@Simply_Sim1

Friday we launched 2X Robin Hood Ticker Symbol ROBN

The H.E.A.T. Formula is a radically different way to look at investing your portfolio.

H- Hedges, you should always have hedges and be agnostic as to being long or short. Bonds are not a hedge

E-Edges, you should always look for edges. Preferably these are edges with some sort of psychological underpinning, structural edges, or some sort of barrier to entry.

A-Asymmetric. Everything you do, be it trades or your overall portfolio, should be designed so that heads you win a lot, tails you lose a little.

T-Themes. You should always be invested in the top themes. Most everything else is just noise.

Our Next Webinar

Uncovering Hidden Themes with AI: How DeepSeek Is Rewriting the Investment Playbook

Thu, Feb 27, 2025 2:00 PM - 3:00 PM EST

1. Bullets From DeepSeek to Disruptors: Explore how one AI breakthrough (DeepSeek) reveals cost-effective strategies and under-the-radar opportunities beyond mainstream tech giants.

2. Finding Alpha in the Noise: Learn how AI-driven data-mining cuts through market hype and identifies genuine growth catalysts—even in emerging or overlooked sectors.

3. Comparing & Contrasting Strategies: Discover how to harness AI to evaluate different investment approaches.

YouTube Videos

We will be hosting The Watchlist every Thursday. Jeremy Vreeland (Bullish Bears) and I will be discussing stocks we are currently watching, buying, or shorting. We will also be discussing how to structure trades for asymmetrical returns and we will take your questions.

Click below to register for the next one:

Market Recap

I had almost forgotten how much fun trading stocks under a Trump administration was. You never had to worry about Joe Biden, but Trump is like the Fed speaker who you know may go off script, only difference is Fed speakers are scheduled, Trump could say something at any time. Right now the market seems to move on any mention of tariffs, which happened Friday when we went from nicely in the green to nicely in the red. Tariffs were announced over the weekend, and today is looking ugly at the moment.

Theoretically you could construct a tariff basket, the problem is you don’t know how much is real and how much is bluff. The answer to that could also turn on a dime. Friday I suggested possibly shorting a name like MGA. I didn’t do it, but it would have worked out great.

The oil names that I suggested maybe going long against it didn’t do so well though.

I do currently have puts in EWW. Technically I like that trade and you could see downside to $46.50.

I’ll continue to think of tariff hedges, the only problem I have to get around is entries are easy, it’s the exits that are problematic. I did ask GPT to give me a list of winners and losers (below).

From Jefferies this morning, I don’t disagree…..

How should we trade markets. As argued before the near term uncertainty should last a few days and potentially weeks. Hence, we have a cautious view short term. However, our medium term view remains that eventually tariffs will not be as bad as feared. Hence, we would be looking to buy the dip at some point, depending on how the negotiations evolve. Our medium term view still remains positive on risky assets.

DeepSeek also dominated the news last week. We still don’t know how it all plays out. We do know that AI is the future, but the future could be different than we thought a couple of weeks ago and less capital and energy intensive. Remember how the market works. Institutions who came into last Monday offside had to flip and they did, selling the energy and infrastructure and buying the software. If you are nimble, like my friend Jeremy Vreeland at Bullish Bears, you can play this. If you are not, then don’t get sucked into this, you need to let it play out.

A stock like CEG, which I own, was a good example. It sold off massively on the news and came back, but still well below where it was prior to the DeepSeek news.

If you bought CRM on Monday you probably have losses, but if you don’t own it, now could be a much better entry.

