Wall Street’s 60/40 formula was born in 1952 — the same year as the first credit card. A lot has changed since.

That’s why we created a new approach — The H.E.A.T. Formula — to empower investors to spot opportunities, think independently, make smarter (often contrarian) moves, and build real wealth.

Table of Contents

🔥 Here’s What’s Happening Now

A day when the indices didn’t tell the entire story. Anything that had been hot got crushed. As I have said before, things like this are normal, but this is also what a top would look like. I don’t think this is the top for reasons I have also said before -AI Capex, Fed lowering rates. So I do think this will turn into a buying opportunity, just be careful out there.

Speaking of AI Capex, I am fully cognizant of the fact that it may not end up panning out like many have hoped…..

Not worried about this today, but keep it in the back of your mind.

One thing to watch, that I have been talking about the past couple of days, is the rotation from tech into real assets. Occasionally, traders take money out of growth stocks and move it to value stocks and all the value managers who have been doing terribly start to celebrate. I don’t put much stock into this, I think the old value style of investing is dead. With the internet, Bloomberg, AI, etc I do not think anyone can consistently pick undervalued stocks. Money will move from what’s hot to what’s not from time to time but I think there’s a better way to play that using tools like RSI than trying to find value stocks.

I do pay attention from the move out of tech into real assets. I’ve been buying some energy companies and I already have coal and of course gold. I luckily stayed away from FCX yesterday but will keep an eye on it. Unfortunately this didn’t help much yesterday as crypto got crushed. Crypto has rewarded the dip buys and I think I will end up being happy about my launch date on BITK. As well as BMNU launching today.

Speaking of the DATs, this is something to keep an eye on. We 2x a bunch of them, and will continue to. I’ve been talking to a lot of reporters lately about DATs and I equate them with what happened with SPACs coming out of Covid. You had some good operators launching SPACs and then you had way too many. I don’t think we need tons of DATs, but I think there will be a few good ones and we will be involved……

The bears do have some things to chew on however. Revised labor data and housing numbers show an economy that may be more fragile than first thought. Trump is also throwing tariffs back into the mix. We are down four days in a row, but if you look at a chart of the QQQs it hardly registers……

⚡️ Will Quantum Computing Make NVDA GPUs Obsolete?

I saw this yesterday…..

If it’s true it will completely shake the foundations of the AI trade, so what are the chances?

🧠 What’s being claimed (and what it implies)

The IONQ CEO is asserting:

Nvidia’s Blackwell architecture will be stagnant/dated by 2027.

Quantum computing (or whatever IONQ is planning) will supplant GPUs for “supercomputers.”

That this shift would relegate Nvidia’s entire performance stack to the sidelines.

If true, this is massive. For IONQ, it’s not just upside — it’s an existential reordering of compute paradigms. But to believe it requires several big “ifs” stacking up.

✅ What makes the claim plausible (or at least worth taking seriously)

Quantum + specialized compute has long-term promise

In specific domains (e.g. chemistry, optimization, certain cryptographic or simulation tasks), quantum or hybrid systems can outperform classical compute. For niche use-cases, GPU+accelerator dominance might be challenged.Physical and economic limits

GPU scaling, power, cooling, interconnects, chip yield — all run into diminishing returns. At some point, new compute models might offer superior cost curves for selected problems.Arms race between classical/GPU and quantum

If IONQ (or others) can deliver usable, fault-tolerant quantum or hybrid machines, the margin erosion for GPUs in specialized applications could begin more rapidly than people expect.

🚫 Why this is likely overstatement / hype (at least for 2027)

Quantum is wildly hard

Quantum error correction, coherence time, scaling qubit count — these aren’t engineering footnotes. The timeline from lab advances to scalable, reliable machines is protracted.GPUs + software ecosystems are robust

Even with architectural improvements, the software stack, CUDA ecosystem, tooling, libraries, interconnects, memory hierarchies — all of this advantage takes many years to dethrone. You don’t just swap in a new chip without the entire ecosystem backing it.Hybrid / domain-specific accelerators will exist

The more likely scenario is a heterogeneous compute future: GPUs for many tasks, FPGAs / ASICs / neuromorphic / quantum hybrids for specific workloads. One architecture dominating everything is less probable.Risk of vaporware / exaggeration

CEOs have incentives to hype. The gap between prototype performance and real-world throughput & latency under load is often vast.Time is short

2027 is barely 2 years away (depending on what “2027” means — calendar vs product cycle). That’s a tight timeframe for a compute paradigm shift of that magnitude.

