track” for OpenAI‑linked data centers. MarketWatch

Citi calls the giant lease commitments “proactive” locking in of energy and building resources. MarketWatch

But others see what this really is: a massive, long‑dated leverage bet on one customer, in a market where leadership can change in a single benchmark refresh.

When your CDS trades like it’s 2008 again, the story has officially moved from growth stock to credit story.

CoreWeave: AI’s Junk‑Rated Mascot

If Oracle is the IG canary, CoreWeave is the speculative version of the same problem.

In just six weeks:

The stock has lost ~46% of its value – roughly $33B in market cap wiped out.

The cost of insuring its debt has spiked to ~7.9 percentage points, signaling real distress in the credit market.

CoreWeave’s business model is simple in theory and brutal in practice:

Borrow at high rates.

Buy thousands of Nvidia GPUs.

Lease data‑center capacity from landlords like Core Scientific.

Rent GPU time to a handful of mega‑customers: OpenAI, Microsoft, Meta.

It’s the leveraged version of “AI as a service.” That’s great until anything goes wrong… and everything went wrong at once:

Construction delays at a massive Texas data‑center cluster (260 MW destined for OpenAI) thanks to rain, wind, and redesigns.

A botched communication cycle: CEO insists it’s “one data center,” CFO corrects him live to “one data‑center provider,” then a repeat of the confusion on CNBC. The Wall Street Journal

A failed $9B bid for Core Scientific, after the target’s largest shareholder warned that CRWV’s stock volatility and capital structure would drag their investors into “substantial economic risk.” The Wall Street Journal

Underneath it all:

Revenue more than doubled YoY to $1.4B, but the company still lost $110M in the quarter.

Operating margin is around 4%—less than half the interest rate it pays on much of its debt.

D.A. Davidson’s Gil Luria calls it “the ugliest balance sheet in technology, by far.”

The bull case is “we’ll scale into it.” The bear case is “there is no scaling when your interest bill outruns your margin.”

The market is voting with its feet.

What “AI Burnout” Really Is

This isn’t about AI demand rolling over. If anything, compute demand is still “insatiable”:

Hyperscalers are still racing to build capacity.

Elon Musk is throwing 200,000 GPUs into a swamp in Tennessee.

AI burnout is something different:

Patience exhaustion

Investors are tired of being told “trust me, it’s early” while cash flows go more negative and debt piles up.Balance‑sheet exhaustion

The easy phase—fund everything at zero rates—is over. Debt is expensive. Credit markets are finally charging for risk.Narrative exhaustion

Oracle, CoreWeave, Broadcom’s post‑earnings drop… plus a steady drumbeat of “AI bubble?” notes… have flipped the trade from “AI at any price” to “show me the math.”

That’s “AI burnout”: big AI‑exposed stocks dragging the indices lower even when the rest of the tape looks fine.

Winners, Watchlist, Losers

Not advice—just how I’d bucket the AI space through the burnout lens.

Likely Winners: Self‑Funded AI & Picks‑and‑Shovels

These are the names the market will let keep spending because they can pay cash for their ambition.

Microsoft (MSFT)

Deep OpenAI integration, massive enterprise distribution, and rivers of free cash flow.

Can fund AI infra out of operations, not balance‑sheet contortions.

Alphabet (GOOGL)

Gemini 3 plus custom TPUs show that the AI race is not one‑horse.

Net cash, dominant ad machine – can keep spending without leaning on bond markets.

Meta (META)

Still spending heavily on AI, but from a core business throwing off cash.

If they ever really monetize Llama‑powered agents inside their apps, the infra spend suddenly looks cheap.

Broadcom (AVGO) – with a caveat

AI chip revenue +74% YoY last quarter; management expects it to double again in the current quarter.

Huge backlog (~$162B) and long‑term custom ASIC deals (Google, Anthropic, others).

But the stock already ran ~75% YTD before the pullback; this is a buy‑the‑air‑pocket compounder, not a lottery ticket.

Micron (MU) – the “quiet” AI infra winner

Sells HBM/DRAM into AI servers rather than running AI clouds itself.

Capex is tied directly to visible bit demand and pricing, not to speculative mega‑campuses.

Street expects positive FCF with record revenue in FY25 – that’s the opposite of the Oracle/CoreWeave profile.

The pattern: these companies sell into the AI boom and self‑fund their capex. They’re not betting the balance sheet on one customer or one project.

Watchlist: Great Stories, Now in “Prove It” Mode

These aren’t automatic sells—but they’ve moved from “no‑brainer AI trades” to “you better nail the execution”.

