I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

Dividends

H.E.A.T.

The “Unprecedented” Memory Squeeze Is a Tell: AI Demand Isn’t Slowing — It’s Spreading

This week’s headline isn’t that AI chips are scarce. We already knew that.

The new signal is that memory is becoming the choke point — and when memory goes scarce, the cost shock ripples into everything: servers, cloud bills, and eventually consumer electronics.

Samsung’s leadership is basically waving a flare gun: calling the memory shortage “unprecedented” and “severe,” while warning that rising memory pricing will inevitably show up in smartphone costs.

At the same time, reporting indicates Samsung and SK Hynix are pushing for massive server DRAM price increases (figures reported in the ballpark of 30–60% and, in some negotiations/headlines, as high as ~70%).

That’s not “normal semi cycle” behavior. That’s what happens when:

AI servers are pulling memory supply forward, and

suppliers realize they have real pricing power again.

What this tells you about the AI trade in 2026

1) The AI boom is getting more physical

2023–2025 was “AI = GPUs.”

2026 is turning into “AI = the entire bill of materials.”

If DRAM and HBM pricing is exploding, it tells you the buildout is still real — because memory is a volume input that scales with deployments. You don’t get a “severe” shortage in a world where AI capex is quietly rolling over.

2) The bottleneck is shifting from compute to bandwidth

AI isn’t only compute-bound anymore. For many inference workloads (and increasingly for training at scale), the constraint becomes feeding the silicon: memory bandwidth, memory capacity, packaging, and power/thermals.

That’s why memory matters: the AI stack is evolving into a “who controls bandwidth wins” regime — and DRAM/HBM is bandwidth in a box.

3) This is where “AI winners vs losers” starts to splinter

When inputs inflate, markets stop rewarding proximity to AI and start rewarding:

pricing power

secured supply

ability to pass through costs

real margins

This is exactly how a theme matures. It stops being a narrative trade and becomes a supply-chain economics trade.

The clean causal chain

AI servers ramp → DRAM/HBM gets tight → memory makers raise prices → somebody eats it → margins shift

The only question is who has the leverage at each link.

Winners

Winner bucket #1: Memory oligopoly (they’re the toll collectors)

This is the most obvious “paid first” group when pricing spikes.

$MU (Micron) — direct beneficiary if server DRAM and HBM pricing tightens; huge operating leverage when pricing turns.

Samsung Electronics (005930.KS) — pricing power + scale; management itself is framing the shortage as severe.

SK Hynix (000660.KS) — structurally levered to HBM demand (and DRAM pricing).

Translation: if GPUs are the “brains,” memory is the “circulatory system.” When the circulatory system is scarce, the suppliers name their price.

Winner bucket #2: Memory-capex “picks & shovels”

When memory gets scarce and prices rise, the next domino is: capex to add supply (even if it takes time). That tends to benefit the equipment and process-control ecosystem.

Watchlist:

$LRCX / $AMAT / $KLAC — process intensity and inspection/metrology matter more as nodes tighten and yields become the fight.

$ASML — not “DRAM-only,” but any sustained industry capex upcycle tends to pull through lithography spend.

This is the “don’t pick the horse, sell the shovels” approach to the memory squeeze.

Winner bucket #3: AI vendors who already locked supply

This is subtle but important: if memory is scarce, the winners are not just who can pay more — it’s who already secured allocation.

Some of the best-positioned AI infrastructure vendors will be the ones who signed long-term supply deals early, because they can keep shipping while others get stalled.

This isn’t a ticker call as much as a framework: scarcity rewards planning.

Losers

Loser bucket #1: Consumer hardware (where costs show up last — but eventually)

Samsung explicitly warning about memory cost pass-through into smartphones is the tell.

$AAPL (Apple) — not because Apple is weak (it has pricing power), but because rising component costs create a decision:

raise ASPs (risk demand elasticity), or

eat margin, or

squeeze suppliers (harder when suppliers have leverage)

Key point: Apple can handle it — but it’s still a headwind versus a world of falling component costs.

Loser bucket #2: Hyperscalers + enterprise buyers (capex gets heavier)

If server DRAM is being repriced higher, the same data-center buildout buys less capacity per dollar.

That pressure hits:

cloud margins (unless they pass it through),

enterprise AI project ROI,

and the “AI is deflationary” narrative (because input costs are inflating).

Loser bucket #3: Levered AI middlemen / thin-margin compute renters

If your model is basically:

borrow money → buy hardware → rent it out → hope input costs stay tame

…then memory inflation is toxic. It raises build costs and compresses the room for error.

This is where “AI is booming!” can coexist with “some AI equities blow up.”

The big takeaway

This is bullish for the AI buildout story — but it changes where the market’s profit pool sits.

When memory suppliers are calling shortages “severe” and trying to push through giant price hikes, it screams one thing:

AI demand is no longer just stressing GPUs. It’s stressing the entire semiconductor plumbing layer.

And that’s when the trade stops being “buy anything AI” and starts being:

own pricing power, and

avoid the players who can’t pass through costs.

What I’d watch next

Contract DRAM pricing prints (do hikes stick, or get negotiated down?)

