I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) December 9 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

I recently had the privilege of presenting the H.E.A.T. Formula at the 2025 Big Sky AI Forum. They also created this white paper for the event….

The moment I saw that AI could help me create a portfolio based on exactly what I wanted, parse Wall Street research and news stories in light of my investment strategy, and give me personalized investment advice, I knew it was going to be a game changer……

Your Next Edge Isn’t a Stock Pick, It’s an AI Co‑Pilot

For most of investing history, the game was simple in theory: read more, think harder, find the thing other people missed. Buffett had Moody’s manuals, Fidelity managers had stacks of 10‑Ks and channel checks, and the edge came from seeing the mosaic before the crowd. That world is gone. Between the internet, real‑time data, Bloomberg, and now models like ChatGPT, there is almost no “secret” information left in public markets. Anything in a filing, a transcript, or a widely used data set is, in principle, knowable by everyone instantly. The question shifts from “what do I know that others don’t?” to “what can I synthesize and act on faster and more coherently than others?” That’s where AI becomes a portfolio tool, not a stock story. The most powerful use of AI in investing won’t be picking a single ticker for you – it’s redesigning how you build, update, and stress‑test a portfolio in a world where informational edge is disappearing.

Start with themes. Traditional process: read a few headlines, skim a strategist note, maybe listen to a podcast or two, and decide “AI” or “onshoring” or “GLP‑1s” are important. An AI‑augmented process says: crawl thousands of earnings transcripts, macro reports, and regulatory filings; map which words, capex lines, and product roadmaps are accelerating; and let the model surface which themes are gaining real capital, not just narrative heat. You can literally ask an AI system to answer questions like, “Which industries have seen the fastest growth in mentions of ‘semiconductor shortages’ and ‘AI inference’ in earnings calls over the last six quarters?” or “Which regions are seeing the most commentary on grid constraints and data centers?” That’s not magic, it’s text and time‑series analysis at scale. Same for healthcare: you can point AI at trial registries, conference abstracts, and FDA calendars to map where money, patents, and breakthroughs are clustering. The edge shifts from guessing the next hot theme to systematically scanning the world and letting the model tell you where the heat is building.

Then you drill down from theme to winners. Historically, “finding the winner” meant a human analyst trying to hold a dozen variables in their head: balance sheet, moat, management, product, valuation. AI lets you run that playbook on an entire sector, in parallel. You can have a model read every 10‑K, 10‑Q, and transcript in a theme basket and score each company on things like pricing power language, capital discipline, alignment between what management promised and what they delivered, or how often competitors mention them as a threat. You can combine that with structured data – margins, R&D intensity, share count, free cash flow – and ask the model to rank the names by “durable compounder,” “high‑beta call option,” or “story stock with no cash engine.” You’re not outsourcing judgment; you’re outsourcing the grunt work. The human job becomes deciding whether you want the stable cash‑flow anchor in a theme, the speculative upside, or some barbell of both – and then sizing accordingly.

On top of that, AI completely changes how you digest research and news. Instead of reading 20 Wall Street notes on the same company, you can have an AI system summarize the key points, highlight where the analysts disagree, and flag what’s actually new versus what has been said for six quarters straight. You can feed in news flows, blog posts, and social chatter and ask, “What changed in the consensus view of this stock in the last week?” or “Which risks are consistently mentioned in footnotes but never in headlines?” The old game of “fundamental analysis” as reading faster and more than the next PM is gone. Everyone has the same firehose; the edge is in having a machine filter it for signal and contradiction so you can focus on the decisions that matter: do I add, cut, hedge, or ignore? Traditional bottom‑up stock picking that pretends the internet, Bloomberg, and large language models don’t exist is, in my view, structurally obsolete. You might get lucky for a while, but you are competing against tools that never sleep and can read everything.

Finally, AI doesn’t just help you find themes and names; it can help design the strategy itself. You can ask a model to generate candidate rules for a portfolio – “show me ten ways to express a view that AI infra is over‑owned but healthcare AI is under‑owned, using ETFs, options, and position sizing constraints” – and then take those candidate strategies into a proper backtest environment. You can simulate how your portfolio would have behaved in past regimes: rising rates, volatility spikes, credit scares. You can use AI to suggest hedge structures (ratio spreads, collars, tail hedges) consistent with your risk budget, and then evaluate them quantitatively before you put any real capital at risk. None of this means you set it and forget it. AI will happily overfit, hallucinate, and optimize to the past if you let it. Your edge is knowing the difference between a backtest and reality, between clever and fragile. But the investors who combine clear goals, risk discipline, and a healthy skepticism with AI‑driven discovery, filtering, and strategy design are going to run circles around those still trying to win by reading one more 10‑K than the next person. In a world where information is effectively free and infinite, the advantage shifts to whoever builds the best human‑plus‑machine process. That’s the portfolio design problem AI is about to rewrite.

