The H.E.A.T. Formula is a radically different way to look at investing your portfolio.

H- Hedges, you should always have hedges and be agnostic as to being long or short. Bonds are not a hedge

E-Edges, you should always look for edges. Preferably these are edges with some sort of psychological underpinning, structural edges, or some sort of barrier to entry.

A-Asymmetric. Everything you do, be it trades or your overall portfolio, should be designed so that heads you win a lot, tails you lose a little.

T-Themes. You should always be invested in the top themes. Most everything else is just noise.

Our Next Webinar

Uncovering Hidden Themes with AI: How DeepSeek Is Rewriting the Investment Playbook

Thu, Feb 27, 2025 2:00 PM - 3:00 PM EST

1. Bullets From DeepSeek to Disruptors: Explore how one AI breakthrough (DeepSeek) reveals cost-effective strategies and under-the-radar opportunities beyond mainstream tech giants.

2. Finding Alpha in the Noise: Learn how AI-driven data-mining cuts through market hype and identifies genuine growth catalysts—even in emerging or overlooked sectors.

3. Comparing & Contrasting Strategies: Discover how to harness AI to evaluate different investment approaches.

Rebel Finance Podcast

Market Recap

That was ugly. Cracks had been forming but looks like three news stories pushed the market over the edge. The first was a new Covid like variant out of China. The second was news that a crypto broker was hacked and a ton of Ether was stolen.

Crypto exchange Bybit suffers $1.4 billion hack. Here’s why it’s troubling for the industry.-MarketWatch

Up until then you had a rally on the SEC dropping the Coinbase lawsuit. The third may have been this….

Then there’s tariffs and maybe DOGE….

“I’m actually pretty negative for the first time in a while,” Cohen said. “It may only last a year or so, but it’s definitely a period where I think the best gains have been had and wouldn’t surprise me to see a significant correction.”

Sometimes when the market tanks like that in a day it can obscure some potentially important moves. One thing I have been noticing is the move in the agentic AI/software names. They spiked on the DeepSeek news as the thinking is that they would benefit most if AI was less expensive. CRM is a great example, they had an immediate spike, people took profits, the 50 day held, and then it started to break down. Yesterday was really just part of what looks like a larger move.

Another area of interest is the nuclear names. SMR sold off big yesterday, but it started breaking down a few days ago….

Same with CCJ….

Back to the tweet about MSFT, interestingly some of the main data center names such as DLR and CEG really didn’t break down until yesterday….

It’s obviously too early to discern what this means yet, except that extreme caution is warranted. If we are going to get Covid II, we’ve seen that playbook, eventually you buy the dip, but not right now. If Microsoft is backing out of capex, that changes the game for a lot of the infrastructure names.

The only real strength Friday was China (which is red this morning).

Looking at SPY you really want the 50 day told hold if you are a bull. It tested it and closed off the low on Friday….

Small caps look worse and IWM needs to hold the 200 day.

Anytime the media is telling you now is the time to buy small caps please resist the urge to buy IWM. It is a crappily designed index. What I like to do within themes is always have the large cap leaders as core holdings and then sprinkle in some of the small caps.

Finally, be careful of nice green opens after a big selloff. Investors who didn’t sell during the selloff often use the pop to do so.

Investing Lesson of the Day

ETFs are great, either as an access vehicle, trading vehicle, or portfolio building block. I have never seen an ETF model portfolio that didn’t suck however…..

The industry is still locked into the same old asset allocation advice that doesn’t work. If you are a financial advisor who wants some help getting away from the traditional crap out there feel free to reach out.

ETF Spotlight

Regional banks took it on the chin Friday.

I had GPT opine on this article and the rumor that Microsoft was trying to slow down it’s capex. If GPT is right, then we are going to have a great dip buying opportunity here…..

AI Spending Is NOT Slowing – Ignore the Microsoft Capex Rumors and Follow the Money

🚀 Wall Street has been buzzing with rumors that Microsoft (MSFT) might be pulling back on AI capex. Let’s get real: This is pure noise.