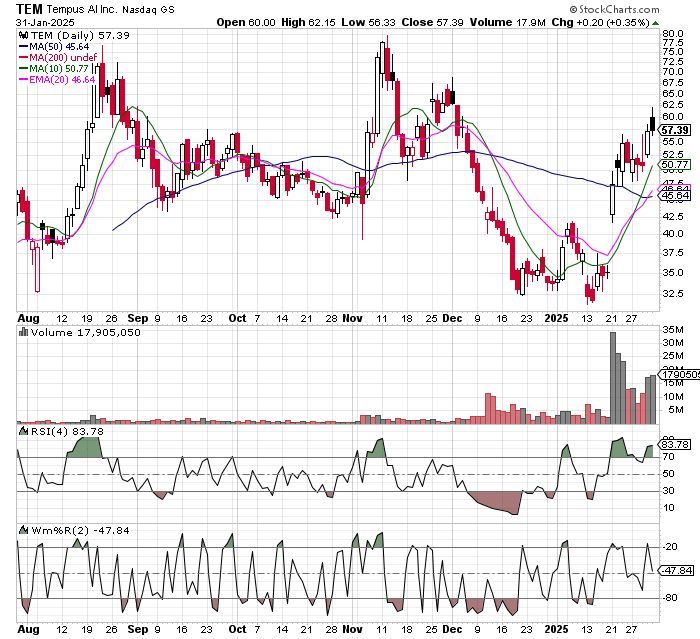

MSFT and META earnings calls gave the market a well needed reprieve, but this is going to dominate the AI trade for a bit. I still believe you want the energy and infrastructure plays, but you should be diversified across the spectrum. Remember, if the future of AI is cheaper then it will benefit all of the companies using it. AI healthcare is one example. Remember, Nancy Pelosi knows what she’s doing, she bought TEM for a reason.

Oh, and it’s a busy week for earnings with 26% of the companies in the S&P reporting.

Alphabet reports results on Tuesday. Results from Amazon are due Thursday. Along with any thoughts about the impact of DeepSeek, there will be also questions about what growth in Microsoft’s cloud business, after it disappointed disappointed investors last week, might mean for Alphabet and Amazon, whose AWS cloud-computing segment is a large sales driver.

Tariff Winners and Losers

I asked GPT for the impact of tariffs and potential winners and losers…

1. Macroeconomic & Sector Analysis

Scope of the Tariffs

25% on imports from Canada and Mexico, the largest U.S. trading partners.

10% on imports from China, a major supplier of electronics and industrial parts.

Immediate Macro Implications

Supply-Chain Disruptions: Automotive, energy, and produce supply chains in North America heavily integrate Canada, Mexico, and the United States. Tariffs can raise production costs, hamper cross-border manufacturing, and prompt potential retaliatory tariffs.

Consumer Price Inflation: Food (especially produce), gasoline, and vehicle prices could surge, compressing real consumer spending.

Risk of Retaliation: Mexico and Canada might impose their own tariffs on U.S. exports (autos, energy, agricultural goods). China may respond in kind, though it has more diversified trade relationships.

Longer-Term Effects

Reconfiguration of Supply Chains: If tariffs persist, some manufacturers might move production capacity domestically or to alternative low-tariff regions (e.g., Southeast Asia).

Shift in Commodity Flows: Canada and Mexico supply ~70% of U.S. crude. Tariffs could alter fueling patterns or push refiners to import from other countries, potentially raising costs and reducing margins for certain midstream players.

2. Potential Winners (8+ Rating)

A. Domestic Agricultural Producers

Calavo Growers (CVGW)

Rating: 8/10

Why: Mexico supplies ~60% of U.S. produce imports. If Mexican produce faces a 25% tariff, domestic or other non-tariff producers (e.g., California, Florida) could command higher prices.

Caveat: Avocado supply still heavily depends on Mexico, so look for partial shifts; big price hikes might also reduce total demand.

Sanderson Farms (SAFM) / Tyson Foods (TSN) (Poultry & Meat)

Rating: 8/10

Why: If Mexican meat imports face tariffs or cross-border supply chains are disrupted, U.S.-based meat producers might see a temporary advantage in domestic markets.

Caveat: Potential for higher feed costs if retaliatory actions or altered grain flows.

B. U.S. Steel & Aluminum Producers

Cleveland-Cliffs (CLF) / Nucor (NUE)

Rating: 8/10

Why: If Canada’s steel exports face a 25% tariff, domestic steel producers (especially those with integrated supply chains) can gain market share.

Caveat: Higher steel prices could also hamper downstream customers (autos, construction).

