I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) November 14 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

The Altman-Gerstner Interview: When the AI Bill Comes Due

Sam Altman from Open AI and Satya Nadella from Microsoft recently sat down with Altimeter Capital founder Brad Gerstner. What was talked about in this interview has massive ramifications for the market, which is being held up by the AI trade.

Gerstner finally asked the question that matters—how do you square tens of billions of revenue with trillion-dollar compute commitments…..

“Hanging over the market is — how can a company with $13 billion in revenue make $1.4 trillion in spending commitments,”

After dodging that question, Altman/Nadella gave the most revealing answer of the cycle: the constraint isn’t chips, it’s power and build speed. That lines up with what we just heard in MAG 7 earnings: capex soared again (GOOGL to $91–$93B, AMZN to $125B, MSFT still accelerating into FY26), yet the gating factor isn’t purchase orders—it’s energizing capacity.

The viral take on X that “Microsoft has racks of H100s it can’t turn on” captures the same truth Nadella voiced on stage: if you can’t plug them in, you can’t monetize them. That has three immediate consequences.

First, the Street has been valuing the wrong constraint. Models built on GPU counts and quarterly chip receipts overstate near-term revenue if those GPUs sit idle through permitting, interconnect, and substation lead times. Every quarter a chip is unpowered is a quarter of lost revenue and accelerated obsolescence as Nvidia collapses the refresh cycle to ~12–18 months; buy today, trail tomorrow.

Second, ROI has become a time-to-energize function. The player who can light a site in 6–9 months captures 12–18 extra months of premium training/inference pricing versus a peer stuck in a 24-month queue. That makes vertically integrated hyperscalers with locked PPAs, land, transformers, and self-build teams structurally advantaged; it also elevates neutral providers with entitled megawatts and shovel-ready shells.

Third, the competitive moat has shifted from “best model” to physical infrastructure. You can ship a better model in six months; you cannot build a 300-MW substation in six months. Altman himself acknowledged the cycle risk: a compute glut will arrive “at some point,” and the most likely trigger is power catching up, not more chips.

What that means for the tape, now that Google crushed, Amazon re-accelerated AWS (+20% YoY), Nvidia hit $5T, and Meta scared investors with open-ended spend: capex ≠ cash flow until watts hit racks. The market has not fully repriced this. If analysts keep treating $50B of GPU deliveries as revenue-ready capacity, estimates will prove front-loaded and margins too rosy, especially for buyers forced to warehouse silicon through a generation change (Blackwell → Rubin). Expect wider gaps between “chips received” and “AI services revenue,” more inventory disclosures, and a growing premium for platforms that show interconnect milestones, energized megawatts, and contracted PPAs alongside GPU counts.

Implications and positioning

• Infrastructure is the new AI trade: the next trillion dollars flows to wires, watts, and wafers—and watts gate the other two. Core winners remain ETN, PWR, HUBB, POWL (transformers/switchgear/EPC), VRT (liquid cooling/UPS), CEG, VST (power portfolios with AI PPAs), EQIX, DLR (entitled land/power for overflow).

• Speed to power = multiple: among hyperscalers and neutral DCs, favor those showing concrete interconnect dates, substation contracts, minimum-bill/take-or-pay terms, and on-site generation/storage plans. A disclosure shift is coming; own the names that lead it.

• Chip cadence risk: the shorter Nvidia cadence makes “dark rack” inventory a P&L risk. Hedge high chip exposure by owning HBM/packaging leverage (MU, TSM) and the thermal/power stack that still monetizes while chips wait.

• New perimeter of winners (select, higher beta): developers sitting on powered campuses or pivoting into AI compute have real optionality (IREN, CIFR, NBIS, APLD, WULF); pair with storage integrators (EOSE) where durations >2h enhance site resilience. Size these as a sleeve; diligence the interconnects and PPAs.

• Model owners vs enablers: keep leaning to enablers over pure model bets. Meta and, to a lesser degree, Microsoft just taught us the market’s tolerance for “trust me” capex is fading; investors will demand unit-economics bridges by 2H26.

• Watch for the glut: Altman’s warning stands—when energized capacity finally outruns demand or a cheaper energy source comes online, the cycle will invert. Your tell will be falling spot pricing for GPU hours alongside improving interconnect queues; that’s when you trim infrastructure beta and stick with high-contract, regulated cash flows.