If you believe AI demand is slowing, you’re about to get run over by what’s coming.

This award-winning newsletter is about facts, not fear-mongering—let’s break down why AI spending is just getting started and where the real money is flowing.

📊 Why AI Capex is Only Going Higher

1️⃣ The AI Model Shift to "Reasoning" Means MORE Compute, Not Less

Early AI models relied on pre-trained LLMs, meaning they mostly used data centers for training.

Now, AI agents and reasoning models require 100X more compute to generate results in real-time.

Translation: AI usage is shifting from training to constant inference demand—which requires exponentially more power, chips, and data centers.

🔮 Key Stat: NVIDIA says next-gen reasoning models will require 100x the compute of traditional AI models.

The idea that AI workloads will "slow down" is dead on arrival.

2️⃣ Microsoft (MSFT), Google (GOOGL), and Meta (META) Are Going ALL IN on AI Infrastructure

MSFT, GOOGL, and META are projected to spend $215 BILLION in 2025 on AI capex.

That’s a 45% YoY increase—and they wouldn’t do this unless they expected a MASSIVE return.

Even if some efficiency improvements emerge, AI demand is scaling so fast that capex has to keep rising.

🔮 Key Fact: If AI models become 10x more efficient but usage grows 100x, we still need 10x more AI infrastructure.

3️⃣ Microsoft Capex Cut Rumors? They’re False.

MSFT is NOT cutting AI capex.

CEO Satya Nadella just confirmed that capacity constraints are still a problem—and Microsoft needs MORE servers, not fewer.

The DeepSeek panic (where investors thought AI training would be cheaper) has already reversed—everyone now understands reasoning models will drive MORE demand.

🚨 Translation: The rumors that Microsoft is "backing off AI spending" are flat-out wrong.

🔥 Who Benefits Most from the AI Capex Explosion?

Forget the noise—these are the real winners.

🚀 Final Verdict: AI Spending Is Only Going Up

📌 Microsoft is NOT pulling back.📌 AI reasoning models are 100x more compute-intensive than older AI models.📌 Cloud giants are spending $215B in AI capex this year—up 45%.

🔥 Ignore the noise—AI infrastructure is still in the early innings. The real winners are NVDA, AVGO, SMCI, EQIX, TSM, and CEG.

Alibaba Group Holding Ltd. pledged to invest more than 380 billion yuan ($53 billion) on AI infrastructure such as data centers over the next three years, a major commitment that underscores the e-commerce pioneer’s ambitions of becoming a leader in artificial intelligence.

Probably also explains why GDS is doing so well. China stocks are pulling back this morning. If you are in them already you may want to take some profits. If you missed it, then I would probably wait a couple of days. I am kind of thinking of potentially selling some puts under key support levels, but we will see how it plays out.

Quantum is beyond me, so I had GPT and Grok 3 analyze this article and give me a probability that quantum is close.

GPT…..

Balancing both perspectives, I estimate the probability of achieving practical quantum computing within the next decade at approximately 30%. This accounts for the promising advancements represented by Microsoft's Majorana 1 chip, tempered by the historical and technical challenges inherent in the field. Continuous research, peer validation, and technological innovations will be critical in determining the actual timeline.

In summary, while Microsoft's announcement marks a noteworthy advance, the journey to operational quantum computing is fraught with scientific and engineering challenges. A cautious yet optimistic outlook suggests that while significant progress is being made, widespread practical applications may still be a decade or more away.

Grok 3…..

Conclusion: Decades More Likely, But Microsoft's Approach Warrants Attention

While Microsoft's announcement is intriguing and could represent a step forward, the probability that practical quantum computing is just a few years away remains low—around 20%. The skepticism from physicists, the lack of conclusive data, and the broader challenges in quantum computing suggest that we are still likely decades away (80% probability) from seeing quantum computers solve real-world problems at scale.