C. Domestic Oil Refiners With U.S. Crude Supply

PBF Energy (PBF) / Marathon Petroleum (MPC)

Rating: 8/10

Why: Tariffs on Canadian/Mexican crude might raise import costs, so refiners that source more from U.S. producers could gain an edge or pass along cost increases.

Caveat: Could also face supply constraints if Mexico retaliates on refined product imports. Net effect likely short-term positive if they have flexible sourcing.

D. U.S. Auto-Parts Suppliers With Minimal Cross-Border Exposure

American Axle & Manufacturing (AXL)

Rating: 8/10

Why: If parts from Mexico/Canada are more expensive, domestic auto-supply chains not reliant on cross-border flows could see new orders or pricing power.

Caveat: The entire auto sector may slow if retail vehicle prices surge.

3. Potential Losers (8+ Rating)

A. Auto Manufacturers & Integrated Supply Chains

General Motors (GM) / Ford (F)

Rating: 9/10

Why: U.S. vehicles rely heavily on cross-border parts from Canada/Mexico. A 25% tariff significantly raises costs, potentially adding $2,000+* to each vehicle.

Caveat: Might accelerate near-shoring or re-shoring expansions, but near-term margin pressure is high.

Toyota (TM), Honda (HMC) (large North American production presence)

Rating: 8/10

Why: While many Japanese OEMs build in the U.S., they often rely on Canadian/Mexican part flows. Tariffs hamper cost structure.

Caveat: Global production networks could mitigate some impact, but near-term headwind for North American profit.

B. Energy Companies Relying on Canadian & Mexican Imports/Exports

Valero (VLO) (Refiner heavily reliant on heavy Canadian crude)

Rating: 8/10

Why: If feedstock from Canada faces a steep tariff, refining margins can get squeezed or require pricey alternatives.

Caveat: Might pass some cost to consumers, but price spikes in gasoline might reduce demand.

Kinder Morgan (KMI) / TC Energy (TRP) (Pipelines)

Rating: 8/10

Why: North-south pipelines (U.S.-Canada, U.S.-Mexico) transport large volumes of crude/gas. Tariffs that reduce cross-border flows can decrease volume throughput.

Caveat: Long-term contracts may buffer near-term revenue, but new expansions or volumes could be stunted.

C. Food & Beverage Companies Dependent on Mexican Sourcing

Chipotle (CMG)

Rating: 8/10

Why: Relies heavily on fresh avocados, tomatoes, peppers from Mexico. A 25% tariff escalates costs, potentially hurting margins or forcing menu price hikes.

Caveat: Strong brand loyalty might let them pass cost increases to consumers, but near-term margin could be impacted.

Fresh Del Monte Produce (FDP)

Rating: 8/10

Why: Mexico is a key source for fresh produce. Higher import costs hamper FDP’s margins or force them to re-route supply from other countries at higher logistics costs.

4. Rating the Tariff-Driven Trend: 1–10

Trend Rating: 9/10

A 25% tariff is massive for heavily integrated supply chains in North America. This scale of disruption can significantly affect corporate earnings—particularly in the auto, energy, and agriculture sectors. Affected stocks could see substantial price moves (10%+), either from margin squeezes or new growth opportunities.

5. Summary & Conclusion

President Trump’s newly announced tariffs on Mexico, Canada (25%) and China (10%) can create near-term shock waves across industries that rely on integrated cross-border supply. The automotive sector stands out as a top loser, given that so many parts flow from Mexico and Canada—GM, Ford, and Japanese OEMs with North American plants all face margin pressure. Refiners heavily sourcing Canadian crude or counting on Mexican feedstocks (like Valero) also risk squeezed margins. Meanwhile, domestic auto parts makers, certain U.S. steel producers, and some domestic ag companies may see an upside as their cross-border competition rises in cost.

