I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) November 14 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

A huge part of thematic investing is thinking beyond the obvious winners in a theme. We call this the thematic investment hierarchy. If you look at the AI theme for example, anyone can pick the winner(s), it’s NVDA and maybe you can throw in AMD, AVGO, and some of the other Mag 7’s. To really generate alpha IMHO you need to look for who are the suppliers to the winners, who are the suppliers to the suppliers, and so on. In that vein, today we talk about connectivity……..

The Hidden Backbone of AI: 10 Stocks Powering the Great Connectivity Boom

The next phase of the AI trade isn’t about chips—it’s about connections. As AI models scale across thousands of GPUs and trillions of parameters, the limiting factor is no longer compute—it’s connectivity. The pipes between AI chips are now the chokepoint, pushing data transmission from copper to optical fiber and triggering one of the least-understood but most explosive capex cycles in tech: the AI Connectivity Supercycle. Nvidia’s recent $1 billion investment in Nokia to co-develop 6G infrastructure highlights this shift. The company that built the brain of AI is now investing in the nervous system. Data centers running AI clusters can no longer rely on copper—its physical limits on speed, heat, and density have been reached. The future of compute depends on light-speed transmission, and that means optical networking, photonics, and high-speed interconnects are the next multibillion-dollar bottleneck.

This “plumbing” layer is now the fastest-growing segment of the AI supply chain. The optical-component market is projected to grow 50%+ in 2025 and maintain that momentum through 2026. Companies enabling that shift—building transceivers, modulators, connectors, and optical switching systems—are quietly becoming the new infrastructure kings. Yet, few retail or institutional investors own them. Mizuho calls these names “the least understood part of the AI boom,” but their revenue trajectories rival semiconductors at far lower market caps.

Here’s the short list of the 10 key players and what they actually do:

Astera Labs (ALAB): Semiconductors for high-speed data transmission and PCIe connectivity inside AI clusters—key enabler of low-latency GPU communication.

Credo Technology (CRDO): Next-gen chips that deliver massive power efficiency advantages; a leader in high-speed SerDes and optical interconnects.

Lumentum (LITE): Optical transceiver modules converting electrical signals to light—core to AI data flow between switches and racks.

Coherent (COHR): Lasers and photonic components used in long-haul and intra-data-center networks; one of the purest optical plays.

Ciena (CIEN): Builds the backbone routing and optical switching infrastructure for hyperscalers; think of it as the AI internet’s traffic controller.

Arista Networks (ANET): Provides high-speed routing and switching systems for AI data centers; a key link between GPU clusters.

Amphenol (APH): Manufactures the physical connectors and specialty cables that carry light signals; low-voltage, high-margin infrastructure.

Fabrinet (FN): Contract manufacturer assembling and packaging optical and photonic modules for all the above players.

Macom (MTSI): Analog semis used in optical systems and 5G/6G radios; the analog heart of digital light transmission.

Semtech (SMTC): Mixed-signal semis that enable low-power data transfer, recently pivoting toward optical edge and sensor integration.

These names aren’t speculative—they’re selling the picks, shovels, and transceivers to the AI gold rush. Astera and Credo, the new entrants, show 35%+ annualized revenue growth through 2027, while legacy players like Lumentum, Ciena, and Coherent are ramping sharply as hyperscalers expand bandwidth and transition to all-optical fabrics. Nvidia’s move into telecom via Nokia validates the thesis: AI no longer stops at the data center—it extends to the edge, cars, robots, and devices, all of which require high-bandwidth, low-latency connections.

Investment implications:

Follow the bandwidth bottleneck. The companies solving data throughput and latency issues will scale with every AI upgrade cycle.

Optical is the new silicon. Margins and valuations may compress short-term, but secular demand makes optical networking the next semiconductor supercycle.

Winners get sticky. Once a hyperscaler adopts a component vendor (think Credo or Astera), design wins lock in for multiple product generations.

Expect volatility. Customer concentration and boom-bust spending cycles make this a bumpy ride, but under-supply through 2026 supports pricing power.

