I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Table of Contents

H.E.A.T.

Gold, along with silver and crypto, is a big part of the H.E.A.T. Formula. Gold has been taking it on the chin the past few days, in today’s newsletter we talk about why this is probably a normal pullback in a bull market.

The Gold Reset: Why the Pullback Is Just Noise in a Structural Bull Market

Gold has been hit hard in recent weeks, retreating from its record highs near $4,350 back toward $4,000. The headlines will frame this as a “burst bubble” or the start of a correction, but that misses the real story. The structural demand for gold has never been stronger—and it’s not coming from the same buyers that used to drive the market.

The new demand base

The most important shift in gold’s ecosystem is who’s buying. Central banks—especially in emerging markets—have purchased more than 1,000 tonnes of gold annually since 2022. This is not cyclical, price-sensitive buying. It’s a deliberate reallocation of reserves after the freezing of Russia’s central bank assets made clear that sovereign FX reserves can be weaponized. Gold, unlike Treasuries or euros, carries no counterparty risk.

These official-sector flows are now the backbone of the market. Central banks aren’t buying dips to flip—they’re accumulating to diversify reserves. That’s why even after a $350 correction, gold is holding near $4,000: the marginal buyer isn’t a retail ETF trader, it’s the People’s Bank of China or the Reserve Bank of India.

Financial repression = quiet support

The fiscal math globally doesn’t work without some degree of financial repression—keeping real rates below nominal GDP growth to erode debt loads. Gold thrives in those environments. It’s no coincidence that gold rose nearly $1,000 per ounce in 2024, even as nominal yields climbed. Markets are learning that gold can now rise alongside yields, breaking the old inverse correlation. In other words, gold’s valuation is increasingly driven by structural flows and macro hedging, not by the old “real yield” model.

Why the selloff is noise

The recent weakness likely reflects ETF profit-taking and CTA rebalancing, not a breakdown in fundamentals. ETF holdings remain well below previous-cycle highs, meaning Western investors haven’t even reentered the trade in size. If macro volatility or currency stress returns, there’s ample room for ETF inflows to reinforce the central-bank bid.

Meanwhile, gold’s so-called “expensiveness” is a mirage. Structural buyers have low price sensitivity—they’re not waiting for dips. This is why gold has begun to trade like a reserve asset, not a speculative one.

Key watchpoints

EU/G7 actions on frozen Russian assets — any legal precedent that confirms reserves are fair game will further accelerate diversification into gold.

Real yield trajectory — if inflation proves sticky while central banks cut rates, that’s gold’s ideal setup.

Asian central bank activity — continued buying from China, India, and the Middle East signals the long game is intact.

ETF and CTA flows — Western investors are still underweight. A rotation back into gold-backed ETFs could power the next leg higher.

Investment implications

Gold is evolving into the core hedge of a multipolar financial system—a structural alternative to sovereign paper, not just a commodity trade. The short-term corrections are positioning noise within a secular uptrend. Investors should treat pullbacks as opportunities, not reversals, and focus on the assets that gain from structural gold demand: physical gold exposure (GLD, IAU, PHYS), producers with disciplined balance sheets (NEM, AEM, GOLD), and royalty models (FNV, WPM) that can compound regardless of spot volatility.

Bottom line:

This isn’t 2011 or 2020. Gold’s strength isn’t speculative—it’s systemic. The marginal buyer is a central bank diversifying away from the dollar, not a retail investor chasing momentum. The market may wobble short term, but the structural case for gold remains bulletproof.

Of course we put our money where our mouth is….

News vs. Noise: What’s Moving Markets Today

FOMC Preview: Cuts, QT, and the Quiet Battle Over Liquidity

The Fed announces the results of it’s meeting today, and while most of Wall Street expects another 25bp rate cut, the real story isn’t the cut—it’s what comes next for the balance sheet. With the government shutdown delaying key data releases, Powell and company are flying partially blind, which means their outlook likely hasn’t changed much since September. But markets are less interested in another “risk management” cut and more focused on whether the Fed will end Quantitative Tightening (QT)—the runoff of Treasuries and mortgage-backed securities that has been quietly draining liquidity from the system.

What’s expected

Rate cut: 25bp to the Fed funds range, taking it another notch lower in the current easing cycle. Powell will emphasize “meeting-by-meeting” flexibility, “two-way risk management,” and the Fed’s continued watch on inflation and labor.

