I am traveling this week so no newsletter Tuesday or Wednesday, should be back Thursday, worst case will be Friday

Our Next Webinar

The AI Investing Playbook For Toppy Markets: How to Find Hidden Opportunities and Hedge Risks in 2025

Thu, March 20, 2025 2:00 PM - 3:00 PM EST

Rebel Finance Podcast-Episode 3 is Out

Episode 4 will live stream Friday (I’m going to Big East Tournament Thursday) from 11:30AM to 12:30PM EST at the link below

Market Recap

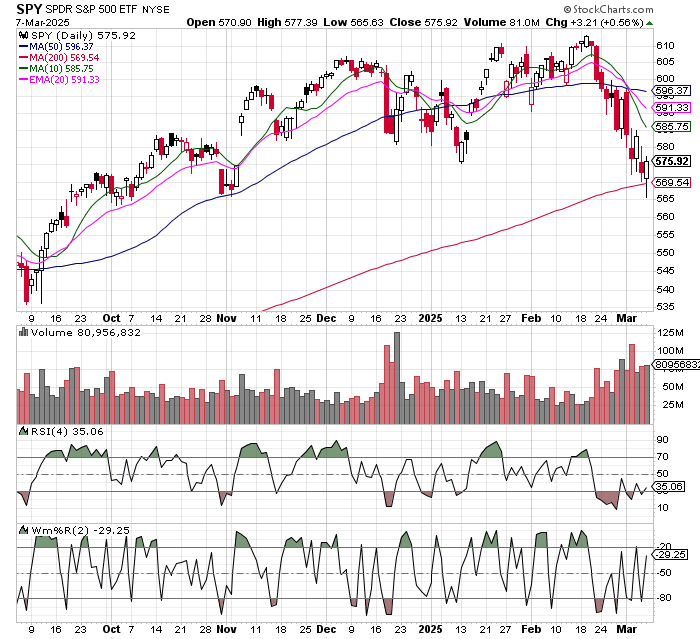

Another bounce attempt on Friday, this time an undercut and rally at the 200 day…..

Now two levels become important this week, the 200 day moving average and Friday’s low of $565.63. We are testing the 200 day this morning. Meanwhile, TLT is up 1% pre market. I continue to believe that outside of European defense stocks that TLT is the only Trump trade left at the moment.

Who could have seen this coming? Oh wait, I did….

In today’s edition we are focusing on a couple of groundbreaking developments out of China on AI and Quantum. Think you’ve got to be exposed to China and still need to be real cautious on US. I have BABA and BIDU, looking for a spot to get back into GDS and would look to add KWEB on dips…

Investing Lesson of the Day

For Hazel Secco, battling uncertainty starts with a morning ritual: meditation. A calm mind enables Secco, a certified financial planner in Hoboken, N.J., to help clients stay grounded. She coaches them to overcome cognitive biases and stick to the financial plan she’s customized for them.

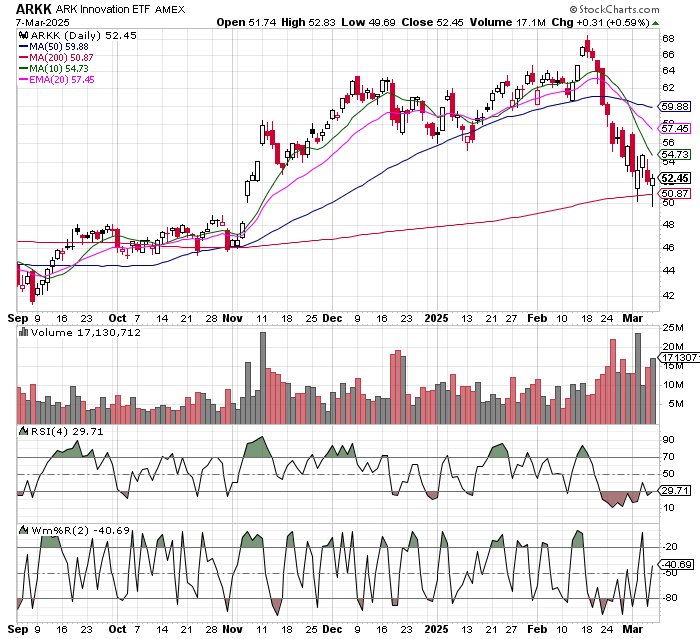

Meditation is all well and good, but I would suggest a better way is to always have hedges. We did end up filing for OHNO on Friday, more about that in a few months. Until then there are some simple things you can do. I do a lot with hedging, here’s one strategy I use, which worked very well the past couple of weeks. Take a chart of the ARK Innovation ETF (ARKK). This ETF hasn’t done well the past few years, but I wouldn’t recommend always having puts on it as it tends to run when the market is risk on. I keep an eye on the chart…….