Rating only those with an 8 or higher (meaning these tariffs “could have a substantial enough impact on revenues to move the stock price significantly”), the above lists highlight a few strategic winners and losers. As always, second-order effects such as possible retaliatory tariffs, currency shifts, and supply-chain reconfiguration further complicate the outlook. But in the immediate to mid-term, these tariffs will likely spawn material revenue gains or losses for the “8+” rated companies, creating potential trading opportunities and volatility across the market.

I then asked for the second order effects of retaliatory tariffs…

Rating the Severity of Second-Order Impacts

Overall, the second-order effect from retaliation likely exacerbates the negative pressure on certain exporters (like U.S. farm goods, refined fuels, industrial machinery, and autos). Meanwhile, domestic producers of items formerly imported from those countries might gain. But the total disruption can raise input costs, hamper volumes, and potentially slow economic growth in certain regions.

Retaliation Risk: 9/10

If Mexico and Canada respond strongly, the North American trade corridor is severely stressed.

Potential to Move Stock Prices:

For ADM, PSX, CAT: Ratings of 8–9 negative if they face direct retaliatory duties.

For EOG, LMT: Possibly an 8 positive if they can fill domestic supply or see budget expansions.

Conclusion

With retaliatory tariffs in play, the biggest shift is that export-centric U.S. companies—particularly in agriculture (ADM, BG), refined fuels (PSX), and industrial equipment (CAT, DE)—face amplified downside risk (8–9 rating). On the flip side, domestic producers that replace imports or face less foreign competition (e.g., certain food, steel, or mid-tier shale producers) stand to benefit, rating 8+ in upside potential.

Ultimately, second-order effects multiply the disruption in global supply chains, intensifying margin pressure and fueling potential rotation in certain commodity and manufacturing segments.

After DeepSeek

The big question after the DeepSeek reveal last week is whether or not it will reshape the AI landscape. As I said last week, AI is the future, we just don’t know if that future looks different than it did 2 weeks ago. I asked GPT to review this article and opine….

1. Why DeepSeek Matters: A Paradigm Shift

Hardware No Longer the Primary Bottleneck

Historically, generative AI was considered expensive: training/inference demanded HPC clusters replete with top-tier GPUs, fueling companies like Nvidia, TSMC, SK Hynix, Super Micro, etc.

DeepSeek challenges that model by achieving near–GPT-4-level performance with fewer or cheaper GPUs, enabling cost reductions for training/inference.

Analogy: 1990s PC Revolution

In the early days, hardware vendor margins (Dell, Compaq) soared as personal computing boomed. Over time, PC hardware became commoditized, with the real value accruing to software (Microsoft Windows, Office, enterprise solutions).

DeepSeek suggests a similar transition: AI hardware may eventually become abundant and lower-margin, while the “app layer” (enterprise software, process automation, platform solutions) reaps the lion’s share of newly liberated AI budgets.

Implications for HPC Infrastructure

Near-term HPC names sold off (e.g., Nvidia down ~13% in a week) on fear that HPC expansions might slow if enterprises adopt less hardware-intensive AI.

Longer term, HPC volumes might still remain robust if cost savings spur broadly scaled AI usage—Jevons’ Paradox: Efficiency improvements can increase total consumption. But HPC margins or pricing power may be tested.

2. Potential Winners: The Shift to Software

Below are names that stand to benefit from cheaper, more pervasive AI. (All rated 8+ = major enough to potentially move share price.)

A. Enterprise Software Vendors Integrating AI

Salesforce (CRM) – Rating: 9/10

Why: CRM’s push to embed AI “agents” across their sales, service, marketing clouds. If HPC overhead is lower, cost constraints on advanced AI features vanish, fueling broader adoption of CRM’s generative add-ons.

ServiceNow (NOW) – Rating: 8/10

Why: A pioneer in workflow/process automation. Cheaper HPC = more impetus for “agentic” AI solutions integrated into ITSM. Slower growth concerns hammered the stock near-term, but if enterprise AI usage surges, NOW’s platform could re-accelerate.

HubSpot (HUBS) – Rating: 8/10

Why: Simplifying AI-based marketing automation for SMBs. Lower HPC cost fosters deeper AI integration into marketing workflows (email personalization, chatbots, etc.), potentially boosting HubSpot’s expansion.