Portfolio strategy: Build a basket approach—pair fast growers (CRDO, ALAB, ANET) with established margin plays (COHR, CIEN, APH) and contract manufacturers (FN).

Bottom line: AI’s compute race created Nvidia’s empire, but the connectivity race will mint the next generation of winners. If AI is the new electricity, these ten companies are building the grid.

News vs. Noise: What’s Moving Markets Today

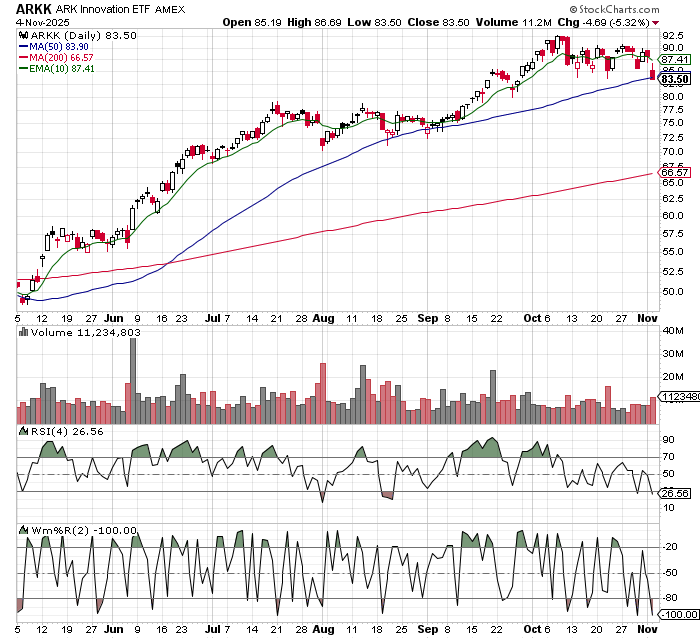

Ugly day yesterday, especially for crypto. You can see these things percolating a lot of times by looking at things like ARKK….

I topped out in early October and hasn’t gone anywhere since. Yesterday it broke the 50 day, which could be used as a signal to short. The key question now is whether we have topped, and will see a market correction, or if this is just another buyable dip in a raging bull market.

Of course, nobody knows the answer to that which is why you need to prepare for both possibilities…..

A Market at a Crossroads

Markets are caught between resilience and fragility. On the surface, the U.S. economy continues to defy expectations — inflation remains contained at 3%, earnings growth just posted one of the strongest beats in 25 years (+13% YoY), and AI momentum is driving historic capex across hyperscalers. Treasuries are up 6% YTD, foreign demand remains strong, and consumer sentiment has rebounded alongside record equity markets. In short, the macro picture looks solid: tariffs haven’t derailed growth, corporations are absorbing costs, and the “AI industrial complex” continues to create a floor for tech-heavy indices. But under the surface, cracks are widening. The Fed’s December cut is “far from foregone,” manufacturing data (PMI 48.7) signals contraction, and market breadth continues to narrow—Mag 7 up, everyone else flat. The risk now isn’t collapse; it’s complacency at the top of the cycle.

Takeaways for Investors:

The real risk is policy and positioning, not fundamentals. Fed indecision and the pending Supreme Court ruling on tariff legality could inject volatility into Q1. Any delay in rate cuts or unexpected fiscal outcome (e.g., tariff refunds) could steepen yields and pressure valuations.