📌 What to Watch / Signals

If the claim has traction and IONQ (or similar) is serious, you’ll see:

Benchmark results vs Blackwell / Hopper / next-gen Nvidia on quantum-relevant workloads.

Partner deals: hyperscalers, government labs, national labs using IONQ / hybrid in production pipelines.

Roadmap disclosures: qubit count, error rates, coherence times, fault correction advances.

Ecosystem movement: software frameworks, APIs, hybrid orchestration tools that integrate quantum + classical.

CapEx and buildouts: If credible quantum compute centers begin being deployed at scale.

If you don’t see that in 12–24 months, the claim is more aspirational than imminent.

🧠 IONQ vs. NVDA — 3-Scenario Model (2027–2035)

Core premise to test: Can quantum/hybrid systems displace GPU clusters economically (throughput/$, latency, reliability, ecosystem) on meaningful workloads by 2027–2030?

Key drivers to monitor

Throughput/$ vs Blackwell & post-Blackwell (measured on specific workloads)

Reliability (error correction, uptime, MTTF)

Ecosystem (frameworks, APIs, tooling, cloud access)

Reference wins (hyperscalers, national labs, pharmas, financials)

Capex & capacity (how many real, revenue-producing systems online)

Scenario A — “Quantum Leap” (Low Probability, High Impact)

IONQ’s 2027 claim proves out on targeted workloads (chemistry, optimization, Monte Carlo variants). Hyperscalers adopt hybrid pipelines at scale.

Assumptions (illustrative, not guidance):

IONQ revs: $0.4B ’27 → $1.5B ’30 → $4B ’35, GM 45→55% (services + systems + cloud)

NVDA DC revs still grow (training remains choke point) but mix shift slows post-’28

5–10 flagship references (MSFT/AWS/GOOG + 2–3 big pharmas + 1–2 national labs)

Quantum workloads = 5–7% of hyperscaler AI budget by 2030

Valuation sketch (illustrative):

IONQ at 8–10x ’30 sales on a $1.5B base = $12–$15B EV; at 8x ’35 on $4B = $32B EV

Optionality if recurring software margins lift to 65% → $40–50B EV range

Market read-through: Not “NVDA irrelevant,” but heterogeneous compute locks in. NVDA retains training moat; classical inference + quantum/hybrid divide workloads.

Scenario B — “Hybrid Adoption” (Base Case)

Quantum is useful on niches; GPUs stay dominant for training and broad inference. Hybrid wins exist but are incremental, not existential.

Assumptions:

IONQ revs: $0.2B ’27 → $0.8–$1.0B ’30 → $2.0B ’35, GM 40–50%

2–4 large references; cloud marketplace SKUs; enterprise pilots scale slowly

Quantum workloads = 1–2% of hyperscaler AI budget by 2030

Valuation sketch:

IONQ at 6–8x ’30 sales on $0.9B = $5–$7B EV; 6x ’35 on $2B = $12B EV

Stock is an optionality asset; upside tied to benchmark & ref wins cadence

Market read-through: NVDA’s cadence (Blackwell → Rubin → post-Rubin) continues to compound. GPU TAM expands; quantum adds a new line item, not a replacement.

Scenario C — “Show Me” (Bear Case)

Quantum remains lab-leaning; error correction and economics lag; customers don’t scale beyond POCs.

Assumptions:

IONQ revs: $100–150M ’27 → $300–400M ’30 → <$1B ’35, GM sub-45%

Mostly research budgets + small commercial deals

Quantum workloads < 0.5% of AI budget by 2030

Valuation sketch:

IONQ compresses toward 3–4x ’30 sales ($0.35B) → $1–$1.4B EV range

Stock trades like a high-beta R&D platform, not a compute disruptor

Market read-through: Nvidia’s full stack (silicon + CUDA + networking + HBM + SW) continues to dominate; post-Blackwell roadmaps outcompete on $/token.

What would change my mind (trigger thresholds)

Hard KPIs (quant before narrative):

Benchmark parity vs Blackwell on 2–3 named workloads (publishable, independent)

Two hyperscaler production wins (not pilots) with committed $ spend and SLOs

Error-corrected scale & sustained uptime; repeatable throughput/$ below GPU cluster costs

Full-stack tooling (SDKs, schedulers, hybrid orchestration) adopted by top-tier partners

Revenue cadence beating the Scenario B ramp for 3–4 quarters

If you see #1 + #2 together → move probability mass from Base to Quantum Leap.