UiPath (PATH) – Rating: 8/10

Why: Specializes in RPA (robotic process automation). With cheaper LLMs, advanced “intelligent automation” can combine structured + unstructured tasks, catapulting UiPath’s capabilities and client ROI.

Microsoft (MSFT) – Rating: 8/10

Why: Balances HPC cloud hosting and the software layer (Office Copilot). A narrower HPC margin might sting Azure’s HPC rentals, but it also significantly lowers MS’s own AI cost, enabling deeper Copilot adoption. Net effect likely positive if volume expansions outpace HPC price compression.

3. Potential Losers: HPC & Infrastructure

While HPC is not doomed, near-term re-pricing or growth revisions can weigh on these names:

Nvidia (NVDA) – Rating: 8/10 (near-term negative risk)

Why: Currently the poster child for HPC GPU demand. DeepSeek’s demonstration of “less GPU per model” might reduce some projected HPC expansions. However, the long-term net effect could remain positive if total AI usage spikes—still, near-term volatility is high.

Taiwan Semiconductor (TSM) – Rating: 8/10

Why: TSMC’s advanced nodes revolve heavily around HPC chips. If HPC growth is recalibrated downward, near-term HPC wafer orders might slow. Overall, TSM remains diversified, but near-term HPC mania cool-down is a headwind.

SK Hynix (000660) – Rating: 8/10

Why: Provides memory solutions critical to HPC/AI servers. If HPC expansions moderate, memory shipments could slip. Over the long run, broader AI usage could offset, but short-term HPC downgrades hamper memory shipments.

Super Micro Computer (SMCI) – Rating: 8/10

Why: Manufacturer of HPC servers. Cheaper HPC might reduce the need for large HPC cluster expansions, pressuring SMCI’s orders.

4. How Big Is the “DeepSeek Reset”? (Impact rating)

Trend Rating: 8/10

This “hardware-to-software pivot” is real but might be less cataclysmic than headlines imply. HPC volumes remain vital, especially if efficiency leads to more AI usage overall. However, HPC growth forecasts may get trimmed, and software valuations might re-rate upward.

5. Should Investors Act Now or Wait?

Short-Term Positioning

If you hold HPC names (Nvidia, TSMC, HPC server makers) with large gains, you might trim some exposure—partly locking in profits given near-term HPC revaluation.

Conversely, if you are underweight enterprise software, it could be an opportune time to accumulate strong AI integrators (ServiceNow, Salesforce, Microsoft) while the market sorts out HPC concerns.

Long-Term Perspective

HPC usage might remain robust if overall AI adoption accelerates. The HPC meltdown fear can be an overreaction. High-quality HPC stocks could bounce once the market sees AI usage expanding across mid-tier customers.

If you believe DeepSeek’s breakthroughs are replicable and HPC expansions become more cost-efficient, software names that embed advanced AI can indeed see faster adoption. That suggests overweighting application-level companies that have real revenue synergy with AI.

Balanced Strategy

If you have a multi-year horizon, partial rebalancing from HPC-centric to software might be wise to reflect the new cost dynamic. Avoid all-or-nothing trades as HPC remains fundamental to AI, but near-term risk is elevated.

6. Conclusion

DeepSeek’s demonstration of cost-effective AI training and inference likely shifts some near-term investor enthusiasm away from HPC hardware and toward software integrators. Although HPC could still flourish if broad AI usage expands, the “hardware mania” is likely to moderate, and enterprise software stands to gain from cheaper, more pervasive AI functionalities.

Software (Salesforce, ServiceNow, HubSpot, UiPath, Microsoft) is poised to see revenue expansions as they embed advanced AI across entire product lines at lower HPC overhead—Ratings: 8–9.

HPC names (Nvidia, TSM, SMCI) might face a re-rating if HPC expansions do not meet lofty expectations—Ratings: 8 near-term negative risk, but potential rebounds if total usage soars.