However, Microsoft's focus on topological qubits is a promising avenue that could eventually pay off. Investors and tech enthusiasts should monitor future developments, particularly:

Peer-reviewed publications or third-party validations of Microsoft's claims.

Presentations at upcoming conferences, such as the American Physical Society meeting in March 2025, where Microsoft plans to share more results.

For now, the establishment narrative of quantum computing being a long-term play remains the most credible. As always, I recommend staying updated on this rapidly evolving field, as new breakthroughs could shift the timeline.

Could be why MSFT didn’t move much on the news the other day

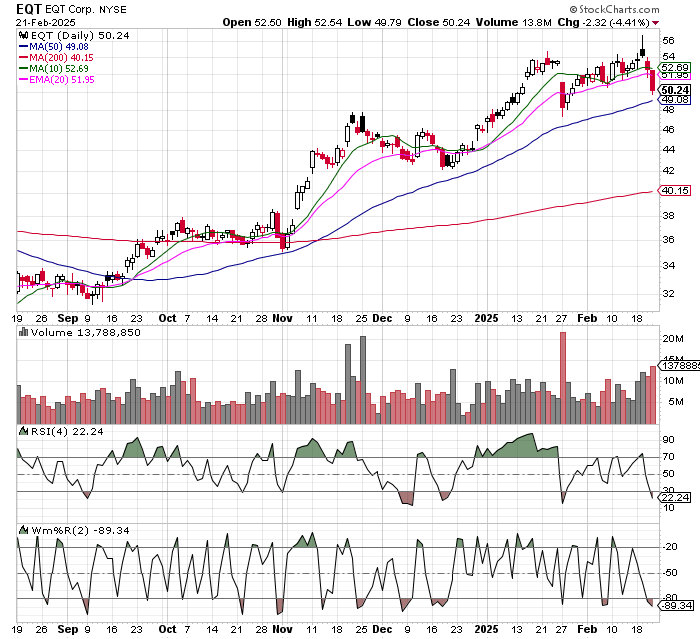

Maybe this is why nuclear has been selling off. Of course so did EQT, but it looks much stronger than a bunch of the other energy names….

Don’t think I’d be buying up here but maybe on a dip into the 50 day or the $48 area. One thing that would concern me is that this stock has already had a massive run. If he is right, can multiples on a natural gas stock expand enough to make this a worthwhile buy. GPT thinks so….

🚀 Final Rating:

Short-Term (3-6 Months): 7.5/10 (Oversold bounce play)

Long-Term (12+ Months): 8.5/10 (If AI gas demand plays out)

Potential to Double in 12-18 Months? 6.5/10 (Needs major AI capex shift toward gas)

🔥 FINAL VERDICT: Short-term, EQT is an oversold bounce play. Long-term, if AI demand for natural gas accelerates, EQT’s multiple could expand significantly.

📌 Trade Plan:✅ Buy Zone: $48-$50 (Oversold, near support)❌ Stop Loss: Below $45 (Breaks key trend)🎯 Target: $60+ if AI demand narrative accelerates

💡 Short-term, this is a high-probability bounce trade. Long-term, it depends on how fast AI gas demand materializes.

Natural gas has been flying as well…..

