I’ve been a trader and investor for 44 years. I left Wall Street long ago—-once I understood that their obsolete advice is designed to profit them, not you.

Today, my firm manages around $5 billion in ETFs, and I don’t answer to anybody. I tell the truth because trying to fool investors doesn’t help them, or me.

In Daily H.E.A.T. , I show you how to Hedge against disaster, find your Edge, exploit Asymmetric opportunities, and ride major Themes before Wall Street catches on.

Today

Income Blast Ex Dividend:

BITK: .18/share

MSTK: .50/Shares

Speaking of Income Blast, I recently sat down with Income Architect to talk about the future of income investing…..

Table of Contents

The Smart Crowd: How to Use Social Media to Find Themes Before Wall Street Does

When Richard Peterson joined us on the podcast, he talked about how his firm, MarketPsych, tracks social media sentiment to anticipate market swings.

But there’s another layer investors can tap into that goes beyond sentiment — using social platforms themselves to discover new themes and connect with the people building or trading them in real time.

I first started playing around with social media sentiment after Covid. I think Covid completely changed markets, and they are not going back. I hear a lot of comparisons with what is going on in today’s markets and the internet boom and bubble. Some are valid, but back then investors didn’t have the ability to connect like they do today, they also had to go through brokers for information and trading. When they lost money in the crash Wall Street go them to go back to buying index huggers and told them to be happy with 8-12% a year.

Covid changed everything. All of the sudden everyone was home and they gravitated towards trading. This time the technology existed for them to connect like never before. They also had access to all the same information Wall Street had, and they could trade lightening fast, without commissions. At first Wall Street didn’t see this coming, but once Melvin Capital went under they had to take notice. Instead of using fundamental analysis, they were identifying the top themes and looking at momentum.

At first I thought there could be some alpha to analyzing overall sentiment, I found out there likely isn’t. What I then realized is there are groups of really smart traders and investors on social media. You can find them on X, but they often move to discords to avoid some of the more problematic issues in an open environment like X. I now monitor 5 discords daily, where often times you find people who are identifying themes and stocks within those themes before Wall Street does.

Social media isn’t just noise. It’s a distributed research network — part crowd-sourced think tank, part early-warning system. The same places that fuel memes and bubbles also surface new technologies, shifts in retail behavior, and microtrends long before they hit Bloomberg terminals. The key is learning how to separate narrative from signal and finding the right communities for your investing style.

If you’re a day trader, you want immediacy — short-term chatter, momentum signals, and order flow discussion. The best communities here tend to be fast-moving Discord servers or Twitter/X lists centered around volume alerts, options activity, and technical setups. You’re looking for traders who post their entries and exits in real time, not hindsight gurus showing end-of-day screenshots.

If you’re a swing trader, look for groups that focus on sector rotations, catalysts, and macro sentiment shifts. I don’t personally use them, but Reddit boards like r/stocks and r/wallstreetbets are noisy but occasionally early. The real edge often comes from smaller, vetted Discords and Substack communities where traders dissect sector flow — the transition from semis to power to commodities, for example. The best groups share annotated charts, watchlists, and positioning changes, not just hot takes.

If you’re a long-term thematic investor, your best leads come from people actually building things — engineers, founders, early employees. LinkedIn, X, and specialized Discords in areas like AI infrastructure, biotech, or nuclear power are invaluable. Following credible operators in these spaces gives you visibility into emerging trends before they reach analysts’ screens. You’re not trading chatter; you’re reading the future supply chain.

Finding the right groups

• Start by identifying your edge — Are you following capital flows, tech cycles, or sentiment? Your social footprint should mirror your strategy.

• Use engagement as a filter. Active debates and backtesting discussions beat one-way hype.

• Join several groups, then prune. Most servers or Discords are 90% noise. Stay where people post data, filings, and credible sources.

• Cross-check insights. Use a second platform — if a Discord is buzzing about uranium or AI power, search that topic on X or Reddit to gauge whether it’s broadening or peaking.