When it broke the 10 day moving average (At the same time I wanted to de risk my portfolio) I bought some puts and I also sold some 68 and 69 calls. Selling uncovered calls is somewhat risky and I never do it on a stock, which can go up an unlimited amount. On an ETF with lots of holdings I feel much more comfortable, if my calls do go in the money I just end up short ARKK shares, which is fine with me. My sense on these levels is we wouldn’t see the highs for a while. I bought more puts when it breached the 50 day. I then got out of my puts on the undercut and rally at the 200 day, but kept my calls for now. One strategy of many you can use to hedge.

Manus AI and China's Quantum Leap: The Next "DeepSeek Moment" in Investing?

A Technological Breakthrough: Manus AI

Manus AI's recent breakthrough could represent another "DeepSeek Moment," reshaping the competitive landscape for global AI technology. By integrating Claude Sonnet 3.5 and a fine-tuned Qwen model, Manus AI demonstrates exceptional proficiency in executing multi-dimensional tasks at unprecedented scales. This hybrid AI agent not only automates complex strategic planning and cybersecurity tasks but also signals a potential pivot point in global AI leadership.

Industry and Investment Implications

This innovation is expected to ignite another wave of aggressive R&D investment in AI. U.S. tech giants such as Alphabet (Google), Microsoft, OpenAI, and Amazon must now significantly ramp up infrastructure and AI R&D spending, possibly compressing profit margins in the short term. Investors could rotate away from richly valued pure-play U.S. AI software stocks (e.g., Palantir, C3.ai, UiPath) in favor of foundational infrastructure and hardware providers such as Nvidia, AMD, Microsoft Azure, and Alphabet.

Chinese AI stocks, including Alibaba, Baidu, and JD.com, now have stronger tailwinds. Investor sentiment toward Chinese ADRs is likely to improve as Manus AI signals China's enhanced global AI competitiveness.

Quantum Computing's Strategic Inflection: Zuchongzhi-3

Simultaneously, China has unveiled Zuchongzhi-3, a quantum processor demonstrating capabilities reportedly one million times superior to Google’s Sycamore quantum chip. This represents a strategic quantum leap, reshaping competitive dynamics and intensifying geopolitical stakes around quantum computing.

Strategic Winners in Quantum Infrastructure

Quantum Cloud Infrastructure Providers:

IBM (IBM): Well-positioned due to robust investment in quantum cloud services, enterprise adoption, and international partnerships.

Alphabet (GOOGL): Accelerated quantum research and cloud integration, driven by competitive pressures.

Amazon (AMZN): Quantum computing infrastructure provider (Amazon Braket) stands to benefit from faster enterprise adoption.

Microsoft (MSFT): Integrating quantum computing solutions into enterprise infrastructure through Azure Quantum.

Quantum Computing Hardware (Long-term potential despite immediate pressures):

Rigetti Computing (RGTI), IonQ (IONQ), D-Wave Quantum (QBTS), Quantum Computing Inc. (QUBT): All face near-term competitive pressures, but accelerated global competition could catalyze faster technological innovation, government and private investments, and strategic partnerships or acquisitions.

Ramifications for U.S. and Chinese Stocks

The advancements of Manus AI and Zuchongzhi-3 introduce heightened risks for U.S. AI and quantum companies that fail to adapt rapidly. Conversely, these developments provide substantial growth potential for agile and strategically positioned players. Chinese tech equities appear increasingly attractive given their proven capabilities in innovative, globally competitive technology.

Actionable Portfolio Moves for Investors:

Trim Exposure:

Pure-play U.S. AI software stocks (Palantir, C3.ai, UiPath).

Increase Exposure:

Semiconductor and AI hardware leaders: Nvidia (NVDA), AMD.

Cloud infrastructure providers: Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN).

AI-driven cybersecurity: CrowdStrike (CRWD), Palo Alto Networks (PANW), Zscaler (ZS).

Strategic Chinese ADRs: Alibaba (BABA), Baidu (BIDU), JD.com (JD).

Manus AI and China's quantum breakthrough with Zuchongzhi-3 represent potential inflection points comparable to the DeepSeek moment. While immediate challenges for certain U.S. technology firms may arise, these developments open new long-term opportunities for strategic investment. Investors should proactively adapt portfolios to capitalize on emerging trends in AI infrastructure, quantum technology, and cybersecurity, positioning themselves for sustained growth amidst rapid technological evolution.

Before you go: Here are ways I can help

ETFs: We offer innovative ETFs that cover all aspects of The H.E.A.T. Formula, Hedges, Edges, and Themes.

Consulting: I'm happy to jump on the phone with financial advisors at no charge. I've built a wealth management firm and helped other advisors grow their practices through the use of substantially differentiated investment strategies. If you want to talk just send me an email at [email protected]

Monthly investing webinars

Rebel Finance Podcast https://www.youtube.com/@TuttleCap

Wealth Management-Coming Soon

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades.TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.