I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) December 9 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

Jensen Huang and Marc Andreessen have both said the biggest beneficiary of AI is going to be healthcare. We’ve done a few podcasts on this theme as biotech/healthcare is a target rich environment, and one that’s not necessarily tied to the overall market. There are three key areas we are watching—-Weight loss drugs, longevity, and general AI in healthcare……

The New AI Trade Is Happening In Your Bloodstream

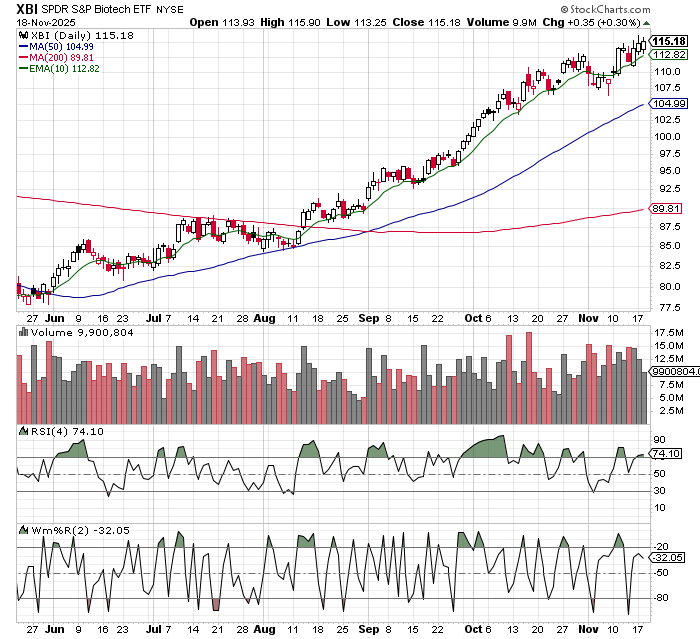

While the front page has been all Nvidia, data centers, and debt-fueled AI capex, one sector has quietly started to lead this market higher: biopharma. The SPDR Biotech ETF (XBI) is up roughly 28% year to date and the pharma ETF (XPH) is up about 22%, while the S&P 500 has rolled over and given back a big chunk of its gains.

Under the surface, the tape has shifted from “AI at any price” to “show me cash flows, moats, and real-world impact.” Drugmakers and select biotechs check those boxes: they benefit from the same secular trends (AI, data, demographics) but without the same frothy valuation and balance sheet risk you’re seeing in the AI infrastructure complex.

Three killer themes we’ve been talking about are all converging here: AI in healthcare, longevity, and weight-loss drugs. Eli Lilly is the poster child, with Zepbound on track to become the world’s top-selling drug and pushing LLY toward a trillion-dollar market cap on the back of the obesity and metabolic health wave. Novo Nordisk, Pfizer, AstraZeneca and others have cut pricing deals with the US government to open up the Medicare and tariff bottlenecks instead of fighting them, essentially trading some margin today for multi-year volume and policy clarity.

At the same time, you’re seeing a material pickup in smart M&A and late-stage deal activity: Pfizer’s move on Metsera in obesity, Merck buying Cidara in flu, J&J going after Halda in oncology, Roche’s Genentech validating Olema’s breast cancer target and igniting a 100%+ move in OLMA. This is what a healthier biotech ecosystem looks like: fewer tourist IPOs, more focus on genuinely differentiated assets, and big pharma using its balance sheet to buy time and innovation as patents expire.

Layer AI on top of this and you start to see why this isn’t just a trade. AI is already being used to screen compounds, design and stratify clinical trials, and pull signal from messy imaging and genomic data. The winners here will be the platforms that marry data and biology: large-cap pharmas with deep pipelines and cash (Lilly, Novo, J&J, Merck), life science tools and diagnostics that sit on the data rails, and a curated handful of small-cap biotechs with clear readouts and validated mechanisms instead of science projects.

