I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar today entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) December 9 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

The Five Stocks that Keep the Lights on for AI

Wall Street is arguing about whether AI is a bubble. But the trade that keeps working doesn’t require you to be “right” about AI at all—because it’s really a grid scarcity story. The dirty secret is that electrification (EV charging peaks, renewables interconnects, aging replacement) was already forcing a rebuild, and AI is just the accelerant. BloombergNEF expects global grid investment to top $470B in 2025 (up ~16%), and it explicitly frames the problem as physical bottlenecks—wires, cables, substations, transformers, permitting and labor—not a lack of capital or “ideas.”

Even more telling: BNEF estimates $15.8T of grid investment needed through 2050 and a required ~29 million km expansion; data centers are a new driver, but BNEF says they only directly account for ~3% of global grid capex over 2025–2050 (indirectly they still pull more spend by forcing new generation + interconnects).

Translation: even if the “AI bubble” cools, the grid upgrade cycle doesn’t just disappear—because the underlying constraint is decades of underbuild meeting a step-change in demand and complexity.

So the real question for investors is: who captures the scarcity rent? Winners are the chokepoints and “toll collectors”—companies selling the hard-to-source hardware and the integration layer that turns megawatts into reliable compute: transformers/switchgear/HV gear, power management, thermal and energy storage solutions for data centers, and the engineers/builders who actually get projects permitted and constructed. BNEF’s own breakdown flags transmission spend accelerating (faster growth than distribution in the near term) precisely because interconnection queues and grid congestion have become the gating factor.

Losers are the parts of the chain that look like “AI winners” on a slide deck but are most sensitive to utilization and financing: levered, single-tenant/single-region data-center projects without secured power; anyone underwriting perpetual scarcity pricing; and utilities in jurisdictions where regulators won’t let them earn a fair return for modernizing the network. One more layer: if data-center load growth continues to surge, the political risk rises (ratepayer backlash, permitting fights, who pays for upgrades)—and that tends to hit the weakest regulatory setups first, not the strongest engineering teams.

Takeaways

Don’t trade “AI,” trade the constraint. The grid is the bottleneck—and bottlenecks create pricing power. Track backlogs, lead times, and capex plans; when those stay tight even as AI headlines wobble, that’s your confirmation.

Separate “grid” from “data-center beta.” Some names are structural grid rebuild plays; others are implicitly a bet on always-full data halls. In an AI slowdown, the latter derate first.

Watch the transmission buildout and interconnect politics. BNEF is telling you the grid needs materially more investment vs. the last few years; the projects that clear permitting and get financed are where the equity wins cluster.

Reality check on the “bubble” framing: if you want a clean, sourced way to say this on one line: BNEF’s math implies AI matters, but the grid capex cycle is bigger than AI.

If you want “must-own” exposure to the grid-tech melt-up (AI + electrification + aging infrastructure), I’d focus on the bottlenecks where pricing power shows up: switchgear/transformers, cables, and data-center power & cooling. The IEA expects data-center electricity demand to more than double by 2030 (AI is a big driver), which is why “grid spend” is turning into a multi-year constraint story—not a one-quarter AI trade.

My “must-own” shortlist (liquid, category leaders)

Eaton (ETN) — one of the cleanest “electrification toll collectors” (power distribution, breakers/switchgear, data-center electrical content).

Schneider Electric (SU.PA / SBGSY) — grid + data-center energy management + automation; big installed base = durable retrofit cycle.

ABB (ABB) — electrification + grid automation exposure; benefits from T&D capex and industrial electrification.

Quanta Services (PWR) — the “picks-and-shovels” contractor for transmission buildouts, interconnects, grid hardening.

Vertiv (VRT) — most direct AI data-center grid-adjacent play (power, thermal, and infrastructure that scales with AI load growth).

High-torque satellites (bigger upside, more cyclicality)

Hubbell (HUBB) — grid components + T&D gear; steadier than most small caps.

Prysmian (PRYMY / PRY.MI) — HV/DC cables are a global chokepoint (interconnect + renewables + grid expansion).

nVent (NVT) — enclosures/thermal/electrical for data centers + industrial electrification.

Myr Group (MYRG) / Primoris (PRIM) — more “beta” to U.S. T&D project cadence.

Korea (harder access, but pure grid torque): Hyosung Heavy Industries / LS Electric — transformer/switchgear winners when global supply is tight.

How I’d frame winners vs. losers:

Winners: companies selling scarce, long-lead-time grid hardware (transformers/switchgear/cables) and data-center power & cooling—they can keep price, extend backlog, and compound through the cycle.

Losers (relative): “nice story, no bottleneck” grid-adjacent names with weak pricing power; and anything that’s AI-only without the broader electrification tailwind (those get punished hardest if AI capex wobbles).

News vs. Noise: What’s Moving Markets Today

ORCL/AVGO are the “tell” this week, not the Fed headline. Yes, the Dec 9–10 FOMC will move rates, but the market’s real argument is whether AI demand is broadening beyond Nvidia in a way that shows up in other companies’ P&Ls. That’s why Oracle (reports Dec 10) and Broadcom (reports Dec 11) matter more than a quarter-point cut: they sit right on the fault line of the “Google complex vs OpenAI complex” narrative, and both are now priced like beneficiaries.

