I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $4 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Dividend Announcements:

BITK .10/Share

MSTK .2/Share

Payable Today

I’m hosting a webinar entitled “Why Covered Call ETFs Suck and What to Do Instead” (More Info Below) January 15 2-3pm. Sign Up Here

Table of Contents

H.E.A.T.

There is so much thematic stuff going on in the defense sector. There’s European aerospace and defense, which I always thought was the most obvious Trump trade…

There’s drones, space, etc. Today we take a deep dive…..

Defense 3.0: The Bull Market Hiding in Plain Sight

If you want to understand the next great bull market, don’t look at Silicon Valley.

Look at the new Department of War.

The U.S. national‑security machine has hit an inflection point. The Pentagon is being forced to completely rebuild America’s “arsenal of freedom” while simultaneously reinventing how it buys technology.

And the checks they’re about to write are enormous.

The Setup: Three Jobs, One Wallet

The U.S. defense establishment as has three jobs at once:

Finish what’s already on the drawing board.

New versions of existing platforms and weapons have to be fully developed and ramped – fighters, ships, submarines, tanks, missiles.Mass‑produce what already works.

After 30 years of “just‑in‑time war,” the U.S. has to crank out volume – especially munitions, ships, fighters, and drones – just to keep pace with peer threats and restore deterrence.Bet big on new tech.

Unmanned systems, space infrastructure, AI‑driven command‑and‑control (C4I), autonomous swarms, hypersonics – all the things that make traditional war‑planning obsolete.

That alone would be a generational capital‑spending cycle.

Now add the wild: a surge of private capital into “military‑tech fusion” – venture‑backed companies building drones, software, sensors, and space assets explicitly for the Pentagon.

This isn’t your father’s defense boom. It’s a merging of Lockheed‑and‑Raytheon world with Anduril‑and‑Palantir world.

And it’s happening under a political regime that does not expect defense spending to fall at all over the next five years, absent a massive geopolitical shift. Under continued Republican control, Cowen even expects another “reconciliation bill” in 2026 to boost the top line again; under a Democratic House, they still see positive growth, just slower.

In other words: the budget’s not your risk. Where you position in the stack is.

Follow the Money: Six Buckets of Explosive Spend

Cowen wrote a report on this recently, their Athena database breaks the FY25 → FY26 budget into categories and shows where the real acceleration is. Six buckets stand out:

Missiles & munitions: +57%

Shipbuilding: +49%

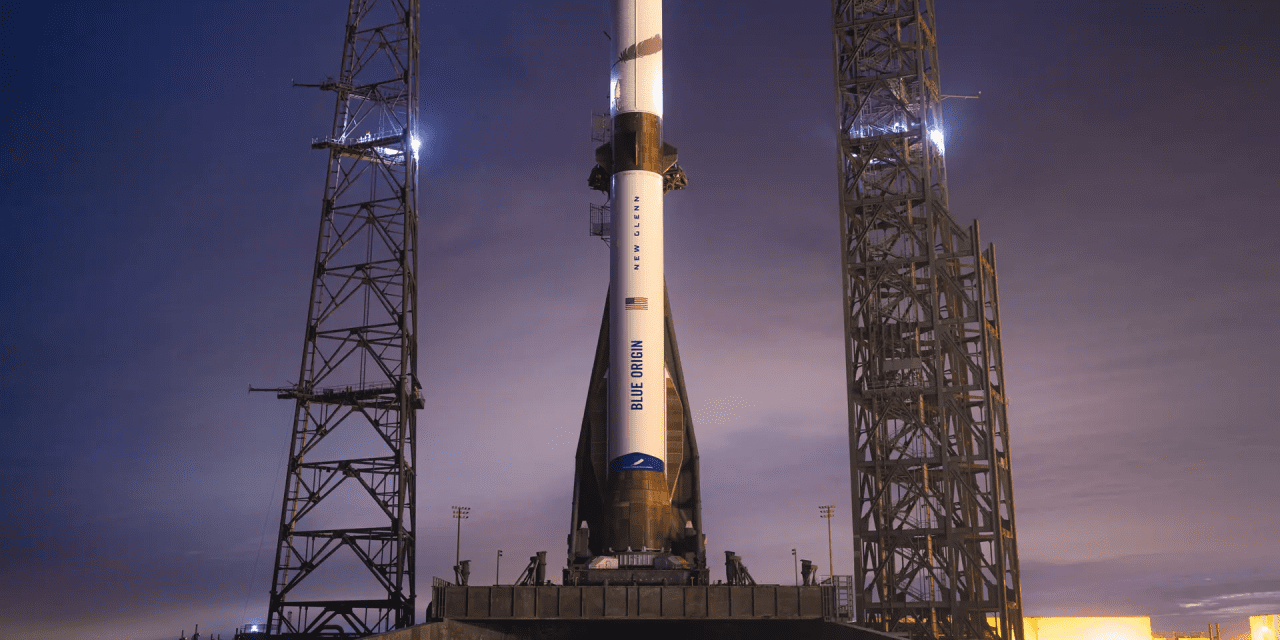

Space: +44%

Unmanned & robotics: +20%

Missile defense: +10%

Strategic nuclear: +9%

That is not a “flat budget, rotate the deck chairs” profile. It’s a re‑armament program.

And it’s being hard‑wired into policy: Golden Dome missile defense, an “8% re‑look” at spending, Trump’s pressure on NATO allies to pony up, new acquisition memos, plus potential laws like a SHIPS Act.

Golden Dome: America’s $175 Billion Force Field

The single best “tell” in the report is the Golden Dome initiative – essentially a U.S. multi‑layer missile shield on steroids:

4 layers (1 space, 3 land)

11 short‑range batteries across the U.S.

3,000 contractors invited to the initial briefing

$175 billion estimated cost

2028 target completion date

This is a program‑of‑programs: interceptors, radars, satellites, command software, launch systems, hardened communications, logistics, test ranges. If you build missiles, sensors, or the software that ties it all together, you’re in the blast radius of this spending.

The Old Guard Isn’t Dead – It’s Booked Out

One chart in the report should be taped above every investor’s screen: cumulative backlog at the six big primes – RTX, Northrop, Lockheed, L3Harris, Huntington Ingalls, and General Dynamics – now exceeds half a trillion dollars, and it’s grown every year since 2021.

That’s your base case:

The “legacy” primes are not being disrupted out of existence; they are being force‑fed work.

The new “defense tech” crowd mostly plugs into their programs – as suppliers, partners, or acquisition targets.

Cowen’s bottom line: in the near term (next five years), both incumbent suppliers and new entrants in emerging tech domains should see robust growth.

Military‑Tech Fusion: How This Cycle Is Different

Cowen’s phrase “Military‑Tech Fusion” is important. It describes a wave of:

True startups built around AI, autonomy, and software‑defined weapons.

Old‑line industrials pivoting hard into defense programs.

The incentives changed:

Geopolitical risk is rising, not falling.

Commercial tech (AI, sensors, cloud, space launch) is maturing.

The Pentagon is rewriting acquisition guidelines to buy faster and from more suppliers.

Cowen is honest: they don’t think anyone can confidently predict which specific private companies win this knife fight yet – it will be “bumpy and expensive.”

But you don’t have to pick every startup winner to make money on this theme. You just need to:

Own the chokepoints the money must flow through.

Add selective “torque” in the obvious growth buckets (missiles, drones, space).

Avoid the structural losers that get squeezed in between.

Winners, Watchlist, Losers

Core Winners: “Arsenal of Freedom” Blue Chips

Cowen explicitly calls out four names as “best positioned”: Huntington Ingalls, General Dynamics, L3Harris, and RTX.

I’d think of them this way:

HII (Huntington Ingalls) – Shipbuilding / nuclear navy

Purest play on the shipbuilding boom (+49% budget growth).

Owns U.S. nuclear carrier and submarine yards – those programs are strategic, long‑cycle, and politically untouchable.