Tone: With inflation mixed and growth resilient, Powell is unlikely to sound alarmist. Expect him to cite progress but warn about lingering services inflation and tight labor markets.

QT watch: This is the wildcard. Markets increasingly expect an announcement to end QT now, but the base case is still December. If the Fed pulls the trigger early, it would effectively be a stealth easing, adding liquidity without cutting rates more aggressively.

Why QT matters

Ending QT would mark the end of the Fed’s liquidity drain—and could have a bigger market impact than the rate cut itself. QT runoff has been quietly pressuring front-end funding markets, repo spreads, and bank reserves. A formal end to QT (or guidance toward it) could steepen the yield curve, narrow credit spreads, and trigger a short-term rally in risk assets, especially in financials and liquidity-sensitive names.

What investors need to watch

Powell’s QT language — Does he hint that the end is near, or does he push it to December? Even subtle changes in tone could shift market expectations.

Funding markets — Watch repo spreads and SOFR/FF basis for clues on liquidity stress. A surprise end to QT could relieve funding pressure and lift the front end.

The curve reaction — A dovish QT announcement likely triggers bull steepening; no action could flatten it.

Risk assets — If QT ends, expect an initial pop in equities, especially liquidity-sensitive sectors (tech, small caps, and financials). But the market may fade the move as traders sell the “fact.”

Investment takeaway

A 25bp cut is priced in; QT guidance is the true swing factor. If the Fed signals an early end, expect a short-term rally in risk and a steepening in the curve. If it punts to December, the disappointment trade could pull yields lower temporarily but tighten financial conditions again.

Bottom line: The Fed may be easing quietly through liquidity rather than rates. The direction of QT—and Powell’s tone on balance-sheet policy—will tell you how much fuel is left in this rally.

A Stock I’m Watching

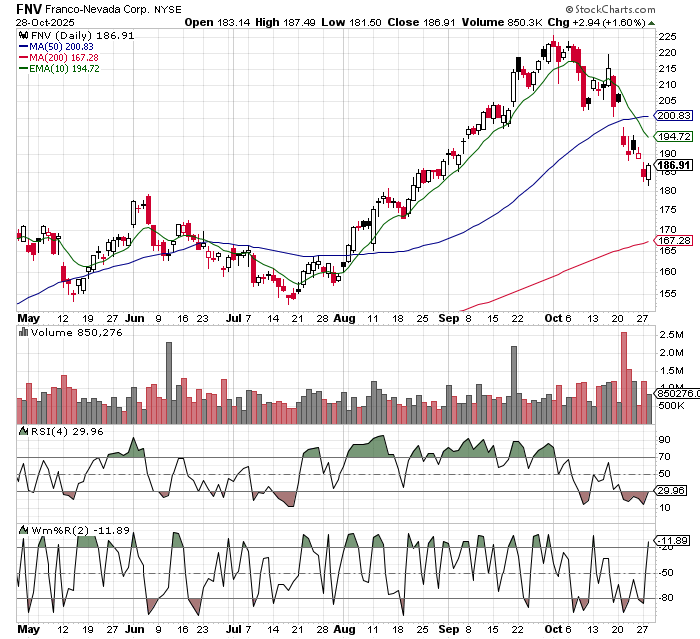

Today’s stock is Franco Nevada (FNV)….

This keeps with our gold theme today. I think people should have some physical gold ETFs but also some gold miners and specifically gold royalty companies.

Gold royalty companies like Franco-Nevada (FNV) offer exposure to gold prices without the headaches of mining. Instead of digging metal out of the ground, they finance miners in exchange for a small percentage of future production or revenue. That means they get paid as long as the mine produces—without taking on operating costs, labor issues, or environmental risk. The result is a business model that’s more stable, more profitable, and less volatile than traditional gold miners like Barrick or Newmont. In a world where inflation and fiscal risk remain stubborn, FNV and other royalty names are becoming the “cash flow kings” of the gold sector—offering gold exposure with dividend consistency and almost no operational drama.

In Case You Missed It

In yesterday’s Financial H.E.A.T. Podcast we talked with professor Russell Rhoads about all things options. Russell is one of the real experts out there, of course we talk about covered calls and put writing, but we also geek about a bit on some more advanced strategies. Click HERE to watch the episode

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.