Wall Street’s 60/40 formula was born in 1952 — the same year as the first credit card. A lot has changed since.

That’s why we created a new approach — The H.E.A.T. Formula — to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

Table of Contents

🔥 Here’s What’s Happening Now

Nothing going on yesterday, market appears to be waiting on Jackson Hole and/or NVDA earnings.

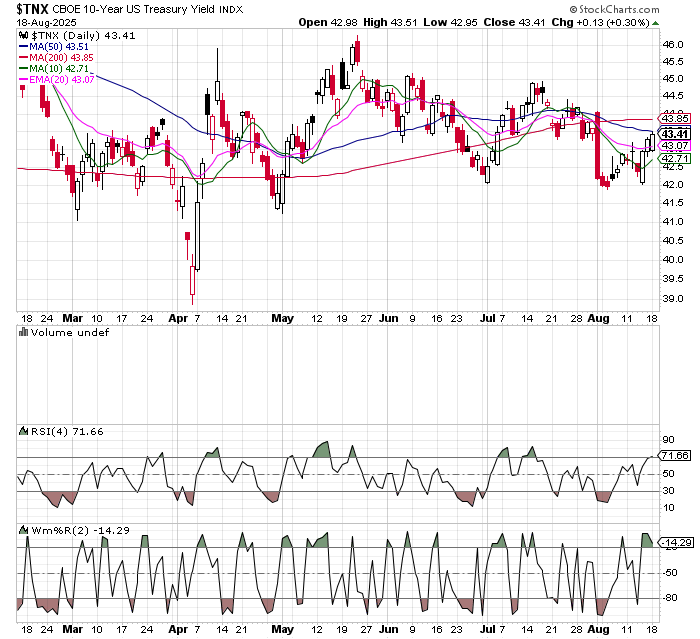

Rates have now been up 3 days in a row, if the whole world is assuming the Fed cuts next meeting maybe the bond guys are trying to tell us something…..

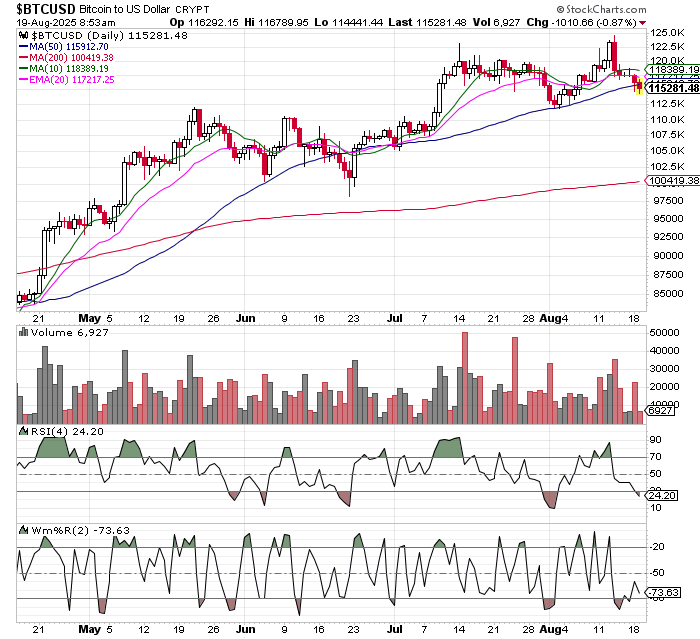

Bitcoin and Ethereum were both breaking out to new highs, now they look more like shorts….

How you handle it depends on whether you are a trader or investor.

This was the most interesting news of the day IMHO…..

Yes, most of his DeSPACs ended up sucking, but he’s politically connected now and brings some excitement back to SPACs, which I think are another must own asset class (pre-merger).

Not everyone agrees……

🧠 The AI Industry Is Still Light-Years From Making a Profit, Experts Warn

This article caught me eye…..

As did this…..

IMHO this is the biggest issue facing the market and the economy. Tariffs, inflation, FOMC, etc are all secondary. Today we take a deep dive on this issue. Who wins if the money keeps flowing in, who can help make AI spend profitable, and what happens if they just can’t turn a profit.

Thesis: Even if current AI economics stay ugly, the capex machine can keep running for years. When profits are scarce, the cash still flows to the enablers—power, racks, cooling, chips, optics, and interconnect. The eventual winners who make AI profitable are those that raise GPU utilization, cut inference cost per query, and turn models into workflow ROI.

First-order winners (get paid whether AI is profitable or not)

Compute & Boards

$NVDA, $AMD – accelerators keep shipping as long as budgets exist.

$AVGO, $MRVL – custom silicon & high-speed networking for AI clusters.

$ANET – 400/800G switching inside AI fabrics.

$SMCI, $DELL, $HPE – rack-scale integration (margin risk later, but volume persists while capex is hot).

Optics & Power Components

$COHR, $LITE, $AAOI – pluggable optics/lasers for 800G+ interconnect.

$MPWR, $ON – power management & SiC for high-density servers.

Power, Cooling & Electrical

$VRT, $MOD – thermal & power systems (white-space bottlenecks).

$ETN, $HUBB, $POWL – switchgear, busway, transformers; HVDC buildouts.

$PWR, $MYRG, $GEV, $ENR, $ABB – grid ties, substations, HVDC.

Energy & PPAs

$CEG, $VST, $NRG, $TLN (TA CN) – dispatchable baseload & hybrid power for campuses.

Select regulated utilities with DC corridors: $ETR, $WEC, $CNP, $PPL, $OGE.

Colo & Interconnect

$EQIX, $DLR – enterprise/retail interconnect growth even as hyperscale soaks up land/power.

If capex keeps flowing despite thin ROI, this stack captures most of the dollars.