Bottom line: the AI economy will scale at the rate power comes online, not at the rate chips ship. After Gerstner’s question and Nadella’s admission, the repricing catalyst is in plain sight: stop valuing GPU counts as revenue capacity and start valuing energized, cooled, networked megawatts. Own the companies that control them, demand time-to-power disclosures from everyone else, and keep a hedge for the moment the watts finally catch up.

News vs. Noise: What’s Moving Markets Today

Market’s are in the red this morning. I added a lot of hedges yesterday, this market just didn’t feel right. Even though it was green the momentum names got hit again. I would assume that just like every other time this happens it turns into a buying opportunity, but have some hedges just in case.

Volatility Watch: A Market of Stocks, Not a Stock Market

Single-stock volatility remains near record highs even as index volatility stays muted — a rare dislocation that’s masking how violent moves are beneath the surface. Mega-cap concentration and crowding in high-beta names have pushed implied single-name volatility to all-time highs relative to the index. Call-heavy flows and leveraged ETF exposure in names like $NVDA and $TSLA are amplifying swings. Indexes look calm because correlations across sectors remain low — but if those correlations rise (for example, via a macro shock or synchronized Tech unwind), index-level volatility could surge fast.

Takeaways:

Watch for rising correlation across large-cap Tech as the potential trigger for an index-level volatility event.

Earnings dispersion is extreme — misses are punished more than any time in 20 years, while beats are rewarded less. That asymmetry can continue to drive single-stock volatility.

Traders can take advantage with selective options plays (long gamma in single names, short correlation via dispersion strategies).

Regional Banks: The Slow-Motion Credit Crunch

Regional banks remain under heavy pressure, with local drawdowns deepening across the space — names like TFIN (-52%), MSBI (-45%), and LOB (-38%) have quietly collapsed this year. The KRE ETF is barely positive YTD, masking pain in smaller lenders tied to commercial real estate (CRE) and multifamily loans. The CMBS delinquency rate hit 7.46%, its highest since mid-2020, and a $600B+ refinancing wall in 2025 looms as office vacancies exceed 20%. With loans written at 2–3% now resetting at 6–7%, credit losses are inevitable. Unlike the big banks (JPM, BAC), regionals don’t have the capital flexibility to absorb hits — which explains the daily 8–10% moves in smaller names.

Takeaways:

Expect more forced mergers and capital raises as smaller banks face funding and CRE pressure.

Avoid banks with outsized office exposure; focus on regional lenders with diversified deposit bases and conservative underwriting.

Rising delinquency in CMBS could bleed into private credit and REITs — keep an eye on KRE and CMBS spreads as stress gauges.

In the broader market, credit tightening from regional bank stress will weigh on small-cap and local lending activity into 2025.

A Stock I’m Watching

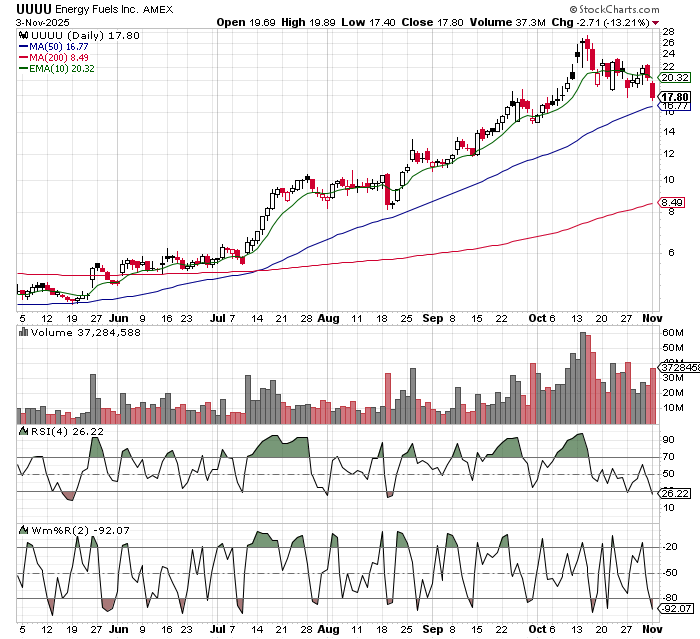

Today’s stock is Energy Fuels (UUUU)…..

I’ve talked about this one a lot. I cut some exposure into earnings last night, lucky for me as it’s down 11%+ in the pre market. This name straddles rare earth and uranium, which are two themes I like. Watch the 50 day moving average here, at this point it would open below. If it can pull an undercut and rally there, then this could be a decent spot.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Friday November 14, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.