I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Dividend Announcements:

BITK .18/Share

MSTK .50/Share

Ex Dividend Friday

Payable Monday

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) November 14 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

A huge part of thematic investing is thinking beyond the obvious winners in a theme. We call this the thematic investment hierarchy. If you look at the AI theme for example, anyone can pick the winner(s), it’s NVDA and maybe you can throw in AMD, AVGO, and some of the other Mag 7’s. To really generate alpha IMHO you need to look for who are the suppliers to the winners, who are the suppliers to the suppliers, and so on. In that vein, today we talk about smaller power solutions…

The AI Power Panic: Small Turbines, Fuel Cells, and the Next Energy Land Grab

AI’s appetite for electricity has turned into a full-blown power panic—and a surprising class of companies is cashing in. With data centers devouring gigawatts and utilities years away from delivering new grid capacity, hyperscalers are turning to modular, fast-deployable power solutions: small turbines, reciprocating engines, and solid-oxide fuel cells. It’s the energy equivalent of buying generators during a blackout—expensive, inefficient, but immediately available. This has triggered a speculative frenzy across smaller equipment manufacturers, some up triple digits YTD as investors chase the “AI power rush.”

The setup: U.S. data centers face a 45 GW power shortfall through 2028—the size of Illinois’ entire grid. Large-scale combined-cycle gas turbines (GE Vernova’s specialty) are too slow to deploy and buried in multi-year permitting queues. So, developers are racing to anything that can be on the ground and producing electrons in 18–24 months. Enter Bloom Energy (BE), Caterpillar (CAT), Cummins (CMI), Rolls-Royce (RR), and Generac (GNRC)—the modular energy suppliers of last resort.

Winners—ranked by leverage to the AI power squeeze:

1️⃣ Bloom Energy (BE) – The clear momentum leader, up nearly 480% YTD. Its solid-oxide fuel cells run on natural gas, offer 24/7 uptime, and can be deployed on data center rooftops. High upfront costs, yes—but its edge is speed to permit and lower emissions. New deals with AEP, Brookfield, and Equinix validate hyperscaler adoption. Its valuation (140x forward earnings) borders on euphoric, but its technology gives it unique optionality if data centers are forced to go “off-grid.”

2️⃣ Caterpillar (CAT) – A steady industrial transforming into an AI utility supplier. Its turbines and reciprocating engines are powering xAI data centers in Memphis and expanding into Utah and Texas. Power-gen revenue jumped +33% YoY, and lead times are stretching—classic early-cycle indicator of capacity stress. Still trades cheap vs. GE Vernova (17x vs. 47x P/E), giving CAT a compelling asymmetry: exposure to AI power without speculative multiples.

3️⃣ Rolls-Royce (RR) – Its small gas turbines and microgrids are in rising demand. RR brings aerospace-grade efficiency to distributed generation, with potential crossover into hydrogen-compatible turbines—a wildcard in long-term decarbonization.

4️⃣ Cummins (CMI) – A dual-benefit play on both diesel-to-gas transition and fuel cell tech. Its “Accelera” line is still early, but partnerships across logistics and AI campus projects make it a dark horse. Solid execution, low valuation, modest growth—it’s the value investor’s AI energy bet.

5️⃣ Generac (GNRC) – A household backup brand now finding a new customer base in hyperscalers. Management cited “strong demand from tech giants,” though residential weakness masks the upside. At $7B market cap, it’s a levered bet on backup redundancy within the AI buildout—if GNRC can shift from suburban to hyperscale, the re-rate could be explosive.

Who’s missing?

The large-cap OEMs—GE Vernova (GEV), Siemens Energy (ENR)—are deliberately holding back, haunted by the post-dot-com overbuild in the early 2000s. Their discipline opens the door for smaller, faster rivals to capture a slice of the trillion-dollar AI energy buildout.

Investment implications:

Speed > efficiency. Data centers can’t wait for perfect power—they’ll pay for immediacy. Companies offering modular, scalable, deployable now solutions will capture the first wave of AI build contracts.

Permitting is the new moat. Fuel cells like Bloom’s can bypass emissions restrictions that slow gas turbines. Watch for manufacturers with streamlined siting and grid interconnection approvals.

Capacity is gold. Caterpillar’s expanding lead times are a bullish tell; any company announcing new manufacturing capacity (like Bloom’s additional 1 GW plant) becomes an instant momentum trade.

Rotation trade: While Bloom dominates headlines, Caterpillar, Rolls-Royce, and Cummins offer better entry points with real industrial backbones.

Bottom line:

The AI revolution just broke the electricity market. The winners aren’t the utilities—they’re the fastest manufacturers of power, not the cleanest or cheapest. For now, electrons delivered by 2027 are worth any price. Bloom is the Tesla of AI power, but Caterpillar may be the next GE Vernova in waiting.

News vs. Noise: What’s Moving Markets Today

The Comeback, the Capex, and the Power Shift Behind the Rally

Yesterday’s sharp rebound after Tuesday’s selloff showed just how reflexively this market still buys the dip — and how much the AI CapEx boom continues to dominate sentiment. The narrative hasn’t changed: AI infrastructure spending remains the gravitational force of this market. After Amazon, Google, and Microsoft all raised 2025–26 CapEx to new records, data shows AI-related construction activity is now up 60% year-over-year, with nonresidential building permits at their highest on record. The Dodge Momentum Index, a reliable 9–12 month leading indicator for construction, is screaming higher, pointing to an AI-led building boom that will hit the real economy in 2026. Companies are borrowing aggressively to fund data centers and power generation, with September alone seeing a record surge in AI-related debt issuance.