HBM allocation language from $MU / Samsung / SK Hynix (who’s locked, who’s scrambling)

Smartphone pricing commentary (do OEMs guide to higher ASPs?)

Capex escalation from memory makers (the seed of the next cycle turn)

News vs. Noise: What’s Moving Markets Today

News: 2026 just opened with a very familiar tape: rates down, risk up, metals up — the same cocktail that powered half of 2025. Markets basically “processed” the Venezuela shock in one day: oil dipped on better supply optics (then rebounded), gold caught a bid as geopolitical risk premium crept back in, and the winners were exactly the ones you’d expect when the world starts whispering “new world order”: Venezuela bonds, defense, select U.S. energy, and gold. Under the hood, the “2025 sequel” trade is alive and well too: meme/retail-favorite baskets, most-shorted baskets, AI/high-beta, crypto-adjacent risk, and precious metals all acting like there’s still a buyer of first resort. The new wrinkle (and it matters): investors also look like they’re rotating into cheaper beta without leaving the party — banks breaking out, value showing real relative life, and equal-weight / small & midcaps finally acting like they want a seat at the table. That’s a classic “stay long, but stop overpaying for the same 20 tickers” regime shift.

Noise: the trap is trading geopolitics like it’s a clean quarterly earnings catalyst. Everyone will want to price Venezuela as if new barrels arrive next month and oil is permanently capped — but the real world is slower, messier, and capex/construction constrained. The more realistic read is: these events limit upside spikes in crude more than they guarantee a straight-line crash, because Venezuela’s production capacity and infrastructure don’t magically heal overnight — and if oil actually broke too far (say sub-$50 for any stretch), the shale cost curve and supply response would likely put a floor under it anyway. Same with the macro leap people will make: “interventionist U.S. = USD doom.” Maybe long-run, but near-term the dollar can also catch a safe-haven bid while gold remains the cleaner ‘diversify away from USD’ expression. So the actionable signal isn’t tomorrow’s headline about who’s “next” (Cuba/Colombia/Greenland/Taiwan chatter will whipsaw you). The signal is whether the market keeps behaving like 2025: dip-buying absorbs shocks, risk stays sticky, and leadership broadens. When that flow stops — that’s when the “news” flips and the air pockets come back.

A Stock I’m Watching

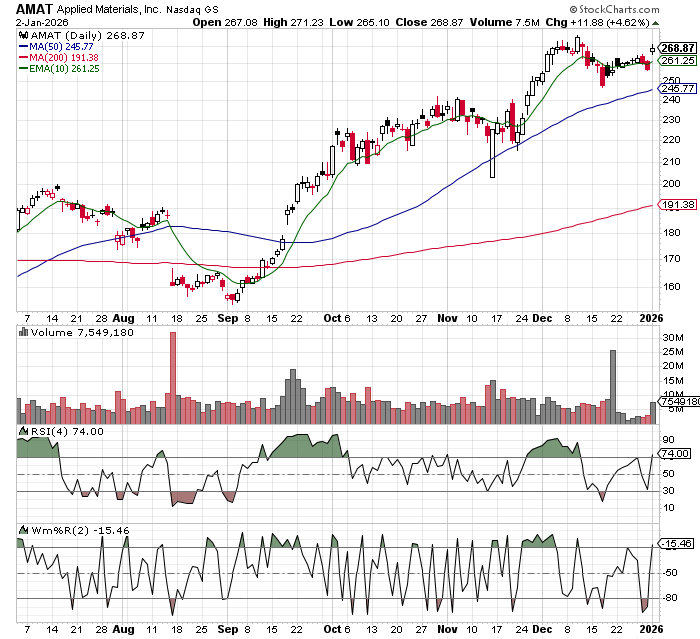

Today’s stock is Applied Materials (AMAT)….

Applied Materials (AMAT) is one of the cleanest “picks-and-shovels” ways to stay long the AI buildout without having to be exactly right on which chip/platform wins next. As the industry moves from a compute-constrained phase to a systems-driven cycle, AMAT sits in the tollbooth across the two places where spend is most persistent: leading-edge foundry/logic (more complex process steps, more deposition/etch intensity) and memory (HBM/DRAM/NAND capacity and technology transitions). The key point is that even if the “next NVIDIA” debate creates volatility in chip stocks, the fabrication complexity trend still forces incremental equipment demand—more layers, tighter tolerances, and more process control—where AMAT’s breadth matters. Into 2026, the underappreciated angle is that a lot of the AI discussion is shifting from who has the best model to who can economically manufacture and scale the infrastructure, and that keeps capex anchored in the semicap stack. If you want AI exposure with a more diversified demand base (memory + foundry + services) and a clearer path to cash generation across cycles, AMAT is a high-quality “backbone” name to keep on the screen.

In Case You Missed It

MAGO Review by Dividend Degenerates……

“Even the attempt to restart Venezuela is service-intensive — broken fields, broken pipes, broken facilities. That’s why the first trade can be bullish for oil services and infrastructure names (the guys who get paid to rebuild the machine), even if you’re bearish long-term oil prices,” said Matthew Tuttle, the chief executive of Tuttle Capital Management.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.