I will be in Las Vegas Through Wednesday for The Exchange ETF Conference so there will be no newsletter Tuesday and Wednesday

Rebel Finance Podcast-Episode 5 is out, we talk to David Blackmon about all things energy

Market Recap

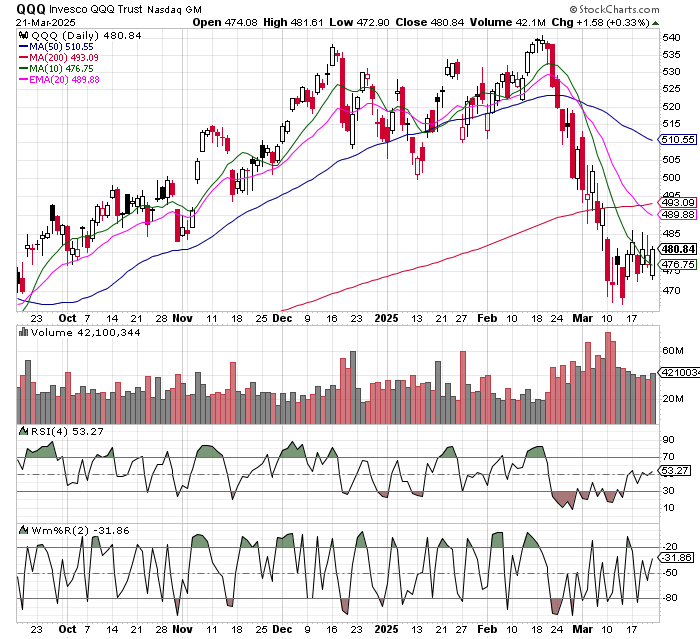

Every market move matters, but some matter less than others. On Friday we had a pretty big reversal into the close with the NASDAQ 100 moving from red to green. Remember, Friday was also massive options expiration, which is why I don’t put as much stock into that move as I would if it was just a normal Friday.

Looking at a chart of the QQQ nothing has really changed, we could have made a low the other day or it could be forming a bear flag. Think a lot is going to depend on tariff’s and April 2…..

Some of the Magnificent 7 are starting to look buyable down here…..

AAPL had an undercut and rally at the 10 day, META is holding the 200 day, MSFT had an undercut and rally at the 10 day, NVDA is holding the 10 day, and TSLA had an undercut and rally at the 10 day. If Friday’s move off the lows was really something, then these are names I wouldn’t mine owning.

I called out India a little bit ago, so far so good, extended short term, but like it better than Germany….

I think EWG would have to pull back to the 50 day for me to get interested….

I’ve been looking for a spot to get short Mexico again, and I did on Friday, looks double toppy….

I’m tempted to short Canada, but this chart just looks like a mess….

Think context is extremely important at the moment. Not seeing anything that screams long or short, but am seeing a lot of charts that could go either way.

News vs. Noise

I still love the coal stocks here…..

Burgum has been vocal about his support for coal since even before he took the job. A prominent theme in his Senate confirmation hearing was the need for “baseload” power — that is, not solar and wind — to ensure the US won the artificial intelligence arms race with China. On that point, he noted that “we have the technology to deliver clean coal.” More recently, he told Bloomberg News on the fringes of an energy conference in Houston that the US should reopen shuttered coal plants.

Still like Copper…..

FCX is a bit extended, but still love this chart…..

Investing Lesson of the Day: Why Buffered ETFs Suck

Interesting piece from AQR on buffered funds…..

Never been a fan myself, for a lot of the reasons AQR mentions. I had GPT take a deep dive on the article and rate the choices AQR presents, I also had it throw The H.E.A.T. Formula in there. I was careful not to guide it in any way, as I was curious myself how it would rate compared to other strategies…..