Investor Recommendation:

Partial reallocation from HPC infrastructure toward AI software could be prudent. If you’re already overweight HPC, consider trimming exposure. If you’re underexposed to enterprise AI software, this pivot might be the ideal moment to add. Nonetheless, HPC fundamentals remain integral to AI, so an extreme shift is unwarranted.

In the near term, the prudent approach is to remain diversified while seizing opportunities to lean into software names that are better positioned to exploit a “cheaper HPC era.”

January Effect?

January ended in the green, so you are going to see a bunch of articles about the “January Effect”. Here’s how GPT defines it and what it thinks of it as a tool to make money in markets..

What Is the “January Effect”?

Basic Concept

The January Effect refers to the theory (and observed historical tendency) that stock prices—especially small caps—often outperform in January more than in other months. Traditionally, analysts attributed this to tax-loss selling in December (driving prices down) followed by fresh inflows or rebalancing at the start of the new year.

January Barometer

A related concept is the “January Barometer,” which suggests that how stocks perform in January can predict the direction or magnitude of market performance for the entire year. For instance, “As goes January, so goes the year.”

Final Word

The January Effect is more of a market lore and a media narrative than a reliable, standalone strategy for professional investors. While it makes headlines and sometimes shows up in historical data, the best asset managers keep their focus on broader fundamentals, risk management, and secular trends—rather than hoping a single month’s performance dictates the rest of the year.

AI Beneficiaries

I’ve talked about this before…..

One beneficiary of potentially cheaper AI are stocks that are not involved in any aspect of AI, but can use it to help cut costs and drive profits. TGLR uses that as one of it’s main themes. They aren’t going to move like the more pure play names, but on the downside that’s a good thing. I asked GPT to analyze the Barron’s article and give me another list of names that it would rate 8 or above (out of 10) for potential:

AMZN

WMT

LOW

BBY

CVS

EBAY

CHWY

Summary

Cheaper AI stands to democratize advanced analytics and automation previously available only to the largest, most resource-rich enterprises.

This new wave of low-cost AI tools can help retailers personalize more effectively, optimize supply chains, and improve in-store or online user experiences.

While many other retailers also have potential, the above 7 are well-positioned to capitalize on cheaper AI due to a combination of scale, data, and existing tech infrastructure—meriting an 8 or above rating in their ability to profit from this trend.

Eaton

ETN is an AI infrastructure name I’ve been in for a while.

“Any notion [the data center] market will slow down is simply not consistent with the data,” said CEO Craig Arnold on Eaton’s earnings conference call. Innovation is good for growth, he added.

Arnold pointed out that the backlog of megaprojects—Eaton defines them as building projects with a budget north of $1 billion—hit $1.9 trillion at the end of 2024.

They got crushed by the DeepSeek news and are struggling to get back above the 200 day. If you are a trader then it could be shortable here if it can’t break through. Longer term though it’s a core holding for me.

GPT’s take…

ETN’s AI Potential Rating

Given Eaton’s:

Core relevance to data-center electrification and power management,

Growing backlog for large infrastructure builds,

CEO confidence in long-term data-center demand,

Historically strong relationships with enterprise and industrial clients,

I’d give Eaton’s AI potential an 8.5 / 10.

Why 8.5?

Bullish: The data-center wave driven by AI is likely to remain a multi-year tailwind. Eaton is well-positioned as a key enabler of high-reliability power and cooling solutions.

Not a “Pure” AI Play: Eaton is still a diversified industrial company—not a direct AI software/hardware provider—so it won’t capture all AI gains. However, it stands to benefit significantly from increased infrastructure spending, making the outlook quite strong but not at the absolute highest “pure-play” level.

Bottom Line

Eaton stands as a prime beneficiary of rising AI-driven data-center demand. Even if AI training/usage becomes cheaper or more efficient, broader AI adoption will likely push data-center capacity to new heights, supporting Eaton’s power-management business. Hence, 8.5 / 10 reflects a robust and sustained upside potential from the AI megatrend.

Intel

INTC is a holding I am going to re-evaluate this week. I had thought they could be a player in Quantum but this has been a hard stock to bet on. This is such a target rich environment of stocks to own that it’s no use wasting time on mediocre names.