What’s different now is the constraint: power, not chips. Microsoft’s own CEO admitted they have racks of GPUs sitting idle because the grid can’t support them. This shifts the leverage away from semiconductors toward energy and infrastructure — the firms that can energize capacity fastest. That’s why names like ETN, PWR, CEG, and VST continue to lead beneath the surface, even as the Mag 7 dominate the headlines. The U.S. economy remains bifurcated — 97% of market wealth sits in just 3% of stocks — but that concentration is being driven by a single secular tailwind: AI CapEx. It’s not a bubble when supply still can’t catch up to demand. The real risk isn’t overvaluation; it’s overdependence on a handful of companies to keep the cycle alive.

Bitcoin, Volatility, and the Jensen Shock

While equities bounced, Bitcoin continued to correct, down roughly 22% from highs, tracking a familiar 1–2 month consolidation pattern. Institutional outflows accelerated after Powell’s hawkish tone last week, but liquidity inflows remain robust and RSI readings are in deeply oversold territory — the same setup that preceded every major rebound since 2023. Historically, these pullbacks resolve higher once leveraged longs are flushed out, and that process appears largely complete. Bitcoin remains the high-beta liquidity barometer for the AI trade — corrections here have consistently preceded tech pullbacks, but bottoms also tend to align with renewed risk-on sentiment.

Meanwhile, Nvidia’s Jensen Huang just lit a geopolitical fire by telling the FT that “China will win the AI race,” citing cheaper energy and looser regulation. It’s a stunning admission that underscores how deeply the power and policy equation now matters. Trump’s export bans may have protected Nvidia’s domestic lead, but they’ve also accelerated Beijing’s push to subsidize power and cut AI costs. In effect, the AI race is no longer about model quality or chips — it’s about who can generate and deliver affordable electrons fastest. That’s as bullish as ever for U.S. grid, utility, and data-center infrastructure names — but it also highlights that the West’s regulatory friction could slow deployment just as China doubles down.

Takeaways for Investors:

The AI CapEx boom remains the foundation of this rally — but leadership is narrowing. Focus on infrastructure enablers (ETN, PWR, VST, CEG) over stretched mega-cap tech.

Power is the new bottleneck — and the new alpha. Companies controlling energy and interconnects now hold the leverage, not chipmakers.

Bitcoin’s correction looks mature, with multiple bullish divergences forming; use retests as tactical entry points, not exit signals.

Global AI dynamics are shifting: China’s energy subsidies and U.S. export bans may invert the competitive edge by 2026. Investors should prepare for an era where “cheap power” defines AI leadership as much as silicon does.

Bottom line: Tuesday’s selloff was a test of nerves; Wednesday’s rally was a reminder that liquidity, AI CapEx, and power demand are still the dominant macro forces. The next phase of this market belongs to whoever controls the watts, not the hype.

A Stock I’m Watching

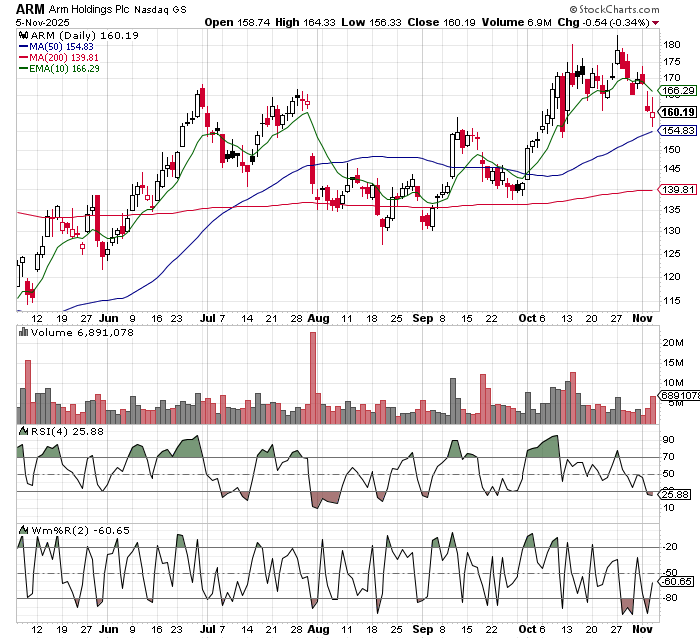

Today’s stock is ARM Holdings (ARM)…

Arm (ARM) just reminded the market why it’s quietly one of the most important enablers of the AI ecosystem. The company posted another billion-dollar quarter — $1.14B in revenue, up 34% year-over-year — and more importantly, it showed where the next leg of AI hardware growth is headed: the CPU side of the stack. With data-center power access now the limiting factor, not GPU supply, hyperscalers are turning to Arm’s power-efficient chip architectures to squeeze more performance per watt. Royalty revenue jumped 21% to $620M, driven by higher licensing rates and wider adoption in data centers, smartphones, and automotive. Licensing revenue surged 56%, with strong uptake for next-gen chiplet and subsystem designs that make AI compute more modular and cost-effective. CEO Rene Haas was explicit: “AI runs on Arm” — and he’s backing that up with heavy R&D spending to move beyond CPU design into full compute subsystems. EPS dipped to $0.22 as R&D ramps, but that’s the right kind of margin compression — reinvestment into a market where every watt matters. If Nvidia is the brain of AI, Arm is quickly becoming the heartbeat — smaller, more efficient, and increasingly indispensable to the entire compute stack.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Friday November 14, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.