News vs. Noise: What’s Moving Markets Today

For a long time I have been telling you that the key to this bull market was massive AI capex and a dovish Fed. NVDAs earnings kept the AI capex hope alive, Fed minutes were less helpful for the bulls…..

Two Signals, One Tape: NVDA Says “Full Speed,” the Fed Says “Go Slow”

The news: Nvidia’s print was a clean validation that AI capex is still accelerating. Record revenue, stronger guidance, data‑center sales now the franchise, and margins holding in the mid‑70s all say the build‑out remains intact.

The drivers were real—Blackwell ramp, networking attach, sovereign AI—and while receivables jumped, that’s a working‑capital artifact of hyperscaler procurement cycles, not the reason EPS beat. The important caveats are known but manageable near‑term: China remains restricted, “circular” vendor financing must be watched, and headline partnerships (e.g., OpenAI) are still moving from intent to binding contracts. Net: the AI infrastructure flywheel just bought itself more time.

The news: the Fed minutes leaned hawkish. “Many” favored holding in December, “several” were open to a cut; the committee is split and data‑dependent with a bias to proceed slowly. Markets now price only a small chance of a December move and the 10‑year is already near 4.15–4.20%, so the upside in yields from here looks limited unless labor data surprises hot. Your base case should be “tight for longer than hoped, easing when jobs weaken,” with November payrolls (Dec 5) as the swing vote.

In other words, AI capex momentum just strengthened while the policy put stayed farther out of the money. What’s noise: hand‑wringing that Nvidia “manufactured” the beat via receivables; that’s not consistent with margin resilience and order visibility. Also noise: treating the December meeting as a binary risk event. Whether the cut comes in December or January matters less than the path—policy is still migrating toward neutral if employment cools.

What matters: the clash between durable AI spend and a slower, more conditional Fed reaction function. The playbook: lean into quality inside AI, hedge the macro. If you want beta, SMH works; if you want idiosyncratic upside with discipline, use call spreads or call ratio spreads in NVDA/SMH rather than max‑delta calls. Upgrade the “arms dealers” with real pricing power and operating leverage—think networking and power/cooling (ANET, AVGO, VRT) and select server beneficiaries (DELL/HPE on pullbacks). Avoid balance‑sheet stretch and business models that depend on perpetual vendor credit; be selective with GPU lessors or highly levered infra plays until credit spreads calm.

Pair that with an index hedge that respects Fed risk: 1–2 month put spreads in SPX/QQQ sized to cover a portion of your equity beta, or a small daily 0DTE put ratio spread overlay to pick up tail risk on shock days.

Bottom line: your market rally still hangs on two pillars—AI capex and a dovish Fed. This week said the first pillar is sturdier than feared, the second is farther away than hoped. Position for continued AI strength with defined risk, and buy yourself time with hedges that let you stay in the trade if the minutes turn into tighter financial conditions before the cut arrives.

A Stock I’m Watching

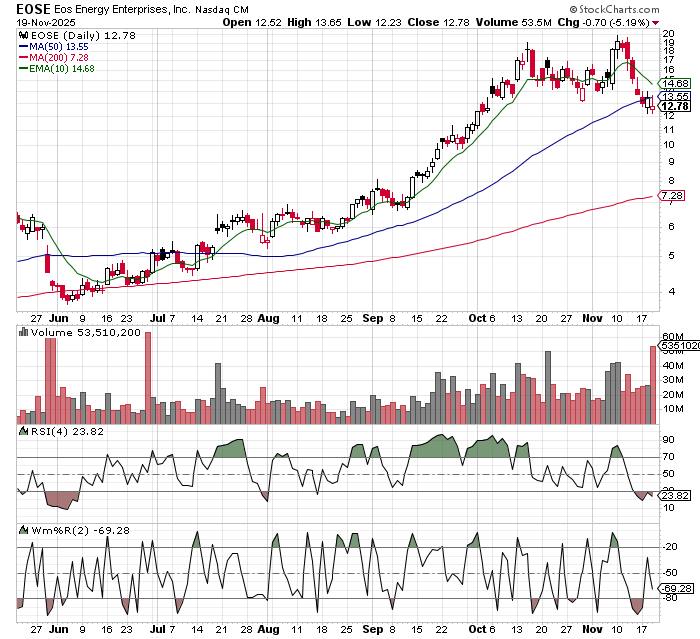

Today’s stock is Eos Energy (EOSE)…..

The investment thesis is that Eos could be a long-term winner of the energy transition – its product is aligned with a massive addressable market (grid storage for renewables, which is growing due to clean energy mandates and the rise of AI/data center power needs). There is a strong strategic rationale to own a company like Eos if one believes in the secular shift to carbon-free grids and the inadequacy of lithium-ion alone to get us there. Eos offers pure-play exposure to that thesis with a unique technology. Every indication (backlog, partnerships, government support) suggests that if the company executes, it can scale rapidly and improve its financial profile dramatically in the next 12–36 months.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Tuesday December 9, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.