• Look for specialists, not influencers. A small group of engineers in a nuclear Discord can teach you more about the next theme than a million-follower finance account.

Social media isn’t replacing research — it’s accelerating discovery. The first time you see a theme like “AI power,” “digital treasuries,” or “longevity biotech” mentioned, it’s usually by a niche community months before it becomes a Wall Street pitch deck. The trick is to stay close to those early adopters, filter ruthlessly, and remember that markets now move at the speed of the feed.

Tomorrow’s alpha isn’t just about analyzing data — it’s about knowing where that data starts whispering.

News vs. Noise: What’s Moving Markets Today

Yesterday I warned you that the real FOMC move is often the next day and I suggested hedges. The market ended down big, but so far this morning, as much as I hate to say it, Cramer may be right…..

MAG 7 Mania, Fed Fallout, and Amazon’s Big Win

The market’s obsession with AI reached another fever pitch overnight. Amazon’s blowout earnings turned sentiment sharply positive across big tech—AWS growth re-accelerated to +20% YoY, the fastest in 11 quarters, and Amazon stock surged more than 13% in after-hours trading, its best move since 2022. That comes as Alphabet and Nvidia both hit record highs earlier this week, and as investors shrug off warnings about overheating valuations and ballooning AI capex. Collectively, the MAG 7 are now pouring over $400 billion a year into AI infrastructure—data centers, chips, and power—but returns remain concentrated in cloud and advertising platforms that can immediately monetize compute demand. For now, investors are rewarding scale and visibility (GOOGL, AMZN) while punishing opaque ROI (META, MSFT).

Still, the speculative tone in the tape is hard to ignore. Nvidia’s $5T valuation briefly jumped another 5% after Trump teased AI-chip talks with Xi—before confirming Blackwell chips remain off-limits to China. The real story is leverage: Big Tech’s debt issuance for data centers is exploding ($30B from META, $38B from ORCL), and even Fed Chair Powell admitted interest rates “aren’t part of the data center story.” That’s not sustainable forever.

Action items for investors:

Stay selective in AI: favor companies already converting spend to profit—GOOGL, AMZN, NVDA, ETN, PWR.

Watch power & liquidity: data-center demand is driving both energy infrastructure and corporate borrowing. Own the grid.

A Stock I’m Watching

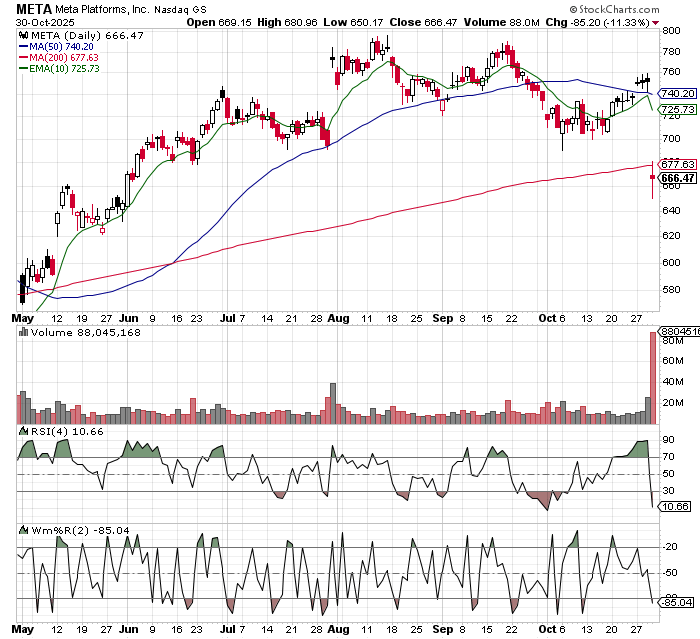

Today’s stock is Meta Platforms (META)…..

In a perfect world you would want to see it pull and undercut and rally at the 200 day moving average. This market is still dominated by the Mag 7 names, if you get dips like this you should probably be buying them.

The H.E.A.T. (Hedge, Edge, Asymmetry and Theme) Formula is designed to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.