Here’s GPT’s take….

Final Verdict & Key Catalysts

Near-Term Outlook: Disappointing earnings, CEO uncertainty, and continuing margin compression weigh on Intel.

Long-Term Possibility:

AI: Intel can leverage its data-center relationships, develop Gaudi further, and push advanced packaging.

Quantum: Potentially game-changing if silicon spin qubits scale, but it’s a multi-year research bet.

Ratings Summary

AI Potential: 6.5 / 10 (Moderate upside if Intel executes well, invests in accelerators, and stabilizes CPU share.)

Quantum Potential: 4 / 10 (Long horizon, incremental progress, not guaranteed to pay off soon.)

Bottom Line

Intel’s short-term struggles and uncertain leadership overshadow its longer-term bets on AI and quantum. While there’s notable upside in both areas—especially AI—Intel has to prove it can innovate and execute in a fiercely competitive market. The next permanent CEO’s strategy and Intel’s ability to meet roadmaps will be critical to realizing any upside.

Bitcoin Miners and Data Centers

One potential AI related theme I have been thinking about is Bitcoin miners pivoting to data centers. GPTs take……

1. Why Pivot from Bitcoin Mining to Data Centers?

Energy Infrastructure

Bitcoin miners already have large-scale power contracts and/or on-site power generation. Data centers are also power-intensive, so existing energy arrangements can be repurposed for HPC or AI cloud services.

Cooling & Facilities

Miners often set up in areas with cooler climates or special cooling systems (immersion/liquid cooling). Data centers also require robust cooling. If a miner’s facility is suitable, it could adapt to different hardware.

Hardware Considerations

ASICs (application-specific integrated circuits), which most Bitcoin miners use, are optimized for SHA-256 hashing. They can’t pivot to AI or HPC.

GPU-based miners (e.g., those who used to mine Ethereum before the merge) are more flexible—GPUs can be repurposed for HPC workloads.

Miners that rely heavily on ASICs would need to reinvest in servers/GPUs or specialized AI hardware (Nvidia H100s, etc.) to pivot effectively.

Revenue Diversification

Instead of being 100% reliant on Bitcoin’s price and block rewards (which get halved every ~4 years), data center services could provide a more stable or recurring revenue stream.

Challenges

Technical Expertise: Running HPC or cloud data centers demands different operational skill sets (maintenance, customer service, networking, virtualization, etc.).

Capital Expenditure: Transitioning from ASIC mining to HPC or AI compute is not trivial—new hardware, new architecture, plus software layers for customers.

Market Competition: Big data center operators (e.g., Equinix, Digital Realty) and cloud giants (AWS, Azure, Google Cloud) already dominate.

2. Potential Candidates & Ratings

A. HIVE Blockchain (HIVE)

Background: Historically had both ASIC mining and GPU mining (they mined Ethereum pre-merge).

AI/HPC Angle: They have some GPU infrastructure that can be repurposed. HIVE has publicly discussed HPC/AI ambitions.

Challenges: Scaling HPC operations is very different from crypto mining. They need new software, clients, marketing.

Rating: 8/10

Among crypto miners, HIVE is one of the most vocal about pivoting to HPC. They have some GPU footprint. Execution risk is still significant, but if any miner can pull it off at scale, HIVE is near the top.

B. Hut 8 Mining (HUT)

Background: Canadian-based miner with multiple sites, some powered by renewable energy.

HPC Initiatives: Hut 8 has a growing high-performance computing services segment alongside its Bitcoin mining. They host enterprise clients using HPC.

Merger: Hut 8 is merging with U.S. Bitcoin Corp, potentially creating more scale and synergy for HPC/data center expansions.

Rating: 7/10

They already have some HPC revenue, which is positive. The new combined entity might have enough resources to expand. Still, they face the standard HPC competition from well-established data center players.

C. Marathon Digital Holdings (MARA)

Background: One of the largest Bitcoin miners by hash rate, heavily ASIC-focused.