Oracle is the balance-sheet barometer for “AI on other people’s books.” The market will care less about EPS optics and more about (1) OCI growth + RPO/backlog momentum, (2) capex intensity and whether buildouts are pulling forward or slipping, and (3) any color on customer concentration/contract duration. If OCI demand and backlog accelerate, it validates that AI factories are real and that Oracle’s data-center war chest can compound (even if the “who wins the model war” stays uncertain). If guidance suggests timing risk, slower ramp, or heavier reliance on a small set of AI counterparties, the ripple won’t stop at ORCL—it hits the whole “levered AI infra” complex (neoclouds, power/cooling, and anyone living off perpetual utilization assumptions).

Broadcom is the cleanest public proxy for the unbundling trade. Watch for AI semiconductor revenue trajectory, custom silicon commentary (design win cadence), and—critically—networking attach (the pipes: switches, interconnect, optics) which tends to persist even as compute vendor share rotates. Here’s the key setup: AVGO has already rerated hard, so “good” may not be enough—what matters is whether guidance implies incremental upside vs what the stock already priced since Gemini 3. A merely-solid print can still sell off if expectations got ahead of reality; a strong guide can cement the idea that the profit pool is migrating from “one GPU monopoly” to “custom silicon + networking + foundry capacity.”

Concrete takeaways to give investors

This week’s real trade is earnings reaction in ORCL/AVGO, not the Fed headline. If they beat and still fade, that’s your signal positioning/expectations are the risk.

For ORCL: prioritize OCI growth, RPO/backlog, and capex/run-rate commentary over GAAP/adj EPS noise.

For AVGO: the “tell” is guidance on AI + custom silicon pipeline and networking growth—this is how the market will price “Nvidia vs everybody” in 2026.

Don’t ignore the supply-chain check: TSMC’s November sales hit Wednesday (Dec 10)—a real-time pulse on leading-edge demand.

Fed angle: even if the Fed cuts, the long end can stay sticky if global duration (Japan/Europe) keeps pushing term premium up—so the market needs earnings-proof of AI cash flows to offset a less-helpful discount-rate backdrop.

One other thing I’m hearing is that ChatGPT 5.2 is coming this week. I’ve noticed that 5.1 has been a bit pedestrian the past couple of days, which I think usually happens before a new release. Rumor has it that it will be on par, or better than Gemini 3. Could have an impact on GOOGL and NVDA.

Speaking of NVDA…..

A Stock I’m Watching

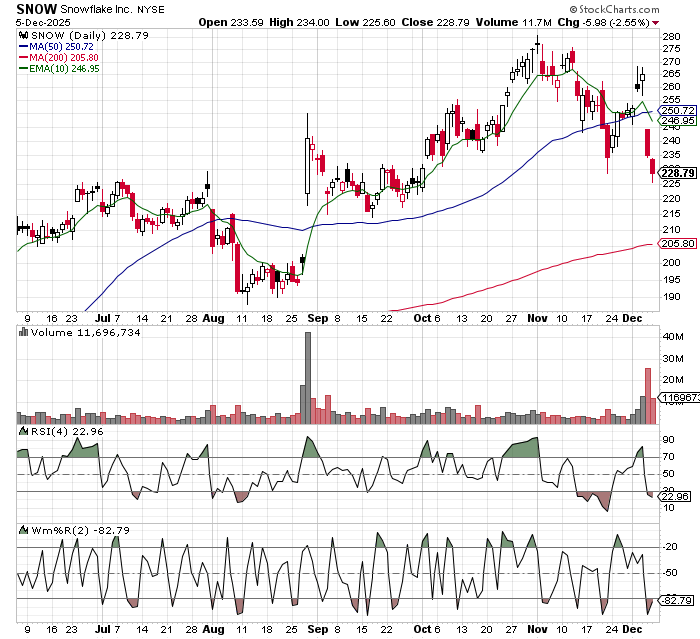

Today stock is Snow Flake (SNOW)…..

SNOW is on my “watch, don’t chase” list because it’s a pure play on the next phase of AI spend: not chips, but data consumption. As agentic AI moves from demos to production, companies don’t just need models — they need governed, permissioned, queryable data at scale, and Snowflake sits right on that “data gravity” layer where usage-based dollars show up fastest when workloads ramp. The bull case is simple: if consumption re-accelerates (more queries, more workloads, more AI apps running on top), Snowflake’s model turns that into revenue with real operating leverage, and the multiple follows. The bear case is also clear: Databricks coexistence, cloud cost scrutiny, and any wobble in big-customer expansions can keep growth “lumpy.” What I’m watching quarter to quarter: net revenue retention/expansion, remaining performance obligations, product revenue growth vs expectations, and AI product/partner traction translating into measurable consumption—because for SNOW, the tell is always the meter running, not the narrative.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Tuesday December 9, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.