Who’s integral to making AI profitable (unit-economics fixers)

Utilization & Orchestration (raise GPU use, cut waste)

$PLTR, $SNOW – data plumbing, governance, agent orchestration; link models to revenue workflows.

$DDOG – observability of AI apps; right-size clusters; spot idle capacity.

$MSFT, $GOOGL, $AMZN – own the app layer (Copilot, Gemini, Bedrock) and custom silicon (TPU/Trainium) that pushes cost/token down.

Inference Efficiency

$NVDA (TensorRT, NIM), $ARM (efficient cores), $AVGO/$MRVL (custom accelerators), $ANET (deterministic fabrics) – software + silicon that enable quantization, caching, model routing, and cheaper small-model inference.

Power Cost per FLOP

$CEG/$BWXT – nuclear baseload & TRISO/HALEU ecosystem for 24/7 clean power.

$AMRC – hybrid on-site power/microgrids; reduce grid charges and curtailments.

Battery/UPS integrators (inside VRT ecosystem) – shave peaks, improve uptime.

Data Layer That Shortens Time-to-Value

$MDB, $ESTC – vector search/RAG to shrink model size & token bills by retrieving only what matters.

These names don’t just sell into the boom; they bend the cost curve (higher utilization, cheaper inference, faster ROI).

Likely losers (if profits stay elusive)

Foundation-model “me-too” vendors with no moat or distribution; model hosting platforms that compete only on price.

Over-levered DC developers/EPCs without firm power or disciplined execution (capex > cash flow = equity risk).

Hardware-only server assemblers if/when GPU supply loosens (pricing compresses; watch GM%)—$SMCI is most reflexive here, so size accordingly.

One-market REITs in jurisdictions facing siting/permitting pushback (parts of VA).

Other implications to watch

Power becomes the new currency. Long-dated nuclear/gas-hybrid PPAs will trade like gold; utilities/IPPs with secured fuel & interconnects gain multiple expansion.

Grid spend supersedes DC spend. HVDC, transformers, and protection relays are gating items—expect multi-year backlogs (bullish ETN/HUBB/POWL/ABB/ENR/GEV).

Shift from training to inference. Street will reward inference margin per user and GPU utilization over raw capex. Track: cloud gross margin, interconnect ARPU, model-in-production counts.

Potential overbuild = later mean-reversion. If utilization disappoints, expect margin pressure first at server integrators and optics before rippling to GPU pricing—keep a hedge book.

Regulatory & supply risks. Export controls, transformer scarcity, permitting. Names with diversified supply (ETN, VRT) and regulated returns (CEG, WEC, ETR) are safer.

Bottom line: If AI capex keeps flowing without profits, the picks-and-shovels keep winning. The next rerating, however, accrues to the companies that lower cost per token, lift utilization, and wire AI into revenue workflows. Own both sides: the builders and the profit-makers.

Please register for our next webinar:

The Investment Strategy Wall Street Hopes You Never Discover

Wednesday August 27, 2-3pm EST

-Why the 60/40 strategy is dead and what to do instead

-Why covered call strategies suck, and what may be much better

- How to use AI to uncover today and tomorrow's hottest themes

- 4 unknown edges that still exist in today's market

- How to set up your portfolio for asymmetrical returns

- Little-known asset class that has limited risk and potentially unlimited returns

- 4 ways to hedge your portfolio that don't include bonds

Click Below to Register

📈 Stock Corner

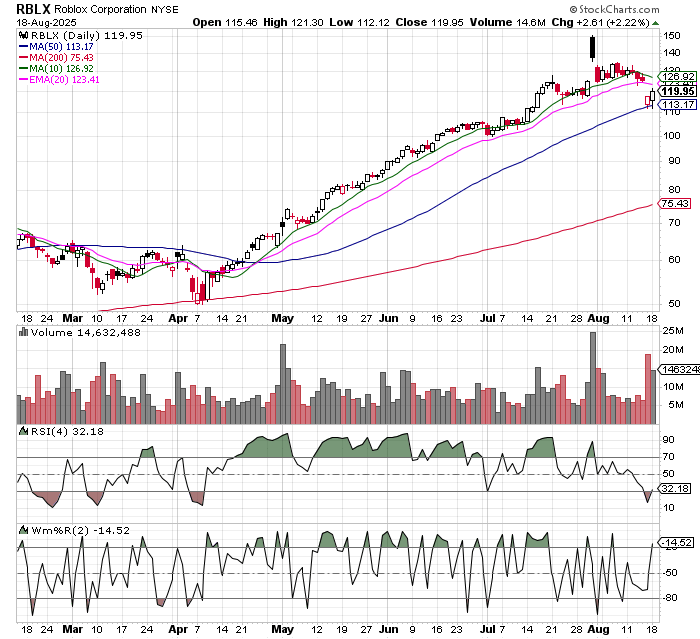

Today’s stock is Roblox (RBLX)…..

It sold off hard on new of potential lawsuits over child exploitation, but it held the 50 day and had an undercut and rally. My kids are in their 20’s but I am told by people who have younger kids that RBLX is a must own stock.

📬 In Case You Missed It

Maybe it’s not Chamath that is a sign of the top, perhaps it’s this….

I have puts and short calls.

🤝 Before You Go Some Ways I Can Help

ETFs: The Antidote to Wall Street

Inside HEAT: Our Monthly Live Call on What Wall Street Doesn’t Want You To Know

Financial HEAT Podcast https://www.youtube.com/@TuttleCap Freedom from the Wall Street Hypocrisy

Tuttle Wealth Management: Your Wealth Unshackled

Advanced HEAT Insights: Matt’s Inner Circle, Your Financial Edge

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.