Buffered ETFs: A Deep Dive and Alternatives

In recent volatile markets, investors often seek strategies that promise market-like returns with lower risks. Buffered ETFs, also known as options-based strategies, have emerged as popular solutions, attracting significant assets with their promise of capturing equity market upside while limiting downside risk through options. However, recent analysis by AQR Capital Management suggests these strategies might not live up to their promises.

Assessing Buffered ETFs (Rating: 4/10)

Buffered ETFs typically use a combination of put and call options to shape investment returns, promising defined outcomes and less market volatility. Yet, empirical data since 2020 demonstrates underperformance relative to passive equity investment:

Underperformance: Virtually all buffered strategies lag behind passive equity returns due to high premium costs and structural inefficiencies.

Inconsistent Downside Protection: Although these strategies claim effective downside protection, analysis shows most fail to outperform a simpler portfolio of equities combined with Treasury Bills during drawdowns.

High Fees and Costs: Option premiums, trading costs, and management fees consistently eat into returns.

Overall, buffered ETFs appear overly complex, costly, and generally ineffective for sustained risk-adjusted outperformance.

AQR's Alternatives: Superior Strategies

1. Reduced Equity Exposure + Treasuries (Rating: 8/10)

Instead of using buffered ETFs, a straightforward combination of equities and Treasuries can deliver superior performance and downside protection:

Simple Implementation: Investors reduce equity exposure and allocate the balance to Treasuries, lowering volatility and effectively managing risk without expensive option premiums.

Better Historical Performance: This simpler mix frequently delivers higher returns and more reliable downside protection compared to buffered ETFs.

Lower Costs: Eliminating the need for complex options transactions significantly reduces overall fees and costs.

2. Enhanced Diversification (Rating: 9/10)

Another powerful alternative involves improving diversification across multiple asset classes:

Multiple Return Streams: Combining equities, bonds, commodities, and alternative investments typically produces better risk-adjusted returns over time.

Lower Correlation: Diversification reduces exposure to single-market downturns, offering inherently robust downside protection.

Proven Effectiveness: Historically validated approach supported by economic theory and long-term market data.

Evaluating the H.E.A.T. Formula (Rating: 9.5/10)

The H.E.A.T. Formula (Hedges, Edges, Asymmetry, and Themes) remains an exceptionally robust investment framework:

Effective Hedges: Identifies strategic hedges that provide genuine protection against adverse market movements.

Market Edges: Leverages quantitative and qualitative analysis to discover inefficiencies and opportunities within markets.

Asymmetric Opportunities: Prioritizes investments where potential returns significantly outweigh risks.

Thematic Alignment: Capitalizes on emerging megatrends like AI, energy transitions, and geopolitical shifts.

The H.E.A.T. Formula outperforms buffered ETFs by consistently capturing substantial upside while effectively managing downside risk through diversified and intelligently hedged positions.

Strategic Implications for Investors

Buffered ETFs have substantial limitations. Instead, investors should consider:

Simplified Equity/Treasury Portfolios: A low-cost approach with proven track records.

Enhanced Multi-Asset Diversification: The best long-term strategy for consistent returns and minimized volatility.

Adopting the H.E.A.T. Formula: A sophisticated framework uniquely suited for capturing thematic investment opportunities with prudent risk management.

In conclusion, the allure of buffered ETFs may attract assets, but their historical and theoretical limitations significantly undermine their appeal. Opting for simpler, more effective alternatives like equity/Treasury allocations, improved diversification, or employing the robust H.E.A.T. Formula remains the prudent course for investors seeking superior risk-adjusted returns.

Before you go: Here are ways I can help

ETFs: We offer innovative ETFs that cover all aspects of The H.E.A.T. Formula, Hedges, Edges, and Themes.

Consulting: I'm happy to jump on the phone with financial advisors at no charge. I've built a wealth management firm and helped other advisors grow their practices through the use of substantially differentiated investment strategies. If you want to talk just send me an email at [email protected]

Monthly investing webinars

Rebel Finance Podcast https://www.youtube.com/@TuttleCap

Wealth Management-Coming Soon

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades.TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.