On the device side, names like Medtronic are quietly grinding higher as procedure volumes normalize and AI-enhanced imaging and robotics improve utilization and mix. The losers are just as important. Legacy pharmas without credible exposure to obesity, oncology, or immunology, me-too biotechs burning cash on crowded targets, and medtech niches structurally hurt by GLP-1s (think pure-play bariatric or marginal diabetes devices) are dead money or worse in this regime.

In an AI-bubble unwind, the market will not treat “generic growth” kindly; it will pay up for companies that can extend healthy lifespan, reduce healthcare costs, or own the workflow where AI meets patients and providers, and it will punish anything that looks like a funding-dependent story stock. Practically, this argues for a barbell: core positions in liquid, diversified vehicles like XBI or XLV plus overweight in obvious compounders (LLY, NVO, select big pharma) on one side, and tightly sized, event-driven bets in a few high-conviction names on the other.

You can express upside in the theme with defined risk using call spreads or ratio call spreads on XBI, LLY, or XLV, and fund those by trimming winners in crowded AI infrastructure. Position sizing and hedges still matter; biotech will not be immune if the market breaks, but right now it’s one of the few places where the tape, the fundamentals, and the macro all rhyme. If the first phase of the AI trade was about chips and data centers, the next phase is about what those models let us do inside the human body. That’s where the real compounding lives.

Here’s a way you might bucket it, given everything we’ve been talking about (AI in healthcare, obesity, longevity, plus risk/reward):

$LLY – Eli Lilly

Anchor of the GLP‑1/obesity theme (Zepbound/Mounjaro doing >$10B a quarter already, with next‑gen obesity drugs and multiple new indications coming)

Also has upside in Alzheimer’s, immunology, and metabolic disease. If you only own one “health + longevity” name, this is LLY

$NVO – Novo Nordisk

Co‑leader in obesity (Wegovy/Ozempic) with a very real second act in amycretin and other next‑gen incretins now moving into Phase 3, showing 22–24% weight loss in early data.

Obesity, diabetes, and cardio‑metabolic disease is a 10–20 year secular theme; Lilly vs. Novo is Coke vs. Pepsi for GLP‑1.

$RHHBY – Roche

Quiet but serious player in obesity via CT‑388 (dual GLP‑1/GIP agonist with ~19% placebo‑adjusted weight loss in early trials) plus a deep oncology and immunology pipeline.

Gives you a diversified “old school” pharma + new‑school obesity optionality without GLP‑1 single‑stock risk.

$JNJ or $MRK – defensive healthcare core

$JNJ: diversified devices + pharma, cleaner balance sheet, steady compounding.

$MRK: still driven by Keytruda but reinvesting heavily in oncology and next‑gen immunotherapies.

Either works as the “ballast” around the higher‑beta plays above.

Small / SMID‑cap asymmetric plays (satellite bets)

These are the ones you size small and trim hard into strength:

$TEM – Tempus AI

$VKTX – Viking Therapeutics

“Challenger” obesity play with promising GLP‑1/GIP programs; if they deliver competitive weight‑loss data and get a partner, the upside vs. current market cap is huge. If the data disappoints, it can get cut in half in a week. Classic asymmetry.

$RXRX – Recursion Pharmaceuticals

One of the highest‑conviction AI‑in‑drug‑discovery names: eight AI‑designed drugs in the clinic, big‑tech partnerships, and a massive proprietary dataset (Recursion OS). Revenue is still tiny and the path to a commercial drug is long, but if AI really does bend the drug‑dev curve, a name like this can go from “science project” to multi‑bagger.

How to actually use this list

Treat LLY / NVO / RHHBY / JNJ/MRK as core, multi‑year positions you scale into on corrections.

Treat TEM / OLMA / VKTX / RXRX as small, sized‑right lottery tickets around those cores; trim into big spikes, don’t average down blindly, and be honest that a couple of them may go to zero.

And as always, this isn’t personalized advice – it’s a curated hunting list tied to the themes we’ve been hammering: AI in healthcare, obesity and metabolic disease, and longevity/oncology. You still want to run your own screens on valuation, position sizing, and risk tolerance before pulling any triggers.