Pivot Plans: MARA has not made significant moves or announcements around HPC or AI. They are mostly doubling down on cost-efficient Bitcoin mining.

Potential: They do have big facilities and energy deals, but repurposing a large fleet of ASICs for HPC is impossible—they’d need a total hardware overhaul.

Rating: 4/10

If they do pivot, it will require major capex. Management so far hasn’t signaled a big shift. They could partner with an HPC operator to use their real estate/power capacity, but no strong plan is evident.

D. Riot Platforms (RIOT)

Background: Another top-tier U.S. Bitcoin miner with large operations in Texas, focusing on low-cost power.

Pivot Outlook: Primarily invests in ASIC rigs. Some talk about “data centers,” but mostly in the context of hosting or expanding Bitcoin HPC.

Potential: They have the real estate and cheap power, which could theoretically house HPC servers. But any pivot to HPC/AI would be a new direction.

Rating: 3/10

Management remains bullish on BTC mining. Minimal public mention of HPC, aside from typical references to “hosting.” So the pivot potential is lower unless major strategy changes occur.

E. Argo Blockchain (ARBK)

Background: UK-based but with major operations in the U.S., focusing on cost-efficient BTC mining.

Possible Pivot: Has not meaningfully indicated HPC or data center expansions. Mostly restructured debt and sold facilities to manage finances.

Rating: 3/10

They have bigger priorities (financial stability) than HPC pivot. Unless they see a major strategic shift or partner with HPC players, the pivot is unlikely near-term.

F. Bitfarms (BITF)

Background: Canadian miner with hydroelectric power in Quebec and expansions into other regions.

Data Center Potential: Low official statements about HPC pivot, though they have cheap power.

Rating: 4/10

Infrastructure is decent, but no public HPC strategy. Could consider a partial pivot, but not actively doing so at scale.

G. Stronghold Digital Mining (SDIG)

Background: Vertically integrated with power generation from waste coal.

Pivot Outlook: Minimal HPC mentions. More focused on “environmentally friendly” or cost-advantaged BTC mining.

Rating: 2/10

Very specialized with waste coal power generation, still focusing on bridging electricity to BTC mining. HPC talk is minimal.

3. Final Observations & Themes

Biggest Factor: Hardware. Bitcoin ASICs can’t just be “re-purposed” for HPC or AI. A real pivot means investing in GPU or specialized AI servers.

Existing GPU Footprint: HIVE stands out because they historically ran GPUs for Ethereum. Hut 8 also has an HPC arm. These two are best positioned if they can scale HPC offerings and market them effectively.

Data Center Economics: True HPC or cloud hosting is as much about software, networking, and enterprise sales as it is about hardware and power. Miners may face a steep learning curve to become serious HPC providers.

Quick Reference Rating Summary

HIVE: 8/10

Hut 8: 7/10

Marathon: 4/10

Bitfarms: 4/10

Riot: 3/10

Argo: 3/10

Stronghold: 2/10

Bottom Line

Yes, there’s some logic in Bitcoin miners pivoting to HPC/data centers, especially if they already have GPU fleets or are willing to invest heavily. HIVE and Hut 8 appear the best-positioned among major players, but success is far from guaranteed.

For miners heavily reliant on ASIC rigs, the pivot is much more challenging unless they repurpose their physical infrastructure (power deals, facilities) and sink capital into HPC/AI hardware.

Ultimately, hardware compatibility + enterprise/IT expertise are critical. So a pivot is possible but not trivially done—and most pure-play BTC miners remain heavily focused on crypto rather than HPC.

Before you go: Here are ways I can help

ETFs: We offer innovative ETFs that cover all aspects of The H.E.A.T. Formula, Hedges, Edges, and Themes.

Consulting: I'm happy to jump on the phone with financial advisors at no charge. I've built a wealth management firm and helped other advisors grow their practices through the use of substantially differentiated investment strategies. If you want to talk just send me an email at [email protected]

Monthly investing webinars

Weekly trading strategy podcast

Weekly investing podcast-Coming Soon

Wealth Management-Coming SoonThe views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades.TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.