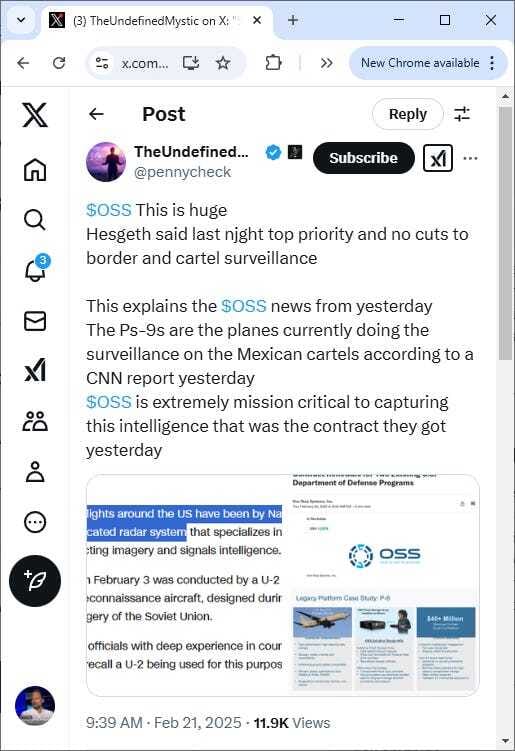

One Stop Systems (OSS): Capitalizing on Defense Contracts in AI Edge Computing

One of the themes I’m watching is the changes to defense, so this tweet got my attention…..

I ran it through GPT and Grok 3…..

GPT….

Opportunity Rating: 8/10

OSS's recent DoD contract renewals and its specialized focus on AI edge computing solutions for defense applications position it well for sustained growth. The company's established relationships and technological integrations within critical defense programs suggest a robust opportunity for investors seeking exposure in the defense technology sector.

Grok 3….

Investment Opportunity Rating: 7/10

After weighing these factors, I rate the investment opportunity for One Stop Systems at 7 out of 10. Here’s the breakdown:

Upside Drivers: The DoD’s emphasis on open-source software aligns strongly with OSS’s expertise in edge computing and AI systems. Existing contracts and a focus on ruggedized solutions position OSS to capture growth in this thematic shift.

Growth Potential: If OSS leverages its niche effectively, it could secure additional contracts and expand its role in the defense ecosystem, driving revenue and market recognition.

Balancing Factors: Competitive pressures from larger players, inconsistent profitability, and reliance on government spending temper the opportunity.

This rating reflects a compelling thematic fit with notable upside, balanced against execution risks and market dynamics. For a thematic investor like yourself, OSS represents a high-potential play on the convergence of open-source adoption and edge computing in defense—worthy of consideration for your newsletter audience, provided they’re comfortable with the associated risks.

The chart is interesting, but not as interesting as it was on Thursday, this goes on the watchlist…..

SkyWater Technology (SKYT)

Another tweet that caught my eye from the same account….

GPT….

Opportunity Rating: 8.5/10

SkyWater Technology stands at a critical intersection of burgeoning quantum computing developments and heightened national security concerns. Its strategic partnerships, government endorsements, and unique market position suggest a promising growth trajectory, making it a compelling consideration for thematic investors focusing on advanced technologies and defense sectors.

Grok 3….

Rating: 8/10

After weighing these factors, I rate SkyWater Technology ($SKYT) an 8 out of 10 as an investment opportunity. Here’s the breakdown:

Government Support (9/10): SKYT’s DoD accreditation and CHIPS Act funding provide a strong tailwind, aligning perfectly with the U.S. reshoring push.

Quantum Computing (7/10): Its leadership in quantum chip production is a high-upside opportunity, tempered by the market’s early stage.

Competitive Position (7/10): SKYT’s niche focus and TaaS model are advantages, but it’s still a small fish in a big pond.

Financials (6/10): Diversified revenue and government backing are strengths, but profitability and scale remain concerns.

Conclusion: $SKYT is a compelling pick for investors bullish on U.S. semiconductor reshoring and quantum computing’s future. The company rides huge market tailwinds, as the tweet suggests, but its smaller size and execution risks keep it from a perfect score. An 8/10 reflects its strong potential balanced against industry challenges—making it a solid buy for those comfortable with some volatility.

I like this chart if the 200 day can hold….

Before you go: Here are ways I can help

ETFs: We offer innovative ETFs that cover all aspects of The H.E.A.T. Formula, Hedges, Edges, and Themes.

Consulting: I'm happy to jump on the phone with financial advisors at no charge. I've built a wealth management firm and helped other advisors grow their practices through the use of substantially differentiated investment strategies. If you want to talk just send me an email at [email protected]

Monthly investing webinars

Rebel Finance Podcast

Wealth Management-Coming SoonThe views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades.TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.