News vs. Noise: What’s Moving Markets Today

AI’s Biggest Believer Just Said “Bust” The Same Day Nvidia Reports

On the same day Alphabet launched Gemini 3 and bragged about 2 billion people touching its AI Overviews each month, Sundar Pichai went on the BBC and basically said: we might be overdoing this. His line was blunt: “When we go through these investment cycles, there are moments we overshoot as an industry… there are elements of irrationality.” That warning hits very differently when it comes from the CEO of Google, not some anonymous PM on Twitter. Under the hood, the numbers back him up: Google, Amazon, Meta, and Microsoft are now using roughly 95% of their operating cash flow on capex, buybacks, and dividends versus about 80% in 2019, with AI spend the main driver. Redburn just downgraded Microsoft and Amazon on concerns the economics of genAI aren’t as juicy as advertised, and for the first time since 2005 a Bank of America fund manager survey shows a net majority saying companies are overinvesting, explicitly citing AI capex and how it’s being financed. When the people writing the checks and the guy selling them the dream both say “this might be too much,” you should listen.

Now layer tonight’s Nvidia earnings on top of that. NVDA is the tollbooth at the center of this whole buildout, and its print has become a proxy referendum on whether this AI capex wave is still a feature or starting to look like a bug. If Nvidia puts up monster numbers and hyperscaler guidance stays strong, the market will tell itself the overshoot talk is just healthy skepticism in a secular bull. If the numbers are fine but commentary turns cautious on spend, utilization, or ROI, Pichai’s “overshoot” comment suddenly looks less philosophical and more like the first crack in the story. Either way, the message for us is the same: this is not the time to be naked long the frothiest AI names with no risk plan. You want core exposure in real cash-flow engines like a GOOGL that Buffett is quietly buying, and you want your upside in defined-risk structures like call or ratio spreads on NVDA, SMH, or the AI complex rather than max-delta YOLOs. The CEOs and the credit guys are telling you the cycle is getting late; let tonight’s Nvidia call move the tape, but don’t let it move your discipline.

A Stock I’m Watching

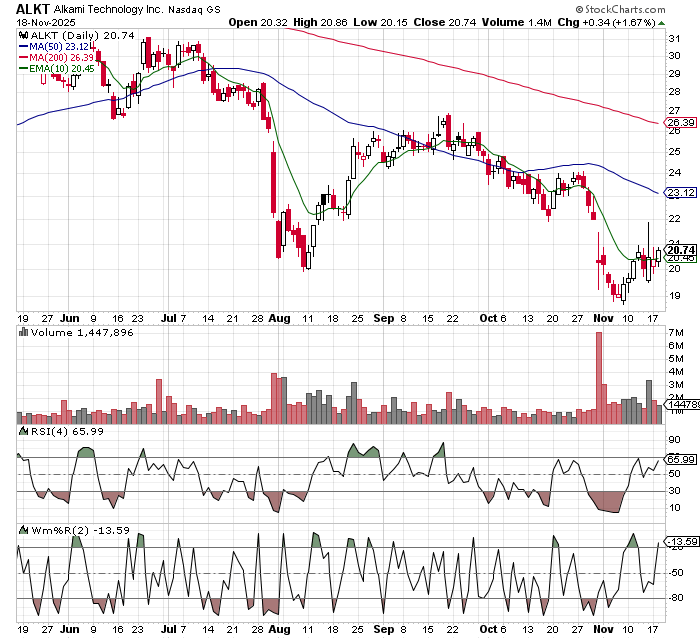

Today’s stock is Alkami Technology (ALKT)…..

Alkami is an emerging small-cap winner delivering cloud-based digital banking solutions to U.S. community banks and credit unions. In an era of fintech disruption, Alkami’s platform enables smaller financial institutions to modernize their online and mobile banking experiences. J.P. Morgan analysts added Alkami to their focus list with an Overweight rating, seeing 86% upside to a $38 target price. This reflects high conviction in Alkami’s scalable SaaS model and revenue growth trajectory. With banks investing in digital transformation, Alkami’s niche dominance in an underserved market makes it a true potential must-own “small-cap” tech idea.

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Tuesday December 9, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.