Portfolio Construction (practical)

Objective: Participate in upside if quantum surprises; don’t jeopardize core AI returns if it doesn’t.

Core AI infra (70–75%) — Own the bottlenecks:

$NVDA, HBM (MU / SK hynix), optics/networking ($AVGO, $ANET, $CRDO), semicap ($AMAT, $LRCX, $KLAC)

Power stack: $CEG, $NEE, $LEU, $CCJ, $VRT, $ETN (AI’s energy constraint)

Quantum optionality (2–4%) — $IONQ sized like a call option:

Start 1–2%; scale toward 3–4% only if #1–#2 triggers hit

Treat new highs on validated news as add points; fade spikes on PR-only headlines

Application barbell (10–15%) — Only platforms with measurable ROI (NOW/SNOW/DDOG)

Watch NRR uplift tied directly to agentic/AI workflows

Bottom Line

The IONQ quote is bold marketing. A world where GPUs are “irrelevant” by 2027 is extremely unlikely.

A world where quantum/hybrid earns a seat at the table on specific workloads is very plausible — and investable — but likely on a 2029–2035 cadence, not 2027.

The right trade today: keep NVDA-led infra as the compounding core; size $IONQ as cheap convexity; upgrade its weight only as hard evidence arrives.

Treat IONQ like a call option on a new compute era — powerful if validated, but small until benchmarks + production wins prove GPUs are losing workloads on throughput/$, not press releases.

The Investment Strategy Wall Street Hopes You Never Discover

Tue, Sep 30, 2025 2:00 PM - 3:00 PM EDT |

-Why the 60/40 strategy is dead and what to do instead

- How to use AI to uncover today and tomorrow's hottest themes

- 4 unknown edges that still exist in today's market

- How to set up your portfolio for asymmetrical returns

- Little-known asset class that has limited risk and potentially unlimited returns

- 4 ways to hedge your portfolio that don't include bonds

Click Below to Register |

📈 Stock Corner

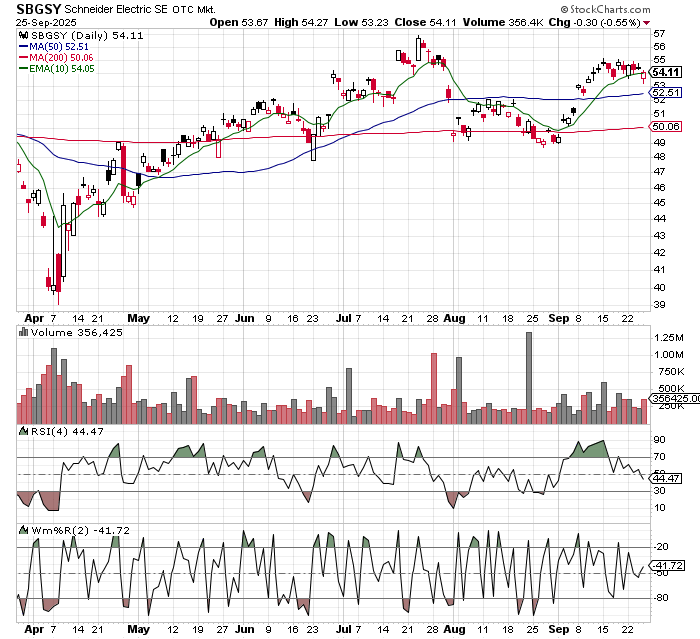

Today’s stock is Schneider Electric (SBGSY)…..

In all this talk of an AI race between the US and China, we forget about Europe. If Europe decides to ramp up, then Schneider benefits.

📬 In Case You Missed It

These launch today!!!!!

🤝 Before You Go Some Ways I Can Help

ETFs: The Antidote to Wall Street

Inside HEAT: Our Monthly Live Call on What Wall Street Doesn’t Want You To Know

Financial HEAT Podcast https://www.youtube.com/@TuttleCap Freedom from the Wall Street Hypocrisy

Tuttle Wealth Management: Your Wealth Unshackled

Advanced HEAT Insights: Matt’s Inner Circle, Your Financial Edge

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades. TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.© 2025 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.