GD (General Dynamics) – Submarines, armor, IT

Co‑owner of the Columbia‑class and Virginia‑class submarine programs (strategic nuclear & undersea deterrence).

Land systems and C4I businesses get leveraged to both “scale current platforms” and field new command networks.

LHX (L3Harris) – Sensors, communications, electronic warfare

The glue layer in Defense 3.0: radios, data links, ISR pods, software‑defined payloads.

Direct beneficiary of Golden Dome, unmanned systems, and space‑to‑ground connectivity.

RTX (RTX Corp.) – Missiles, missile defense, radars

Owns many of the interceptors listed in the Golden Dome architecture (SM‑3, SM‑6, PAC‑3, NGI workshare, etc.).

+57% missile & munitions growth and +10% missile‑defense growth is the RTX story.

Then you have the two “obvious” names Cowen rates more neutrally but that still sit on massive, diversified backlogs:

LMT (Lockheed Martin) – fighters, missiles, space

NOC (Northrop Grumman) – strategic nuclear, space, missile defense

Between them, they touch F‑35, strategic bombers, ICBMs, missile warning satellites, and large chunks of the deterrent triad and missile defense – exactly where the budget is growing fastest.

How I’d use this group in a portfolio:

This is your “don’t get cute” core basket for the Defense 3.0 theme.

You’re not trying to 10x in a year; you’re compounding with decades‑long programs plus a structurally rising budget.

Offense Watchlist: Higher‑Torque “Defense Tech”

If you want more upside (and more volatility), you move closer to the edge of Military‑Tech Fusion:

Drones & Loitering Munitions

AVAV (AeroVironment) – small tactical drones and switchblade loitering munitions; direct play on unmanned systems (+20% category growth).

KTOS (Kratos Defense) – target drones, tactical UAVs, and experimental hypersonic/space systems; positioned for cheap, “attritable” platforms.

Space & Orbital Infrastructure

RKLB (Rocket Lab) – small‑launch and satellite‑bus provider; levered to proliferated LEO constellations for missile warning, comms, and ISR.

RDW (Redwire) – space components, power, and structures; benefits from expanded space budgets (+44%).

Defense Software / C4I

PLTR (Palantir) – controversial but very real; already embedded in U.S. and allied defense analytics, and pushing hard into battlefield AI and sensor fusion.

Other private names (Anduril, Shield AI, etc.) are the purest “defense‑tech startup” plays – but for now, they’re mostly future IPO/exit optionality for the primes and late‑stage VC, not for public‑market investors.

How to treat this bucket:

This is your “torque” sleeve – smaller weights, accept higher volatility.

Use it to express views on specific sub‑themes: drones, space, software.

Likely Losers (or At Least, Places to Be Careful)

You don’t have to short anything, but you do want to avoid the wrong side of this regime change:

Defense names with little exposure to the six high‑growth buckets.

If a company is mostly tied to legacy, low‑growth support services or older ground vehicles without serious roles in missiles, space, unmanned, or nuclear, it’s fighting a budget headwind rather than a tailwind.

Over‑owned “defense meme stocks.”

Anything that has already re‑rated to a “perfect war premium” on Twitter narratives alone – usually tiny drone or cyber names with minimal actual contract exposure – is vulnerable if budgets disappoint or programs slip.

Middle‑men integrators with no proprietary tech.

As the DoD experiments with new acquisition rules and buying from more tech‑native vendors, low‑value “bodies and PowerPoints” contractors risk margin and relevance compression. Cowen explicitly notes that meaningful reform is likely to be “bumpy and expensive,” which is often bad for low‑moat middle layers.

Big Takeaways

This is not a normal defense up‑cycle.

The U.S. is trying to simultaneously rebuild stockpiles, ramp existing platforms, and field entirely new classes of AI‑enabled weapons – with help from a wave of private “defense tech” capital.Budgets are likely to grind higher, not lower, regardless of which party controls Congress.

Cowen doesn’t see a top‑line decline over the next five years absent a major geopolitical shock; at worst, growth slows from “very strong” to “merely positive.”The fastest growth is in missiles, ships, space, unmanned systems, missile defense, and strategic nuclear.