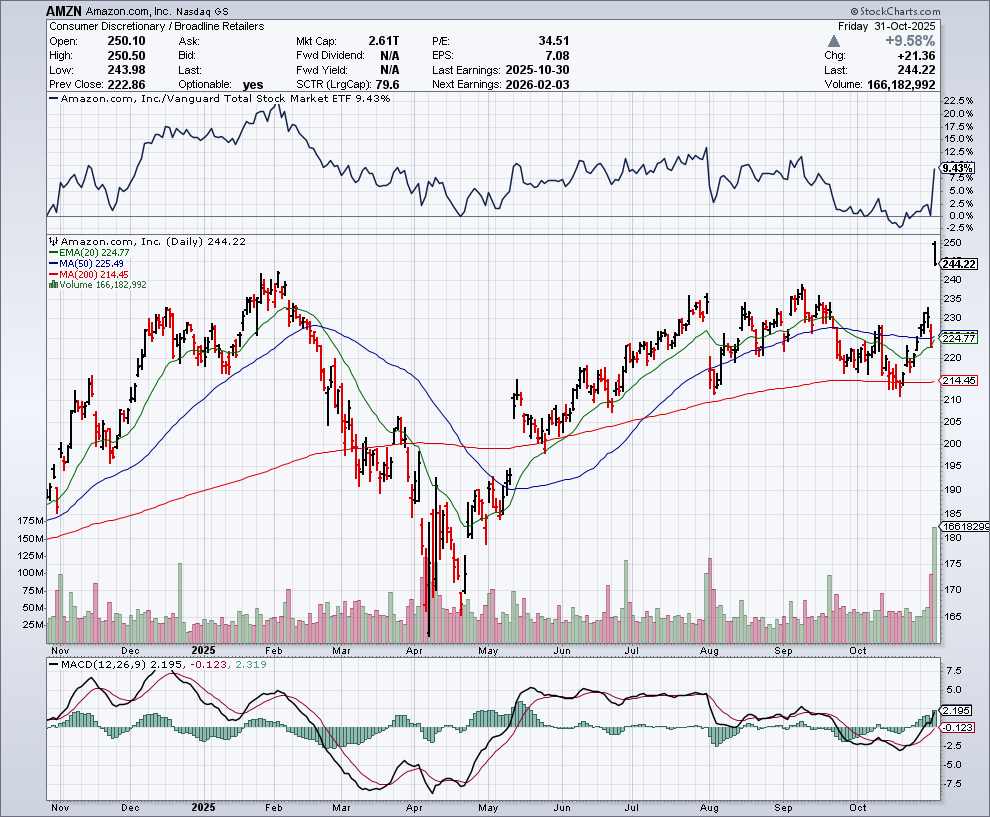

The AI trade remains intact—but rotation risk is real. Capex guidance from Amazon, Google, and Microsoft signals multi-year tailwinds, but valuations are full and dispersion is widening. Stick with AI infrastructure (ETN, PWR, VST, CEG, VRT) and quality compounders with pricing power; fade pure momentum.

Rates stay range-bound for now. Expect yields to hover around 4% until labor-market cracks deepen, delaying steepening into late 2026. Treasuries remain the cleanest hedge if volatility spikes.

Macro setup: bullish yet brittle. The U.S. is still the cleanest shirt in a messy closet, but stretched tech valuations, tariff uncertainty, and geopolitics (China AI decoupling) could make November’s strength short-lived. Quality, liquidity, and infrastructure remain the trades that work when optimism runs hot.

A Stock I’m Watching

Today’s stock is Ormat (ORA)…….

Ormat (ORA) just delivered a modest beat and raise, but the real story isn’t the headline—it’s the groundwork for a potential step-change in enhanced geothermal systems (EGS) that could make geothermal the next must-own theme in the AI power trade. Q3 revenue came in at $249.7M vs. $235.5M consensus, with adjusted EBITDA of $138.4M vs. $136M, driven by 67% YoY growth in the Product segment and triple-digit gains in Storage (+108%). Management nudged FY25 guidance higher on both revenue and EBITDA, underscoring operational momentum despite outages in the core Electricity business. But the real upside is strategic: ORA is accelerating its EGS roadmap, a move that positions it to serve hyperscaler data centers hungry for firm, carbon-free baseload power. Partnerships with Sage Geosystems and SLB hint at a pivot toward scaling next-gen geothermal capable of >$100/MWh PPAs—exactly what AI data centers are paying for right now. With 1,268MW of geothermal capacity already online (en route to 1,750MW by 2028), the company has a clear runway to capture the premium pricing emerging from the AI–energy intersection. The key catalyst: updates on the 250MW data center opportunity and visibility into EGS commissioning timelines. If management shows credible acceleration on that front, ORA could quickly move from a clean energy story to a power infrastructure re-rating—the kind that the AI grid will pay up for.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Friday November 14, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.