AI data‑center REITs and builders

Fantastic headlines about power‑hungry AI campuses; less clarity on tenant quality and long‑term economics.

Reuters has already flagged that “shaky data centre tenants” could choke off the AI boom if over‑levered GPU clouds stumble.

GPU‑cloud middlemen (CoreWeave & friends)

Business model works only if:

GPUs stay scarce

Funding stays cheap

Key customers (OpenAI, MSFT, META) stay locked in

A few delays, a higher cost of capital, or one contract renegotiation, and the equity goes from “hyper‑growth” to “distressed tech landlord” very quickly.

Second‑tier AI infra vendors with big promises, thin cash flow

Any company whose pitch is “Nvidia but smaller,” with heavy capex and slim margins, is now in the “show me” bucket.

These are trading vehicles, not core holdings, until the financing model looks less fragile.

Losers / Danger Zone: Where AI Burnout Hurts Most

This is where the regime change bites:

Debt‑funded AI infra tourists

Oracle is the current poster child: huge AI backlog, but CDS at crisis levels, negative FCF projections, and $248B of lease obligations tied to a handful of mega‑projects.

Equity holders are now long AI and long credit risk in the same ticker.

Over‑levered GPU clouds with thin margins

CoreWeave’s 4% operating margin vs much higher interest cost is the template.

If AI pricing power weakens or customers diversify away, there’s no cushion.

Narrative‑only AI small caps

No durable cash flows, no competitive moat, just “we’re AI‑adjacent.”

As soon as the big boys stumble, these become the funding source for every PM in the book.

In a “burnout” phase, the market stops forgiving balance‑sheet sins. That’s where the real damage shows up.

Takeaways

The AI theme isn’t dead — the “AI at any price” trade is.

Demand for compute is still exploding, but capital is no longer free. Credit markets are now a key part of the AI story, not a footnote.From here, balance sheet matters as much as model quality.

The new divide is simple:Can you self‑fund your AI build‑out from strong core businesses?

Or are you borrowing tens of billions on the promise that one or two counterparties never blink?

Oracle and CoreWeave are warnings, not one‑offs.

Oracle’s CDS spike and CoreWeave’s 46% face‑plant are how the market prices financing risk in real time. Expect more “funding scares” in AI infra over the next 12–24 months.Own the toll roads, not the over‑levered theme parks.

Favor hyperscalers, component vendors, and true picks‑and‑shovels that sell into the AI boom with positive FCF… and treat heavily leveraged infra plays as tactical trades, not permanent holdings.AI burnout is exactly when the next leg of real winners gets set up.

In every major tech cycle, the first wave of casualties is the over‑funded, over‑levered “pure plays.” The durable compounding happens in the businesses that survive the hangover and keep investing through it.

News vs. Noise: What’s Moving Markets Today

Is There a Crack in the Market’s Plumbing?

Everyone’s watching AI tickers and Fed cuts… but the most important chart on my screen yesterday wasn’t NVDA or the 10‑year. It was the overnight repo rate quietly trading above the Fed’s target band.

Here’s what actually happened:

The Fed’s policy range is 3.5%–3.75%.

The overnight general collateral (GC) repo rate — what big institutions pay to borrow cash overnight against Treasurys — has been printing around 3.8%.

That’s after the Fed announced it will buy $40B/month in T‑bills through mid‑January to ease funding stress and refill the system with reserves.

Why does that matter? The repo market is the plumbing of the system. If it doesn’t clear smoothly, banks and dealers stop trusting they can get overnight cash at a reasonable rate. At that point, instead of borrowing in repo, they raise cash the old‑fashioned way: sell other assets – loans, bonds, stocks – into a hole.

If banks decide “repo isn’t working,” the next step is forced selling elsewhere to raise liquidity. Think late‑2019: a “technical” money‑market hiccup that suddenly matters to everything on your screen.

The Fed’s T‑bill buying is supposed to prevent that. Morgan Stanley basically says, “We’ll see if $40B/month is enough – the market will tell us.” If GC repo keeps trading above fed funds into year‑end, the market is saying it isn’t.

To be fair, not everyone thinks this is systemic. JP Morgan’s FX/ rates desk is calling it more of a “reserves are tight but manageable” situation: liquidity is uneven, year‑end always gets weird, but money‑market conditions should stay “well behaved.” And Scott Skyrm (Curvature) chalks the latest bump up to technical year‑end noise, not a 2008‑style stress event.

So which is it – real “news” or background “noise”?

Right now, I’d frame it like this:

Noise in the level… news in the direction. A 3.8% GC print isn’t a crisis. But it tells you the system is already a bit short of the “comfortable reserves” level even after the Fed restarted net T‑bill buying. That’s a regime change from the post‑Covid flood of free liquidity.