That’s where the incremental dollars – and the highest operating leverage – will be.Golden Dome is the canary in the gold mine.

A $175B, four‑layer missile shield with thousands of contractors involved is basically a long‑dated call option on every enabling technology: interceptors, radars, space sensors, command‑and‑control, hardened networks.Backlogs are already there.

The big six primes sit on >$500B of funded work and climbing. Even if new programs slip, you’re not buying a “hope” story – you’re buying a cash‑flow machine with years of visibility.It’s a stock‑picker’s theme – but you don’t have to overcomplicate it.

Core basket: HII, GD, LHX, RTX, with LMT and NOC as “don’t overthink it” add‑ons on weakness.

Torque: a small sleeve in defense‑tech names levered to drones, space, and software.

Avoid: low‑moat service contractors and narrative‑only defense memes.

News vs. Noise: What’s Moving Markets Today

Under the surface of “dovish cut + QE restart,” the macro backdrop is still bullish, but the margin for error is shrinking. The Fed just restarted balance‑sheet expansion and cut to 3.75% with ~3.5% GDP, 2.8% core PCE, 4.4% unemployment, and 6%‑of‑GDP deficits – a full “run it hot” regime. That’s rocket fuel for risk assets as long as three things hold: inflation doesn’t re‑accelerate, credit markets stay calm, and the AI/earnings story doesn’t crack. Break any one of those (oil or wage shock, policy/fiscal accident, or hard‑landing earnings reset) and QE won’t stop an air pocket.

Leadership is quietly rotating. Equal‑weight S&P, small caps, cyclicals, and hard assets (gold, silver, copper, coal, eventually oil & gas) are smoking the Mag 7 while growth/value rolls over and AI darlings like ORCL show what happens when capex and leverage get questioned. This hammers home the point: copper miners up ~80% vs NVDA ~30% and Mag 7 ~22% this year, while natural‑resource market caps are still tiny versus mega‑cap tech. Add in the AI‑driven demand for power and metals and you get a regime where “owning the shovels” (energy, miners, grid) can finally start to catch up to “owning the chips”

Takeaways

Don’t fight the Fed, but don’t get lazy: QE is back and cuts are still coming, but the three real derailers are inflation re‑flare, a credit/fiscal accident, or an AI/earnings disappointment. That’s where the “real” risk lives now, not in the next 25 bps.

Leadership is broadening: small caps, equal‑weight S&P, industrials, financials and hard assets are starting to outperform mega‑cap growth; this is classic “late‑stage liquidity + rotation” behavior.

AI still bullish… but more selective: the market is done paying any price for “AI infra at scale” if it’s funded with leverage and negative FCF (Oracle is now the poster child). Favor self‑funders and toll‑collectors over capex junkies.

Hard assets are the stealth AI trade: copper, precious metals, and natural‑gas‑levered E&Ps are direct beneficiaries of data‑center build‑out and “electrify everything,” but still a rounding error in index weight. Owning some real‑asset exposure is both a macro hedge and an AI derivative.

Positioning risk is real in crowded growth: when everyone is long the same speculative growth / AI / meme complex, even a small wobble in earnings, rates, or liquidity can trigger factor unwinds that swamp the QE tailwind for a while.

A Stock I’m Watching

Today’s stock is Adobe (ADBE)…..

From an “agentic AI + rails” framework, ADBE is exactly the kind of picks‑and‑shovels creative infrastructure that survives model churn. Yes, cheap gen‑AI tools pressure the bottom of the funnel, but enterprises and pro creators won’t run their content and audit/compliance workflows on random apps.

In Case You Missed It

How Else I Can Help You Beat Wall Street at Its Own Game

Inside H.E.A.T. is our monthly webinar series, sign up for this month’s webinar below….

Why Covered Call ETFs Suck-And What To Do Instead

Thursday January 15, 2-3PM EST |

Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. |

The truth? |

They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. |

Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. |

What You’ll Learn:

🔥 Why “high yield” covered call ETFs are often just returning your own capital |

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.