The Fed is already using the balance sheet again. They just cut to 3.75% and restarted QE‑lite via $40B/month in T‑bill purchases. When the central bank is this aggressive and short‑term funding is still twitchy, you pay attention.

Also notice how this lines up with the rest of what we’ve been talking about:

We have AI capex monsters (Oracle, CoreWeave, others) levering up into a world where the cost of short‑term cash is getting noisy again.

We have a “stronger for longer” natural‑gas and power story building under the surface as data‑center demand collides with constrained energy supply.

When plumbing is tight and capital isn’t free, over‑levered stories get punished, and real‑asset cash flows (energy, power, quality credit) start to matter a lot more.

Takeaways

This is not 2008… yet. A few basis points of repo stress is not a systemic event. For now it’s classic year‑end “who’s got balance sheet left?” mechanics.

But it is a yellow flag. If GC repo keeps living above the Fed’s band after the T‑bill program ramps, the market will force the Fed to either (a) do more QE‑lite, or (b) tolerate tighter financial conditions than their forward guidance implies.

If repo really breaks, equities become the ATM. Banks can’t print collateral. If they can’t reliably borrow against it, the next step is liquidating “liquid” assets — think credit and stocks first, not last.

Portfolio angle:

Keep some dry powder in short‑term cash / T‑bills rather than reaching for the last inch of beta.

Stay biased to self‑funders with real free cash flow over levered “growth at any price.”

Don’t abandon your hard‑asset and energy exposure – it’s one of the few places that benefits from the same inflation/deficit mix that’s now stressing the plumbing.

In other words: the AI story is still fun, but the stuff that decides how the party ends is back in the boring corner of the market – repo, reserves, and the price of overnight cash.

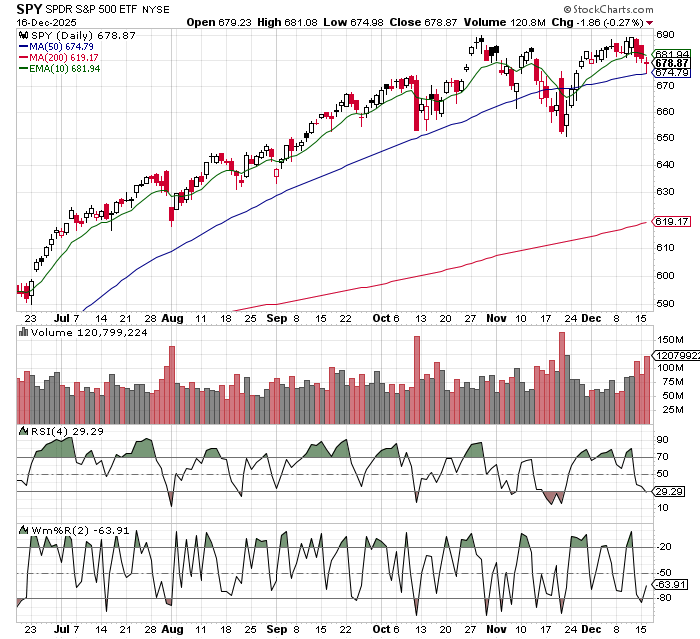

Meanwhile, watch the 50 day moving averages on SPY and QQQ…..

SPY held yesterday…

QQQ broke below, but as of now looks like an undercut and rally…

A Stock I’m Watching

Today’s stock is Service Now (NOW)….

ServiceNow (NOW) is one of the cleanest “enterprise AI actually gets deployed” beneficiaries because it sits in the workflow layer where work is approved, routed, audited, and measured — not just generated. As companies move from pilots to production, the bottleneck isn’t model quality, it’s turning messy real-world processes (IT ops, employee onboarding, risk/compliance, customer service) into governed, automated workflows with clear permissions and accountability — and that’s exactly where NOW already lives as a system-of-action. The upside is that AI doesn’t have to “replace” ServiceNow to matter; it just has to increase the number of tasks automated per customer, expand footprint across departments, and raise attach of higher-value modules — which drops through with real operating leverage because the platform is already embedded. The key tell to watch is whether AI features show up in consumption of workflows (more cases resolved, more automations triggered, expanding platform usage) rather than flashy demos. The risk is straightforward: at-scale enterprise software still lives and dies by execution (seat/usage expansion, large deal cycles, implementation capacity), and any slowdown in big-customer expansion or a failed push into adjacent categories can compress the multiple quickly — but if “agentic” automation becomes a core budget line item, NOW is positioned to be the tollbooth rather than the experiment.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.